Bangkok/iStock via Getty Images

Overview

I believe Matterport (NASDAQ:MTTR) is undervalued by 34%. MTTR’s technology allows for the digitization of buildings and spaces, creating a digital replica of the real world that can be accessed and analyzed by subscribers. I believe this technology presents a large growth opportunity for the company, as the global addressable market for such solutions is estimated to be over $20 billion.

Business description

Matterport has a 3D camera and a platform for interactive viewing that lets users take digital scans of real-world environments, upload them, and share them online.

Even buildings and spaces can be digitized

Most physical locations have not yet been digitized, despite the widespread use of digital technologies. Management thinks that the global market for MTTR solutions is worth more than $20 billion and could grow to more than $1 trillion based on the number of buildings (according to the S-1). Because of the restrictions caused by the COVID-19 pandemic, MTTR’s 3D capture solutions for different industries and markets are more important than ever.

Proprietary technology and large TAM

To me, MTTR’s cutting-edge technology is the primary factor in its ability to shake up the industry. In order to provide users with information and insights about real-world buildings and spaces that were previously unavailable, this technology uses spatial data from various digital capture devices to create realistic digital replicas of these physical locations.

MTTR has been at the forefront of the multibillion dollar 3D reconstruction industry for nearly a decade. With the help of Cortex, MTTR’s proprietary AI-driven software engine, they have developed state-of-the-art technology that employs machine learning to generate precise 3D virtual representations of physical structures. The end result is an interactive digital replica of the real world that can be viewed on any web-enabled device, even mobile phones, and explored, analyzed, and modified as needed. In my opinion, this is a huge technological advancement because it gives each subscriber the power to control even enormous commercial structures.

I believe that the digitization and datafication of this enormous category and asset class present a tremendous greenfield opportunity for growth. The MTTR platform’s software and technology equip subscribers with essential resources and insights at every stage of the building life cycle, from planning and design to promotion and operation, allowing them to cut costs, boost profits, and maximize the efficiency with which they run their properties. In my opinion, the MTTR spatial data platform has the potential to increase operational efficiency in the built world and release hundreds of billions of dollars in unrealized value. This framework’s adaptability makes it suitable for use in many contexts, from manufacturing to hotel design. Because of this, MTTR has a leg up on the competition; no other company can effectively address the full breadth of the market and boost the value of the world’s most valuable asset class the way that MTTR can.

Comprehensive offering in one platform with strong network effect

A major factor in MTTR’s success is the company’s ability to provide a comprehensive spatial data platform that can be applied to a wide range of industries and locations. The beauty of this solution is that it can facilitate capture and processing in multiple industries with little to no customization. This means that MTTR can expand into new markets without incurring additional R&D costs or sacrificing scalability. The MTTR platform adds value all through the property lifecycle for a wide variety of end markets, and it integrates with a wide variety of enterprise systems.

More importantly, MTTR subscribers have a distinct advantage due to the extensiveness of the MTTR’s spatial data library. With the help of MTTR, billions of 3D data points have been connected into a network covering millions of locations. This is noteworthy because MTTR has the potential to significantly improve property insights and analytics for paying customers across a wide range of sectors. Facilities managers, for example, can save a lot of money on site surveys and as-built models by making the process of making building layouts more efficient.

Each new data point added to the platform enriches the MTTR dataset and provides deeper insights from managed spaces. Additional data from subscribers’ new data captures, along with Matterport’s MTTR data-to-insights conversion capability, enables Matterport to create new and exciting features for its paying customers. Therefore, MTTR has a significant advantage over smaller competitors as it grows in size and collects more data, allowing it to know what subscribers want.

Growth opportunities

In my opinion, MTTR has a lot of room to grow, both domestically and internationally, and especially in different types of industries.

In order to continue growing its subscriber base, MTTR needs to expand the number of use cases and applications for its technology. The company’s extensive spatial data library and AI capabilities make it possible for them to expand into various end markets, such as real estate, facilities management, and travel and hospitality. As MTTR’s data library and platform evolve to meet the needs of the industries it serves, I have faith that there is potential for them to also provide solutions for the manufacturing sector. However, investing in industry-specific sales representatives and marketing campaigns may increase sales and marketing costs, potentially impacting margins in the short term.

Over the course of a longer time frame, I see the international market as a promising opportunity. To date, less than 0.1% of the world’s building stock – worth an estimated $228 trillion – has undergone digital transformation (according to management estimates in the S-1). Given that most structures around the world aren’t in the United States, I see great potential in pursuing global building digitization and datafication.

Some thoughts on latest earnings

Revenue from Matterport’s third quarter was above the high end of its guidance range and above Street estimates, thanks in part to greater-than-anticipated growth in subscriptions and services. The company’s small and medium-sized business clients continue to bear the brunt of the unpredictability brought on by the economy. Investments in product, support, and go-to-market are starting to bear fruit, so enterprise growth is expected to accelerate. Despite the macroeconomic uncertainty and investor frustration with the lack of profitability, the company’s third-quarter EBITDA and implied fourth-quarter margins came in above expectations on the strength of its strong cost management. Despite the strong showing in the third quarter, the company only narrowed its updated revenue forecast for the full year, which is a cautious move in my opinion and suggests that macro conditions are still having an effect on results, which bodes well for the fourth quarter.

I expect that the continued upbeat commentary on enterprise traction, the stabilization of the supply chain for the Pro2 cameras, and the introduction of the Pro3 camera will all contribute to keeping the CY23 subscription revenue momentum going strong, if not accelerating it. Quantitative feedback on adoption aside, the fact that the Pro3 was made specifically for architecture, engineering, and construction [AEC] uses is a huge boon for Matterport’s future prospects. These product upgrades, along with the ongoing emphasis on capture services, should speed up enterprise subscriptions in the long run. It’s possible, though, that the sales cycles and scan cycles associated with such contracts will slow growth. A slowing real estate market and persistent commotion among SMB subscribers could also slow subscription growth in the near future.

Forecast

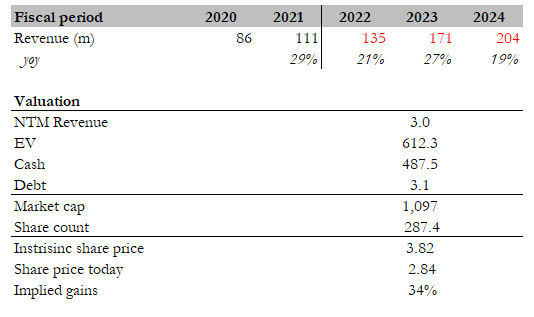

My investment thesis predicts that MTTR will grow as expected in FY22, reaching $135 million in revenue. Given the above-mentioned large TAM and MTTR growth momentum, I believe MTTR can maintain 20+% growth going forward. Because the company is not making any money right now due to reinvestment, which is a wise decision, in my opinion, it should be valued on a forward revenue basis. In total, I expect MTTR to generate $204 million in revenue in FY24.

Given its growth momentum, I believe MTTR should trade at a higher multiple. The stock’s valuation re-rating in recent months has been far too aggressive. If MTTR rerates to 3x revenue, the stock would be worth $3.82 in FY23. This is approximately 34% more than the current share price.

Author’s estimates

Key risks

No profits in sight yet

I worry that if the macroenvironment worsens, investors will be scared off by this, even though it is not a structural risk to the business. Unlike many other software companies, which have scaled back growth investments in favor of profits – to appease shareholders – MTTR is still losing money and is not expected to turn a profit anytime soon.

The use case may not be as large in other industries

There is a reason why MTTR began in the industries it is now in: they are lower-hanging fruits with more use cases that its solutions can address. While I believe that MTTR can improve its solution by adding more features and supporting it with more data sets, I believe that it may not be able to provide a compelling enough reason for other industries to adopt it. This may shorten the growth window.

Conclusion

It is my opinion that MTTR is currently undervalued by 34%. With MTTR’s technology, physical locations and structures can be digitized to produce a digital twin that paying users can explore and analyze. The global addressable market for such solutions is estimated to be over $20 billion, making this technology a potentially lucrative investment for the company.

Be the first to comment