Spencer Platt/Getty Images News

Marriott International, Inc. (NASDAQ:MAR) continues demonstrating its resilience with its outstanding performance this quarter. Its operations remain unfazed despite the risks of inflation. Its efficiency and increased business and leisure travel drive its solid recovery. Yet, it must not be complacent since recessionary headwinds may hamper its rebound. Nevertheless, its solid fundamentals remain its cornerstone in a stormy market. Cash inflows stay high and stable enough to cover borrowings and dividends. However, its stock price does not reflect recessionary risks and appears overvalued.

Company Performance

Marriott International, Inc. felt the pandemic’s impact despite being an industry giant. Restrictions led to a sharp plunge in its financials. Yet, Marriott proved to be a resilient company as it rebounded. Its recovery started in the latter part of 2020 and persisted in the following quarters. With its prudent asset management and revenge travel, the upsurge has been evident this year.

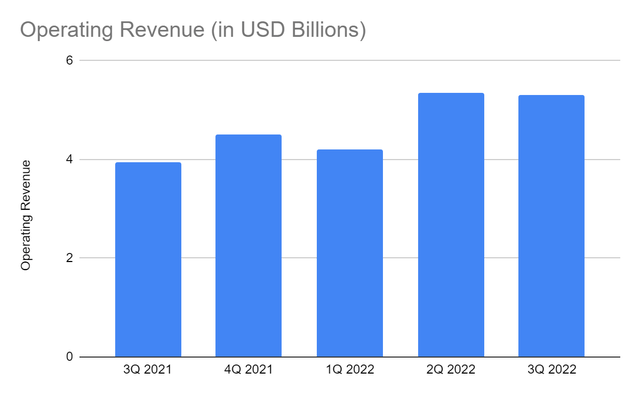

This quarter, the operating revenue amounts to $5.31 billion, an 34% year-over-year growth. It is evident across all its business segments, showing absolute recovery. It is an outstanding quarter as the recent revenue is one of the record highs in history. Its global RevPAR is 36.3%, higher than in the comparative quarter. Even better, it has already exceeded pre-pandemic levels by 2-4%. Its impeccable rebound across all markets is visible despite inflationary headwinds.

Operating Revenue (MarketWatch)

Marriott is doing an excellent execution of its strategies amidst mixed market results. As the demand for its rooms increases, it continues to expand its operating capacity. Occupancy rates are still increasing, so it is wise to open more rooms and properties. It coincides with revenge travel, especially during summer and autumn. This quarter, its performance may be affected by seasonality. Recession must also be accounted for so it can create better strategies.

Aside from its strong demand and efficiency, its business model is one of its core drivers. Cost reimbursements comprise 70-80% of the operating revenue. It is under a management business model since it has extensive control of hotels. These include cost reimbursements from properties and salaries paid for property-level and centralized services. The second-largest component is its franchise fees, with 14% revenues. Unlike many of its competitors relying heavily on a fee-based and lease-based model, its business model is more agile. It is essential during downturns and disruptions. Reimbursements depend on its operating capacity, while franchise fees are more fixed. These make revenues more secure and manageable.

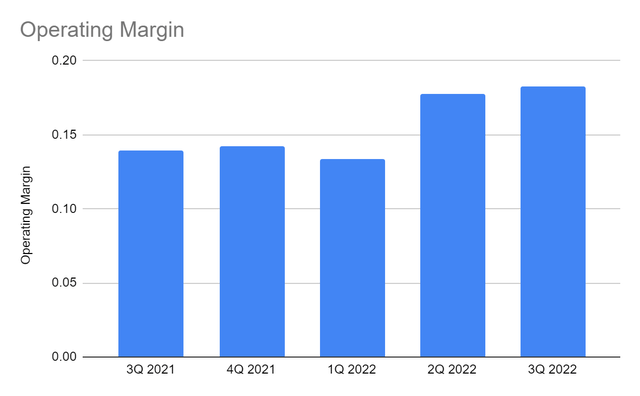

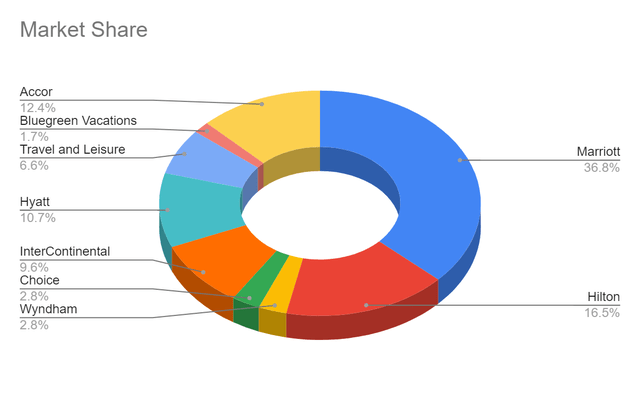

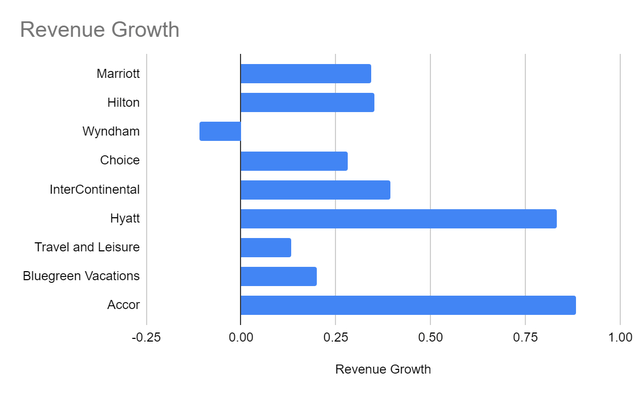

With regard to its peers, Marriott remains the industry leader. It holds 37% market share, which is almost the same as in 3Q 2021, showing its maintained dominance. Its 34% revenue growth is slightly lower than the market average of 36%, but it remains robust. Even better, it has an 18% operating margin compared to 14% in the comparative quarter. It is lower than Hilton (HLT) and InterContinental Hotels (IHG), with 26% and 20%, respectively. But it is way higher than the other large peers, such as Hyatt (H) with 10% and Accor (OTCPK:ACRFF) with 8%. It is higher than the peer average of 16%, making it one of the most viable hotels in the industry.

Operating Margin (MarketWatch)

How Marriott International, Inc. Can Stay Afloat

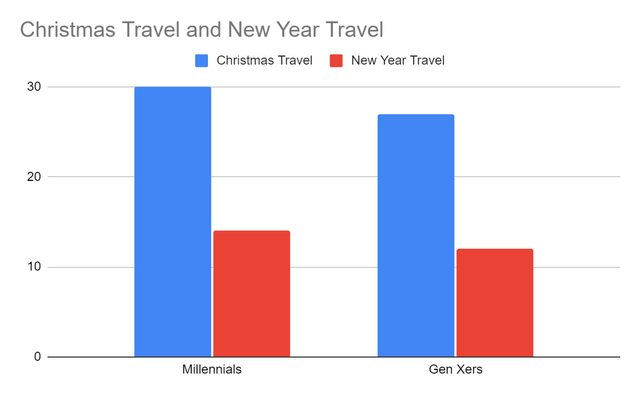

Christmas And New Year Travel (Destination Analysts)

Marriott International, Inc. enjoys a solid recovery that exceeds pre-pandemic levels. Revenge travel remains fired up across regions. Yet, Marriott must not be complacent amidst inflationary headwinds. Prices are now higher, affecting gas prices, hotels, and flights. With the looming recession, its recovery may be hampered. Seasonality must also be considered since travel may decrease during Winter. Despite all these, hope still floats as inflation slows down, landing at 7.7% recently. Also, the unemployment rate remains stable, far from 9.5% during the Global Financial Crisis. It shows that purchasing power may stay the same. If this trend continues, inflation may become more stable. Interest rates may continue to increase but at a lower rate. Near-run performance may be affected, but a more stable economy may lead to another rebound. Fortunately, the demand for accommodation seems unperturbed.

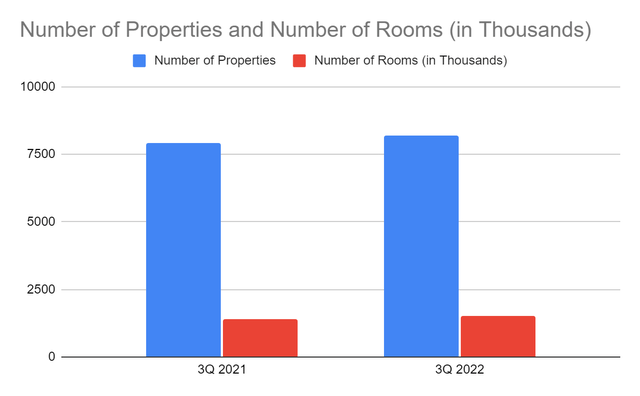

In a survey, 82% of millennials and 82% of Gen Zers said inflation strained their travel budgets. But they will only change their itineraries to manage their spending. They still intend to travel. The same survey shows that the plan to lodge away from home is 2.9% higher than the previous year. Another survey shows 47% of Americans still plan to travel despite the skyrocketing prices. In another survey, 30% of Millennials have Christmas Travel plans, up from 27% in 2021. Likewise, New Year travel comprises 14% of Millennial plans compared to 12% in the comparative quarter. Indeed, the company may have a better comparative performance. With these potential uptrends, Marriott remains on the right track. Its larger operating capacity allows it to cater to more travelers. It now has 8,200 properties with 1,500 rooms compared to 7,900 properties with 1,400 rooms in 3Q 2021. With its higher RevPAR and margins, its expansion appears timely as the demand increases. But again, it must watch for the impending recession to ensure its sustainability.

Number Of Properties And Number Of Rooms (3Q Financial Report)

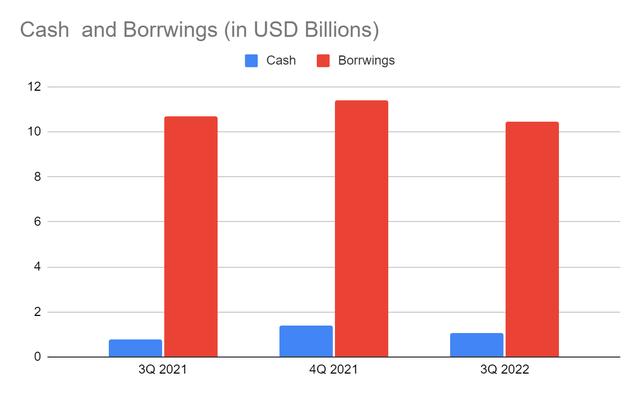

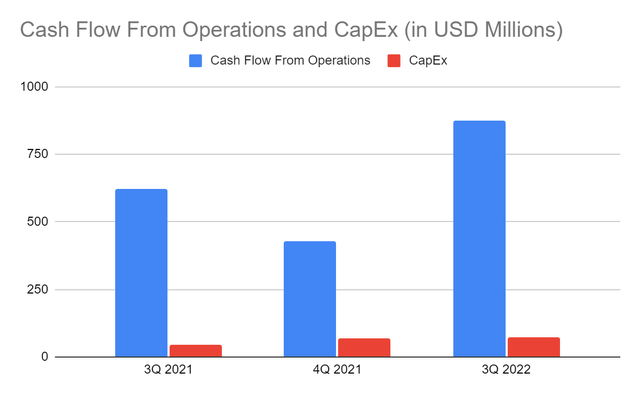

Its sound fundamentals are evident, showing its capacity to withstand disruptions. Its current ratio is less than one, but there is an improvement with borrowings. Also, cash alone is enough to pay its short-term borrowings. Even better, it has a Net Debt/EBITDA ratio of 2.8x, which is way better than the average range of 3.5x-4x. The company maintains increasing cash levels and enough income to cover its borrowings. Using the actual cash flow from operations and CapEx, we can see why cash levels increase and borrowings decrease. The uptrend shows a high probability of cash inflows as the company expands. Its FCF increased from $576 million to $800 million, allowing it to pay borrowings and dividends. Meanwhile, the FCF/Sales Ratio is 15%, showing that it turns 15% of revenues into free cash. With that, I expect MAR to cover its expansion and financial leverage.

Cash And Cash Equivalents And Borrowings (MarketWatch)

Cash And Cash Equivalents And Borrowings (MarketWatch)

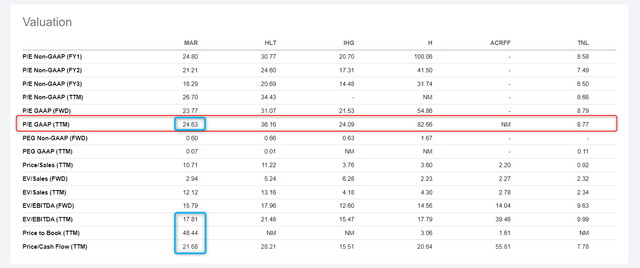

Stock Price Assessment

The stock price of Marriott International, Inc. has been moving sideways, in general, in the last year. After rebounding last month, the stock price remains almost unchanged for three weeks. At $162.49, it’s almost the same as the starting price. It trades at an earnings multiple of 24x. It is lower than the peer average, as shown below, and its five-year average of 30x. However, Intercontinental Hotels, Travel + Leisure (TNL) has a better ratio. Also, it does not reflect the real value of the company. Its PTBV of 47x and Price/Operating Cash Flow of 21x are a lot higher than the reasonable value.

Stock Price Metrics (Seeking Alpha)

Meanwhile, dividend payments have resumed after a temporary cut in the last two years. These are well-covered with a dividend payout ratio of only 21%. Only, its yield is only 1.02%, which is lower than the S&P 500 and NASDAQ composite average of 1.82% and 1.21%. So, it shows that the stock price appears too high relative to its payouts. To assess the stock price better, we will use the DCF Model.

FCFF $2,004,000,000

Cash $1,045,000,000

Current Borrowings $550,000,000

Perpetual Growth Rate 4.8%

WACC 9.2%

Common Shares Outstanding 316,539,613

Stock Price $162.49

Derived Value $145.02

The derived value verifies that the stock price does not reflect its intrinsic value. There may be a 12% downside in the next twelve months. So investors must wait for a better entry point.

Bottom line

Marriott International, Inc. maintains an impressive rebound in its revenues and margins. Its sound fundamentals are what make it a durable company amidst inflation. It has adequate means to sustain its operations while covering its dividends and financial leverage. But even if the stock price adheres to it, it has already climbed more than the reasonable value. The recommendation, for now, is that Marriott International, Inc. is solid but still a hold.

Be the first to comment