jbk_photography

In my last article about Mastercard Incorporated (NYSE:MA), I stated that the stock was still not a bargain at 40 times free cash flow. At the time of publication, the stock was trading for $350, and I was rather neutral about the stock. Right now, the stock is trading slightly lower, and the business might have improved during the last two quarters. We can take another look and try to answer the question if Mastercard is a good investment right now.

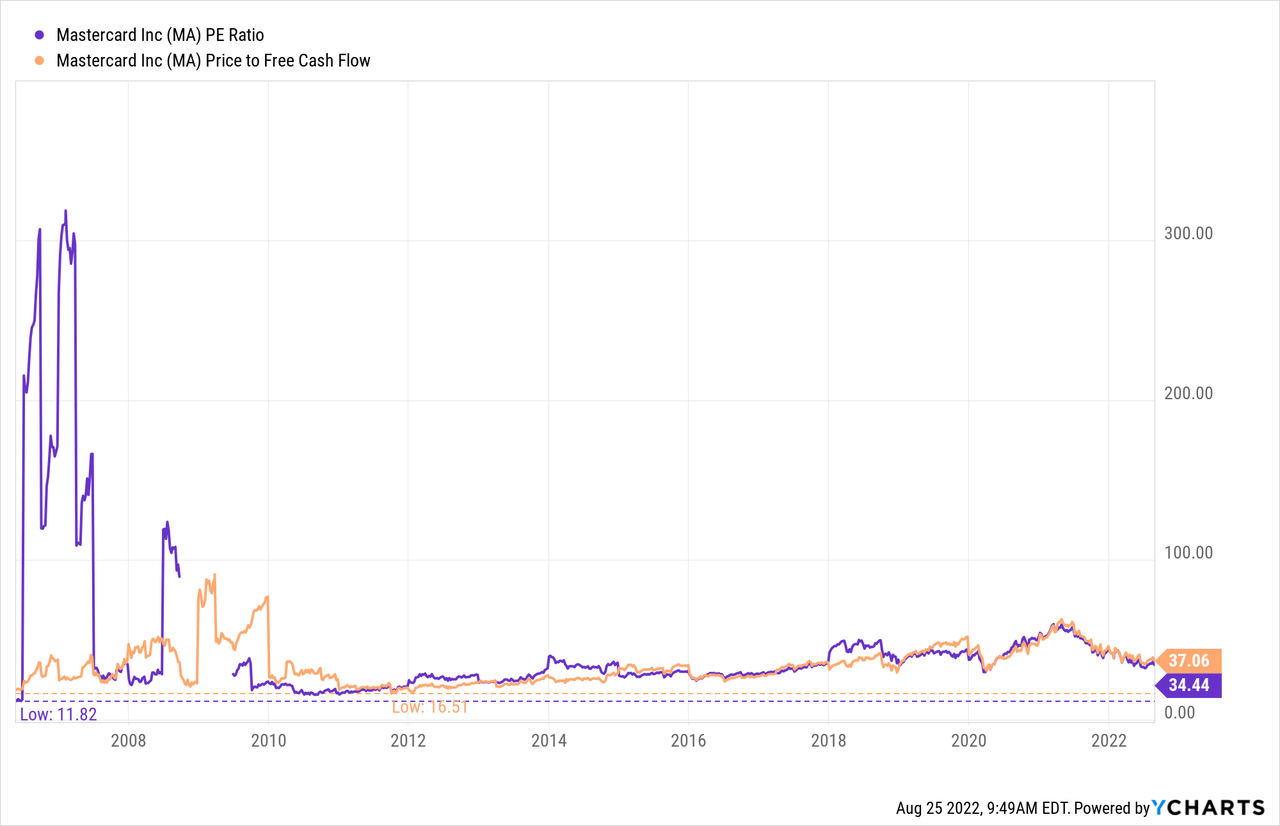

Valuation Multiples

When looking at the valuation multiples the stock is trading for, we see a slight improvement compared to our last article. At the time of writing, Mastercard is trading for 37 times free cash flow and about 34 times earnings. And although these are not huge differences, the stock is a little cheaper than it was about 5 months ago when my last article was published. The stock is still rather expensive in my opinion, but we will get to this.

Quarterly Results

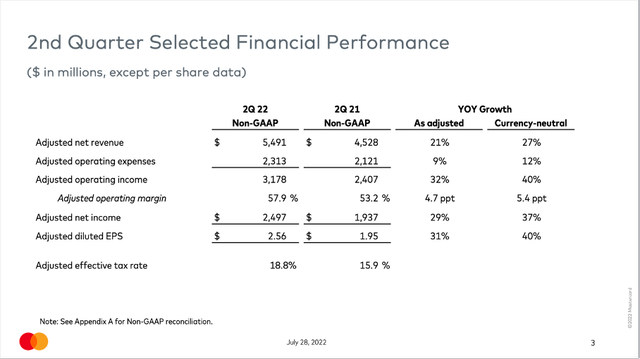

When looking at the quarterly results, Mastercard is still reporting impressive growth rates for the top and bottom line. Net revenue increased from $4,528 million in Q2/21 to $5,497 million in Q2/22 – resulting in 21.4% year-over-year growth. Operating income increased 28.9% year-over-year from $2,341 million in the same quarter last year to $3,018 million this quarter. And finally, diluted earnings per share increased from $2.08 in Q2/21 to $2.34 in Q2/22 – an increase of 12.5%. We can also look at adjusted diluted earnings per share, which increased 31.3% from $1.95 in the same quarter last year to $2.56 this quarter.

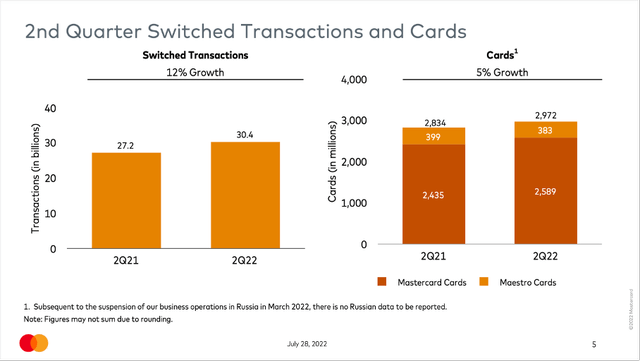

When looking at some further metrics, the number of cards increased from 2,834 million one year ago to 2,972 million at the end of the second quarter. Switched transactions increased from 27.2 billion during the second quarter of fiscal 2021 to 30.4 billion in the previous quarter. And gross dollar volume increased from $1,908 billion in Q2/21 to $2,054 billion in Q2/22.

Recession

It seems right now as if Mastercard is firing on all cylinders – by the way, the same is true for Visa (V). Mastercard is clearly profiting from the economy recovering from the COVID-19 recession and the negative impacts of lockdowns around the world. But when looking at current results, it seems rather strange to talk about a recession when a company can grow its top line with such a high pace.

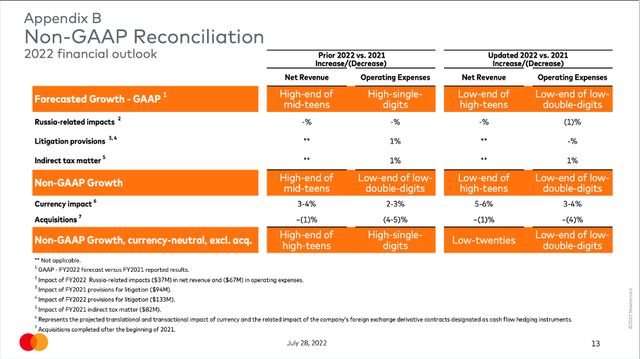

And when looking at the outlook for fiscal 2022, we don’t see many signs for a slowdown so far. While Mastercard is now expecting growth rates at the low-end of high teens (on a GAAP basis) and therefore had to lower its expectations a bit, it is now expecting non-GAAP growth (currency-neutral and excluding acquisitions) to be in the low-twenties. And we can spin it how we want – these are impressive growth rates for a rather mature business which is also one of the largest corporations in the world (on the 22nd spot according to market capitalization).

Visa management commented quite a lot on the topic of a recession and potential economic slowdown (“recession” was mentioned 9 times and it was basically the first topic CEO Al Kelly talked about during the earnings call). Mastercard, on the other hand, did not mention the topic in its prepared remarks but commented due to a question during the Q&A. When asked about a recession and economic slowdown, Michael Miebach made the following statement:

I think the last word, as you said, is instructive as we are not seeing it right now, generally resilient consumer spending for the time being and we talked about the modest improvement in cross-border and same – spending behaviors until the end of last year. Now you’re taking us really a long time back in 2008 and 2009.

I think the first thing I would say is it’s a very different scenario. A scenario that we’re looking at externally, that I come to the company in a moment, externally is we are not having a crisis around unemployment. We’re having high consumer spending levels. So we don’t have an asset bubble that looks anything similar than what we’ve seen at that time.

(…)

Now the company also looks entirely different than it looked in 2008 and 2009. It’s a much more diversified business. It’s a highly diversified business. I think we were largely consumer credit debit oriented at the time.”

Both CEOs – of Visa and Mastercard – seem to be quite optimistic that their businesses will perform well in case of a recession. In my last article about Visa, I also wrote:

I would not go so far to call Visa a recession-proof business, but I would paint a similar picture as the CEO. Visa might be quite resilient in case of a recession, and we should not expect the business to grow in case of an economic slowdown, but we also must not fear steep declines for revenue or earnings per share. Of course, in case of a recession, disposable income will be lower for most people and the payments volume will decline which will lead to a lower revenue for Visa and Mastercard. But if the biggest part of payments volume is stemming from everyday products, the drawdown might be limited.

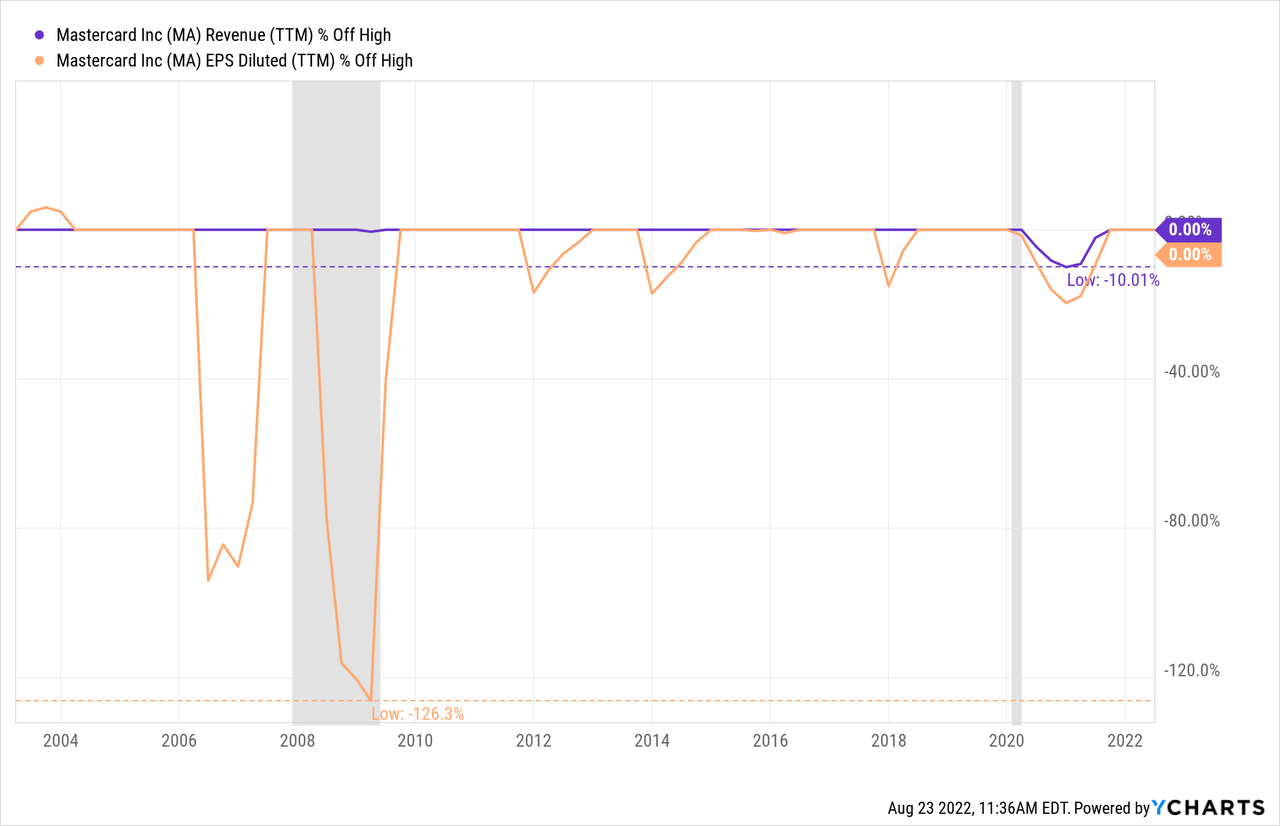

I agree with Miebach that we are talking about an asset bubble that doesn’t look like what we’ve seen during the Great Financial Crisis – but while he sees it as rather positive, I would expect the current asset bubble to be worse. When looking at the numbers – in this case for Mastercard – we see the company being affected by recessions and I also don’t know if I would share the optimism of the CEO.

However, revenue didn’t show any signs of decline during the Great Financial Crisis, and when looking at the 2020 recession, we always must keep in mind that travel restrictions had a huge negative effect on the business. When looking at earnings per share, we see a moderate decline during the 2020 recession and a huge decline during the Great Financial Crisis (numbers being even negative).

And for the next potential recession – especially as I expect that recession being one of the worst we have seen in a long time – I expect earnings per share to decline and revenue might be affected as well. Mastercard might perform better than several other businesses, but we should be prepared for a negative impact.

Increased Competition

A potential recession is definitely a risk Mastercard is facing, although there are many other businesses being affected much more. Another risk might be the increasing competition Visa and Mastercard are experiencing. These are of course companies like PayPal Holdings (PYPL), which offer alternative ways to pay for products purchased online.

The core business model of Mastercard and Visa is to offer a payment network for merchants and customers that enables quick and smooth transactions. But part of the business model is also enabling customers to purchase products right now and postpone the payment for several days or weeks. And this is more or less the business model of “Buy Now, Pay Later” (“BNPL”) – a service that is offered by PayPal but also by companies like AfterPay (OTCPK:AFTPF, OTCPK:AFTPY), Klarna (KLAR), or Affirm (AFRM). And while Klarna has about 147 million active consumers, PayPal already has about 430 million active accounts.

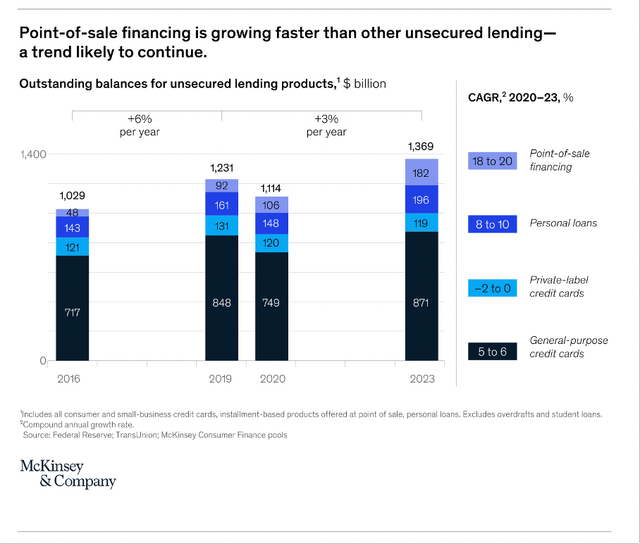

These point-of-sale financing services have grown with a high pace in the last few quarters and according to McKinsey took about $8 billion to $10 billion in annual revenue away from banks. And while general-purpose credit cards had an outstanding balance of $749 billion, point of sale financing had an outstanding balance of $106 billion. But McKinsey is estimating growth rates of 20% for the next few years and is seeing the outstanding balance at $182 billion in 2023 while growth rates for general-purpose credit cards are estimated to be in the mid-single digits.

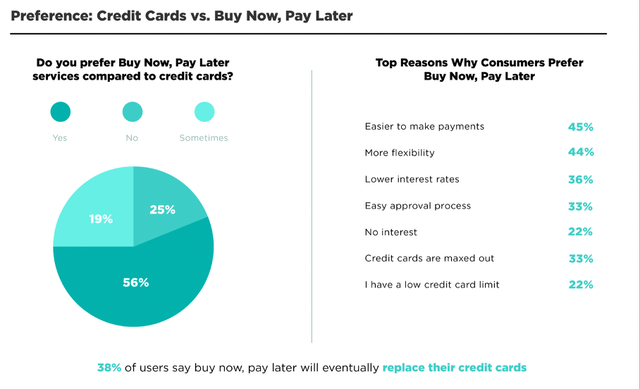

And according to a different study, 38% of users of Buy Now, Pay Later are saying these services might eventually replace their credit cards and 56% prefer Buy Now, Pay Later services for different reasons.

One of the major problems for Mastercard and Visa stemming from additional competition could be a pressure to lower fees. Right now, the two major credit card companies can charge rather high fees that merchants and small businesses must pay. But with more and more competitors entering the market – especially for purchasing products online – the pressure could increase on Mastercard (and Visa) to lower fees.

Wide Economic Moat

Despite clearly existing risks for Mastercard, we should not forget that the company has an extremely wide economic moat around its business. I have already described the economic moat for Mastercard as well as Visa in previous articles – see here for example – and will quote:

The wide economic moat of both companies stems from the impressive network these two created over the last few decades. The resulting network effect is the reason why Mastercard’s and Visa’s business models are among the very best we know. The network effect arises, when the value of a product or service increases with every new user – and not only for the existing user but also for the new user. And, the network is very difficult to replicate because new competitors would have to replicate the entire network (or at least a big part) before the value for the users is similar high as with the already existing network. Visa and Mastercard are connecting millions of cardholders and a very large number of retailers and merchants all over the world, and replicating this network is a really tall order for every company.

And this is the reason why especially the “offline business” is extremely difficult to duplicate. The technology and infrastructure which are necessary to offer easy transactions is almost impossible to duplicate for a new business as it is time-consuming and expensive. And especially the high fragmentation on both sides (many small businesses accepting payments and many individual customers using cards to pay) as well as the high density of the network (every business can accept every card and every cardholder can pay at every retailer) are making the network valuable – and difficult to attack.

Intrinsic Value Calculation

I already mentioned above that Mastercard became a little cheaper compared to my last article five months ago, but 37 times free cash flow is still a high valuation multiple. And although Mastercard is trading for one of the lower valuation multiples of the last five years, we should not ignore that stocks trading for high valuation multiples are at a huge risk for multiple contractions. Mastercard is a business that can grow with a high pace and high growth rates are usually justifying high valuation multiples. However, if growth rates should slow down in the coming quarters (or if earnings per share should decline a bit), investors might suddenly decide that such a high valuation multiple is not justified for Mastercard anymore and a multiple of only 20 is certainly a possibility (of course, much lower multiples are also a possibility as Mastercard was already trading for 16 times free cash flow and 11 times earnings in the past).

Aside from using valuation multiples to determine for what price the stock should or might trade, we can also use a discount cash flow calculation to determine an intrinsic value for the stock. When taking the free cash flow of the last four quarters as basis ($9,509 million), Mastercard must grow its business (or to be more precise: its free cash flow) 11% annually for the next decade followed by 6% growth till perpetuity to be fairly valued right now. For starters we can argue what growth rates are realistic for Mastercard and when looking at the last ten years, Mastercard could grow its earnings per share with a CAGR of 19.42%. From that point of view, a growth rate of 11% seems too conservative for Mastercard and when excluding the COVID-19 crisis, it also doesn’t seem like growth is slowing down for Mastercard (the CAGR of almost 20% is actually including fiscal 2020).

Let’s assume a moderate decline for fiscal 2023 due to a potential recession and we expect free cash flow to decline 10%. When using that assumption, Mastercard must grow 14% in the following years (and once again 6% growth till perpetuity after 10 years) to be fairly valued.

These are growth rates I could imagine for Mastercard in the years to come, but I also would be rather cautious about calculating with such high growth rates. The risk of growth slowing down is omnipresent for such high-growth companies. And especially when considering the increased competition – and competition increased in the last few years – we should be cautious if Mastercard will be able to continue growing in the mid-teens for such a long time.

Conclusion

Mastercard is trading more or less in a sideway range between $300 on the lower end and $400 on the upper end. And it could make sense to wait until Mastercard will be trading at the lower end of this sideway range again before initiating a position. Of course, nobody can know or guarantee that Mastercard will reach these price levels again but considering the high valuation multiples the stock is still trading for as well as the risk of a recession, I would see the potential for lower stock prices. I certainly can imagine Mastercard trading for 20 times earnings (it has in the past) and this would lead to a stock price of $210 right now.

And Mastercard is still trading very close to its all-time high (about 15% below) and in case of a recession it is rather untypical for stocks to decline only slightly. When considering a recession like the Great Financial Crisis, it is more likely for stocks to decline at least 40% to 50% and I would assume such a decline for Mastercard as well – no matter if it is justified from a fundamental point of view.

Be the first to comment