Mario Tama

Transport and logistics services have continued to thrive on renewed demand for consumer/ manufactured goods. Abatement of the Covid19 scare has also aided the growth of players in the freight industry. Stocks like Matson, Inc (NYSE:MATX), C.H. Robinson Worldwide (CHRW), and Hub Group (HUBG) are well-positioned to capitalize on the increase in demand for transport and logistics services.

Thesis

Despite the near-term uncertainty brought by the supply-chain bottlenecks in China, Matson expects a combination of the current supply and demand factors to remain in place for a better part of 2022. Growth investors will find this stock worthwhile due to its potential in elevating container volume based on high retailer-related demand. The company is also increasing its annualized yield on the dividend which will strengthen into the year as it overcomes the uncertainties in the recovery trajectory.

Matson, Inc. is a provider of ocean transport and logistical services headquartered in Honolulu, Hawaii. The company leverages its network of asset-based services through ocean services, warehouses (located on the east and west coasts), and 53 intermodal containers. This network supports its supply chain from China to any point in North America. The company also prides itself on its relationship with rail and trucking service providers to complete its logistics services.

As of June 2022, China’s official manufacturing purchasing managers’ index (PMI) rose to 50.2% from a deficit of 49.6 a month earlier. The growth in factory activities and services was attributed to the lifting of the strict COVID lockdown in Shanghai. Economists expect a further surge in economic activities as the country approaches the zero-COVID policy state. In turn, improved mobility will likely see a growth in Matson’s business model in the near and long term.

Yield

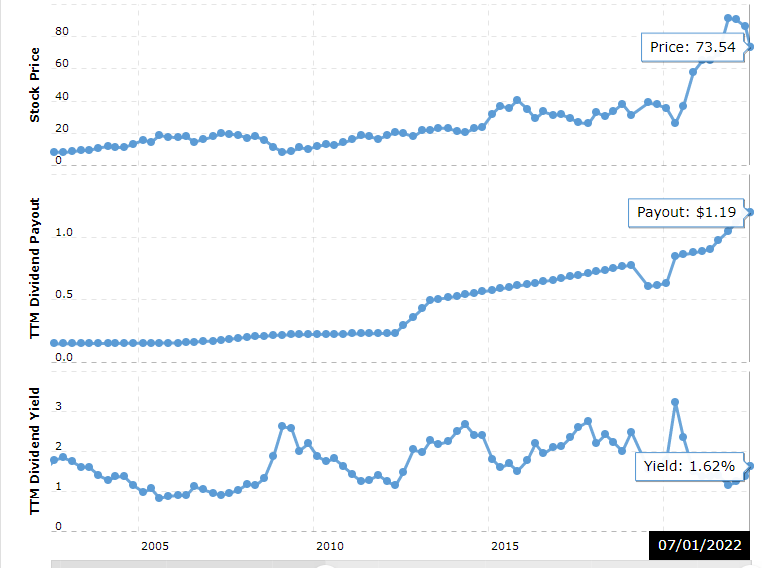

In June 2022, Matson’s board cleared a 3.3% growth in its quarterly dividend thereby taking the total hike to 31 cents a share. As of July 5, 2022; the dividend TTM payout stood at $1.20 against a yield of 1.63%. Since July 31, 2012 (about a month after it went public), Matson’s dividend payout has surged more than 290% from $0.30 to $1.19.

Macrotrends

Similar growth was replicated by C.H. Robinson in its quarterly dividend payout in 2021. As of July 1, 2022, CHRW’s dividend yield was 2.16% against a TTM dividend payout of $2.20.

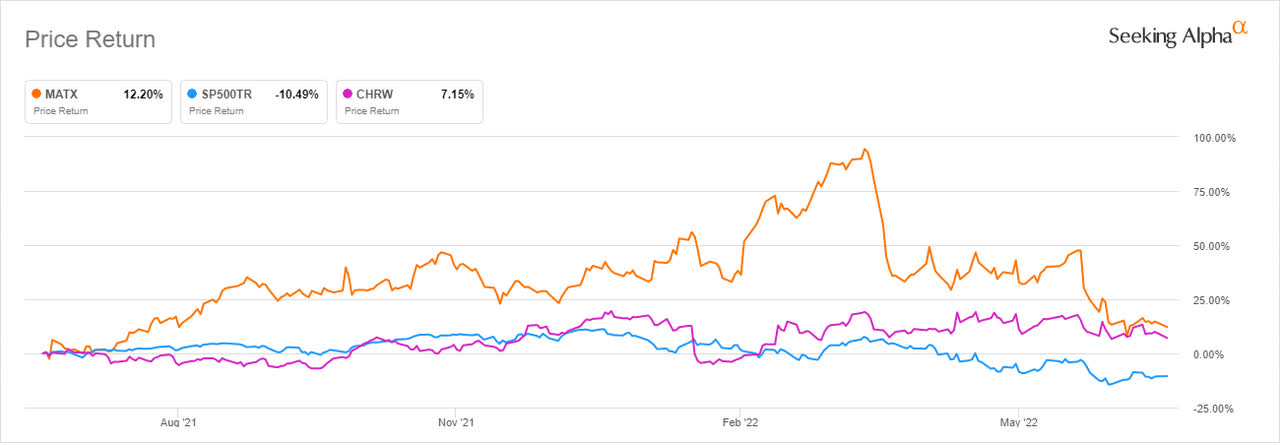

MATX is trending at 42.63% below its 52-week high of $125.34 attained at the end of March 2022. The share price is down 19% in its YTD but up 12.20% in the one-year analysis. This trend is better than some of its peers such as CHRW which was up 7.15% in its one-year analysis but down 7.82% in its YTD score. MATX also outperformed the S&P 500 by more than 22% over the past year.

Seeking Alpha

This positive performance shows investors’ optimism about the strengthening economies even as China relaxes most of its Covid19 restrictions imposed in Q1 2022. On the other hand, US manufacturers have had to deal with inflationary hike pressures as well as the rise in oil prices. However, due to the complex nature of Matson’s business model involving a network of ships, trucks, and rail transport, it is vital to consider the ways the company is using to mitigate price controls, especially on the part of consumers.

Duel Fuel Box-fit Retrofit and the Net-Zero Carbon Agenda Risks

In a business development update on June 27, 2022; Matson announced that it had signed a contract with Man Energy Solutions (MAN ES) a German engine manufacturer for the retrofit of its main engine aboard its containership. The purpose of this retrofit is to ensure the engine operates on both LNG and fuel oil. The object of this contract is to lower the usage of carbon-based fuel with the emission of CO 2 set to lower by 24%. It is also expected to be accompanied by an ultra-low methane reduction of 0.20-0.28g/kWh. Overall, the company will retrofit its 3,600 TEU containership to run on a MAN B&W 7590 ME-GI engine.

In a statement by Jens Seeberg, MAN Energy’s head of Retrofit and Upgrade in Denmark it was opined that

“Retrofitting a MAN B&W engine to dual-fuel running is a straightforward, proven process as our standard, electronic diesel engines are already built as ‘dual-fuel ready’ and are therefore readily convertible.”

The advantage of dual-fuel retrofits is that they present ship-owners like Matson a chance to ultimately reach a net-zero carbon footprint by 2050. The combination of bio-LNG and SNG in sufficient volumes will enable the ME-GI engines to operate based on sustainable fuel consumption.

As we know, the International Maritime Organization (IMO) adopted new greenhouse gas (GHG) emission requirements concerning ships. According to the rules after 2023, containerships with more than 5,000 gross tonnages will be needed to meet the annual Carbon Intensity Indicator (CII) as the maritime/ freight logistics head towards 2030.

To put it into perspective, the rushed compliance with these new climate change requirements could slow down Matson’s fleet including its efficiency. At the moment, Matson’s expedited business model could be impacted by the new environmental requirements. We are looking at an increase in construction costs, especially for new vessels. These vessels will need to accommodate newer technologies as they emerge. In retrospect, today’s technology will grow obsolete as the company embodies newer and unexpected systems such as retrofit projects. So, on one hand, the climate-change-focused technologies will help lower greenhouse gas emissions and on the other side, they will increase risks due to the unreliability of renewable energy sources.

Financial Standpoint

Matson realized $1.166 billion in total revenue as of March 31, 2022 (a decline of 7.97% from $1.267 billion fetched in the quarter ending on December 31, 2021). Consequently, gross profit fell 11.02% to $461.8 million in the quarter from $519 million realized as of December 2021.

Total cash and short-term investments grew 39.09% in the quarter to $392.8 million. Total current assets (on the quarterly analysis) are at the highest level at $874.8 million. This growth was replicated in the total asset base which also surged 7.7% to $3.978 billion against liabilities that stand at $2.067 billion.

Further, Matson has reduced its cash used in operations in the quarter by 31.66% to $273.9 million from $400.8 million in December 2021. Matson is hoping to continue increasing its receivables as compared to payables as the year progresses with a forecast of income higher than overall expenses (especially on a longer-term basis).

The business navigation front also forecasts a higher container volume into the second half of 2022. During the first quarter of 2022, Matson’s Guam location realized a 10% (YoY) increase in the container volume due to high retail-related demand. In the near term, the company hopes to increase its overall return as tourism traffic progresses in the year.

In Alaska, Matson’s container volume soared 20.2% (YoY) in Q1 2022. It was driven by an increase in Alaska-Asia Express (AAX) and higher retail demand that increased the northbound volume. There was also an increase in the southbound volumes caused by higher seafood volumes slated for transportation. The company is hopeful that the economic trends in Alaska will improve despite the inflationary pressure dominant in the US economy at the moment.

Takeaway

Matson is likely to be a key beneficiary of improved economic activity as China recovers from Covid19-related lockdowns. The ocean transport and logistics service provider has experienced an increase in dividend payouts over the years with no sign of slowing down. However, the company is rushing to beat the climate-change-related adjustments such as the use of the dual-fuel retrofit. These adjustments may slow down Matson’s expedited business strategy. Still, the company’s revenues are on an upward trajectory in the long term. For these reasons, we propose a buy rating of the stock.

Be the first to comment