Mlenny/E+ via Getty Images

Nothing Lasts Forever

I think IBM has had a good run, [and] not all companies last forever. There is a life cycle to a company. They are born [to] grow and then decline. They [IBM] have been in decline for 10 or 12 years…When you’re 75, you’d love to be 35 again, but you’re not going to…So that’s the way I think of aging companies. Trying to turn them around might be the most dangerous thing you can do. – Aswath Damodaran, July 22, 2017

I included the quote above in one of my prior IBM (NYSE:IBM) analyses back in early 2020 when I took an in-depth look at the firm’s newer (at the time) hybrid cloud and artificial intelligence (“AI”) strategy. It’s strong, if understandable logic. But, in the particular case of IBM, is it accurate?

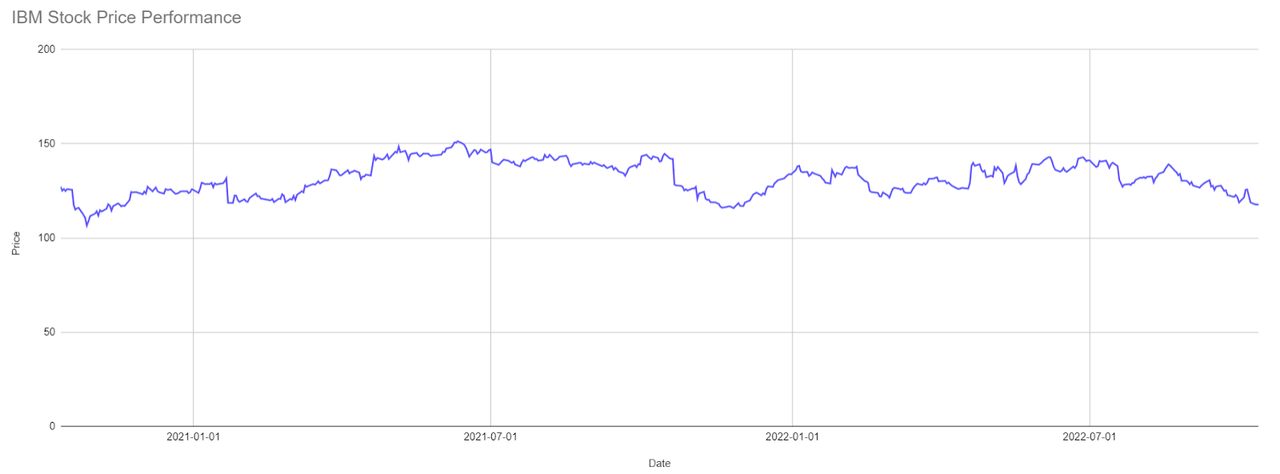

With IBM’s earnings date set for next Wednesday, October 19 to report Q3 FY ‘22 results, investors might wonder if Dr. Damodaran is right. If we were only to consider the share price, his words might seem prescient since the stock was trading around ~$140/share at the time the article from which the quote was referenced was published; as compared to today’s close of $117.57. In fact, the stock has barely nudged above $140/share over the last 18 months.

Figure 1: IBM 18-Month Stock Price Performance (Yves Sukhu)

Notes:

-

Data as of market close October 12, 2022.

Yet, 2022 has proved to be a reasonably good year for IBM…so far.

-

As other Seeking Alpha authors have noted, the stock has held up fairly well, dropping “only” ~(14%) YTD as compared to ~(25%) YTD for the S&P 500.

-

Q2 FY ‘22 revenue of $15.5B reflected 16% growth versus the prior period in constant currency.

-

The revenue performance in Q2 FY ‘22 demonstrated strength across all geographies and the company’s key operating segments, namely software, infrastructure, and consulting.

-

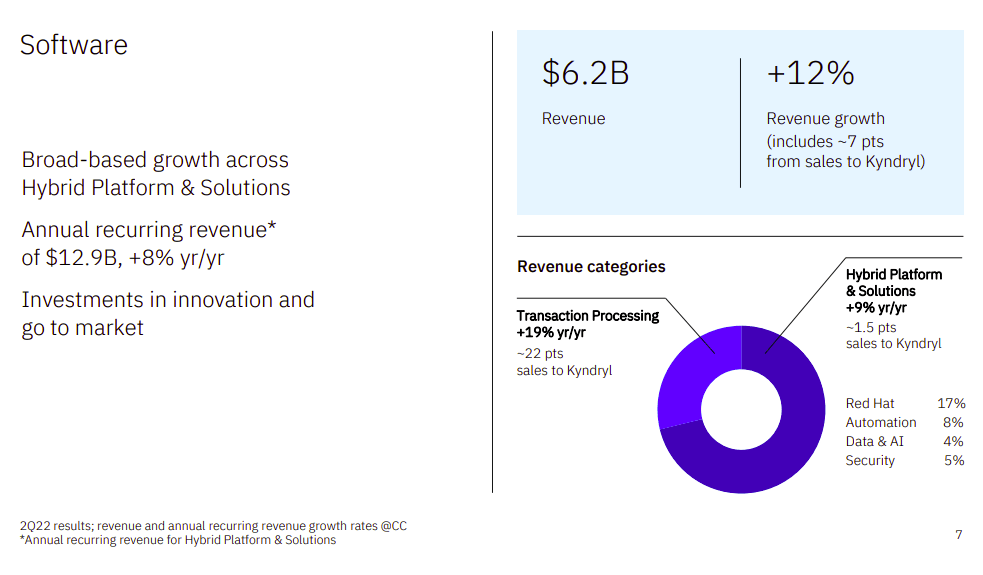

The software, infrastructure, and consulting segments racked up sales of $6.2B, $4.2B, and $4.8B respectively during the quarter, reflecting growth of 12%, 25%, and 18% respectively versus the prior period in constant currency.

-

TTM hybrid cloud revenue stood at $21.7B at the end of the quarter, up 19% in constant currency.

-

YTD cash from operating activities was $4.6B at the end of Q2 FY ‘22, driving YTD free cash flow of $3.3B.

Management’s confidence exiting Q2 FY ‘22 allowed CEO Arvind Krishna to reaffirm full-year guidance noting that “[with] our first half results, we continue to expect full-year revenue growth at the high end of our mid-single digit model.” Free cash flow for the full-year is expected at $10B.

With the foregoing in mind, we might predict a strong Q3 FY ‘22 performance as well. But, recently lowered price targets by several analysts might hint that dark clouds may have already formed over IBM’s 2H FY ‘22.

Any Life Left in the Core Business?

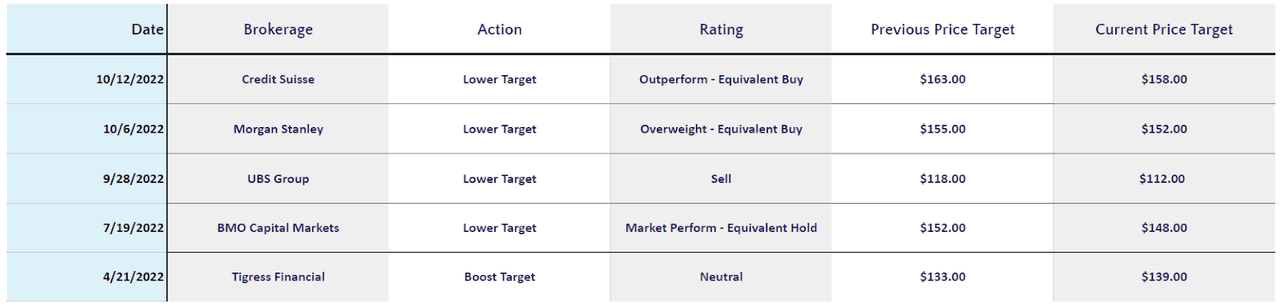

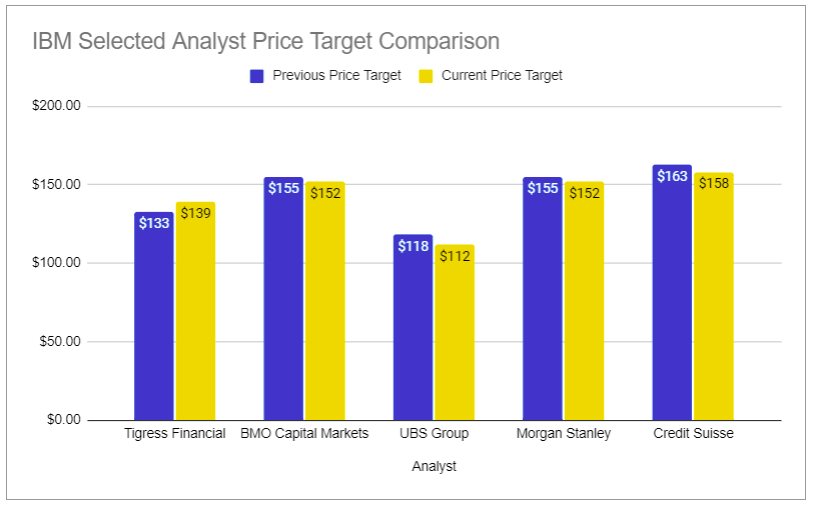

To put IBM bulls at ease, recently lowered price targets by two analysts reflect a minor “trimming”, with both maintaining their buy ratings.

Figure 2: IBM Selected Analyst Ratings (MarketBeat)

However, UBS Group, who had previously slashed their price target from $136/share to $124/share in early January, did so again dropping their price target to $112/share while maintaining a sell rating.

Figure 3: IBM Selected Analyst Price Targets (MarketBeat)

UBS analyst David Vogt had suggested early in the year that the firm was trading at “…an ‘elevated valuation’ [leaving] the shares ‘vulnerable’ over the next 12 months”.

The contrast between UBS and Morgan Stanley/Credit Suisse above could not be starker. Even without reading their research notes, we might assume the Morgan Stanley and Credit Suisse analyst teams are pleased with the performance of the core business, even if they are dropping their price targets a bit. And, on that point, I think there are reasons to be bullish.

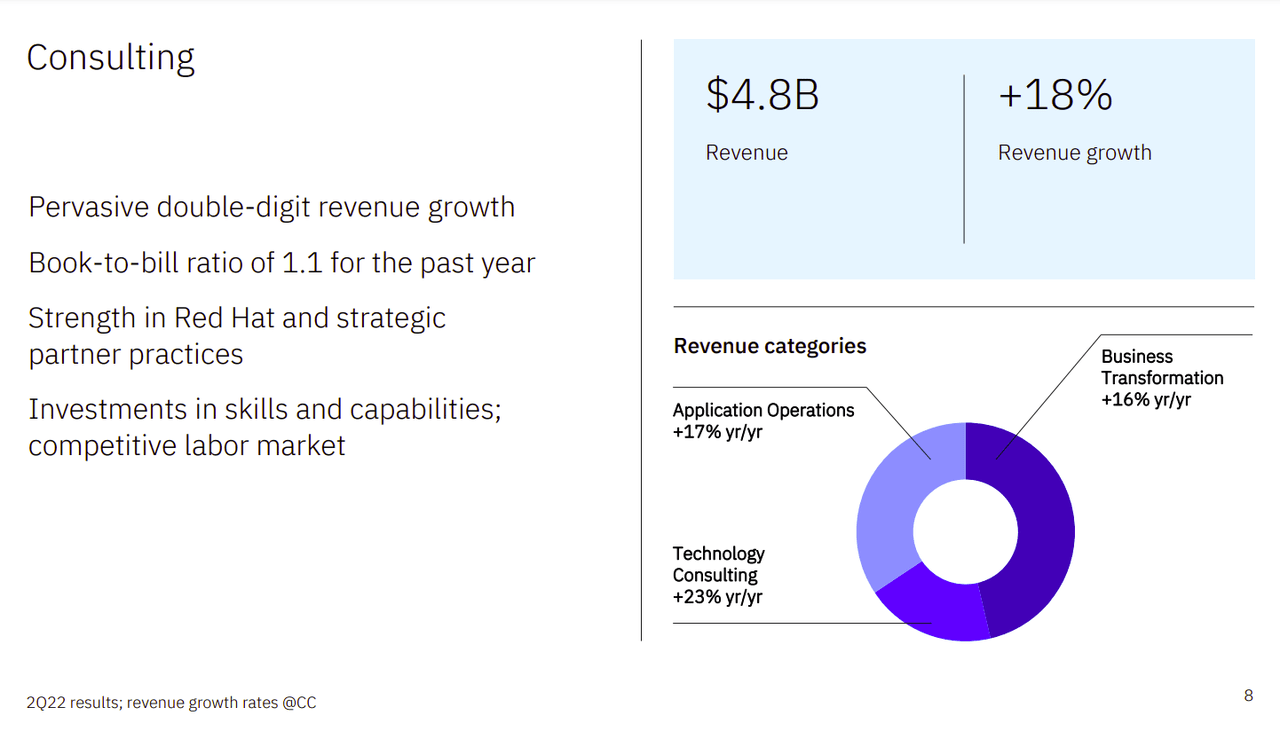

1. IBM Consulting demonstrating strength.

During the recent Goldman Sachs Communacopia and Technology Conference, John Granger, Senior Vice President of IBM Consulting, noted that “[IBM is] a big consulting player…[with] 150,000 professionals across the world. Revenue is approaching $20 billion. And within the IBM family, [consulting is] about a third of IBM’s revenue, but nearly two-thirds of IBM’s people.” As customers, particularly large enterprises, evolve existing legacy systems and/or digitize non-digital processes, they will draw upon such services as provided by IBM Consulting, including business transformation and technology consulting. These engagements are typically high-margin and high-value, often driving revenue in other parts of the business. Hence, as Mr. Granger also pointed out, the segment is extremely important with respect to IBM’s ongoing success.

Figure 4: IBM Consulting Segment Performance Q2 FY ‘22 (IBM Q2 FY ’22 Earnings Presentation)

There are not many companies that can do what IBM is capable of doing via its IBM Consulting segment. To reiterate the statistic that Mr. Granger mentioned, the organization reflects two-thirds of IBM’s entire employee headcount. The ability to put a large number of “feet-on the-ground” for a given project is somewhat unique to IBM, as it is for key consulting competitors like Accenture (ACN) and Cognizant (CTSH).

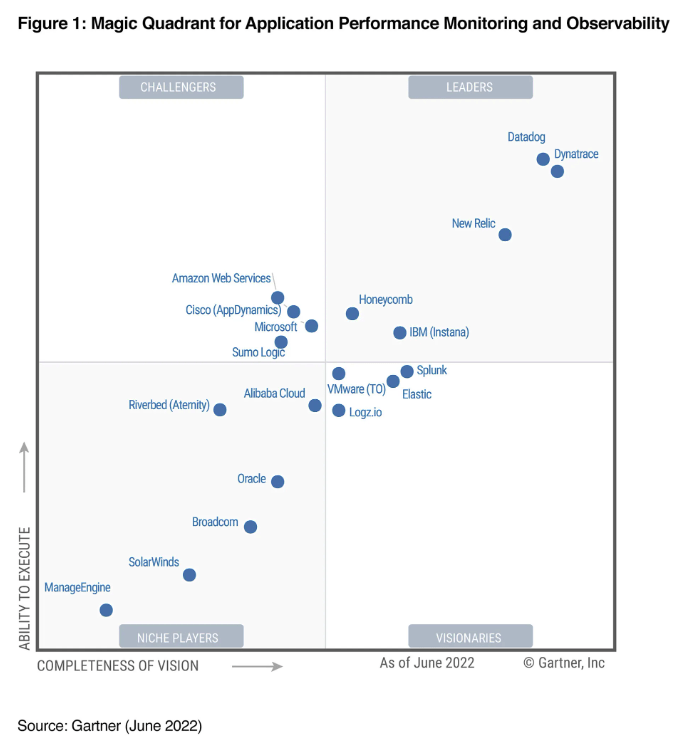

2. IBM has found its footing again in the APM and Observability space.

IBM’s acquisition of Instana in 2020 gave the company a boost in the large, multi-billion dollar application performance management (“APM”) market. Consider IBM’s position in Gartner’s APM Magic Quadrant from March 2019 versus their Magic Quadrant for June 2022 below.

Figure 5: Magic Quadrant for Application Performance Monitoring March 2019 (Gartner)

Figure 6: Magic Quadrant for Application Performance Monitoring June 2022 (Gartner)

As a leader, it is noteworthy to see IBM ranked higher, overall, than Cisco’s AppDynamics and Splunk, among others. Quoting myself from a prior article on Datadog (DDOG), “…the architecture of modern applications is radically different from even just 10 years ago – they are far more complex with many ‘moving parts’ that may reside in one or more clouds, and/or in on-premise environments.” This complexity – which is increasing in many ways – drives the need for APM solutions, and I theorized in the same article on DDOG that investors might see a certain resiliency within that market despite the economic slowdown. Time will tell if I am right about that. But, the point is that it is a large market, growing double-digits year-on-year by some estimates, and IBM is well-positioned to grow with it.

3. Management’s move deeper into security and automation technologies is a smart move.

During the Q2 FY ‘22 Earnings Call, Mr. Krishna noted that “[given] the importance of cybersecurity, in this past quarter, we also acquired Randori, a leading attack surface management, and offensive cybersecurity provider. This builds on the recent acquisition of ReaQta and the launch of QRadar XDR.” As the computing environments become more complex (see the prior point), security becomes that much more difficult. I think management shows good judgment pushing further into the security space as it is somewhat hard to imagine enterprises spending significantly less on security regardless of economic conditions. Automation is also front-of-mind for many organizations today as they attempt to streamline routine workflows and free-up employees to focus on more strategic work. Accordingly, Mr. Krishna explained that “[this] is one of the many reasons we are investing heavily in both AI and automation.” AI plays a key role in IT operations today, with Gartner inventing the term “AIOps” to refer to the combination of “artificial intelligence” and “IT operations”. On that basis, IBM would seem well positioned to capture a significant share of the fast-growing AIOps market via its tooling.

Figure 7: IBM Software Segment Performance Q2 FY ‘22 (IBM Q2 FY ’22 Earnings Presentation)

While we see the automation and security sub-segments only posting single-digit growth in Q2 FY ‘22 as per Figure 7, I would expect the growth rates of both businesses to increase moving forward due to the nature of those particular markets.

So, with reasons to think the core business still has some life left in it, is UBS too bearish with their call?

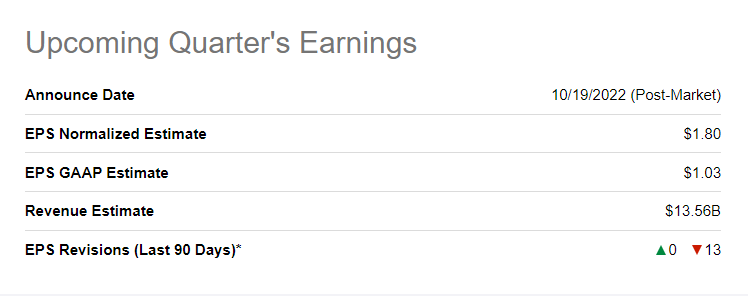

IBM Q3 FY22 Expectations and Exposures

IBM’s revenue and EPS estimates are seen in the table below, along with the glaring marker of 13 downward revisions in the last 90 days.

Figure 8: IBM Q3 FY ‘22 Revenue and EPS Estimates (Seeking Alpha)

With analysts clearly expecting a weaker performance, investors might keep a few other points in mind.

1. Q3 tends to be a weaker quarter for IBM.

As readers likely know, Q4 tends to be the strongest quarter for many technology companies. Such is the case with IBM as well; and thus history does not play in the company’s favor heading into Q3 FY ‘22 results. Investors might also remember that the company missed its Q3 FY ‘21 estimates.

2. The Red Hat business is decelerating.

Red Hat sales growth in Q2 FY ‘22 declined to 12% versus the prior period which saw a growth rate of 20%. Although, both growth rates were identical at 17% adjusting for currency. Still, with a Red Hat growth rate of 21% in Q1 FY ‘22, this is not a trend that investors want to see considering that IBM bet the farm to a certain extent on Red Hat. Of course, it’s premature to declare that the business is in trouble. But, investors will certainly want to pay attention to the business’ results when Q3 FY ‘22 earnings are announced.

3. The hybrid cloud and AI strategy may be weaker than some investors think.

On the surface, IBM’s stated hybrid cloud and AI solutions strategy would seem to be gaining traction in the context of Q1 FY ‘22 and Q2 FY ‘22 results, with revenue growing 11% and 16% respectively versus the prior periods in constant currency. Mr. Krishna mentioned during the company’s Q2 FY ‘22 Earnings Call that the firm had more than 4,000 hybrid-cloud clients at the end of Q2 FY ‘22, including more than 250 added in the quarter itself. Of course, this is a bullish signal and it reinforces uptake of IBM’s architectural model centered on Red Hat Enterprise Linux, containers, and orchestration. However, we might also argue that 4,000 hybrid-cloud customers might seem a little low, especially as IBM has been talking about hybrid-cloud as far back as its Annual Report FY ‘11. I think this shows that while IBM correctly foresaw an evolution of the cloud into a “multi-cloud” as it pertains to how enterprises would deploy and run applications, there are any number of supporting technology stacks to support multi-cloud application environments, some of which might feature IBM technologies and some which feature none at all. There is a somewhat analogous story with respect to AI. The AI market is composed of innumerable players, many with specializations in particular sub-fields under the AI umbrella. Accordingly, it is an incredibly competitive space, sometimes characterized by a lack of compelling differentiation between competing solutions. While IBM is still regarded as a leader in AI by some, remember that their grand vision for IBM Watson never really came to fruition. This is all to say that IBM’s stated strategy may not be all that strong, especially in consideration of the prior point discussing the deceleration of the Red Hat business.

Having worked at IBM during my enterprise software career, I would lean toward the typical weakness seen in Q3 possibly driving a miss on both lines. Couple that with the possibility of emerging weakness in the firm’s strategy along with economic headwinds, and the outlook becomes somewhat gloomy. Maybe UBS was right.

Playing This Hulking Service Integrator

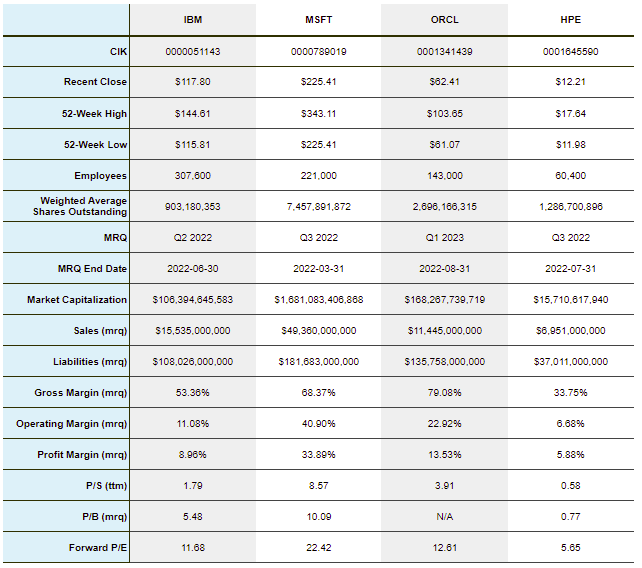

As UBS lamented, IBM’s share price did not offer investors any kind of grand bargain early in the year; nor is it wildly cheap even after its YTD decline.

Figure 9: IBM and Selected Competitor Statistics (Yves Sukhu)

Notes:

-

Data as of market close October 11, 2022.

-

Data from Polygon.io except P/S, P/B, and P/E data from Yahoo Finance; as well as ORCL and HPE gross margin data also from Yahoo Finance.

At the same time, it’s not wildly expensive either. As mentioned in the previous section, I do think Q3 FY ‘22 might be a bit rough, if only because it often is. But, with the idea that the “future” of the core business may be powered to a greater extent by IBM Consulting, and that IBM’s deeper push into APM, security, and automation may offset weakness elsewhere, I think it makes sense to hold the stock even with the threat of a weaker-than-expected Q3. Again, Q4 tends to be IBM’s strongest quarter so if the stock dips following Q3 earnings, there’s a good chance it can recover following Q4.

I deliberately referred to IBM as a “service integrator”, rather than a “technology company”, in the title of this section because I tend to think of the firm more and more as a service integrator with technology, as opposed to a technology company with services. Services have been a core part of IBM’s business for decades; and I am betting services will drive a majority of revenues in the not too distant future. And, I actually think that’s a good thing because I personally think that’s where IBM excels. With Kyndryl (KD) spun out, I wouldn’t be surprised if IBM continues to slim itself down even more, perhaps with IBM Infrastructure the next to go.

Responding to the question I posed about Dr. Damodaran’s quote in the introduction: he’s probably right. But, that doesn’t necessarily mean investors can’t profit off an investment in the company. I think IBM’s core business will continue to throw off cash for a long time to come; and the stock likely will suit income investors just fine during that time.

Upcoming Q3 FY ‘22 results might leave investors wanting, but I think they owe themselves a longer-term perspective on the company’s forward prospects.

Be the first to comment