Khaosai Wongnatthakan

After Affirm (NASDAQ:AFRM) reported its quarterly results in May, the stock dipped. It fell to a $13.64 low before rallying back to its 50-day simple moving average at around $30. AFRM stock closed recently at $23.84.

The supplier of buy now, pay later (“BNPL”) posted revenue, earnings, and gross merchandise volume figures that beat expectations. Its outlook spooked investors. Despite the potential for the BNPL market worth $900 billion in 2021, shareholders are nervous.

After AFRM stock consolidated at around the $20 – $24 level since mid-May 2022, should investors consider buying?

Strong Third Quarter, Weak Outlook

Affirm posted a GAAP EPS loss of 19 cents. Revenue soared by 53.8% Y/Y to $354.8 million. GMV increased by 73% to $3.9 billion. The company expects to reach income profitability on a run rate basis by the end of its fiscal year of 2023.

Affirm’s revenue outlook in the range of $345 million to $355 million is slightly below consensus. Furthermore, its $1.33 billion to $1.34 billion revenue for fiscal 2022 is within consensus estimates. Markets are overlooking its good quarterly results and reasonable outlook. Bears have a significant enough short interest against AFRM stock, at 16.55%.

Bears are not targeting only Affirm stock. Sofi (SOFI) has a short interest of 18%. By comparison, the short float on Block (SQ) is 7.71% and just 2.03% for Visa (V).

According to Seeking Alpha Premium, bears may rely on a weak profitability. Still, its valuation score of “C” and growth score of B- should concern short-sellers.

SA Premium

On July 14, the company announced a team-up with SeatGeek. Consumers may buy and sell tickets for live events. They will have flexibility with payment options at checkout. More importantly, fans may pay in monthly installments and up to four interest-free biweekly payments.

BNPL a Growth Driver Amid Recession

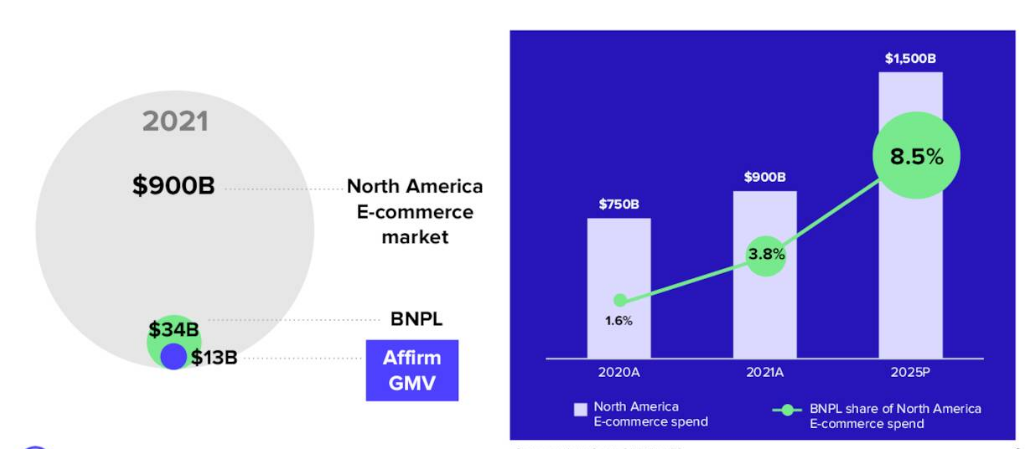

In its recent investor presentation, Affirm said it had $13 billion in GMV in 2021. With the e-commerce market worth $900 billion, its growing BNPL share would lead to sustained profitability through 2025.

Affirm Presentation

In the bar chart above on the right, the company will grow its BNPL share from 3.8% in 2021 to 8.5% by 2025. Granted, the recession would shrink the $1.5 trillion e-commerce spending forecast. Still, companies will rely on their online business to cut costs. The size of the online market should continue expanding despite the current recession.

Amazon (AMZN) accounts for 41% of online sales, followed by Shopify (SHOP) at 10.3% and Walmart (WMT) at 6.6%. As its integrated partners, Affirm’s business will thrive with them. In the last quarter, Amazon cut hiring and investments in its warehouse. Walmart recognized it had excess inventory for goods that consumers did not want. Other than splitting its stock to increase affordability, Shopify warned investors of higher costs.

Shopify spent $2.1 billion to acquire Deliverr. Its investments in global logistics will benefit its independent brand customers.

Opportunity

Markets are still digesting the negative impact of Peloton’s (PTON) decelerating business momentum. This hurts Affirm’s large purchase support for customers. As the recession unfolds, customers will be more mindful of applying for credit. To avoid higher costs, they will consider Affirm’s business instead.

Affirm will fund its business in several ways. It will have floating rate warehouse financing. It will fund its business with a securitization program. In its forward flow funding, it will sell loans to counterparties. Those loans will have an extended duration of up to 24 months.

Affirm will stagger its securitization maturity durations. It will have plenty of near-term visibility. Furthermore, its business will be sensitive to the short-term end of the debt curve. This minimizes the risk of the Federal Reserve’s continued interest rate hikes.

According to Wall Street, the average price target is $35.50. The highest price target is $80.00.

Risk

Apple’s (AAPL) launch of Apple Pay Later is a potential risk. Investors are speculating on what the product looks like. Still, Apple’s entry into the BNPL market validates Affirm’s business model. In addition, Apple will target customers with high income and strong credit scores. Chances are good that Apple’s Pay Later market will not overlap with that of Affirm’s target customers.

Chief Financial Officer Michael Linford said that there is not much overlap between the planned implementation and Apple’s service. Affirm integrates with leading technology platforms. Amazon, Shopify, and Walmart are dominant players in the e-commerce market.

Your Takeaway

Investors seeking financial lending companies should look at Affirm. The stock potentially bottomed from here. Based on its revenue trajectory, the company will report profits later, by the end of its fiscal year 2023.

Markets priced the risk of Apple’s competition on AFRM stock revealed in June 2022.

At a macroeconomic level, the U.S. is already in a technical recession. Demand for goods will keep falling. As disposable income tightens, consumers still need BNPL options. Affirm fills that need. As a result, the company’s market share will expand. By the time markets realize it, Affirm will achieve operating profitability sooner than it expects.

Be the first to comment