ljubaphoto/E+ via Getty Images

Introduction

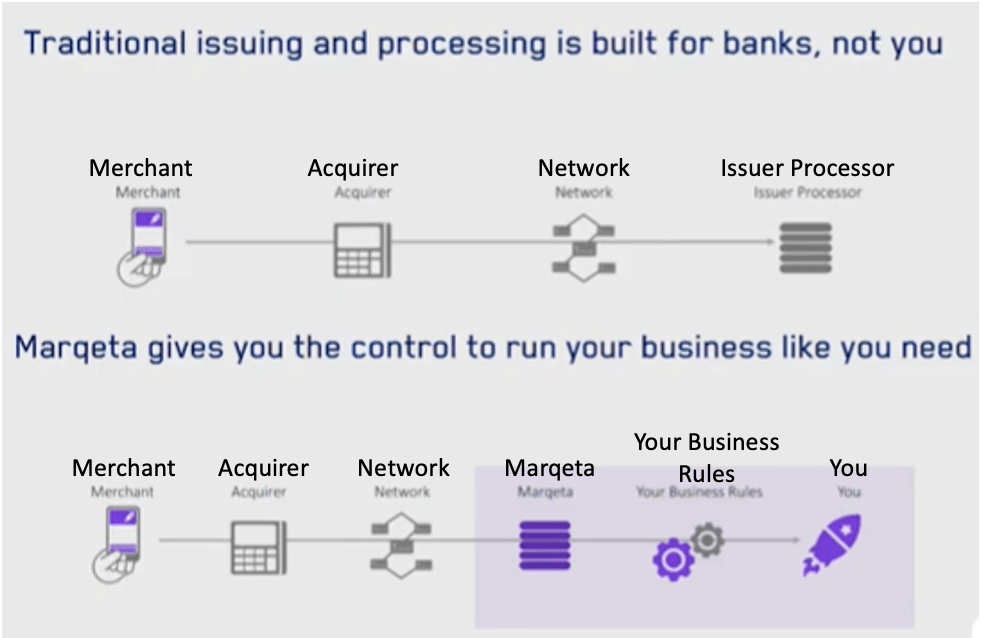

Marqeta’s (NASDAQ:MQ) Platform is essentially an operating system that enables its customers to build innovative money movement solutions that enable them to capture more sales and drive user engagement. Marqeta is a Modern Card Issuer, and as we will explore in this note, issuing processing is much more complex than acquiring processing.

Marqeta

Marqeta is a part of the traditional four-party model that includes an acquiring bank, an issuing bank, and a consumer, all of which are connected by card networks like Visa (V) and Mastercard (MA). Marqeta is the system of record for its customers’ transactions as it enables its customers to act as the issuer processor and issue payments within the Visa or Mastercard networks. It was difficult for parties other than banks to authorize payments within the card networks, but Marqeta pioneered Modern Card Issuing and turned the industry on its head.

Embedding

As we shared in our latest BTM Fintech Update:

There are thousands and thousands of acquires worldwide and acquiring is not programmable, while there are only a few hundred issuer processors which are programmable. Issuing is where the ledger is, and the issuer processors are ultimately responsible for managing fraud and guiding where the money flows or settlement. This is highly complex…

Settlement is like shoveling snow in a blizzard with people throwing rocks at you… Acquiring is very different. It’s not programmable, you can introduce four lines of code into your website if you ultimately want to do eCommerce. It’s not – it’s complex, but issuing processing is orders and orders of magnitudes more complex. And that’s why in the beginning when I said I wanted to go build an issuing processing system from scratch, people thought I was absolutely nuts to go and do it.”

This ultimately gives Marqeta deep embedding moats.

For example, Marqeta is Affirm’s (AFRM) issuer processor, and it enables Affirm to offer its full gamut of financial products in the form of a card. Marqeta enables Affirm to offer its wide range of products (from instant payments to longer duration loans) at non-integrated Affirm merchants as it allows Affirm to offer products within the Visa network. The Affirm Chrome extension and Debit+ are supported by Visa’s network, while it’s Marqeta which is the “system of record” that enables Affirm to guide its consumers to an appropriate financial product, whether Split Pay or another loan product. Marqeta will benefit from the widespread distribution of Debit+, if Affirm is successful in scaling the product.

Marqeta offers an extremely sticky product because it enables its customers to move money while giving them the ability to control the flow of funds. This is extremely valuable as Marqeta’s customers leverage the platform to process more inflows and outflows which leads to more revenues. Customers like Branch, Block, and Coinbase work with Marqeta to develop new money movement solutions like the Coinbase Card which enables users to spend crypto at the POS (enabled by Marqeta’s JIT Funding). Marqeta is heavily embedded in its customers as it acts as the system of record for its customers while it enables them to transfer money through other payment networks like ACH or even ATMs. As Marqeta increases the utility of its platform by adding solutions and integrating with more payment networks, its offering becomes increasingly more ingrained and embedded in its customers’ businesses.

Network Effects

-

Because Marqeta is the industry standard, i.e., the universally recognized best platform for modern (cloud-deployed) card issuing, all top financial institutions want to use Marqeta. Because all top financial institutions want to use Marqeta, the company further solidifies its place as the industry standard, which attracts more of the best financial institutions, and so on and so forth.

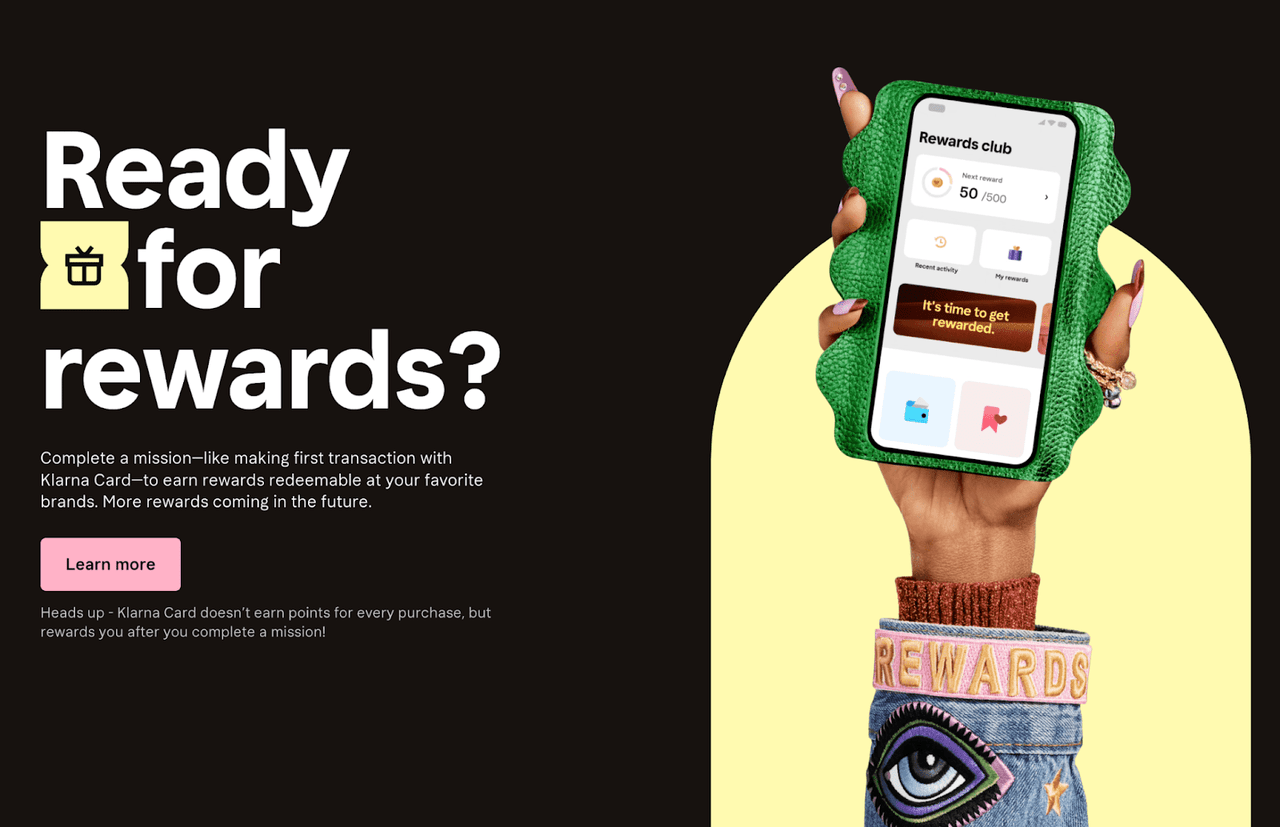

More than 10 teams at Block (SQ) are building on the Marqeta platform, while the Afterpay (OTCPK:AFTPF) acquisition also strengthens Marqeta’s long-term relationship with Block. Block already utilized Marqeta in a variety of ways, but now with Afterpay on board, it will need Marqeta to offer a competitive BNPL product, especially as the other BNPLs rely on Marqeta. Recently, Klarna formally announced that Marqeta will power the Klarna Card, which comes after Klarna extended its relationship with Marqeta in 13 European countries. Marqeta also won this deal from Stripe, which indicates its value when it comes to modern card issuing. Marqeta also powers Affirm’s Debit+, which will feature Affirm Rewards. Klarna also leverages Marqeta to offer unique rewards.

Klarna

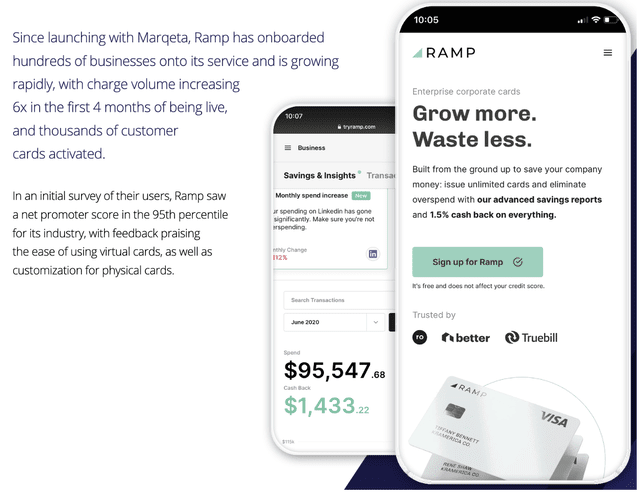

Marqeta enables its customers to build solutions from the ground-up, as the firm is willing to invest and develop alongside its customers. Marqeta strives to be the industry standard when it enters a new vertical. Marqeta traditionally goes after companies that are large commerce disruptors like On-Demand Delivery services such as DoorDash (DASH) or Uber (UBER), as well as fintechs like Block. Marqeta lands one of the top players in its new verticals and uses these partnerships as a means to develop its product roadmap. For example, Marqeta partnered with Ramp in 2019, while the expense management vertical is currently experiencing rapid growth.

Ramp Marqeta Case Study

Ramp launched its first launched its corporate card in late 2019 and since the beginning of 2021, Ramp’s seen the number of cardholders on its platform 5x. More than 2,000 businesses are using Ramp as their “primary management solution”, while card volume tripled from April to September. As a result, Ramp’s transaction processing volume is up over 1,000% YoY and Marqeta’s platform is crucial to enabling Ramp to grow at scale.” – Marqeta Stock Q3: Now, It’s Time For Takeoff

Marqeta supports many expense management companies including Divvy, Payhawk, and Expensify while seven expense management customers grew over 100% last quarter.

Marqeta is following a similar roadmap as it enters the financial institution (FI) vertical by landing partnerships with Goldman Sachs, JPMorgan, and Citi. Since FIs traditionally move slowly to implement new technologies, Marqeta enables these institutions to leverage its tokenization-as-a-service capabilities, which gives FIs an introduction to the Marqeta platform. Legacy processors like TSYS don’t have the capabilities to support tokenization to leverage Apple Pay and Google Pay wallets, which gives Marqeta a unique wedge into financial institutions as FIs will look to Marqeta as they innovate their card issuing services and expand on their product roadmaps.

Switching Costs

Marqeta’s wide range of customers gives its platform a unique network effect or tidal wave as its platform has an edge when it comes to modern card issuing. For example, if Marqeta customers were to switch to another issuing platform or attempt to build their own, they’d be directly competing with customers that use Marqeta. Marqeta’s embedding moat easily makes its technology a staple across multiple industries, since it is the leader of the pack when it comes to modern card issuing. If a customer were to leave, it would be incredibly difficult for them to launch a platform that could compete with Marqeta in terms of use cases, while it’d also be difficult to achieve Marqeta’s massive scale.

Marqeta.com

Marqeta experiences a ripple effect across industries, as we see across the expense management and BNPL verticals. This increases the value of MQ’s platform, especially as each customer leverages Marqeta to differentiate their offerings from their competitors, even if their competition builds on Marqeta’s platform as well.

Scale

Marqeta has 12 years of operating experience and has built an immense amount of trust with large companies at scale, as it processed over $130B in volume over the past 12 months. More than 50% of Marqeta’s top customers use its platform in more than one country, as Marqeta makes it easy for its customers to roll out functionalities in regions where it operates (up to 44+ markets).

Marqeta comparison:

Lithic was founded in 2014, while Unit was founded in 2019. Marqeta has a first-mover advantage when it comes to modern card issuing, but its volume is less than 1% of total card volume just in the U.S.

The company has a significant edge when it comes to other issuers as it is known for its reliability, better than 99.99% uptime in 2021, which is even more impressive considering that Marqeta issued more than 500 million cards through its platform.

Brand

When it comes to modern card issuing, it all started with Marqeta. MQ not only pioneered modern card issuing, but also coined the term. Marqeta is the most dominant brand thus far, in terms of modern card issuing, hence the partnerships with well-known companies, ranging from Uber to Google to JPMorgan. Since Marqeta developed this technology and re-oriented issuing processing, it is well-positioned to remain a leader in modern card issuing for years to come. This is especially true as Marqeta continues to aggressively invest in its platform and new capabilities.

Valuation

I will share our revenue projections for Marqeta, based on the assessment of the company’s future annual TPV.

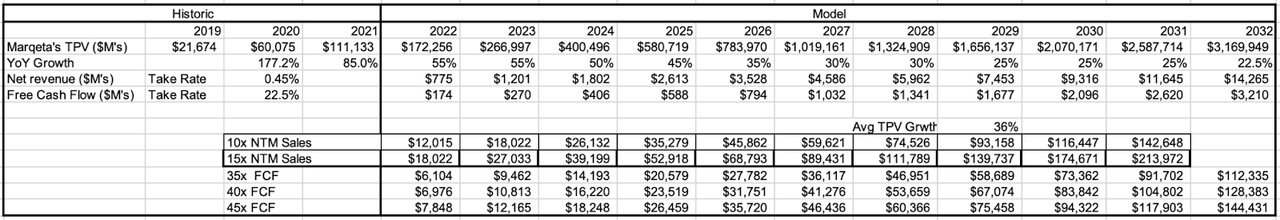

Below are our estimates:

Author’s Estimates

Assuming our base case that Marqeta trades at 35x free cash flow over the long term, Marqeta would be worth ~$112B by 2032, compared to our $98B 2032 price target in the Goldilocks Zone Portfolio. For the model above, we assume Marqeta will derive 0.45% of TPV as revenue while ultimately 22.5% of revenue will flow to free cash flow. Marqeta’s take rate will fluctuate between 4% and 5% while its take rates could be higher or lower due to revenue incentives from the card networks or revenue incentives Marqeta’s customers reach. Marqeta incentivizes its customers to process more volume on its platform by offering volume incentives, which make Marqeta uniquely positioned to grow alongside its customers. Marqeta’s expected TPV growth over the next 10 years is ~36%, which is conservative and well within reach for Marqeta considering the company’s TPV was only $21B in 2019, compared to $111B in 2021. Marqeta’s TPV increased by five times in three years, while Marqeta’s captured less than 1% of its TAM thus far.

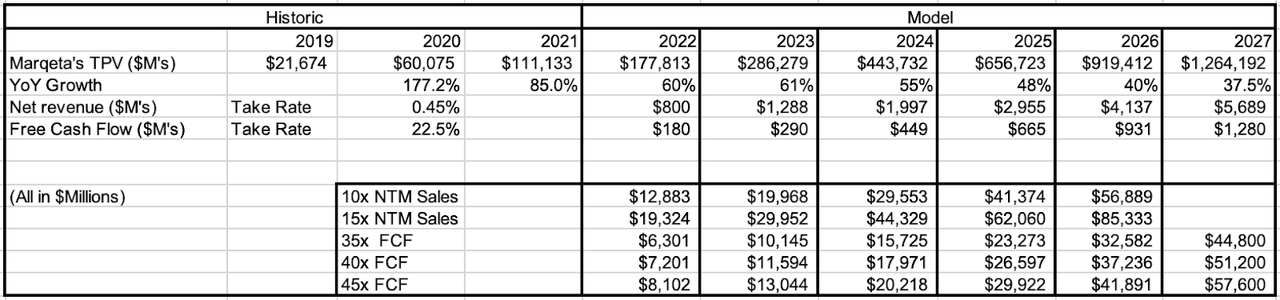

Below are our results for a more aggressive model, which assumes that growth accelerates due to the roll out of Debit+, the Klarna Card, and Block as BNPL is experiencing strong tailwinds. I think that this scenario is more likely as just one of Marqeta’s customers that we haven’t heard of could easily turn into a large customer.

Author’s Estimates

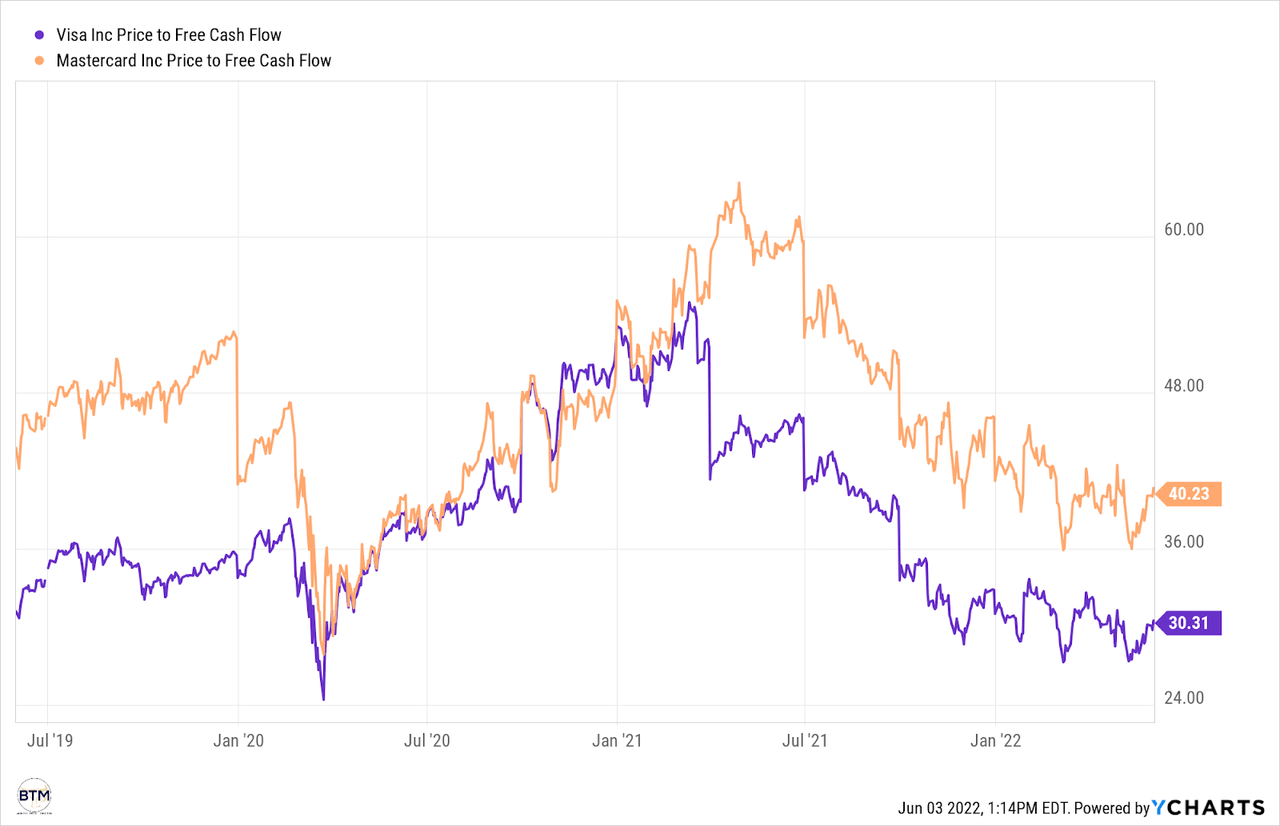

As much more mature companies, still growing albeit not as fast as Marqeta, Visa and Mastercard can be viewed as a good proxy for our Marqeta valuation.

YCharts

Over the past three years, Visa and Mastercard’s P/FCF has fluctuated primarily between 30 and 45 times free cash flow. Since Marqeta is growing rapidly and only captures a small portion of volume compared to Visa ($13T) and Mastercard ($7.3T), Marqeta has much more upside as it’s currently in its hypergrowth stage. Therefore, it’s fair to assume that Marqeta should trade at a premium as it focuses on operating cash flows hitting the bottom line versus being invested back into the growth of the business. Marqeta’s made significant investments for the next two to three years, while these investments should begin to slow over the next 12 to 24 months as Marqeta’s investing for significant increases in revenue for two to three years out, which will ultimately slow. However, given the strong tailwinds in payments, Marqeta is well-positioned to grow revenues 30%+ annually over the next 10 years.

I would say we’re very disciplined about how we deploy investment and how we prioritize those investments. So, I think it’s more a matter of changing or looking at that priority list and deciding what’s really important and what’s going to really move the needle? What is — which of those investments really have the most revenue, and you have to balance — have a balanced portfolio of investments for things that will move the needle one to two years from now versus things that are a little further out, three to five years out, for example. And so, we just try to be very disciplined about that and be very kind of ROI-oriented so that we think we’re successfully balancing the level of investment with our path to profitability. The one, I guess, benefit that we have is that our unit economics are very attractive, right? So, we have a very low marginal operating cost once we reach a certain level of scale.

And our investments are typically going to need to be made two to three years prior to meaningful revenue. So, we’re balancing those things, making sure we target the right growth areas. But then our underlying economics are quite strong, and that’s where we think we’ll be on a path to profitability, which we’ll share more about in the coming quarters as we — and I’ll finalize our multiyear plans.” – Mike Milotich, Marqeta CFO

Over the coming years, these investments will pay off and result in strong unit economics as Marqeta reaches a large scale. Marqeta is also strapped with $1.6B in cash and equivalents to build out its platform to further differentiate itself from these large payment networks.

Conclusion

When it comes to our thesis for Marqeta, nothing has changed other than the company continuing to land new partnerships and announcing good new products, like RiskControl, a revenue-generating solution for card issuers to combat payment fraud and focus on bringing payment solutions to life.

We are extremely excited to be partnered with Marqeta as we believe that the rise of BNPL and continued growth from the expense management vertical will make 2023 a pivotal year for the company. Marqeta remains one of our highest conviction picks and serves as a great way to get exposure to a wide range of companies, both public and private. For more on Marqeta, here’s some of our previous work:

-

Marqeta Q1 ’22: Another Quarter, Another Revenue Beat & Raised Guidance

-

Marqeta: An Inflation Power Play

-

Marqeta: A Concise Summary (Includes The “Peter Lynch Notecard”)

-

Original Marqeta Deep Dive

-

Marqeta’s Journey From 2010 To Now

Be the first to comment