jir/iStock Editorial via Getty Images

Price Action Thesis

We follow up with a detailed price action analysis on Mastercard (NYSE:MA) stock, following our previous update (Hold rating) in October 2021.

We urged investors to bide their time in MA as we thought it traded at a rich premium. Despite its recent sell-off, we believe the stock is still overvalued. Furthermore, given its slowing revenue growth moving ahead, we find it challenging to suggest a buy point now.

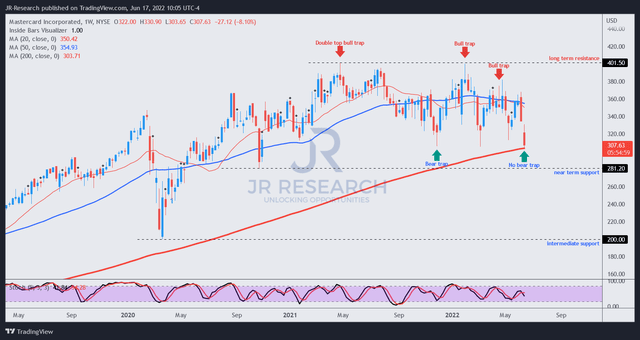

Our price action analysis indicates a double top bull trap has hindered its recovery momentum since April 2021. Furthermore, a series of subsequent bull traps confirmed our suspicion that MA stock is likely in a distribution phase. Therefore, we believe the risk of a steeper sell-off could ensue moving forward.

Moreover, our reverse cash flow valuation analysis suggests that MA stock seems overvalued as growth continues to slow. Investors could likely underperform the market, and thus adding at the current levels could offer an unattractive risk/reward profile.

Consequently, we reiterate our Hold rating on MA stock.

Double Top Bull Trap And Its Long-Term Resistance

MA price chart (monthly) (TradingView)

MA stock is likely at a near-term bottom, supported by its near-term support, seen in its monthly chart above. The near-term support has been fending off selling pressure in MA stock since January 2021, as it drew in dip buyers consistently to defend.

However, we accord a larger significance to its double top bull trap that formed in April 2021, which also sets up its long-term resistance. Moreover, a subsequent bull trap that occurred in February 2022 lent further credence to the strength of the resistance zone.

MA price chart (weekly) (TradingView)

Moving into its weekly chart, we can corral the bull traps clearly. As seen above, the menacing double top bull trap helped define its long-term resistance that MA stock has failed to re-test recently.

Notably, a series of bull traps formed subsequently, rejecting the buying momentum convincingly and forcing lower highs. Moreover, the consolidation (which we believe is a likely distribution phase) significantly weakened MA’s bullish bias. As a result, the stock has moved decisively into negative flow (dominant bearish momentum), which doesn’t bode well for its upward momentum.

Importantly, we believe the market has continued to draw in dip buyers close to its near-term support before setting up for an eventual steep sell-off to force a rapid liquidation of positions.

MA Stock Is Overvalued

| Stock | MA |

| Current market cap | $299.62B |

| Hurdle rate (CAGR) | 20% |

| Projection through | CQ2’26 |

| Required FCF yield in CQ2’26 | 3% |

| Assumed TTM FCF margin in CQ2’26 | 45.7% |

| Implied TTM revenue by CQ2’26 | $40.79B |

MA stock reverse cash flow valuation model. Data source: S&P Cap IQ, author

We used an aggressive hurdle rate of 20%, based on MA stock’s 5Y CAGR of 20.3%. We also applied the 5Y mean of its FCF yield of 3%. As a result, we require Mastercard to deliver TTM revenue of $40.8B by CQ2’26, an improbable task.

The consensus estimates suggest that the company could post revenue of $30.16B by FY24. Accordingly, Mastercard needs to deliver a revenue CAGR of 22.3% from FY24-CQ2’26. However, the Street’s modeling suggests that its growth could continue to moderate to the mid-teens over time. As a result, investors choosing to add at the current levels could likely underperform the market.

Is MA Stock A Buy, Sell, Or Hold?

We reiterate our Hold rating on MA stock. We believe that the market has started to distribute MA stock before forcing a steeper decline resulting in rapid liquidation of positions.

Dip buyers who choose to enter at the current price could be disappointed as they might underperform the market moving ahead.

Investors should also significantly temper their expectations of repeating MA stock’s 20% CAGR performance over the past five years.

Be the first to comment