Liudmila Chernetska

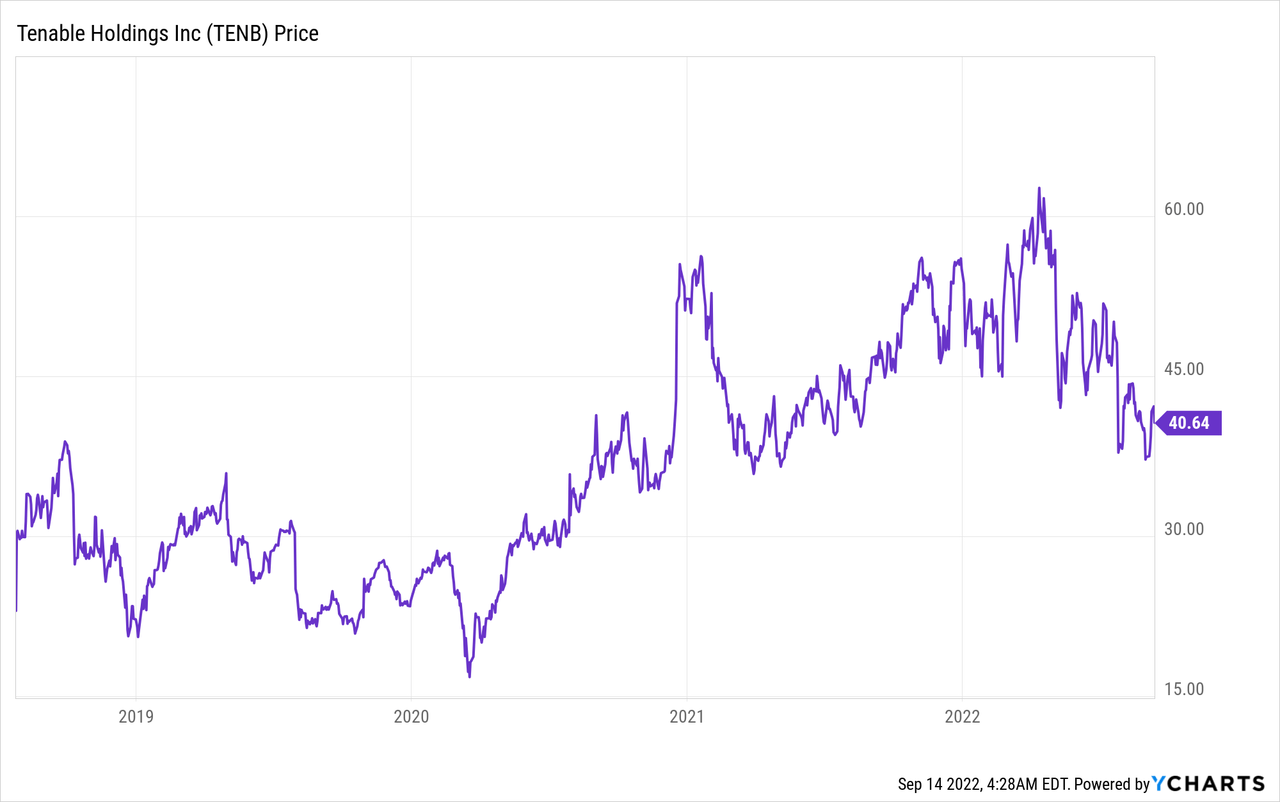

Tenable Holdings, Inc. (NASDAQ:NASDAQ:TENB) is a leading cybersecurity firm which helps companies assess their “cyber exposure” and protect it. The cybersecurity industry is forecasted to grow at over 18% CAGR up until 2027 and reach a value of $298 billion by the end of the period. Tenable has recently generated strong financial results for the second quarter of 2022, beating both revenue and earnings estimates. In this post I’m going to break down the company’s business model, financials, and valuation, so let’s dive in.

Secure Business Model

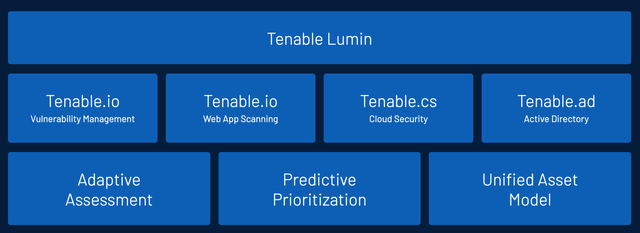

Enterprise environments are expanding from on-prem to the cloud, containers to web applications. The distributed network has a wider “attack surface” and thus offers more opportunities for hackers. Tenable has created a “cyber exposure” platform which brings together its different products into one solution to offer: Vulnerability Management, Web App Scanning, Cloud security, and Active Directory.

The Tenable Lumin platform ties this all together with a “cyber exposure” score. This can be tracked against historical metrics in order to see improvement over time. This unified view gives the customer a “single pane of glass” to view all the vulnerabilities on their network.

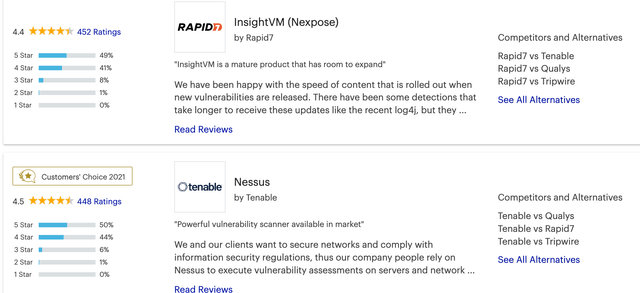

Tenable’s flagship Vulnerability Assessment (Nessus) has been ranked as the Customers Choice for the past three years in a row. In addition, it has a 4.5 out of 5-star rating, with the second-largest number of reviews.

Gartner Customer Choice (Tenable)

The company recently acquired Bit Discovery, which helped the company to cover Internet-facing assets such as web applications, cloud resources, and open gateways. This then enabled its Nessus platform to be expanded to an expert version.

Tenable’s growth strategy uses the Vulnerability Assessment solution (Nessus) as a cost-effective on-ramp to the larger enterprise platform. This classic “land and expand” approach has been working well so far, as the company has over 40,000 customers globally. Its customers include 60% of the Fortune 500, 40% of the Global 2000, and many large government agencies.

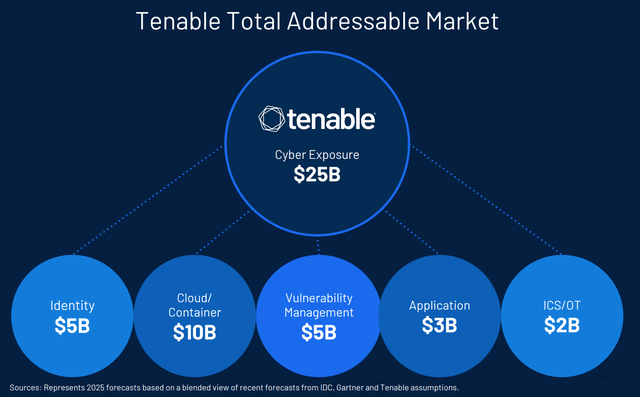

The Total Addressable Market (“TAM”) across “cyber exposure” equates to $25 billion. Given the company generated just $611 million in revenue during the trailing 12 months, its potential runway for growth is huge.

Growing Financials

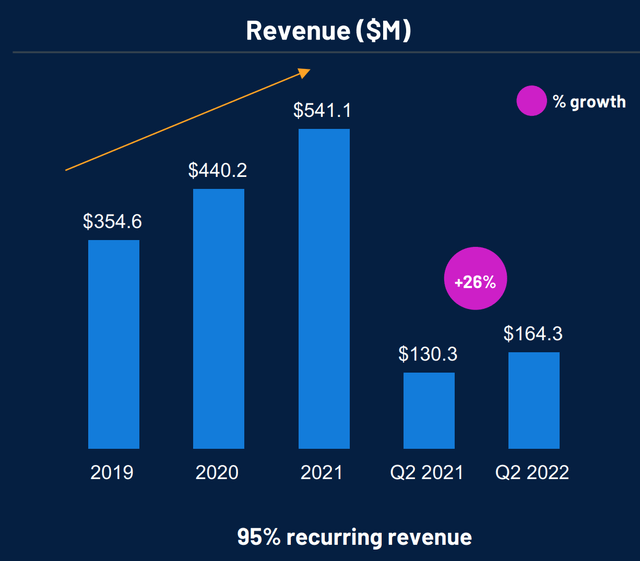

Tenable generated strong financial results for the second quarter of 2022. Revenue was $164.3 million, which beat analyst estimates by $1.08 million, and popped by 26% year-over-year.

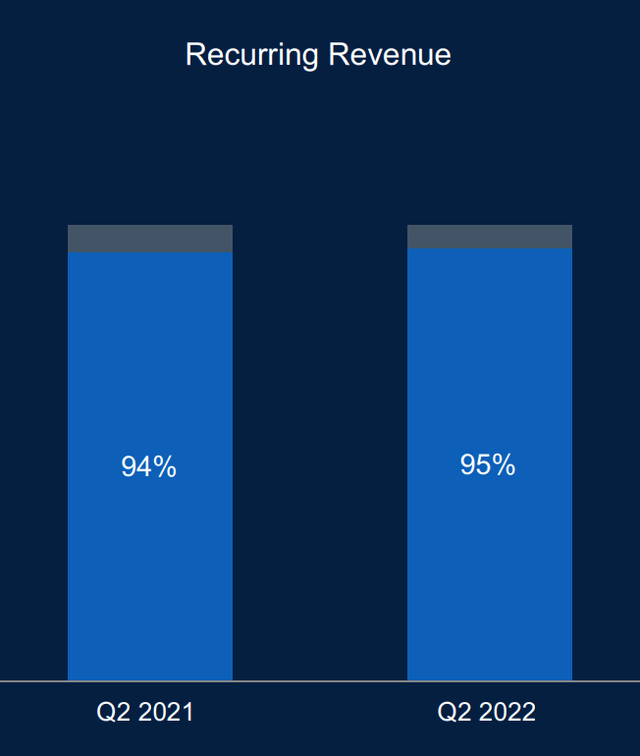

The majority (95%) of this revenue is recurring, which is up by 1% year-over-year and adds consistency to the financials. Billings increased to $174.1 million, up a rapid 27% year-over-year.

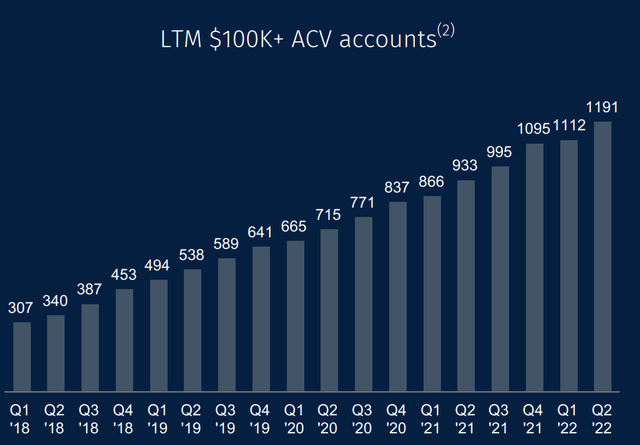

The company added 540 enterprise customers in the quarter with 79 new six-figure customers. Its number of customers with greater than $100k in annual contract value has also increased by a substantial 28% YOY.

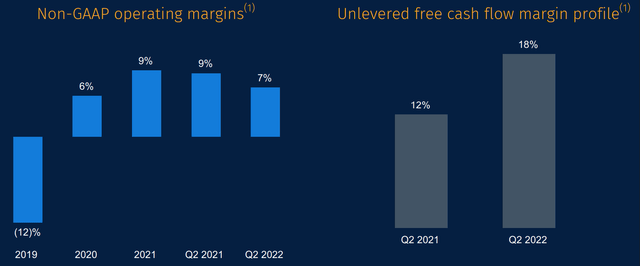

The company did generate a GAAP loss from operations of $23.2 million, as it invests aggressively for growth. However, on a normalized basis, Earnings Per Share [EPS] Normalized was $0.05, which beat analyst estimates by $0.04. Unlevered free cash flow was $29.1 million at an 18% margin, which increased by 6% YOY, which is a positive sign.

Tenable has a solid balance sheet, with $511 million in cash and short-term investments, in addition to $423 million in total debt.

For the full year of 2022, management is expecting Revenue in the range of $673 million to $679 million, up 24% year over year.

Advanced Valuation

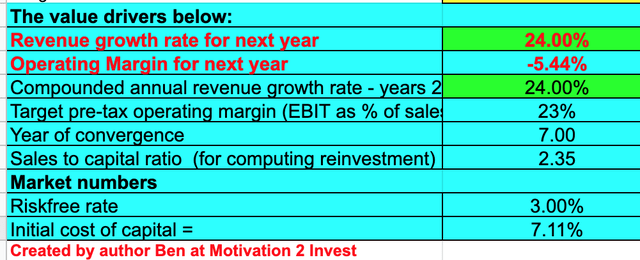

In order to value Tenable, I have plugged the latest financial data into my advanced valuation model which uses the DCF (discounted cash flow) method of valuation. I have forecasted 24% revenue growth per year over the next 5 years.

Tenable (created by author Ben at Motivation 2 Invest)

I have also forecasted the operating margin to expand to 23% over the next 7 years, which is the average for the software industry. I expect this to be driven by increasing operating leverage over time and return on Tenable’s strategy for investment. It should be noted this margin includes an adjustment for R&D expenses which I have capitalized.

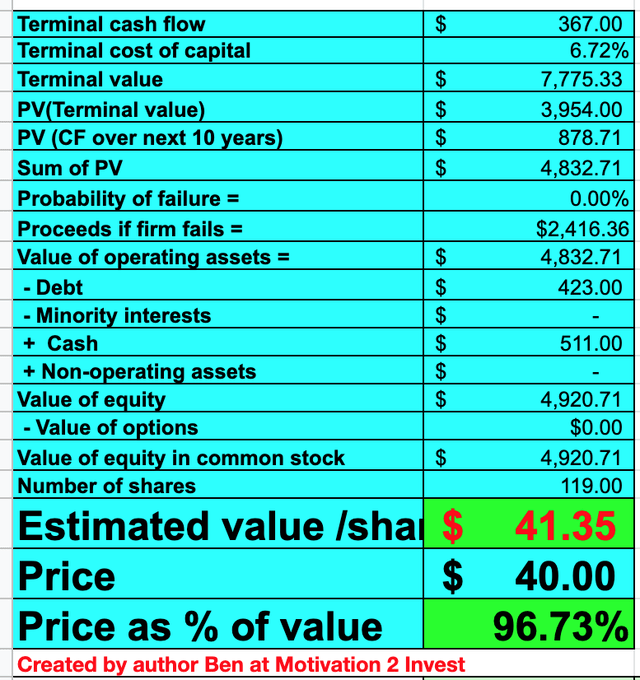

Tenable stock valuation 2 (created by author Ben at Motivation 2 Invest)

Given these factors, I get a fair value of $41 per share. The stock is currently trading at $40 per share and thus is ~4% undervalued.

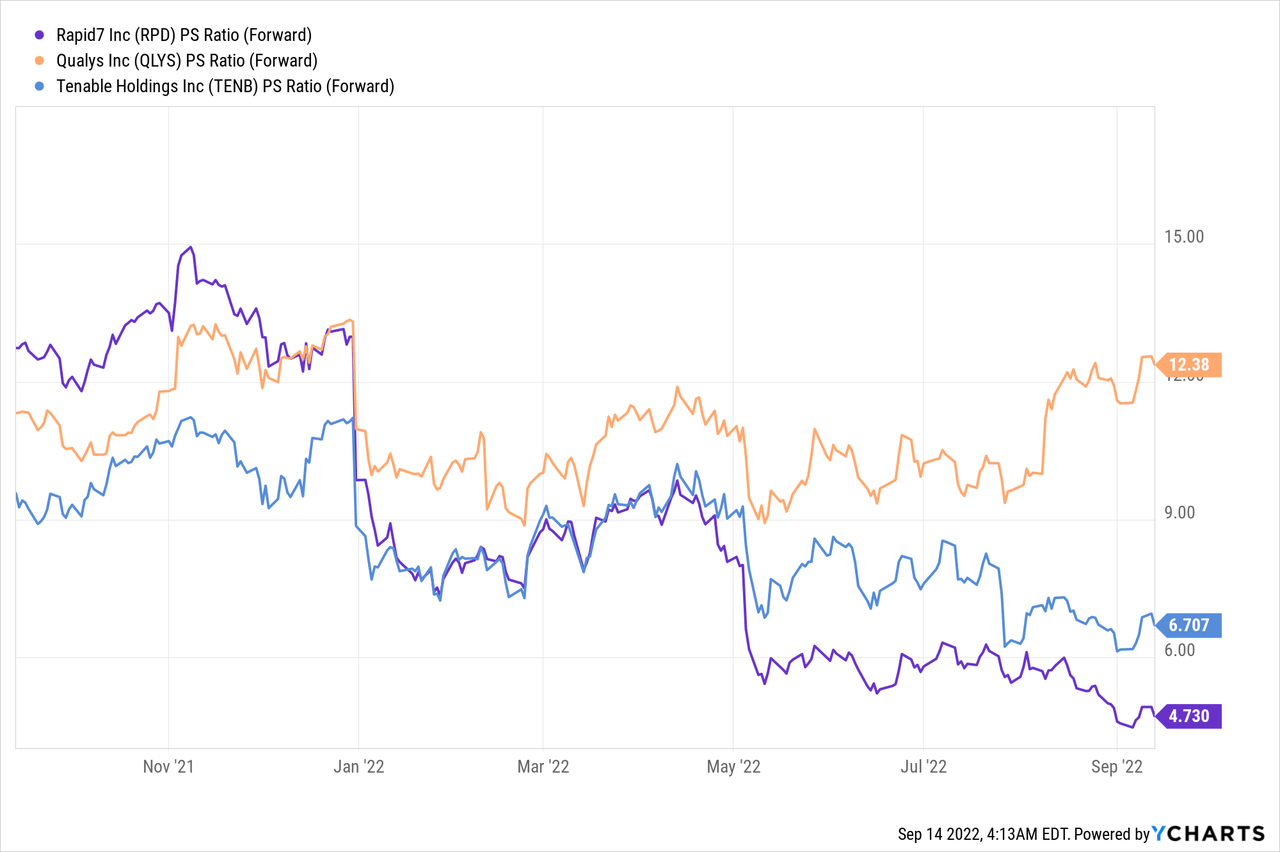

As an extra datapoint, Tenable trades at a Price to Sales Ratio = 7, which is 9% cheaper than its 5-year average. Relative to industry competitors, Tenable trades at the low end of the valuation spectrum. For example, Qualys (QLYS) trades at a P/S ratio = 12.4, which is more expensive. Rapid7 (RPD) trades slightly cheaper with a P/S Ratio = 4.7.

Risks

Competition

Competition is increasing in the cybersecurity industry and there is a series of fragmented solutions. This extra choice could drive down the return on capital for each individual player in the industry.

Recession/IT spending Slowdown

Many analysts are forecasting a recession, and thus a temporary slowdown in IT spending is likely to occur. I expect this to be driven by longer sales cycles as decisionmakers are more hesitant about product purchases. The good news is the long-term trend in increased security spending is up.

Final Thoughts

Tenable is a Gartner leader in vulnerability assessment, which enables them to get their “foot in the door” for upsell opportunities, despite the competitive landscape. Management is executing well and the industry tailwinds offer plenty of runway for growth ahead. The stock is undervalued intrinsically and relative to historic metrics, thus it could be a great buy for the long term.

Be the first to comment