thamerpic/iStock Editorial via Getty Images

Investment thesis

Mastercard Incorporated (NYSE:MA) evolved from a simple card provider and payment processor to a non-cyclical, major company over the last 15 years. Despite several articles (investors.com, fool.com) still referring to Mastercard as a growth stock, I believe that by now the company should be categorized as a defensive stock. Its market share is stable, the valuation is fair, and the company is fairly resistant to general market downturns such as the most recent one in the first half of 2022.

The majority of the external factors are in Mastercard’s favor in the long term. The only significant challenge could be a longer-than-expected recession in 2023 when the service fees could potentially stagnate or drop while the other revenue streams may not be able to substitute the missing revenue. That is why I am neutral on MA in the short-term (next 5-6 months) but buy in the long term.

External trends affecting Mastercard

In my opinion, 3 major external factors will affect Mastercard. In the short term, I believe that there is still a place for further downward movement but in the longer-term MA is in a good position to grow with the expanding digital trends and the rise of ML and AI. This will provide moderate growth over the next 5 years to Mastercard.

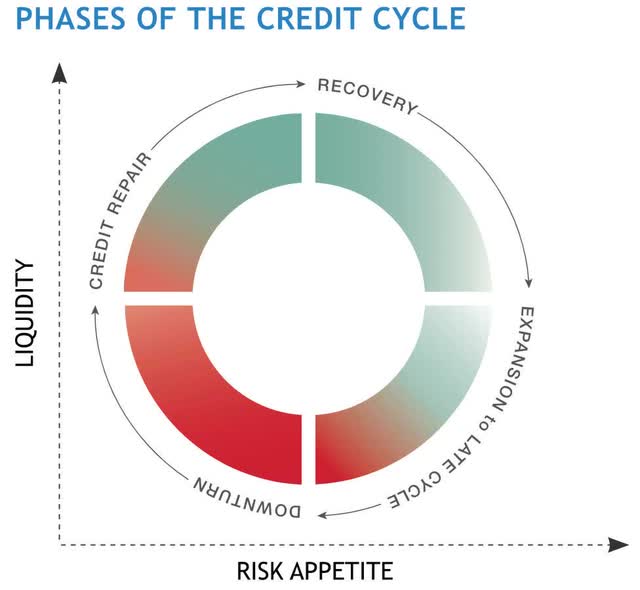

First of all, let’s see where we are at the credit cycle and how that affects Mastercard. All of the credit cycle frameworks analyze who is borrowing and spending, and who is saving and deleveraging. We are at the late of the expansion cycle when central bank policies are tightening, inflation is high and, on the rise, liquidity declining. The yield curve is flattening or possibly inverting, and the overall dept is more than the actual profit growth. Among CEOs, the chance has been on the rise since the beginning of 2022 and now stands at 60%. The markets have already started to price in these figures and the further rise of interest rates by the Fed. According to the credit cycle theory, equity prices are very likely to further decline in the next months and MA will be no exception.

Second of all, the credit card trends will not only affect Mastercard but determines its future profitability. The more cards they can issue and the more volume goes through them the better it is for the company. One of the recent moves of MA is to allow its 2.9 billion card users to purchase NFTs directly via cards without the need to buy crypto first. The number of cashless transactions will increase by 42% by the end of 2025 and increase further by 2030. This is more than good news for Mastercard because this means that a significant part of this volume will go through Mastercard debit and credit cards.

Third of all, MA will be affected by the comeback of airline credit cards. A substantial portion of major airlines’ revenue comes from their credit cards and the issuer of those cards are Mastercard and Visa. Of the Top 10 airlines of the world, 5 of those credit cards are issued by Mastercard (American Airlines, Lufthansa, Air France – KLM, China Eastern, All Nippon Airways). The rise of these credit cards will increase the fee revenue of MA. Small but significant news for MA is that The Reserve Bank of India lifted the restriction of issuing debit and credit cards to new domestic customers. Since India is one of MA’s key growth markets, it is good news for MA in the long term.

Valuation

I believe that MA is fairly valued at the moment. You could say that due to the company’s P/E ratio being below its 5-year average (almost by 20%) MA is undervalued, but I see it otherwise. This suggests to me that the market calculates more moderate growth for the upcoming years than in the previous 5 years. The extreme year-on-year revenue growth of 23.43% in 2021 is not sustainable in the long term and the company will fall back to approximately 10-11% yearly revenue growth on average according to my calculations. Their average revenue growth was 12.3% between 2012 to 2019.

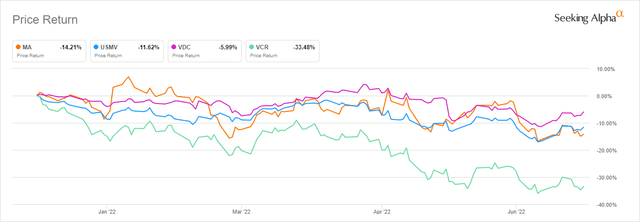

Why do I strongly believe that Mastercard is no longer a growth company but could rather be categorized as a non-cyclical corporation? When looking at the recent bear market and comparing defensive stocks, ETFs and cyclical stocks, ETFs to Mastercard a clear pattern emerges. Mastercard’s YTD return is much closer to the largest defensive ETFs than to cyclical stocks and ETFs. I attached a chart with the most popular cyclical and non-cyclical ETFs for a quick comparison but the same pattern is true with several other cyclical and defensive individual stocks.

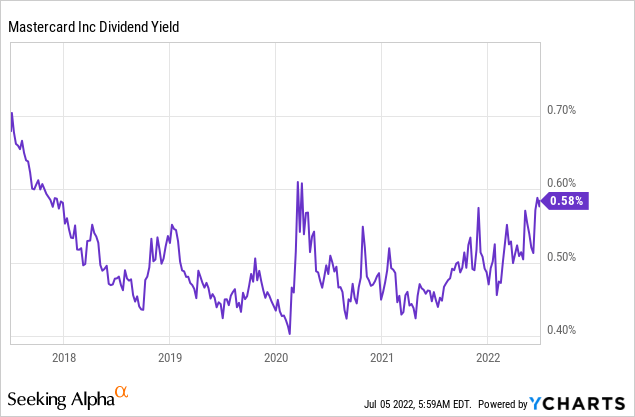

In terms of its dividend yield, the current valuation is fairly good. Of course, the 0.58% dividend yield is far from an income investor’s dream, especially with almost double-digit inflation. However, it is interesting that most of the companies had a massive dividend yield peak during the first part of the pandemic (2020 March-April) then slid back to normal levels and have not returned to the elevated pandemic yield levels since. Mastercard is different, as its dividend yield at the moment is almost as high as the pandemic peak. This is further evidence to me that MA is no longer a growth company but a mature, non-cyclical corporation.

Company-specific risks

I could summarize the biggest risks to Mastercard in a small sentence: credit cycle effects and hacker attacks that destroy the reputation. You could easily say that, wait a minute, what about regulation changes, card issuing restrictions, etc. The recent Indian restrictions issue and its effective handling proved to me that Mastercard is still capable of handling these unpleasant situations well.

However, due to Mastercard’s business structure as a payment processor, a significant part of its revenue comes from commissions after card transactions. These service fees or transaction processing fees are approximately 26% of MA’s revenue. If consumer spending declines due to the next phase of the credit cycle (downturn) then the service fees income segment will likely decline or stagnate. I believe that this stagnation or decline can be compensated in the other revenue streams, but there is a chance that the other segments’ revenue growth will not be enough. Especially if there will be a recession, and it will last longer than expected. The other major risk factor is cybersecurity risk. Ironically, there is virtually no risk management a regular shareholder like you and me can do about it. But if a cybersecurity problem occurs then the stock price will immediately reflect on that, similarly to an ecological accident in the oil and gas industry (BP oil spill in the Gulf of Mexico) or an accidental food poisoning in the food industry (salmonella virus in Kinder products recently in Europe).

My take on MA’s dividend

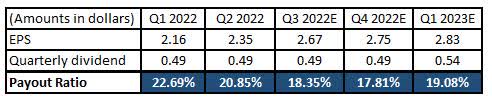

Since its IPO, Mastercard is a reliable dividend payer company. They have been paying dividends consecutively since 2006 and have been raising the dividend consecutively for 11 years. The company is not a primary target for income investors due to its very low but stable 0.58% dividend yield. However, there is much room for dividend increases as its payout ratio is around 20%. Mastercard’s management usually increases its dividend in the first quarter and I expect them to do the same in Q1 2023. Analysts estimate an at least 10% increase in 2023.

The table is created by the author. All figures are from the company’s financial statements and SA Earnings Estimates.

Final thoughts

Due to the defensive nature of the business, I do not expect exponential growth over the next years but rather a steady growth in revenue, net income, and EPS. The bear market could push the price down by another 6-7% in the short-term but in the long-term there is no question in my mind that Mastercard will grow, the external factors are in its favor and its stock price will follow this trend. That is why I am neutral on MA in the short-term (next 5-6 months) but buy in the long term. However, investors who expect its stock price to quadruple in the next 5 years may be disappointed because it is no longer a growth company. Despite this fact, I believe investors can realistically expect a decent shareholder return in the upcoming years.

Be the first to comment