Seiya Tabuchi/iStock via Getty Images

A few months ago, I wrote a cautious article on the ProShares UltraShort Yen ETF (NYSEARCA:YCS), warning investors that although momentum in the YCS ETF was strong, time was running out as policymakers were getting concerned with the Yen’s weakness and would start intervening.

Big Reversal Of Weak Yen Trend

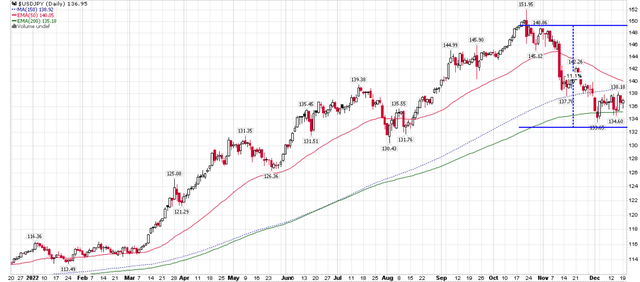

My warning proved prescient, as soon after my article, a number of macro events took place that sparked a large reversal of the weak Japanese Yen trend, from ~149 on the USDJPY FX rate at publication to ~132 after the BOJ’s surprise policy move on December 20, 2022 (Figure 1). This has led to a 20%+ decline in the YCS ETF.

Figure 1 – Large reversal in USDJPY (Author created with price chart from stockcharts.com)

Let’s recap what happened for those who have not been following the macro developments.

BOJ Intervention Was The First Volley

Previously, I warned:

The biggest short-term risk is additional interventions by the BOJ, and perhaps even the U.S. Federal Reserve. Note in 1998, the Fed and BOJ coordinated together to support a weak yen. So far, the intervention has been small and unsuccessful. However, as the strong U.S. dollar puts more strain on the international financial system, there is a rising possibility of something ‘breaking’, and a coordinated response from central banks around the world. The recent U.K. sterling and pension crisis is a prime example of pressures building and things ‘breaking’.

That is exactly what happened, as the BOJ spent a record $42.8 billion in currency reserves in October 2022 to defend the Yen, arresting the decline at the psychological 150 level and preventing Japan from experiencing a currency crisis.

Dovish Fed Was The Second

The next volley against the weak Yen trend was a shift in the Federal Reserve’s monetary policy, relative to other central banks. Recall from my previous article:

The main reason behind the currency moves YTD has been the actions of the Federal Reserve vis-a-vis that of foreign central banks. The Federal Reserve has embarked on the fastest interest rate hiking cycle ever to tame soaring inflation. Any foreign central bank that hasn’t followed suit saw their currencies routed.

Although the Federal Reserve raised the Fed Funds rate by 75 bps at its November meeting, it also hinted that the period of rapid rate increases was nearing an end. Going forward, it would focus more on the ultimate level of interest rates and the length of time interest rates will have to stay elevated.

This shift in monetary policy stance from the Fed helped alleviate mounting pressures from a strong U.S. dollar, and coincided with a reversal in many major cross currency trends like a weak Euro and a weak Yen.

Is A BOJ Pivot The Third Volley?

Finally, on December 20, 2022, the BOJ surprised global markets by raising the yield limit for 10-Yr JGBs to 0.50%, from a previous limit of 0.25%. This BOJ surprise during a period of low liquidity strengthened the Japanese Yen by over 3.5% against the U.S. dollar, from over 137 immediately prior to the announcement to ~132.

While the BOJ stressed that both long and short-term official interest rates remain unchanged, this move is a subtle shift towards an exit from the BOJ’s yield curve control (“YCC”) policy that had been in place since 2016. Bloomberg Economics believe this move is tantamount to a reduction of monetary policy easing:

Make no mistake, a decision to let the 10-year JGB rise is clearly a decision to pare the degree of easing — especially considering the added monetary tightening impact of the stronger yen and weaker stocks.

– Quote from Bloomberg economist, Yuki Masujima

The change in BOJ policy is likely a response to Japanese inflation figures, which have soared far above the official 2% target for many months and appears to be accelerating to the upside.

With Japan re-opened to tourism, Japan’s domestic inflation is set to rise even further in the coming months, especially as China drops all COVID restrictions and millions of Chinese tourists have been stuck at home for 3 years.

Already, we see anecdotes of a rush of wealthy Chinese tourists flocking to ski vacations in Japan, COVID-be-damned (Figure 2).

Figure 2 – Anecdotal evidence of Chinese tourists flocking to Japan (Noted China analyst, Hao Hong, via Twitter)

Outlook For YCS Is Negative Based On Hawkish BOJ

I believe this change in yield limit on the 10-Yr JGB is not an isolated move, but rather, the beginning of the end of the BOJ’s ultra-loose monetary policy. In theory, the Yen should strengthen on the back of the BOJ turning incrementally more hawkish, with negative implications for the YCS ETF, as the YCS ETF provides investors with exposure to -2x the daily price returns of the Japanese yen vs. the U.S. dollar.

But Who Will Be The Most Hawkish?

However, in practice, we may actually see a stalemate in the major currency pairs.

From my recent article on the WisdomTree Bloomberg U.S. Dollar Bullish Fund (USDU), I wrote that the Federal Reserve’s focus on a ‘higher for longer’ policy can be viewed as a mildly hawkish outcome, particularly as core inflation appears sticky. However, the ECB appears to be even more hawkish than the Fed, with its expectation of continued interest rate increases in the coming months and the ECB chairperson’s ‘more ground to cover’ comment. Finally, the BOJ appears close to flipping from dove to hawk, as it needs to tame domestic inflation.

Looking forward, 2023 could be a year where global central banks fight to see who can be the most hawkish.

Unfortunately for risk assets, I do not believe this is a good setup. Hawkish central banks remove liquidity from markets and tighten financial conditions. As central banks ‘put the screws’ on their economies, we should expect global economic growth to continue to slow, perhaps even into recession territory.

Increased Volatility Works Against YCS

In hindsight, the 2022 strength of the U.S. dollar was an easy call, as the Fed was the most hawkish central bank intent on using its monetary policy tools to tame inflation while other central banks lagged in their responses. However, as we move into 2023, the divergence in monetary policies is narrowing, as even the BOJ is shifting its stance away from uber-dove.

This increases the expected volatility between currencies, as there are no clear ‘winners’.

For YCS, as it is a levered ETF, increased 2-way volatility increases the drag from ‘volatility decay’ (for an explanation on levered ETF volatility decay, investors should read my prior article discussing the ProShares UltraPro Short QQQ ETF (SQQQ)).

Heightened volatility decay combined with a less dovish BOJ makes the YCS an unappealing investment.

Risk To My Analysis

The risk to my analysis is that with heightened uncertainty due to converging monetary policies, literally anything is possible. For example, core inflation could prove sticky in the U.S., forcing the Fed to stay hawkish for longer than anticipated, which could boost the U.S. dollar against the Yen. Alternatively, inflation pressures could ease in Japan, allowing the BOJ to stay dovish for longer, weakening the Yen against the U.S. dollar.

Conclusion

With the BOJ’s shift away from ultra-loose monetary policies, the investment implication for the YCS ETF is negative. Furthermore, as monetary policies converge in a hawkish direction, FX volatility is expected to increase, which will increase the ‘volatility decay’ drag on the YCS ETF. I would avoid the YCS ETF at this time.

Be the first to comment