niphon

Investment Thesis

Masco Corporation (NYSE:MAS) is witnessing a slowdown in the order rate and point-of-sale transactions due to the moderation in consumer demand, which is impacting volume growth. However, the low-ticket nature of its products makes it relatively less cyclical compared to its peers and it should be able to manage the downside well. Also, the company’s margin, which suffered from lower volume and higher operational costs (high material and freight costs), should improve as the lower cost of raw materials flows through the company’s P&L. Masco’s sound capital allocation policy, including reinvestments in the business, paying dividends, share repurchases, and mergers & acquisitions (M&A), should be beneficial for the company’s growth and long term shareholder value creation.

Revenue

In the third quarter of 2022, moderating demand for Masco’s products led to a year-over-year decline in volume. The point of sale transactions and incoming orders slowed down in the quarter across most of its product categories. Higher price realization, on the other hand, helped the company to offset this decline. The sales growth was flat Y/Y in the quarter as a 9% positive impact from the pricing actions was offset by a 6% decline in volumes and a 3% impact from the foreign currency translation.

The plumbing products segment grew 5% Y/Y (on a constant currency basis) in the quarter against a 15% comp. In the international plumbing business, Masco is continuing to gain market share in China with strong sales growth largely driven by the Hansgrohe brand, whereas it is facing flattish growth in the European markets. The incoming orders in Europe have started to moderate. However, the demand in other markets such as India, China, and the Middle East remains strong. Additionally, the backlog in the spa business was down to a 10 to 12-week range in Q3 FY22 from a 25-week range at the end of the second quarter of 2022. In the Decorative Architectural Products segment, pro paint sales grew mid-teens in the quarter against a 45% comp in Q3 FY21, offsetting a low single-digit Y/Y sales decline in DIY paint in the quarter. Over the past 12 months, Masco has gained significant market share in the pro-business and plans to continue the rollout of additional capabilities and services for pro painters.

The incoming order and POS should continue to slow down into the fourth quarter due to declining customer demand. The volumes are also expected to decline in both segments in Q4 of 2022. However, the company has a healthy backlog in the wellness business, which should benefit sales to some extent. The sales in the fourth quarter should also benefit from the pricing actions taken by the company over the last few quarters. However, the volume in both the plumbing and decorative architectural segment should decline in Q4 2022 resulting in an overall sales decline for the quarter.

The management has lowered the sales growth projection for FY22 from 5% to 7% to 3% to 4% due to moderating demand and additional foreign currency headwinds. The plumbing products segment is expected to grow between 1% and 2%, which is lower than the previous guidance of 3% to 5%. The revenue of the decorative architectural segment is expected to grow in the range of 7% to 8% versus the previous range of 9% to 11%. The paint business is expected to grow for the full year 2022, with DIY paint sales increasing by mid-single digits and pro paint sales increasing by double digits.

While the macros are certainly challenging, the good news is that Masco’s portfolio, consisting majorly of lower ticket repair and remodel products, is relatively less cyclical and much better placed compared to many building product companies with high ticket products and exposed to new construction end markets. Also, despite macro headwinds, Masco is continuing with its capital allocation strategy, which includes reinvesting in the business to drive profitable growth, maintaining a strong investment-grade balance sheet, paying dividends with a targeted dividend payout ratio of 30%, and deploying excess free cash flow for repurchasing shares or making bolt-on acquisitions. The company’s board recently approved a $2 billion share repurchase program. The company has a strong balance sheet with 1.9x net debt to EBITDA, which should support this repurchase. The company continues to invest in its leading brands and innovations to capture market share which bodes well for long-term growth and the company should emerge stronger on the other side of the macrocycle.

Margins

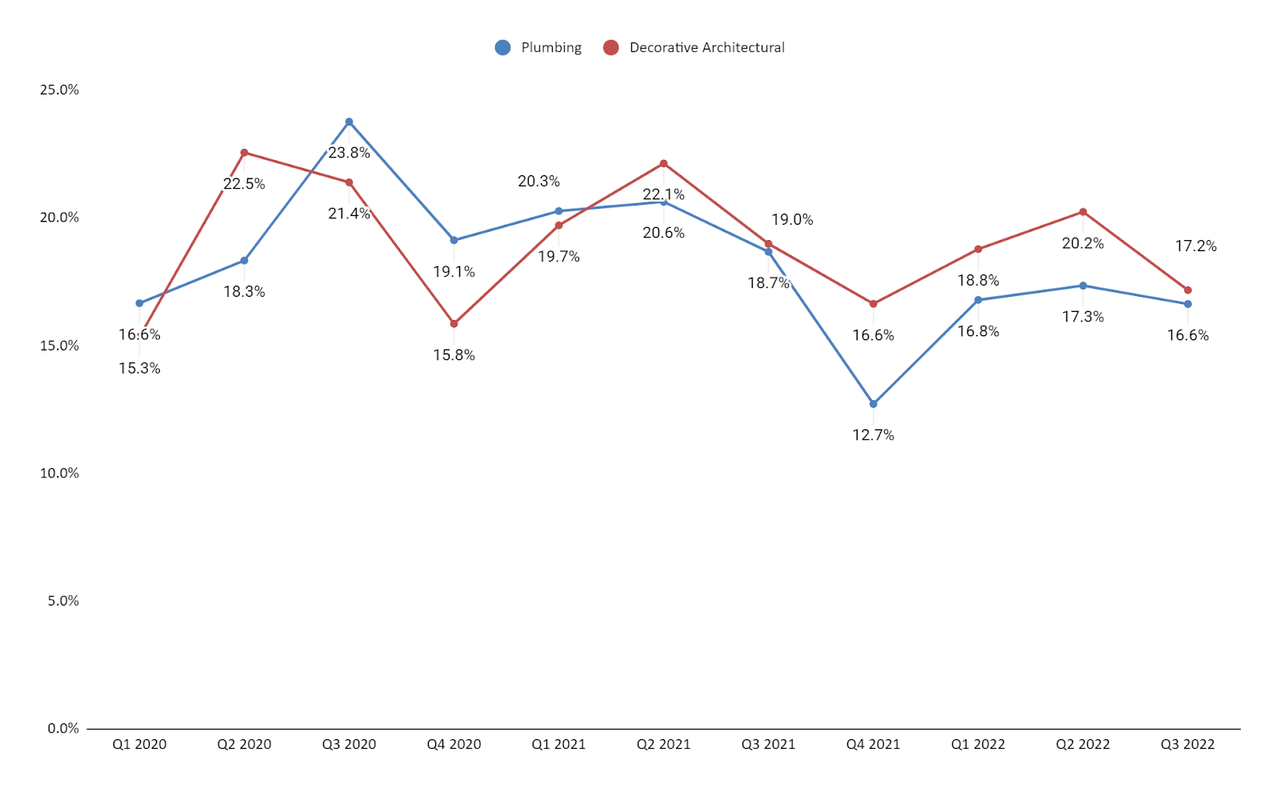

The adjusted operating margin in Q3 FY22 was down 160 bps Y/Y to 15.9% due to lower volumes, higher operational costs, and negative foreign currency translation, partially offset by higher net selling prices. The higher operational costs were due to higher-than-expected freight and material costs due to inflation and absorption inefficiencies due to the changing volume levels. The plumbing products segment’s adjusted operating margin was down 210 bps Y/Y to 16.6% due to higher operational costs and forex woes, partially offset by higher net selling prices. The decorative architectural products segment’s adjusted operating margin was down 180 bps Y/Y to 17.2% due to lower volumes, higher freight costs, and material costs, partially offset by higher net selling prices.

Masco’s segmentwise adjusted operating margin (Company data, GS Analytics Research)

Even though the raw material costs moderated in the third quarter, the company did not benefit from this decline as there is a one to two quarters of lag for the lower material costs to flow through the P&L.

Looking forward, while absorption efficiencies due to lower volumes are expected to remain a headwind, this decline in raw material costs should act as a tailwind in Q4 of 2022 and 2023. The company can also adjust its marketing and advertising expenses in FY2023 if the need arises.

Valuation & Conclusion

The stock is currently trading at a P/E of 13.58x FY23 consensus EPS estimate of $3.75, which is lower than its five-year average forward P/E of 16.21x. While I understand the near-term sales-related headwinds, I believe the company has good growth prospects and should emerge stronger on the other side of the cycle. The company’s margin prospects also look good and the margin should benefit as the lower raw material costs flow through the P&L in FY23. I believe the current valuations give an attractive entry point for long-term investors and, hence, have a buy rating on the stock.

Be the first to comment