yalcinsonat1/iStock Editorial via Getty Images

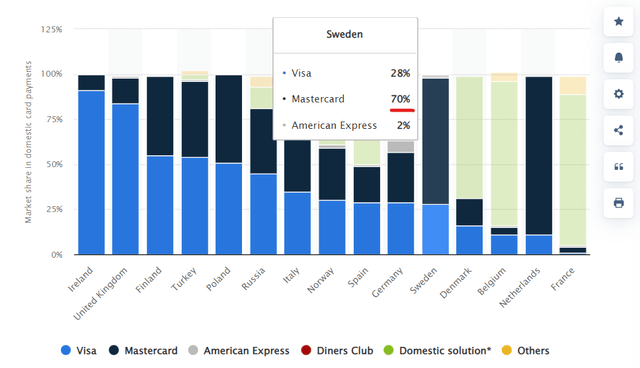

Mastercard (NYSE:MA) is a global payments titan which owns one of the most popular card processing networks in the world. Visa (V) has the largest market share in the USA, with 53% share vs. MasterCard at 23%. But in certain countries in Europe, such as Poland, Sweden, Netherlands, and Germany, Mastercard is a close rival or dominant, as you can see in the chart below with Mastercard represented by the dark blue bars.

Visa/Mastercard Market share (Statista)

Mastercard has a high-quality business model, which takes a percentage of every transaction in which the Mastercard network is used. This has resulted in super high-profit margins, high returns on capital, and solid network effects.

The company has recently reported a strong earnings report for the third quarter of fiscal year 2022. Top and bottom-line growth surpassed analyst expectations, despite economic headwinds. Mastercard is poised to benefit from Crypto tailwinds as the company has announced a new service that helps banks with secure crypto trading. Thus, in this post I’m going to break down Mastercard’s third-quarter results in granular detail and reveal its valuation. Let’s dive in.

Third Quarter Breakdown

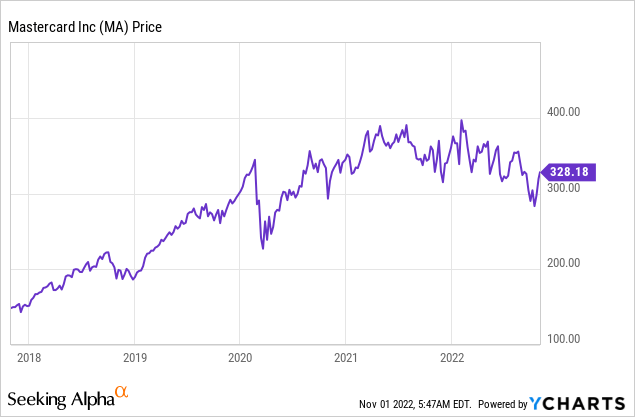

Mastercard generated solid financial results for the third quarter of fiscal year 2022. Revenue was $5.67 billion which increased by ~15% year over year and beat analyst estimates by $95.09 million. On a constant currency basis, revenue increased by a rapid 23% year over year, with a 1% tailwind from acquisitions.

Revenue Mastercard (Q3F22 report)

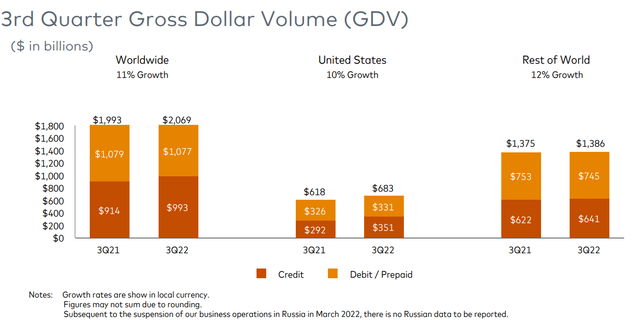

The primary drivers of the revenue growth include solid Gross dollar volume growth of 11% to a staggering $2.1 trillion. In addition, Cross Border volume reported huge growth of 41% to $1.8 billion, this was also a similar trend rival Visa reported in its earnings report for the September quarter, and was driven by strong pent-up travel demand. According to the Mastercard Economics Institute, at the current rate of flight booking trends an estimated 1.5 billion more passengers globally will fly in 2022 compared to the prior year. With tourists spending 34% more on experiences than pre-pandemic.

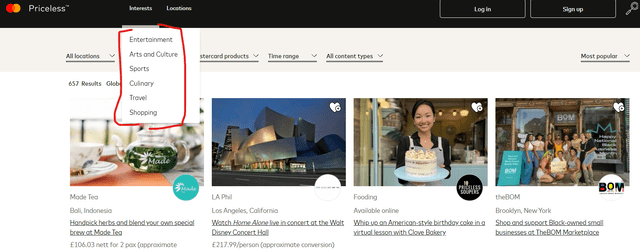

Mastercard is poised to continually ride this trend as the business has expanded its Mastercard Travel & Lifestyle Services platform with a series of new partnerships. This platform includes the lowest Hotel Rate guarantees, lounge access when flights are delayed, and even a series of “Priceless Experiences”. These experiences are fairly interesting and include walking tours, art classes, and even wine tasting at a vineyard. This service looks to compete directly with Airbnb (ABNB) experiences, as the travel industry becomes further commoditized. Mastercard makes its money from affiliate commissions and transaction volume, thus such “Priceless experiences” can generate extra revenue for the company and enhance the customer’s relationship with the Mastercard brand. A quick look at the pricing shows the experiences are fairly expensive relative to other websites such as “Get Your Guide”, thus it looks as though Mastercard is targeting the premium customer. WhatsApp servicing is another interesting perk that enables members to message a “lifestyle manager” directly with travel requests.

Mastercard Priceless Experiences (Mastercard)

Back to Mastercard’s core dollar volume metrics, Domestic Assessments, which are the fees charged to issuers and acquirers based on the volume of activity, when in the same country. This metric reported steady growth of 5% year over year to $2.252 billion. “Other Revenues” which includes Cyber Intelligence and Data solutions, were up a solid 17% year over year to $1.8 billion. Revenue was offset by a series of Rebates and Incentives which increased by negative 20% to $3.4 billion. The overall number of Mastercards grew by 5% year over year to just over 3 million. While switched transactions increased by 9% year over year to $32.4 billion. With Contactless payments now representing 54% of all in-person switch purchase transactions.

Mastercard Gross Dollar Volume (Q3 22 Earnings)

Similar to Visa, Mastercard has acquired many smaller entities to bolster its offerings. For example in 2021, Mastercard acquired Arcus, a payments-as-a-services platform that is expected to accelerate Mastercard’s penetration across Latin America, which is a large fintech growth market as the region has a large unbanked population.

In 2021, Mastercard also acquired “CipherTrace” a crypto intelligence company that helps customers enhance security and fraud monitoring across the crypto ecosystem. This is part of Mastercard’s strategy to position itself as the “trustworthy” party in the cryptocurrency market. For example, in October 2022, the company launched “Crypto Secure” which uses the CipherTrace data to help card issuers stay compliant across the complex regulatory landscape. The platform also enables the risk profile of crypto exchanges to be assessed more accurately. In addition, the company announced Crypto Source, a platform that will enable “crypto trading” to be implemented by banks.

Expenses and Profitability

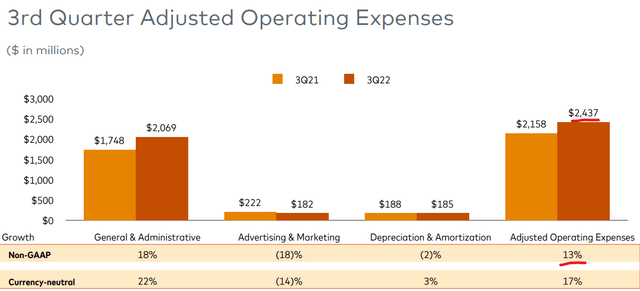

Mastercard reported a 17% increase in its operating expenses or 13% on an adjusted basis. This was primarily driven by higher personnel costs and investments across its payments, services, and Network. Overall, I don’t deem these costs to be negative, as I believe paying employees well encourages strong retention long term. I also highlighted a similar trend during my analysis of rival Visa, so this is not out of the ordinary. Platform investments are also necessary to continually innovate especially given the rapid progression of fintech and the number of competitors on the rise.

Despite the increase in operating expenses Earnings Per Share still increased by 22% year over year to $2.68, which beat analyst expectations by $0.11.

Operating Expenses (Mastercard)

Management repurchased $1.6 billion worth of stock in the third quarter and an additional $505 million throughout October 2022. Mastercard has a 0.6% dividend yield which isn’t amazingly high but is incredibly consistent and secure.

Mastercard has a solid balance sheet with $8.045 billion in cash and short-term investments. The company does have fairly high long-term debt of $13.6 billion. However, “just” $957 million is in current debt (due within the next two years) and thus is manageable.

Advanced Valuation

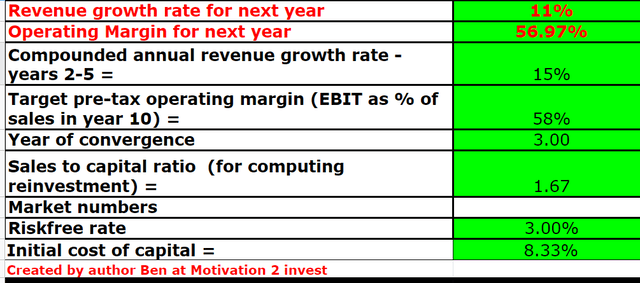

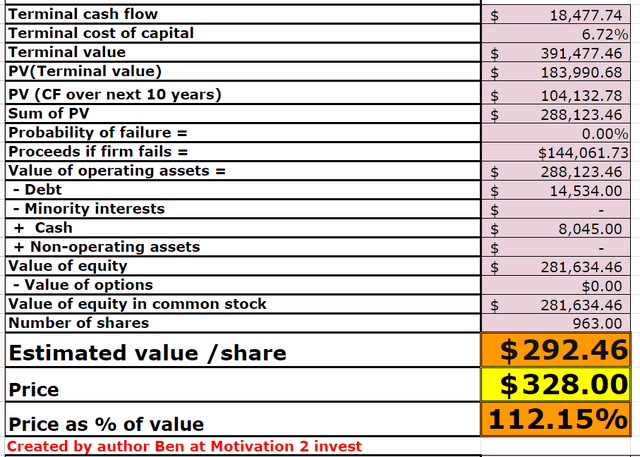

In order to value Mastercard, I have plugged the latest financials into my advanced valuation model which uses the discounted method of valuation. I have forecasted 11% revenue growth for next year, as the recessionary pressure is likely to cause a slowdown in consumer spending. However, in years 2 to 5, I have forecasted a conservative 15% growth rate per year.

Mastercard stock valuation 1 (created by author Ben at Motivation 2 Invest)

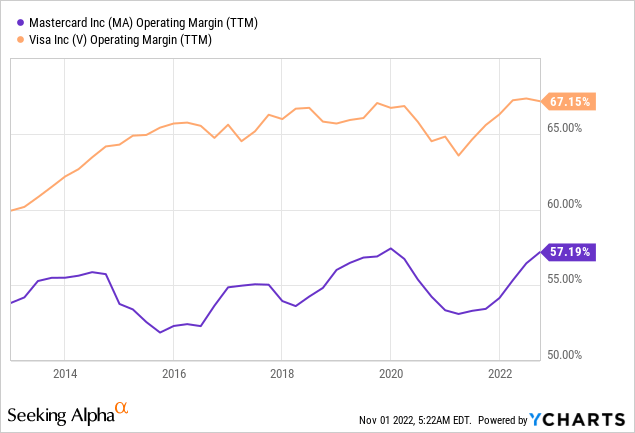

I have forecasted the business to increase its operating margin slightly to 58% over the next three years, as economic headwinds are expected to reduce. Mastercard and rival Visa have exceptionally high and consistent profit margins, although Visa’s margin has been slightly higher historically.

Mastercard stock valuation 2 (created by author Ben at Motivation 2 Invest)

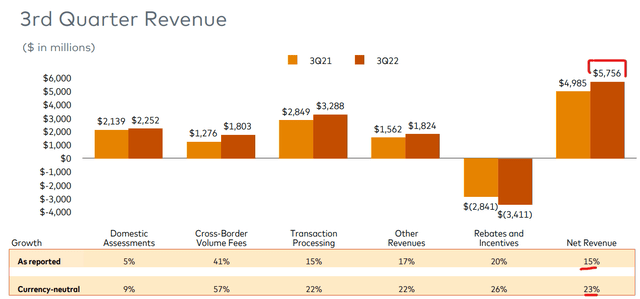

Given the financials and forecasts, I get a fair value of $292 per share, the stock is trading at $328 per share at the time of writing and thus is ~12% overvalued, as the stock price has spiked by ~12% over the past few weeks in October 2022. This gives me faith in my valuation model and due to the high quality of Mastercard the company is rarely undervalued. In addition, the financial estimates are fairly conservative, as should the FX exchange rates correct, Mastercard could easy grow its revenue at over a 20% clip, which would make the stock “fairly valued” at these levels.

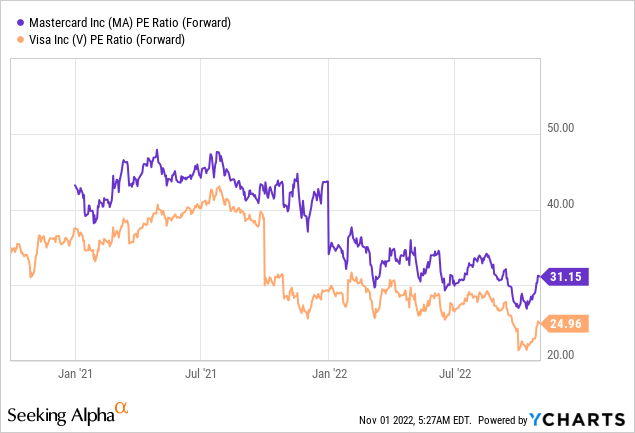

As an extra data point, Mastercard trades at a P/E ratio = 31, which is 16% cheaper than its 5-year average. Although this is slightly more expensive than rival Visa.

Risks

Recession/Lower Payment Volume

The high inflation and rising interest rate environment have caused many analysts to forecast a recession. During recessionary times, both the consumer and businesses get squeezed by higher input costs and the velocity of transactions tends to slow. This is a risk for Mastercard but only a temporary issue as economic conditions tend to be cyclical.

Final Thoughts

Mastercard is one of the greatest companies to have ever existed. The company has strong competitive advantages, a dominant market position and is continually innovating. The stock is slightly overvalued intrinsically at the time of writing, but given more optimistic estimates it is “fairly valued” with Crypto tailwinds. Therefore the stock could be a great long-term investment.

Be the first to comment