Georgijevic/E+ via Getty Images

The market has an odd way of losing interest in stocks once the price collapses. Matterport (NASDAQ:MTTR) falls into this exact category with the promising 3D data technology stock trading near all-time lows in the $6s. My investment thesis is far more Bullish long term, but the prospects for the next year probably aren’t very impressive for existing shareholders.

Decade Ahead

As with most companies transforming the digital world, Covid impacts and supply chain constraints have wreaked havoc on financial results. Matterport is set to transform buildings to data for customers to extract efficiency improvements in the future from better insights into real estate spaces.

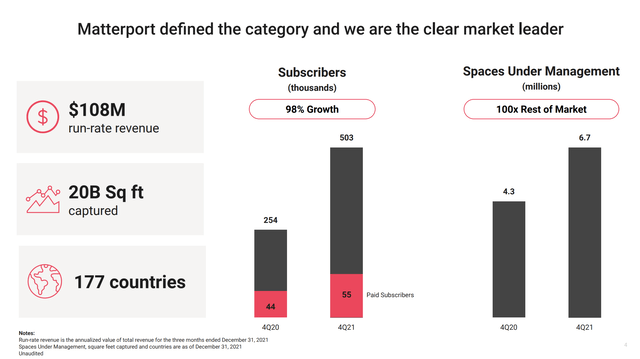

The company spent 2021 successfully adding new free subscribers and even growing the Spaces Under Management. Both metrics grew over 50% during Q4’21 with subscribers surging 98%. Unfortunately, paying subscribers only grew 11K to reach 55K, or just 11% of subscribers.

Source: Matterport Q4’21 presentation

The launch of smartphone applications with the iPhone app back in 2019 and the Android app recently in Q4’21 hasn’t led to significant conversions from the freemium channel. Per the CEO on the Q4’21 earnings call, Matterport for Android was very successful at attracting user interest outside the U.S.:

This will help us accelerate our international expansion across Europe, Middle East and Africa and the Asia Pacific region where Android market share is especially concentrated. At launch, we saw tremendous response from Android users. We served over 200,000 app downloads from the Google Play store in just the last two months of the fourth quarter.

The company has a decade or more of growth ahead as Matterport utilizes AI to create a spatial digital library for customers down the centimeter. The current issue is monetizing users partially due to Covid lockdowns.

Recurring Subscriptions

Last year was the first year where subscription revenues were more than 50% of revenues. The company grew subscriptions to 55% of total revenue with higher gross margins leading to a more promising future, but the short term results were impacted with key subscribers lacking the equipment to capture 3D building data to start subscriptions.

Subscription revenue hit 61% of total revenue in Q4’21 and grew 32% YoY to reach $16.5 million. Even ARR grew to a record $66.1 million in the quarter with a corporate goal of topping $100 million to end 2022.

Total revenues were disappointing with only 15% growth during the last quarter, but the biggest hit was from Product revenues declining by $1.8 million YoY. Matterport only obtained $6.8 million in revenues during the quarter from Product and License revenues further future impacts of Product sales on total revenue growth.

Even the Product category is expected to see a rebound with supply constraint issues resolving during the quarter. The company is focused on growing Subscription and Services revenues, so Product revenues not holding back growth is just a bonus going forward. Not to mention, customers waiting on cameras from Matterport to capture space data is also holding back future subscribers waiting to onboard onto the platform.

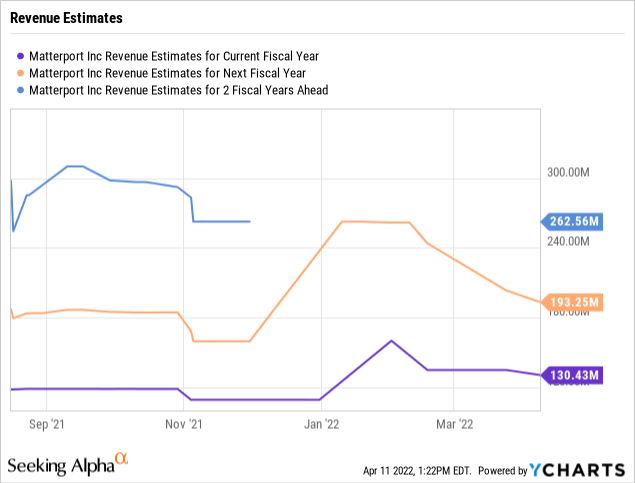

The shift to subscriptions combined with supply issues with capturing data and starting subscriptions has led to a massive reduction in revenue expectation. With the market cap close to $2 billion, Matterport is highly unlikely to rally much in the next year from these market valuation levels despite the massive declines from the highs.

The company guided 2022 revenues to ~$130 million led by $81 million in subscription revenues. If Matterport starts hitting revenue targets, investors will start seeing the stock fairly valued for 2023 revenues approaching $200 million.

The investing story becomes far more interesting heading into 2023 where Matterport is hitting targets with subscription revenues growing at a 30% clip. A stock valuation around $2 billion will definitely reward shareholders over the long term for a leader in the digital transformation of the real estate spaces.

The company has $674 million in cash to fund ongoing operating losses. Matterport just needs time to build back the growth rate before investors can start seeing rewards.

Takeaway

The key investor takeaway is that Matterport is attacking a compelling market providing customers with a digital twin of physical locations. Unfortunately, some Covid issues slowed down adoption leaving the stock valuation disconnected with the current business. As the company executes over the next couple of quarters, the stock will become far more compelling at this valuation or lower.

Be the first to comment