D3signAllTheThings/iStock via Getty Images

Overview

The focus of this article will be Federal funding for U.S. based lithium projects. Second, we are going to look at just how much land Lithium Nevada (a subsidiary of Lithium Americas) holds. Lastly, due to popular demand, we will explore how Lithium Americas might divide into two publicly traded companies.

Moving on to how times are changing, initial financial support is generally the most difficult part of getting a lithium project off the ground. You have to prove a property can work and this involves capital to drill and explore. Moving beyond this seed money though can be a rather large challenge (to the tune of projects costing anywhere from $300-$400 million to $1.2 billion to bring to construction in the case of Thacker Pass). Obtaining funding in the past was quite difficult – but times are changing.

Geopolitical Picture

From the larger geopolitical picture, it makes zero sense to be at the mercy of those that have critical elements and dominate the lithium sector. In this article, we will explore some of the big picture viewpoints and how the United States government is finally waking up to this threat. We are going to look at the government backing of United States lithium projects and how you, the investor, can benefit.

US Government Backs US Lithium Projects

The United States government is offering loans that will fund a project for 50 to 60% of a mine’s construction cost, according to the CEO of Lithium Americas (NYSE:LAC) Jonathan Evans.

That is just such a simple topic, yet it lacks the utter power behind it. Think about that for a moment. The United States Government is willing to fund projects for 50-60% at Treasury rates for a 25-year loan. Given some projects (like Thacker Pass), if fully developed would cost $1.2 billion, this is quite the development. Furthermore, from a banker’s point of view, US Government loans significantly de-risk funding the remainder of a project because the odds of the US Government defaulting are low. Hence, obtaining the remainder of the funding should be much easier.

Thacker Pass Could Spin Off

In a recent video interview, CEO of Lithium Americas, Jonathan Evans, spoke about spinning Thacker Pass off into its own public company:

|

“Post appeal this summer, we are shovel ready. We are starting to line up financing sources, the strategic partnerships, but also leveraging the Department of Energy, which has a very active loan program office now, which offers basically debt up to 50 to 60% of the capital costs of the project at fixed treasury rates for up to 25-years.” |

Additional details of a possible spin off and loans can be found here. I’ve had quite a few people message me about this, asking “What happens to my LAC shares?” The answer is quite simple: LAC could spin off Thacker Pass into a new stock symbol. Some X value would be placed on it. Let’s play with imaginary numbers and say that 50% of LAC’s value is in Thacker Pass. Hence, you would see LAC decrease in stock price by half; yet, you would have a new ticker that represents Thacker Pass that trades at 50% of what LAC was at (so no value is lost.)

The new symbol would be a pure play, free of Chinese associations and might trade for a richer value as it would be able to obtain U.S. Government backing. Thus, the value would be unlocked. Of course, none of this matters till Lithium Americas successfully defends the rights granted to it in Nevada. We will look at Pacer for legal updates in a moment, but before we do, realize just how big the holdings of subsidiary Lithium Nevada are.

Lithium Nevada Land Holdings are Immense

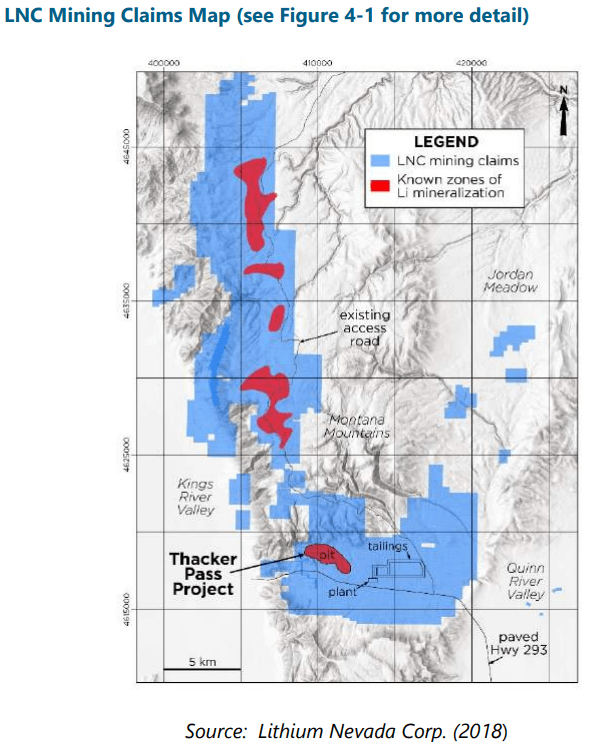

Something I was unaware of (till Uncle Rico pointed it out to me) was that subsidiary Lithium Nevada’s land holdings are immense. Looking at the Thacker Pass 43-103 document we see:

Lithium Nevada Land Holdings (Thacker Pass 43-103 Report)

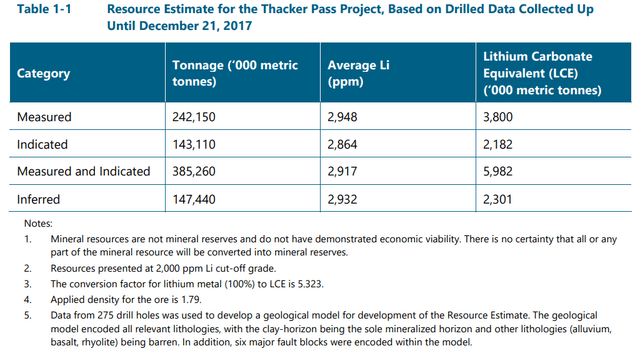

Looking at the Thacker Pass 43-103, we are confronted with a very interesting blurb discussing the cut off grade of the lithium on page 30.

|

Looking at page 32, we can see various average lithium grades, which explains why the cut off is 2000 ppm. Frankly, it is a very rich lithium deposit:

Thacker Pass Cut Off Grade (Lithium Americas) |

If the cut off grade for Thacker Pass proper is 2,000, this means (with lithium prices blasting off) that LAC would lower the cut off grade and the resource size would “expand” in a sense. Pretty interesting to ponder. Moving on. Notice that the blue areas are land Lithium Nevada has rights to. The red zones are lithium deposits. It makes you wonder what Lithium Nevada will do with these areas in the future. Would the proposed rail line maybe extend to some of the lithium deposits north and they would simply ship the raw lithium clay south for processing? Where to store/ship tailings? I digress, but it is interesting to see the lithium deposits and be presented with a long-term future path of lithium expansion.

Given the government funding of 50-60%, you have to wonder if Lithium Nevada would accelerate the development of those northern lithium deposits once Thacker Pass is more advanced. Remember, just a few years ago LAC was a $2 dollar stock with some barren but lithium-rich property in South America. Now that same property is a sprawling hive of activity. Could the same be said for some of the northern lithium deposits on the above map one day? I reckon so.

Lithium Future Shock

I’ve been preaching for a few years that a sea change is coming in the form of electric cars. The amount of new lithium battery factories is accelerating. Automakers are also expanding capacity and laying down new electric car factories or retooling older ICE (internal combustion engine) lines into electric car lines. However, the impact goes far outside of just cars. Just today I was stuck in traffic. I looked to my right as a kid coasted up a seemingly never-ending hill on a skateboard… a lithium fueled electric skateboard. 4-Wheelers are also going electric. School buses join the electric fray. Even trains are going electric via lithium.

The point is the world is indeed going lithium. In ten years, we will look back and say “How obvious”. It will be as it was when cell phones arrived. In retrospect, it was obvious everyone was going to embrace them. The point is, right now is the time to identify the future best-of-breed lithium companies. That is not to say you have to weld your account into them. No, you can simply acquire a basket of names and trade around a portion of those holdings all the while keeping a core amount for long-term growth.

Best of Breed Lithium Stocks

Taking a break from the major topic, in this section I’m going to break down what I’m monitoring or actively investing in lithium-wise. My intent is to give the reader a few ideas of companies they should be researching (besides the obvious LAC). These are broken down by tier: Grand Daddies (aka blue chips), Mid-Tier, Juniors, and super risky “wild cards”.

Grand Daddy: Albemarle (ALB) – One of the “bigger boys” of the lithium world. They move slow (quite frankly) and need to accelerate plans in Clayton Valley, but they are a solid company. Consider them a blue chip.

Mid-Tier: More established with less bankrolls than the Grand Daddies, but much more than the junior miners. Far more advanced projects.

Lithium Americas – With a massive bankroll and arguably three projects (Nevada, Cauchari-Olaroz in South America along with the Millennial property – not to mention they own a large chunk of Arena Minerals (OTCPK:AMRZF): this one is a no brainer for the long term investor.

Standard Lithium (SLI) – While the subject of two massive short-seller attacks, which I covered (and now the FBI is investigating the short seller firms). Powerhouse Koch has backed the company via a $100 million investment. Located in mining-friendly Arkansas, this one strikes me as a worthwhile one to research.

Juniors: Less capital than mid-tier, but often hold interesting property, or they are in a stage of pre-financing a project.

Cypress Development (OTCQB:CYDVF) – Holder of contested water rights in water challenged Clayton Valley. I consider them my #1 junior pick.

Nano One (OTCPK:NNOMF) – While challenged via restrictive NDAs with big automotive companies, they are an interesting lithium technology play.

Wild Cards: Wild cards are feast or famine stocks. Nail a multi-bagger or lose it all is the name of the game here. The hope is one of these becomes the next Lake Resources (OTCQB:LLKKF). These need to be approached with extreme caution, yet placing small bets on these might prove to be worthwhile if due diligence is conducted along with an extreme risk tolerance.

HeliosX Lithium (OTCQB:HXLTF) – A rather intriguing micro-cap. With various deep partnerships (such as Lilac Solutions and PlusPetrol), they are one to research. They are very capital challenged, but given partners have a 51% ownership in the South American project and a potential 75% of one of two Nevada projects; one can ponder a future where high lithium prices compel these partners to move projects forward.

Lithium Americas Legal Update

Getting back on topic, let’s look at Pacer Legal to see if any new interesting developments are in the works. While these are minor puzzle pieces, I think the overall awareness is useful for investors to be aware of.

Bartell Ranch vs US Dept of Interior (Pacer Legal – Docket 189) |

Looking at docket 189, we can see Lithium Nevada’s opposition to Tribal Plaintiffs Motion to Extend Time to Review the Admin Record. Per docket 189:

|

Docket 190 is the Federal response to the proposed delays and they offer up a new proposed schedule:

|

Plaintiff Intervenors, the Burns Paiute Tribe and Reno-Sparks Indian Colony moved on February 25, 2022, requesting 60 days to review the new record and an additional 30 days for filing opening motions for summary judgment in this action. 1 See ECF No. 183. Plaintiffs, Bartell Ranch and Western Watersheds Project et. al., filed a similar motion on February 28, 2022, requesting 30 days to review the new record and file motions on the administrative record and 30 days after resolution of those motions to prepare briefs on summary judgment. |

Docket 191 is just Lithium Nevada protesting proposed delays.

Docket 195 is the court informing the people of Red Mountain they have till May 2nd to obtain legal counsel or they will be dismissed from the case.

Docket 196 is simply the reasoning for the tribe’s request for more time and associated legal jousting.

Docket 197 – Orders on time frames and the below notes per the court:

|

Time is of the essence here so the Court will address all the pending motions now. Regardless of what proposed schedule the Court were to adopt, this case is on the verge of merits briefing. The Court has also expressed repeatedly throughout this case that it hoped to resolve it on the merits before the 2022 construction season began so that, if Plaintiffs and Plaintiff Intervenors ultimately prevail on the merits, they will do so before further ground disturbance occurs. However, that goal was always an aspiration, and it is now clear that it is simply not possible to resolve this case this spring. Even though, as further explained below, the Court will adopt Defendants’ proposed schedule that is a compromise between the various parties’ positions, the parties’ merits briefing will not be complete until around the middle of July 2022. And the Court will endeavor to complete a merits order relatively quickly, but likely will not be able to complete one until late summer or early fall 2022. In any event, the Court still wishes to resolve this case on the merits as soon as possible for the same reasons it has previously expressed. |

and

|

It is further ordered that on April 5, 2022, Plaintiffs and Plaintiff Intervenors must file their opening motions for summary judgment limited to 40 pages for Rancher Plaintiffs, 40 pages for Environmental Plaintiffs, and 25 pages each for Plaintiff Intervenors Reno Sparks Indian Colony, and the Burns Paiute Tribe. It is further ordered that Defendants and Lithium Nevada must file their separate cross-motions for summary judgment (combined with their oppositions to Plaintiffs’ and Plaintiff Intervenors’ motions), limited to 40 pages in response to Rancher Plaintiffs, 40 pages in response to Environmental Plaintiffs, and 50 pages in response to Plaintiff Intervenors, by no later than 45 days after the filing of Plaintiffs’ and Plaintiff Intervenors’ opening briefs. |

The translation here is come April 5th Plaintiffs must file. Then no later than 45 days after the Plaintiffs filing the Defendants must file. Hence, the takeaway here is the legal jousting will continue to Q3 before a hopeful resolution. Plan option trades accordingly.

Conclusion

Today’s news that the Biden administration may push out an executive order for critical elements has been met by the market in a positive manner (although I wish it would go through Congress). Lithium prices continue to remain high, having seemingly plateaued for the moment. Per CEO comments, LAC will most likely split into two public companies to unlock government loans and shareholder value. The legal case will most likely be pushed back to Q3 for resolution.

What does this all mean for investors? Well, for the patient investor it means you just need to sit back and relax. I could easily see this stock reaching $40-$50 range in a year (if not more). What of a longer view, though? What do things look like say five or 10 years down the road? What happens long-term if Thacker Pass is approved (likely) and then Lithium Nevada starts expanding on its property to the north? Realize those northern properties could be additional Thacker Passes in the making. Consider how much tonnage of lithium LAC via Lithium Nevada could be extracting. Ergo, buy and hold is the name of the long-term game as the EV revolution is just starting.

Be the first to comment