fcafotodigital

McCormick & Company, Incorporated (NYSE:MKC) manufactures, markets, and distributes spices, seasoning mixes, condiments, and other flavorful products to the food industry. It operates in two segments, Consumer and Flavor Solutions.

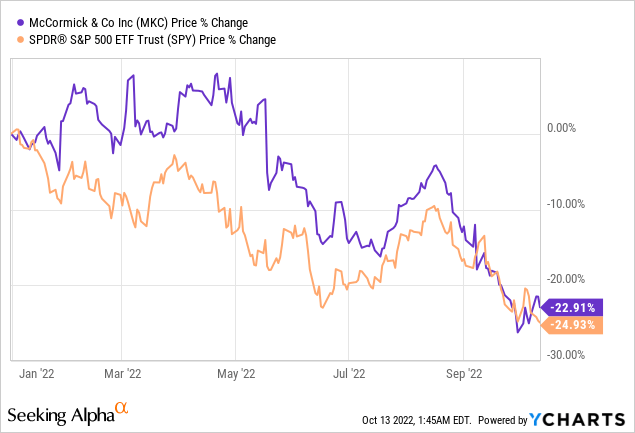

Year-to-date, MKC’s share price has fallen by about 23%, in comparison with the 25% decline of the broader market.

Today, we are going to take a look at the firm’s latest earnings results and give our view on the numbers and the outlook.

Third quarter results

Sales results

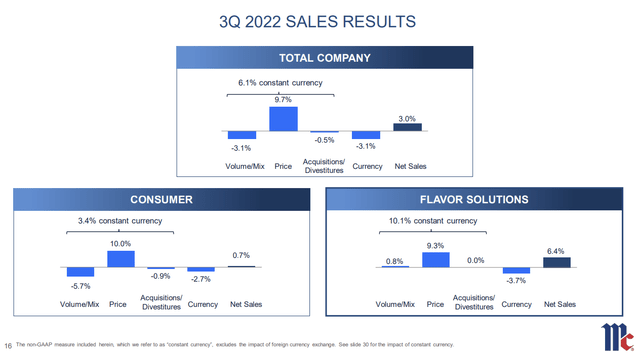

Earlier in October, MKC has reported its third quarter financial results. Sales increased 3% in the third quarter from the year-ago period. In constant currency, sales increased 6% driven by growth in both the Consumer and Flavor Solutions segments.

Sales (MKC)

Demand

So far, the company has been successful in increasing its sales, by pricing, but at the same time, volume has been declining, driven by the consumer segment. This indicates that the demand for MKS’s products at higher prices is falling. We have argued in several of our previous articles that the demand for consumer staples is normally relatively inelastic and may remain high even during periods of low consumer confidence. It may not be the case for MKC’s products. In our opinion, the switching cost for spices and other flavorful products in the food industry is relatively low, therefore customers may choose more affordable, lower cost alternatives, potentially hurting MKC’s financial performance in the coming quarters.

Also important to note that the decline in demand was primarily driven by the Americas and EMEA regions. The main causes were: price elasticities, supply chain constraints and lower sales in Russia.

Currency

Not only the declining demand is raising concerns, but also the currency headwinds in the EMEA and Asia/Pacific regions.

The relative strength of the USD has been causing headwinds for many American firms in 2022 and MKC is no exception either. Currency headwinds in the consumer segment have been -12.1% in the EMEA region, and -4.7% in Asia/Pacific. In the flavor solutions segment these figures were -12.5% and -6.3%, respectively.

In our opinion, both headwinds are likely to continue to negatively impact the firm’s financial performance in the near term. The uncertain geopolitical situation in the Eastern European region, combined with the financial uncertainty in the U.K. and the questionable energy security of Europe during the winter, is probably going to further impact the demand for MKC’s products. Further, the volatility of the British pound and the relatively weak EUR compared to the USD are not likely to dramatically improve in the near future, in our opinion.

Guidance

For the rest of 2022, MKC has maintained its guidance, forecasting a 2% sales growth for 2022. We believe that this guidance is relatively conservative and takes the above mentioned potential headwinds into account. While 2% growth is not the most attractive figure, it is definitely better than what many firms in the current market environment can even hope for.

Gross margin

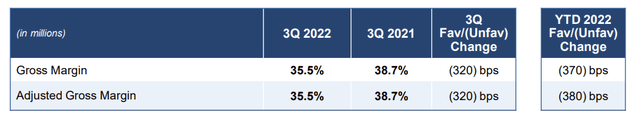

Gross margin (MKC)

The gross margins have been hurt by the dollar cost inflation, which MKC has been able to partially offset by pricing. Further negative impacts on the gross margin included:

- Elevated costs to meet strong Flavor Solutions segment demand

- Flavor Solutions manufacturing facility start-up costs

- Lower operating leverage in Consumer segment

On the other hand, it has been noted that pricing action has begun to outpace cost inflation across both segments, which may be a sign that in the next quarters we will see slightly higher gross margin figures.

Operating income

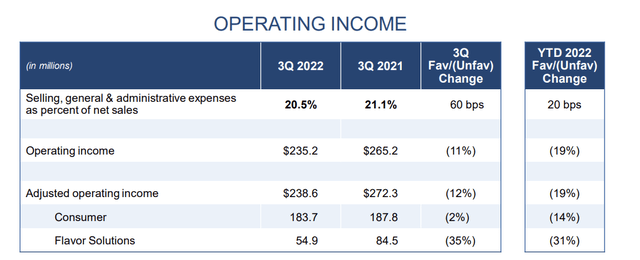

Operating income and adjusted operating income have substantially fallen compared to the year ago quarter.

Operating income (MKC)

This decline has been driven by the gross margin compression, primarily in the Company’s Flavor Solutions segment. On the other hand, selling, general and administrative expenses have been comparable to Q3 of last year with higher distribution costs and brand marketing investments offset by lower employee benefit expenses.

Looking forward, we believe, the downward pressure on the operating income may continue. Elevated energy prices are an important driver of high distribution costs and, in our opinion, energy prices are likely to remain relatively high in the coming quarters.

Guidance

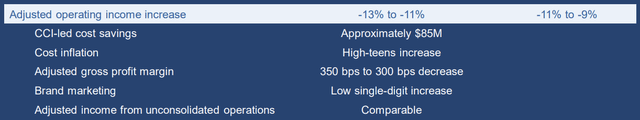

The firm also highlighted in their guidance that they expect the operating income to be lower in 2022 than in the prior year, by as much as -13% to -11%.

Guidance (MKC)

Earnings

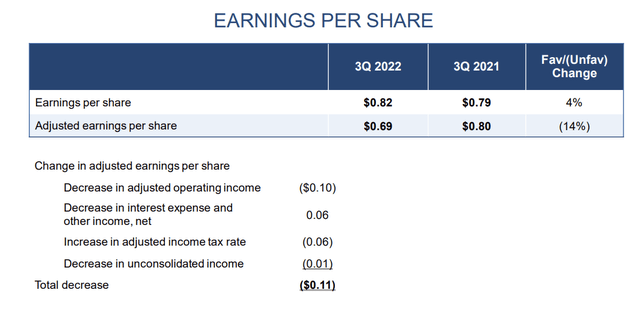

While earnings per share have changed by +4%, adjusted earnings per share have decreased by as much as 14%. The main drivers of the decline were the decrease in adjusted operating income, the increase in the adjusted income tax rate, due to higher level of discrete tax items in 2021, and the decrease in unconsolidated income.

Based on the guidance, adjusted EPS is expected to decline by 14% to 12% in 2022.

Earnings per share (MKC)

All in all, we believe that the declining demand and elevated costs are likely to keep impacting MKC’s business in the near future. While pricing actions have started to outpace the cost inflation, which is good from one perspective, we believe that it may cause further negative impact on the demand. Macroeconomic factors, like the geopolitical tension and the uncertain economic landscape in Europe, together with elevated energy prices are also concerning. Based on the third quarter results, we are not convinced with starting a new position in MKC’s stock right now.

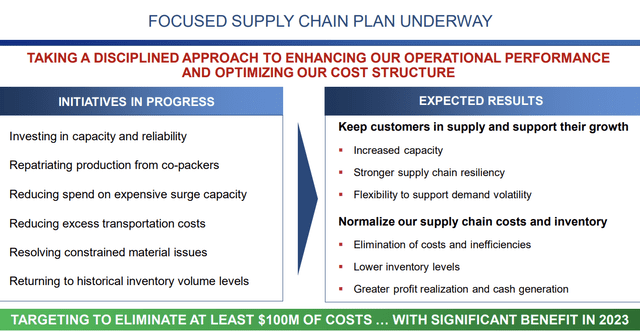

We cannot forget, however, that MKC is working on improving its supply chain, which could result in significant cost savings in 2023.

Initiatives (MKC)

We find the initiatives themselves attractive and suitable, however we would like to see the execution of these, before we would consider investing.

Let us take a look at the dividend, as many investors choose to invest in MKC for its reliable quarterly payments.

Dividend

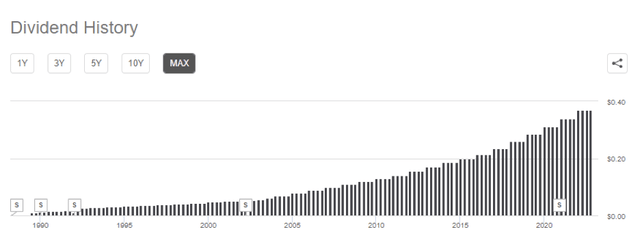

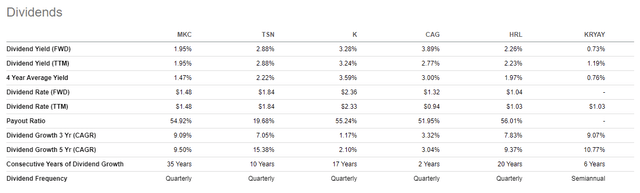

MKC has a strong track record of returning value to its shareholder in the form of quarterly dividend payments. The company has been rewarding its shareholders for the past 96 years, consecutively. In each of the last 35 year, the firm has also managed to increase their dividend.

Dividend history (Seeking Alpha)

From this perspective, we believe that MKC could be an attractive investment option for dividend and dividend growth investors.

While the payout ratio is about 55%, which appears to be high, it is not uncommon in the industry to have a payout ratio of more than 50%.

Dividends (MKC)

We believe that even if earnings are to slightly decline in the coming quarters, the dividend is not likely to be paused.

Before concluding, we will also take a look at some key financial ratios, to see how MKC compares to its peers and competitors.

Financial ratios

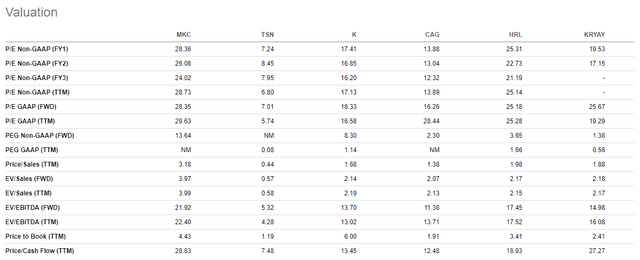

Valuation

According to most traditional price multiples, MKC is trading at a significant premium compared to its peers. In our opinion, a forward P/E ratio of 26 in the current, uncertain market environment is not justified, especially when expecting the earnings to keep decreasing in the rest of 2022. In our opinion, there is potential downside for the stock price from the current price levels.

Valuation (Seeking Alpha)

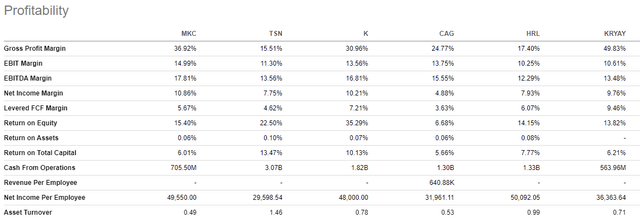

Profitability

While the margins of MKC appear to be higher than those of its competitors, the return on assets indicates that there are peers, which are more efficient in generating profits using their assets. We believe this again signals that the significant premium compared to the peers is not justified.

Profitability (Seeking Alpha)

Key takeaways

While sales have increased, demand has been declining especially in the EMEA and Asia/Pacific regions. Increasing costs have resulted in contracting margins and lower net income than in the year ago quarter. The headwinds causing these changes, including the geopolitical and economic situation in Europe and the elevated energy prices, are likely to continue negatively impacting the firm in the coming quarters.

On the other hand, the firm is actively working on improving its supply chains, which could lead to substantial savings in 2023.

While the firm could look attractive to dividend and dividend growth investors, we believe it is trading at a significant premium compared to its peers, which we believe is not justified based on the fundamentals.

We rate MKC’s stock as “hold”.

Be the first to comment