peepo/E+ via Getty Images

While the market doesn’t want to touch any company investing for the future, investors should actually start loading up on the corporations set to lead the next revolution. The key to such investing is buying companies with plenty of cash on hand to continue investing during a recession, and Joby Aviation (NYSE:JOBY) fits that bill. My investment thesis remains Bullish on the stock below $5 as the 2024 electric vertical take-off and landing (eVTOL) launch quickly approaches.

Future Is Approaching

The goal of Joby Aviation is to make an eVTOL 100x quieter than a helicopter with 25% of the costs of a traditional twin engine helicopter. Throw in safety improvements due to multiple engines and the air taxi market takes off from one not currently very feasible for most passengers.

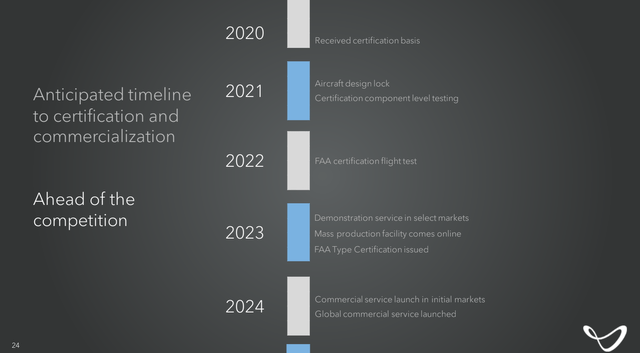

When Joby originally announced the SPAC deal with LinkedIn co-founder Reid Hastings and Zynga co-founder Mark Pincus back in early 2021, the company and other sector players predicted a timeline with 2024 as the commercial launch. The time period was stretched, but we’re now in the 2H of 2022 leaving ~2 years until the expected launch. The company has already obtained Part 135 Air Carrier certification from the FAA ahead of schedule.

Joby Aviation SPAC presentation

In the stock market, a couple of years can be an eternity. The once-promising market has seen stocks crushed due to a looming recession and a loss of faith in SPAC deals.

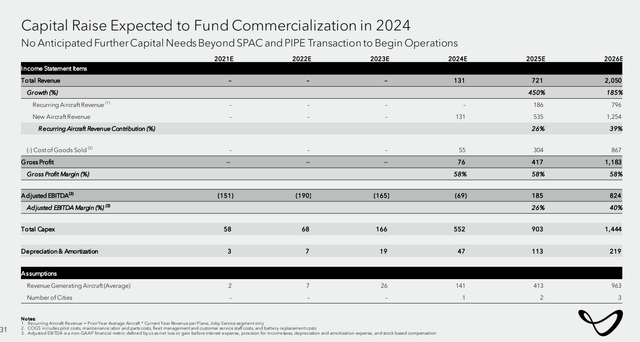

Now, investors need to start returning to the promise of the eVTOL space. Joby forecast 2026 revenues topping $2 billion. The company will generate sales from both selling aircraft to other operators and running an air taxi business.

Joby Aviation SPAC presentation

The company has two paths to a successful commercial business. Either business path quickly goes from limited revenues in 2024 to ~$1 billion worth of revenues by 2026. As when the SPAC deal was announced, the market will love the revenue growth once the business operations officially launch and Joby Aviation goes from limited revenues to multi-billions in just a couple of years.

The dates might get pushed out, but Joby Aviation is only likely to see a pull forward in demand when these aircraft are produced considering the ability to reduce costs and most importantly time for short trips in congested cities.

The stock has a market cap in the $3.0 billion range. The valuation doesn’t appear to be rationale with revenues not starting until 2024 or 2025, but investors were once willing to pay more than double this valuation with nearly 4 years prior to commercialization of the business model.

Cash Is King

In order to reach the promising future in eVTOLs and air taxis, a sector company has to survive the hype period and reach at least 2026. A lot of the eVTOLs predicted FAA certification in 2024 leading to a major ramp in production into 2026 where sales soar.

Due to the huge investments by Reinvent Technology Partners back in 2020, Joby Aviation still has a cash balance of $1.2 billion. The company is aggressively investing in the FAA certification process, test flights and ramping up manufacturing capabilities in order to be operational in 2024.

In the March quarter, Joby Aviation burned $61.4 million in operating activities and another $10.8 million on purchases of property and equipment. The company can definitely handle burning $72.4 million per quarter with at least 3 years of cash on hand.

Since Joby Aviation was seen as the leader in the sector and the first to go public, the company raised far more cash. Archer Aviation (ACHR) has a cash balance of $704.2 million and Lilium (LILM) has $331.0 million.

The largest cash balance or highest cash spend definitely doesn’t guarantee success in this sector. The company to first obtain FAA certification, complete production and target the right end market will be the most successful. Considering the different manufacturers are all targeting different applications for their eVTOLs, the competition isn’t exactly direct amongst all of these firms.

Joby Aviation had the biggest backing and strongest balance sheet which increases the chance of success. The sector stocks have huge risks due to the potential delay of FAA certification leading to an extended period of cash burn. The companies might be forced to raise cash in a tough economy or when the stock is beaten down leading to extensive dilution.

Takeaway

The key investor takeaway is that Joby Aviation is far closer to aircraft certification now while the stock is down over 50%. The eVTOL manufacturer still has a lengthy path to producing aircraft and starting an air taxi service, but the risks are reduced every day that passes.

Joby Aviation remains a risky play with a lengthy period until aircraft certification, but the company has targeted a potentially monster market. Investors should use the weakness to start building a position for the long term, but investors have to be prepared for a volatile few years where the stock could remain out of favor.

Be the first to comment