shaunl/iStock Unreleased via Getty Images

Thesis Statement

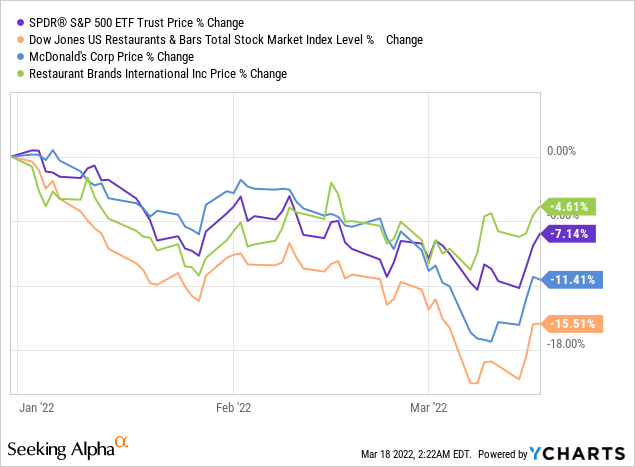

The previous months have been susceptible to high volatility, and the stock market has had a disappointing year so far. The S&P 500 is down 7.1%, while Dow Jones U.S. Restaurants & Bars Index (DJUSRU) is down 15.5% YTD. Accordingly, McDonald’s Corporation (NYSE:MCD) stock plunged 11.4% compared to 4.6% for Restaurant Brands International Inc. (NYSE:QSR) YTD, but stretching back 52 weeks, MCD gained 6.5% compared to QSR’s 9.3% loss.

With the current slide going on, especially considering the Russia-Ukraine situation, it would seem like the desirable valuation metrics are a welcome sign to potential investors looking for a long position in restaurant stocks. Despite the volatility, I assign a buy rating to both stocks, with a slight edge to MCD over QSR.

Profitability: MCD takes the lead

After a tough 2020, the restaurant industry saw growing revenues in 2021 as the Coronavirus pandemic restrictions got curbed. Both companies performed well during the year beating analyst EPS expectations, except in Q4 reports from MCD.

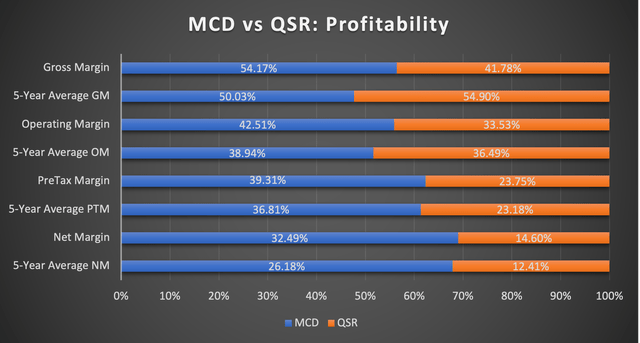

MCD’s more than 40,000 restaurants generated over $23.2 billion in revenue with a 20.9% YoY growth compared to QSR’s over 29,000 restaurants generating over $5.7 billion with 15.5% YoY growth in FY2021. In addition to YoY revenue growth, MCD leads in all other profitability margins because of greater operational efficiencies, especially as 93% of its franchised restaurants yield higher margins.

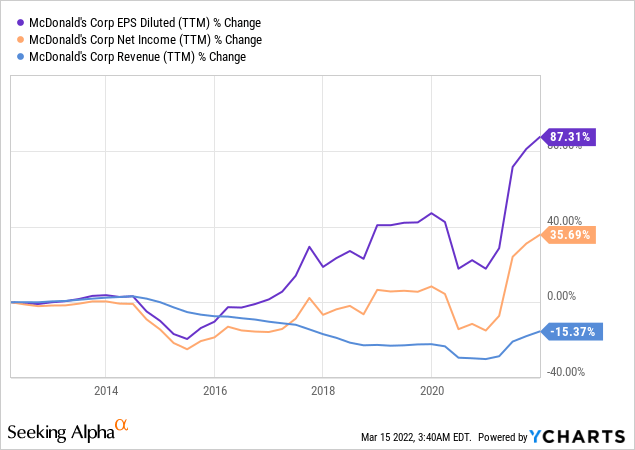

Within the past decade, McDonald’s has drastically increased the share of revenue received from franchises instead of company-operated stores, which is one of the reasons that the company has been able to sustain a 5-year EPS growth of over 13% despite a 5-year revenue decline of over 1%. In addition, the current margins are roughly in line with the 5-year average of both companies, signifying that the previous year’s figures aren’t outliers.

Profitability Comparison (seekingalpha.com)

Both restaurants mainly bank on quick fast-food service, which is precedented to perform well during economic downturns as consumers halt their dine-out spending and look towards economical eateries such as MCD and QSR-owned businesses. MCD’s EPS grew with double-digit CAGR during the 2008 recession with 26% YoY growth in 2008, 8% in 2009, and 16% in 2010. This holds strong value for potential investors of both stocks who fear that another recession might be around the corner.

www.mcdonalds.com/us/en-us.html

Management Effectiveness: Another Point to McDonald’s

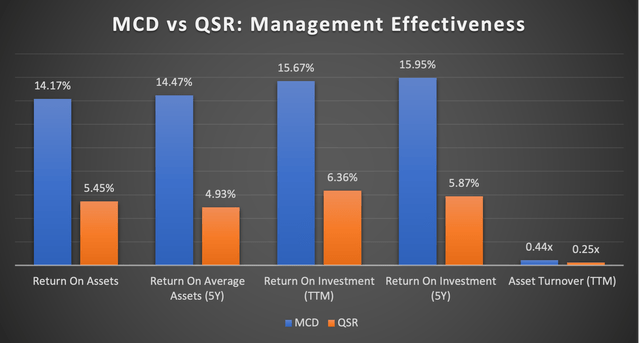

Looking at the management effectiveness ratios, MCD has historically performed better than QSR with better resource utilization. For example, McDonald’s’ Return on Assets (ROA) is 2.6 times higher than QSR, Return on Investment is 2.5 times higher, and Asset turnover is 1.76 times higher. Of course, these metrics don’t mean that QSR isn’t utilizing its assets well, but they show that MCD’s management is better at asset utilization than QSR. In general, better resource utilization means that the company is extracting higher revenue per dollar of investment, which investors should always scrutinize before investing in a company. Surprisingly, despite the asset-heavy balance sheet resulting from its real estate empire, MCD achieves leading utilization rates deriving from its superior net income margin at 32.5%, more than double what QSR delivers.

Management Effectiveness Comparison (www.reuters.com/companies/MCD/key-metrics)

One thing that might seem peculiar to potential investors is the shareholders’ equity deficit on the balance sheet, which is why I haven’t calculated equity-based ratios such as the Return on Equity (ROE), etc. When a company buys back stock, those shares are removed from the public, with remaining investors having a larger percentage of a smaller pie (since the assets are reduced) – their total value is theoretically unchanged. It shows up in “treasury stock” as a negative number (shares that were in public but removed).

In McDonald’s case, the primary driver in the equity change is that MCD has repurchased over a quarter of its outstanding shares over the past decade, reducing assets and equity. If it had paid off debt, its equity would not be negative. Therefore, it made more financial sense for the company to buy back stock instead of paying off debt. This is why the EPS has so disproportionally risen over the years compared to the revenue and net income.

Dividends and Stock Buybacks: Both Stocks Going Strong

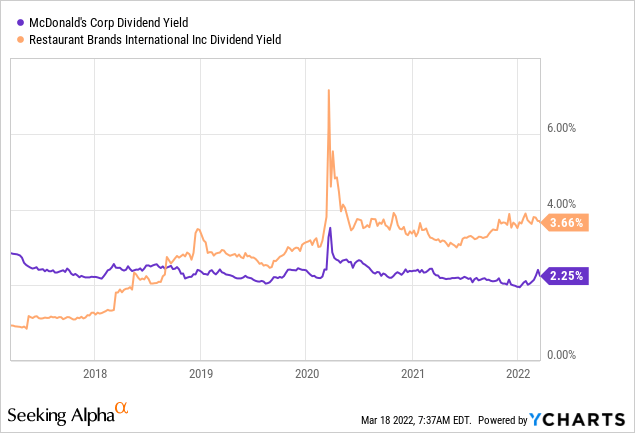

MCD and QSR have a strong dividend payout history with 2.25% and 3.66% current dividend yields, respectively. Moreover, both stocks have a history of consistently growing their dividends at an annual pace. QSR has had a consistent dividend growth since 2014, while McDonald’s has raised its dividend for 43 consecutive years since paying its first dividend in 1976. With expected high cash flows that come with improving performance, it can be reasonably assumed that both companies will continue to stick to this precedent.

McDonald’s has historically kept its Payout Ratio between 50% to 70%, with the highest going up to as much as 80%. Total dividends paid by MCD during the last decade have risen from $2.9 billion in 2012 to $3.9 billion in 2021, an increase of almost 35%. However, due to the company’s extensive share buyback program, the dividend payout per share has risen from $1.96 per share per annum a decade ago to $5.52 in 2022, an increase of 2.8 times.

McDonald’s had previously suspended its $15 billion buyback program in 2021 to preserve cash for navigating through the pandemic, which had led many of its restaurants towards temporary closure. However, the program has been resumed on the back of improving performance metrics.

In contrast, QSR has a forward annual dividend of $2.16 for 2022, with a 5-Year CAGR of 27.88% and a sustainable Payout Ratio of over 75%. The company has a comparatively smaller share buyback program to buy $1 billion worth of shares by mid-2023. The figures look much more attractive than McDonald’s’ because QSR is a much smaller company than MCD with more room to grow.

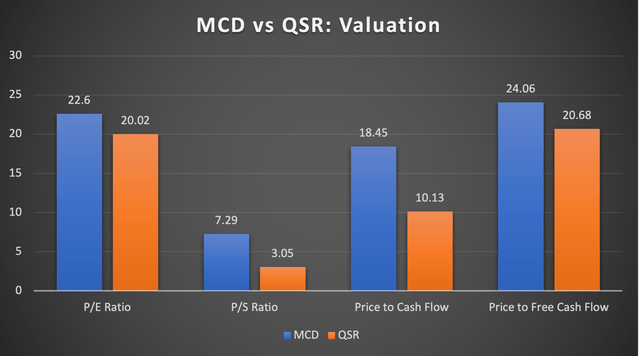

Valuation: QSR takes this One

QSR is cheaper than MCD in virtually all price ratios as a part of relative valuation metrics. The more important question is whether these metrics justify the stocks’ share price? Historically speaking, both shares are trading at lower valuation multiples than prior years. With the pandemic subsiding and the expected growth in the coming year, the multiples are likely to revert to their historical median, increasing their stock price. Apart from Q1-2020, QSR is currently trading at its lowest valuation metrics since the start of 2019.

Valuation Comparison (seekingalpha.com/symbol/MCD/peers/comparison)

Meanwhile, MCD appears to be fairly valued, but potential investors need to keep the dividends and share buybacks in mind when considering the stock’s total returns. The company has, on average, returned over $9.5 billion in capital to its shareholders in the five years from 2016 to 2020. The returns were around $4.7 billion in 2021 due to the suspension of its buyback program but are expected to normalize in 2022.

Russia-Ukraine Situation: MCD has higher exposure than QSR

The world is amid political turmoil due to the Russia-Ukraine situation. The situation profoundly affects financial markets concerning interest rates, commodities, and multinational corporations such as MCD and QSR. MCD identified Russia as a particularly booming market for its Famous Orders campaign in Q3 2021, while Burger has almost doubled its footprint in Russia since 2021, explicitly identifying it in its Q3 conference call as well.

However, along with seven other fast-food brands with more than 2,600 outlets in Russia, McDonald’s has recently announced a temporary shutdown of around 950 branches in Russia and Ukraine, 84% and 100% of which are company-operated (non-franchised), respectively.

This will cost the company about $50 million per month as it will continue to pay around 62,000 employees, location lease payments, supply chain costs, and other expenses. In addition, the branches account for roughly 2% of McDonald’s systemwide sales, 9% of its revenue, and 3% of its operating income. However, as the Bank of America Securities analyst, Sara Senatore has expressed that if the conflict spills over into Europe due to any reason whatsoever, the company would have a significantly higher threat as a quarter of its systemwide sales and a third of its operating profit comes from the region.

In contrast, QSR’s largest footprint in Russia is the 800 franchised Burger King locations that remain open. Even though the company has suspended corporate support, including operations, marketing, and supply chain support, towards its Russia-based franchises, it remains mostly intact as the revenue from these locations remains below 1% of total revenue. QSR has remarked that Burger King has “long-standing legal agreements” with its franchisees in Russia “that are not easily changeable in the foreseeable future.” This has resulted in a vocal backlash from its customers from the western world, but its consequences are yet to be seen in its financials.

Fitch Ratings rightfully writes that:

A lengthy war and its ramifications, including sanctions, can exacerbate cost pressures and dampen demand, which could lead to weaker-than-expected cash flow and leverage metrics.

It elaborates that the U.S. consumer price inflation can peak at around 8% and, if sustained, will compromise Americans’ restaurant spending, resulting in lower business volumes.

The ultimate consequences for MCD and QSR remain unpredictable due to the nature of the conflict. Still, the operating impact seems limited unless it expands into Europe. Comparably, MCD remains highly exposed to the situation because of its higher proportion of company-operated locations than QSR.

Conclusion

McDonald’s and Restaurant Brands International have created a firm foothold in the quick-service restaurant industry with a robust global presence. However, both corporations have a major size difference, with McDonald’s over 40,000 restaurants compared to QSR’s 29,000. This reflects in the market cap of both companies, with MCD boasting about $177.1 billion against QSR’s $17.8 billion.

Comparing both stocks shows that both are solid investments offering good investor returns. MCD exhibits its grandeur in almost every metric, but QSR’s smaller size means it has a lot more room to grow at a faster pace. For me, owning MCD stock appears to outweigh the rewards of QSR based on its solid fundamentals and aggressive shareholder returns. However, I remain confident that the same bull case can be made for QSR from a growth perspective. Therefore, potential investors would do well to invest in either of the two stocks, depending on their market cap preferences.

Be the first to comment