skynesher/E+ via Getty Images

MasterCraft Boat Holdings, Inc. (NASDAQ:MCFT) is a manufacturer of boats across a number of brands covering luxury performance runabouts, specialty wakeboarding models, high-end saltwater fishing boats, pontoons, and general small-craft vessels. The company benefited during the early stages of the pandemic from a boost in demand with consumers looking for outdoor recreational activities. Indeed, 2021 was a record year for the company in terms of deliveries and earnings despite the ongoing supply chain issues that have limited production and are now adding to costs.

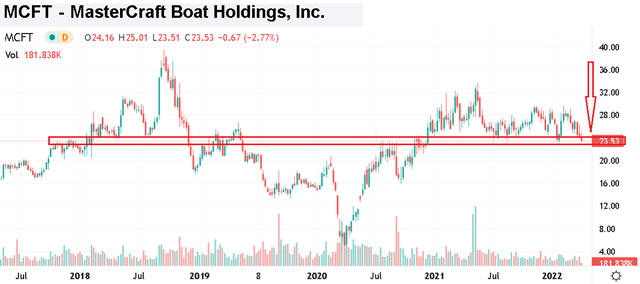

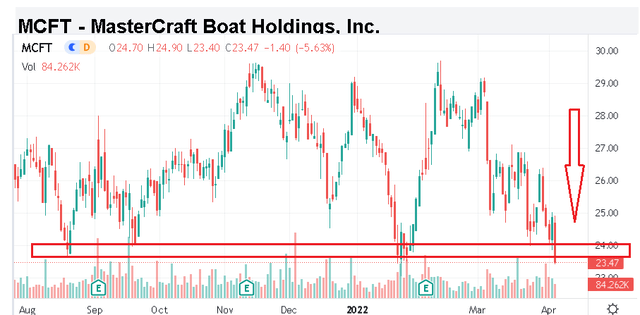

While management remains optimistic for the year ahead with positive guidance citing trends like low levels of industry-wide dealer inventory, shares of MCFT are under pressure, trading at the lowest level since December 2020. There is a sense that the “boating boom” could be on its final legs with consumers facing the reality of high gas prices and tighter discretionary budgets. If anything, the challenge here is the poor sentiment towards the industry that is typically highly leveraged to the economic cycle.

Seeking Alpha

MCFT Earnings Recap

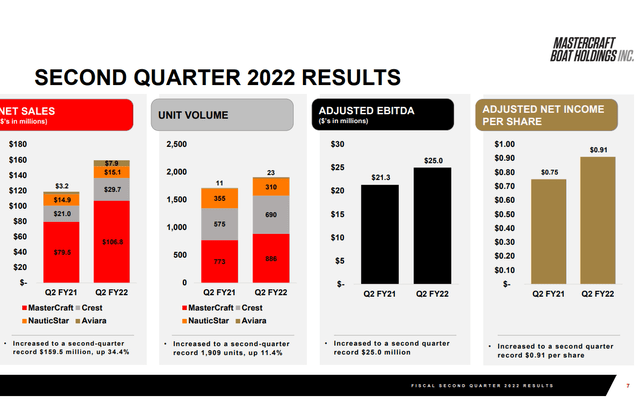

MasterCraft last reported its fiscal Q2 2022 results back in February with non-GAAP EPS of $0.91 which was $0.12 ahead of estimates. Revenue of $160 million climbed by 34% year-over-year and was also $6 million above the consensus. Unit volumes reached 1,909, up 11.4% from the period last year with particular strength in the “Crest” pontoon brand. The trend of net sales exceeding volumes reflects overall higher average pricing at wholesale. Adjusted EBITDA at $25.0 million, increased 17.4% from $21.3 million in Q2 fiscal 2021.

source: company IR

Management noted that despite the “most profitable second quarter in the company’s history”, the results were limited by production and shipments delays. Inflationary trends have increased material costs and also labor expenses. The result is that the adjusted EBITDA margin at 15.6% declined from 17.9% in the period last year. The company expects some of these trends to continue but is making an effort to focus on efficiency in support of margins.

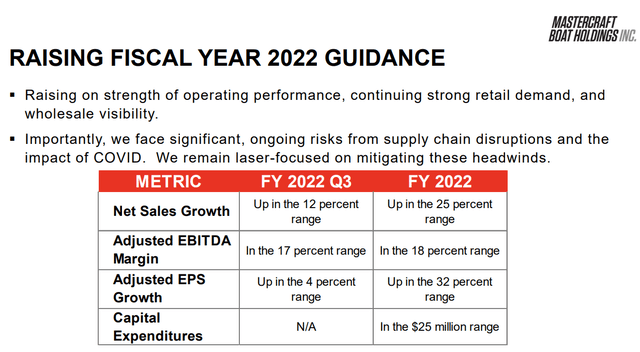

In terms of guidance, management is targeting net sales growth “up in the 25 percent range” this year with some visibility for EPS to climb 32% towards $4.26. The setup here is for continued strong retail demand and wholesale visibility which refers to historically low dealer inventory levels that are expected to be rebuilt.

source: company IR

Finally, we note that MasterCraft ended the quarter with a net debt position of $60 million against $98 million in adjusted EBITDA over the past year. A leverage ratio of 0.6x highlights the overall solid balance sheet position. On that point, the company has been active with share buybacks, repurchasing $10 million in stock during the last quarter with another $40 million remaining in the authorization.

MCFT Stock Price Forecast

By all accounts, the fundamentals are positive and MCFT continues to benefit from several tailwinds over the near term. Working with its dealer network, it’s likely that production into the current quarter includes expected deliveries through the end of the year.

That said, the challenge we see is looking ahead towards 2023 and 2024 when the industry and demand could look a lot different. It’s possible that consumers could think twice about jumping into recreational boating with the national average price of gas now above $4.00 per gallon. The other insight we offer is the potential glut in the used-boat market as first-time buyers in 2020 and 2021 look to offload their “investment” into what remains a hot market in terms of pricing.

The setup here is that getting past this year, the market for boats could be facing a one-two punch of weaker demand and excess supply. We believe that the slowdown has already started and 2021 represented an environment of “peak” demand for the foreseeable future.

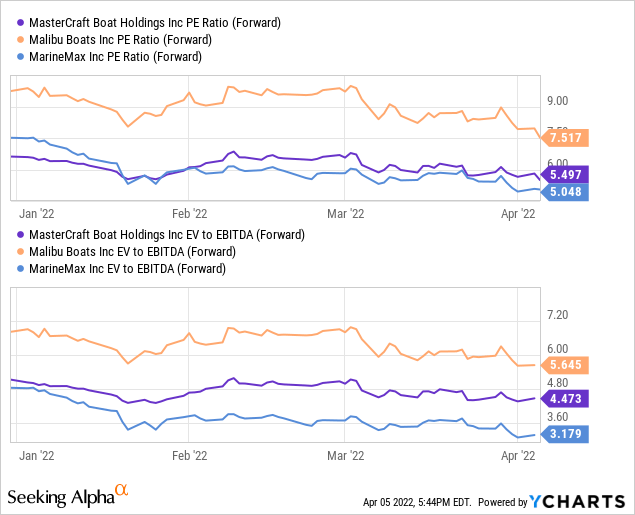

The other side to the discussion is that shares “appear cheap” with MCFT trading at a forward P/E of just 6x against the management’s 2022 EPS guidance. On this point, it’s important to recognize that boating industry stocks historically trade with depressed multiples as a discount to the broader market given its sensitivity to the economic cycle.

We note that its peer in Malibu Boats, Inc. (MBUU) and boating supplies retailer MarineMax, Inc. (HZO) also trade with earnings ratios in the single teen which also reflects the skepticism towards the sustainability of currently elevated profitability. In other words, the bearish case for MCFT puts it on the side of a “value trap” in a scenario where upcoming results miss expectations and industry sales trends begin to underperform.

On a technical basis, we view the current breakdown in shares as an important market signal that opens the door for more downside. It simply does not appear to be good momentum to be betting on the boat market as a good investment in the current market environment.

Seeking Alpha

Final Thoughts

We rate MCFT as a hold leaning on the side of being bearish but at the same time recognizing the strengths in MasterCraft Boat Holdings. The company’s balance sheet and recurring profitability likely limit the downside in shares with some fundamental value. We see fair value in the stock closer to $20.00 implying a forward P/E closer to 5x on the current consensus 2022 EPS. That said, the downside here likely isn’t enough to call MCFT a “sell” or necessarily a great short opportunity.

The way we see it playing out is that elevated production costs with continued supply chain disruptions can lead to some softer-than-expected margins over the next few quarters. Headlines of deteriorating consumer spending dynamics can further pressure sentiment towards the stock and lead to revisions lower in the long-term earnings outlook. To the upside, we want to see the company accelerate deliveries while the margin levels will be a key monitoring point for the rest of the year.

Be the first to comment