mironaleks/iStock Editorial via Getty Images

Overview and investment thesis

In an October 11, 2021, article on Mastercard (NYSE:MA), I put forth my investment thesis (summarized in figure 1) that focused on the defensive, growth, and operating leverage characteristics which led me to conclude that Mastercard presents an attractive long-term investment.

As nine months have elapsed, I decided to revisit the thesis to see if it continues to hold.

Figure 1: My investment thesis for Mastercard from October 2021

|

Original thesis |

July 2022 update |

|

|

A. |

Defensive Characteristics

|

No change – defensive characteristics remain intact |

|

B. |

Growth Drivers

|

Mastercard’s purchase volume continues to outgrow its cash transaction volume International GDV and purchase transactions are driving Mastercard’s growth E-commerce benefited from a strong boost following the COVID-19 outbreak; trend is decelerating but long-term positive |

|

C. |

Operating leverage |

EBITDA margins moving back up to 2019 pre-COVID levels |

|

D. |

Recovery of and increase in high-margin cross border transactions |

Cross-border transactions and switch volume have exceeded pre-COVID levels |

|

E. |

Valuation |

With the market pullback, the stock is beginning to move away from over-valued territory |

Update on thesis

(I suggest that you refer to my original article for additional background and context)

A. Defensive characteristics

I articulated five factors that account for Mastercard’s defensive characteristics: a highly oligopolistic industry, high barriers to entry, powerful network effects, the relationship with customers and access to customer data, and the critical role payment cards play in the smooth functioning of the global economy.

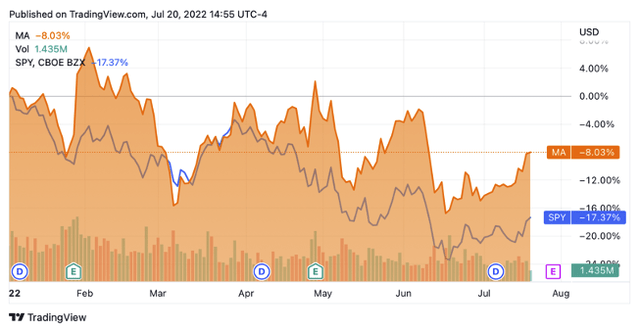

None of these factors have changed, which reinforced my conviction in the relative safety of an investment in Mastercard. Over the last year, Mastercard stock was down just 8.0% (figure 2, orange line) compared to the S&P 500 which declined by 17.4% (blue line).

Figure 2: Mastercard stock price vs the S&P 500 Index

B. Growth drivers

Gross Dollar Volume

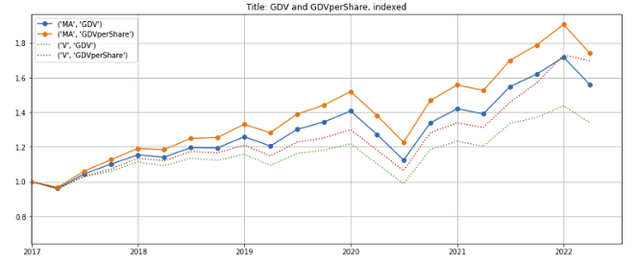

Mastercard’s GDV (Gross Dollar Volume), the amount of money the company processes, is one of the key performance indicators I watch most closely as it measures the relevance of the company’s platform, which is an important determinant of long-term shareholder value.

GDV has continued to rise after rebounding from the sharp pull-back in 2020 due to the lockdowns and reduced spending at the initial stages of the COVID-19 pandemic. GDV for the fourth quarter of 2021 has exceeded the pre-COVID high set in the fourth quarter of 2019 by 40% (figure 3, blue line). The per-share GDV has risen even more as Mastercard continued to buy back shares (orange line). Visa Inc. (V), Mastercard’s closest competitor, has also experienced a similar rebound in its GDV and per-share GDV (green and red dotted lines).

Figure 3: Mastercard and Visa GDV and per-share GDV

Created by author using publicly available financial data

In the company’s 1Q 2022 earnings call, management noted growing market share in 16 of its 20 top markets, driven by stronger than expected volumes in US retail spending aided by the build-up of excess savings during the pandemic and positive spending trends in Europe, which were countered by a moderation in Latin America and a lagging recovery in Asia.

Management also cited strength across a broad range of sectors, including travel and entertainment spending in airlines, lodging, travel agencies, and restaurants. Cross-border recovery has been broad-based with volume up 53%, and cross-border travel exceeded 2019 levels for the first time since the COVID-19 outbreak, coming in at 110% of 2019 levels.

Switched transactions – the number of transactions initiated and switched through Mastercard’s network – were 50% above 2019 levels despite the company’s decision to exit Russia, a market that accounted for 4% of its total revenues.

The decreased use of cash and checks in payments

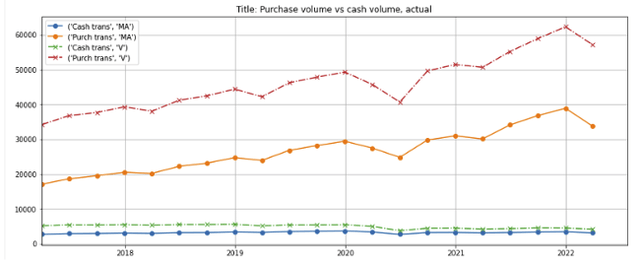

In my previous article, I cited statistics from a 2020 McKinsey Global Payments Report and a February 2020 Federal Reserve study highlighting the decreased use of cash and checks, a trend that would benefit Mastercard and other payment transaction processors.

Even though there is no evidence or reason to think that this trend has reversed itself, I analyzed data provided by both Mastercard and Visa going back to 2017 and noted that while their cash volumes (i.e., cash withdrawals from banks or auto teller machines with the companies’ cards) have remained static over the last half a decade (figure 4, blue and green lines), the purchase volume on both platforms has almost doubled (orange and red lines).

Figure 4: Mastercard and Visa: purchase volume vs cash volume (in $billions)

Created by author using publicly available financial data

International spending growth: currency effects and Russia

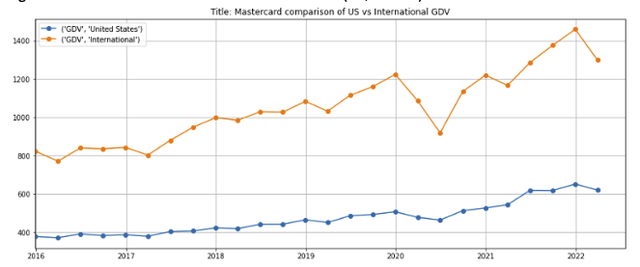

From 2016 through 2021, Mastercard’s quarterly international GDV has increased by $500 billion (figure 5, orange line), which to put into perspective, is equivalent to over 80% of the total of ~$600 billion generated in the US in the first quarter of 2022 (blue line).

Figure 5: Mastercard actual GDV: US vs international (in $billions)

Created by author using publicly available financial data

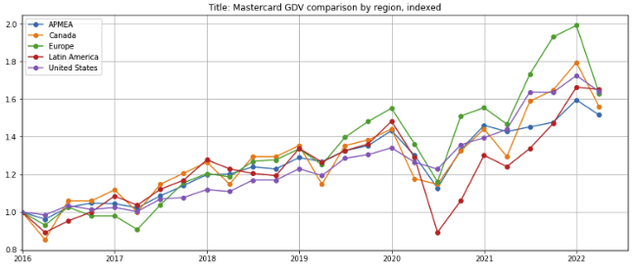

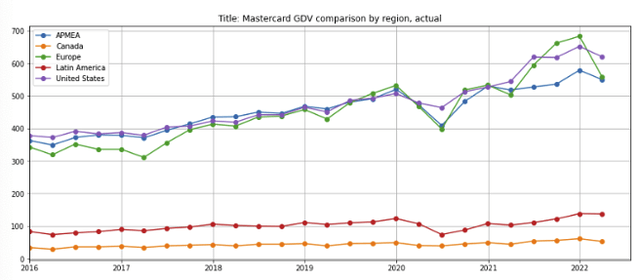

Over the last decade, the growth rate of Mastercard’s five reported regions have generally moved in lockstep (figure 6), although there have been variations as a result of variances in local economic growth and foreign currency effects. However, as the US, Europe, and APMEA (Asia Pacific, Middle East, and Africa) have been the largest regions by GDV (figure 7), they are expected to contribute the bulk of Mastercard’s growth in the coming years.

Figure 6: Mastercard GDV growth by region, indexed

Created by author using publicly available financial data

Figure 7: Mastercard GDV growth by region, actual

Created by author using publicly available financial data

Impact of the Russian invasion of Ukraine:

According to the company’s 8-K filing on March 1, 2022, Russia represented approximately 4% of revenues and 2% of operating expenses in 2021.

Following the Russian invasion of Ukraine, sanctioned Russian banks did not transaction data to Mastercard, which resulted in the drop in European GDV shown in the two charts above (green lines). The company’s suspension of operations in Russia in response to the invasion resulted in a negative impact of 5% on card count and a disproportionately large reduction in switched transactions due to the low average ticket sizes in Russia. Excluding Russia-related transactions, 1Q 2021 card count and switched transactions grew by 9% and 25% over 1Q 2021 respectively.

Management noted that the suspension of Russian operations had a “minimal impact” on 1Q 2022 growth due to a one-time benefit from lower rebates and incentives, and it expects the strong recovery in cross-border travel and consumer spending in its other markets to mitigate the loss in revenues.

The effects will start showing up in future quarters. As CFO Sachin Mehra said on the 1Q 2022 earnings call: “clearly, the elimination of Russia-related revenues and the reduction of those from Ukraine create a headwind to achieving [three-year (2022 to 2024)] performance objectives.”

In addition, there are signs of economic softness and increasing risks of an impending global recession. However, given the ongoing rise of the middle class and under-penetration of bankcards compared to the US, I believe the international markets and the emerging economies will continue to be a strong driver of long-term GDV and revenues.

Cross-border transactions

Cross-border transactions are more complicated to execute, bring more value to all parties involved, and are thus subject to fewer rebates incentives and command higher margins.

In my previous article, I wrote that:

As cross-border transactions typically command higher fees and margins, its slower recovery has caused operating income to lag. With the worldwide rollout of COVID-19 vaccines, international borders will continue to reopen, driving growth in cross-border transactions volumes, which should in turn accelerate revenue and operating income growth.

This has turned out to be correct. In the 1Q 2022 earnings call, management noted that for the quarter, cross-border volumes increased 53% and fees increased 57%. More importantly:

For the first time since the onset of the pandemic, cross-border volume was above 2019 levels for all regions and cross-border travel was above 2019 levels for the first time in March.

The improvement in cross-border volume has accelerated since the end of 1Q 2022. Through the first three weeks of April:

- Overall cross-border volumes grew 60% year-over-year, up 7% percentage points compared to Q1 2022,

- Excluding Russia from the current and prior periods, cross-border volumes grew 65% year-over-year, up 13 percentage points compared to Q1 2022, and

- Cross-border travel was up 179% year-over-year, up 38 percentage points compared to Q1 2021.

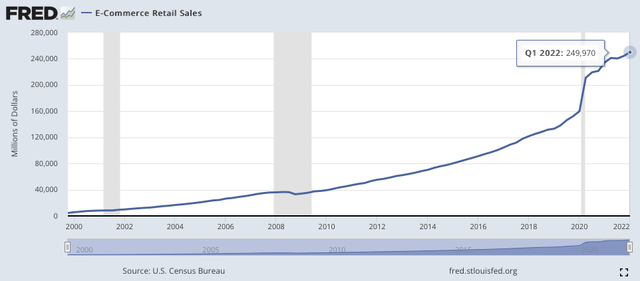

E-commerce sales

Mastercard has been a beneficiary of the shift of retail online as its payment cards are necessary to pay for e-commerce purchases. While the growth in e-commerce that spiked during the COVID-19 outbreak has decelerated as the COVID-19 pandemic recedes (figure 8), I believe online retail will continue to grow for the foreseeable future.

Figure 8: E-commerce growth continues to be strong

U.S. Census Bureau data from fred.stlouisfed.org

C. Operating leverage

The transaction processing business has high operating leverage business in which a large proportion of incremental revenue flows to the bottom line; but conversely, any decrease in revenue will come straight out from the bottom line.

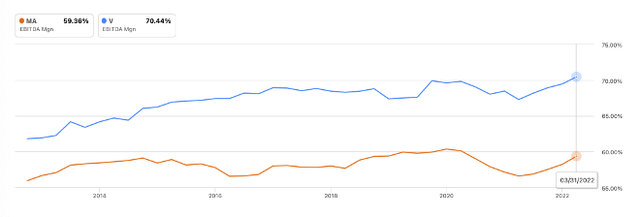

Mastercard’s EBITDA margin dropped sharply as revenues and higher margin cross-border transactions declined following the COVID-19 outbreak. Fortunately for investors, both have recovered strongly. EBITDA margins for the most recent quarter (1Q 2022) is within 100 basis points of 10-year highs and 75 bps of the 1Q 2020 high set just before the COVID outbreak (figure 9, orange line).

Figure 9: Visa and Mastercard’s EBITDA margin

Visa’s EBITDA margin is a full 1000 basis points higher than Mastercard’s (blue line). I attribute Visa’s wider margins to its greater economies of scale, which is a result of Visa’s revenues being 35% higher than Mastercard’s. As Mastercard’s revenues continue to scale up, it is almost inevitable that EBITDA margins will rise over the long term.

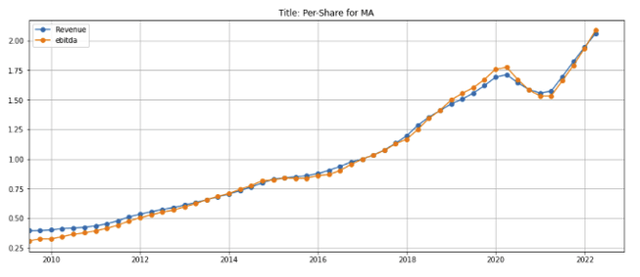

Financials

Despite the setback from COVID in 2020, Mastercard’s per-share revenues and EBITDA have doubled since 2017 and appear on track to resume its pre-COVID growth trajectory (figure 10). Even though the economy faces recessionary risks and uncertainty that could result in revenue and EBITDA volatility over the next year, I believe industry fundamentals are in place for long-term revenue and EBITDA growth.

Figure 10: Mastercard’s per-share revenue and EBITDA, indexed to 2017

Created by author using publicly available financial data

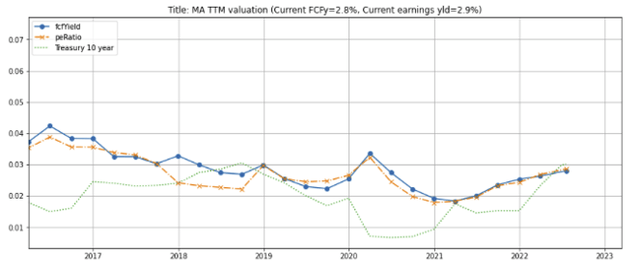

Valuation

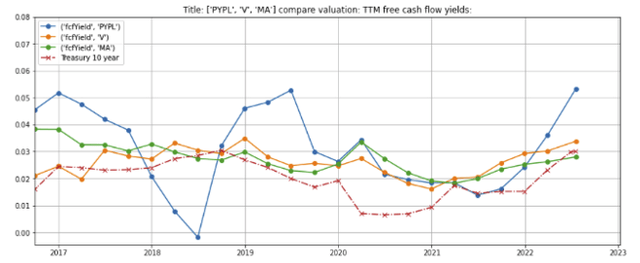

Mastercard’s free cash flow yield has ticked up to 2.8% as its stock price declined with the market pullback resulting from the Federal Reserve interest rate hikes and commodity price increases due to the Russian invasion of Ukraine (figure 11).

Figure 11: Mastercard’s free cash flow and earnings yield valuations

Created by author using publicly available financial data

Compared to its direct competitors Visa and PayPal (PYPL), Mastercard’s valuation is still the most demanding of the three owing to its higher growth compared to Visa while PayPal’s recent troubles have caused the stock to be hammered, bringing its free cash flow yield to a 5-year high (figure 12, blue line).

Figure 12: Mastercard, PayPal, and Visa free cash flow yields

Created by author using publicly available financial data

I do not believe now is the time to back up the truck for Mastercard stock. However, given Mastercard’s long-term growth potential, I believe its valuation is inching towards the “fair” territory, particularly for long-term buy-and-hold investors.

Update on concerns

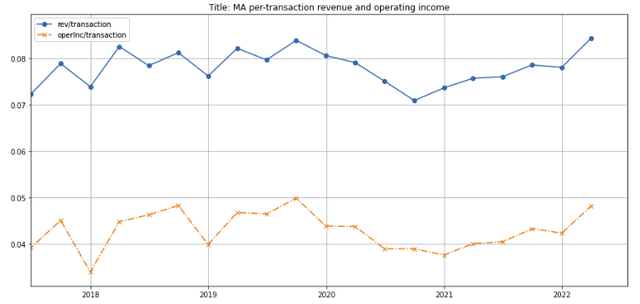

1. Compression of transaction fees

Mastercard suffered per-transaction feed and spread compression due to “negative” operating leverage and rebates to customers as the spending slowdown due to COVID-19 outbreak occurred. As a result, per-transaction revenue and spread have compressed since 2020 (figure 13, solid blue and dashed orange lines).

Both metrics showed strong recovery for the quarter ended March 31, 2022, and are returning to 2019 pre-COVID levels.

Figure 13: Mastercard per-transaction revenue and spread

Created by author using publicly available financial data

2. Threat of DeFi payment technologies

DeFi, or Decentralized Finance, are decentralized applications running on decentralized blockchain infrastructure that can replicate and enhance traditional financial products. Developers of DeFi platforms are working hard to upend traditional fintech platforms by offering users better products at lower costs, more control, and fewer restrictions. DeFi developers could potentially create decentralized platforms to disrupt or take over the payment processors’ transaction processing function.

I believe the competitive moats of the traditional transaction processors (i.e., Mastercard, Visa, American Express (AXP)) are very wide, which will likely necessitate would-be new DeFi entrants to employ a trojan horse entry strategy using cryptocurrencies. Mastercard has made the expansion into new payment technologies one of its three strategic priorities. It is staking out a presence in the area by investing in and partnering with DeFi firms, engaging with central banks and preparing its core network to directly support digital currencies, and has launched crypto-related products in the US, Europe, and Latin America.

While this may not eliminate risk entirely, it will reduce the probability of Mastercard getting caught behind the eight ball.

In summary

- The thesis I put forth in my October 2021 article, which is that Mastercard has superb defensive, growth, and operating leverage characteristics, continues to hold.

- The company’s GDV exceeded pre-COVID highs by 40% in 4Q2021, and I expect it to continue to benefit from the tailwinds of the decreased usage of cash/checks, growth in international markets and emerging economies, recovery from COVID-19, more cross-border transactions, and operating leverage.

- Mastercard’s per-share revenues and EBITDA have doubled since 2017. Even though the economy faces near-term recessionary risks, I believe industry fundamentals are in place for long-term revenue and EBITDA growth.

- The free cash flow yield has pulled back to 2.8% with the recent stock market decline. Even though it is not yet time to back up the truck, the valuation is moving towards a “fair” zone for long-term buy-and-hold investors.

Be the first to comment