NicoElNino

Investment Thesis

MaxLinear, Inc. (NASDAQ:MXL) mainly provides wired & wireless infrastructure, digital and mixed-signal integrated circuits for connectivity. The company has recently announced its partnership with RFHIC to deliver Ultra Wide-band 5G Power Amplifiers (PA) which I believe can act as a primary catalyst to boost the company’s growth in coming years.

About MXL

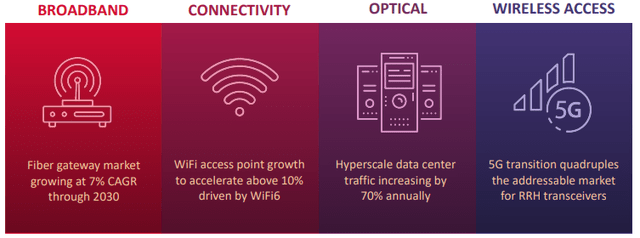

MXL is a hardware company that provides mobile and wireline infrastructure, data centers, communications systems-on-chips (SoC), industrial applications & solutions used in broadband. It is a fabless circuit designing company whose products integrate most parts of high-speed communication systems, including security engines, radio frequency, high-performance analog, and power management. The company’s customer base includes module makers, original design manufacturers, original equipment manufacturers, and electronics distributors. It uses low-cost CMOS process technology to manufacture semiconductor devices and platform-level solutions, enabling high-volume and low-cost consumer applications manufacturing. The company aims to be the leading provider of communication SoCs for industrial and multimarket applications and wire & wireless infrastructure by expanding technological leadership & customer base, targeting additional high-growth markets, and expanding its global presence. The easy availability of internet connectivity has led to significant data content, distribution, and consumption growth. This trend might continue after considering factors such as the rapid growth of social media, increasing demand for OTT Platforms & video services, rise in data centers & cloud-based services, high dependency on video conferencing applications, and the high growth rate of broadband 4G/5G mobile internet connectivity. The network traffic generated from these activities requires broad-spectrum or broadband, high-frequency circuits, and specific algorithms to improve spectrum utilization efficiency. These trends act as critical drivers for the company’s growth and are end markets to sell their products.

Investor Presentation: Slide no. 10

Partnership with RFHIC

The 5G technology market is one of the most rapidly growing markets globally. This technology is designed with forwarding compatibility, which enables it to integrate with various devices such as laptops, smartphones, and security systems. This technology can transform various industries by enhancing production, and cutting down costs, reflecting its vast potential addressable market. Huge investments have been made in smart tech cities, which can be a possible growth opportunity for 5G technology. 5G provides improved latency (time delay between sender and receiver) as compared to 4G, which has increased the demand and requirements of radio-frequency [RF] hardware as it helps in providing increased amplitude. To address this growing demand, the company has collaborated with RFHIC, which designs and manufactures GaN RF and microwave components. As per the deal, it will deliver a 400MHz Power Amplifier (PA) solution for 5G macrocell radios by leveraging MaxLinear’s Digital Predistortion and Crest Factor Reduction technologies combined with RFHIC’s GaN RF Transistors. Power amplifiers are mainly used to increase the amplitude and provide a high-power signal. These solutions will be available to the Radio Access product (RAN) developers, enabling them to deliver Ultra-wide-band 400 MHz macro power amplifiers with low emissions and high-power efficiencies. I believe this partnership can significantly help the company to attract a large customer base, such as mobile operators and network providers, as they highly need 5G radio innovations which can help them reduce cost, power consumption, and tower space along with delivering high capacity. It will also be providing customizable solutions which can benefit the customers to design & build their own products. After considering all these factors, I think this partnership can also help the company to achieve market synergies by leveraging the advanced technologies of RFHIC and creating its strong presence in the competitive market. I believe the company can significantly increase its market share and increase its sales volume and earnings by attracting new customers. For the year ended December 2021, the top two customers contributed 26% to the company’s total net revenue, and the ten largest customers contributed 69% to the company’s total revenue. This collaboration can also reduce the company’s dependency on limited customers as it can expand MXL’s customer base in the coming years.

What is the Main Risk Faced by MXL?

Dependency on Semiconductor Industry

The semiconductor industry is highly cyclical and is characterized by constant and rapid technological change, rapid product obsolescence and price erosion, evolving standards, short product life cycles, and wide fluctuations in product supply & demand. Any future downturns may result in diminished product demand, production overcapacity, high inventory levels, and accelerated erosion of average selling prices. Furthermore, any upturn in the semiconductor industry could result in increased competition for access to third-party foundry and assembly capacity. The company is dependent on the availability of this capacity to manufacture and assemble all of its products. None of MXL’s third-party foundry or assembly contractors provided assurances that adequate capacity would be available to the company in the future. If there is a significant downturn or upturn in the semiconductor industry, it could be materially detrimental to the business and operating results of the company.

Valuation

The company has recently announced its partnership with RFHIC to accelerate the deployment of Ultra-wide-band 5G Power amplifiers. I believe this partnership can drive the company’s growth by increasing its customer base and creating a solid presence in the market in the coming years. After considering all the above factors, I am estimating EPS of $4.17 for FY2023, giving the forward P/E ratio of 7.19x. After comparing the forward P/E ratio of 7.19x with the sector median of 16.70x, I think the company is undervalued. After considering the company’s rising customer base and dependency on the semiconductor industry, I think the company can gain significant momentum and trades well below the sector median P/E ratio. Hence, I estimate the company might trade at a P/E ratio of 11.8x, giving the target price of $49.20, which is a 61.47% upside compared to the current share price of $30.47.

Conclusion

MXL focuses on providing radio frequency, integrated circuits for connectivity, wired and wireless infrastructure, and multimarket and industrial applications. The company depends on a limited number of customers, exposing them to the risk of losing market share. But I believe this risk can fade by the end of this year as the company has recently announced its partnership with RFHIC. According to this partnership, RFHIC will deliver power amplifier solutions that can accelerate its growth by capturing a large customer base and creating a solid presence in the competitive market. The company is exposed to the cyclical nature of the semiconductor industry. After comparing the forward P/E ratio of 7.19x with the sector median of 16.70x, I think the company is undervalued. After analyzing all the above factors, I assign a buy rating to MXL.

Be the first to comment