AsiaVision

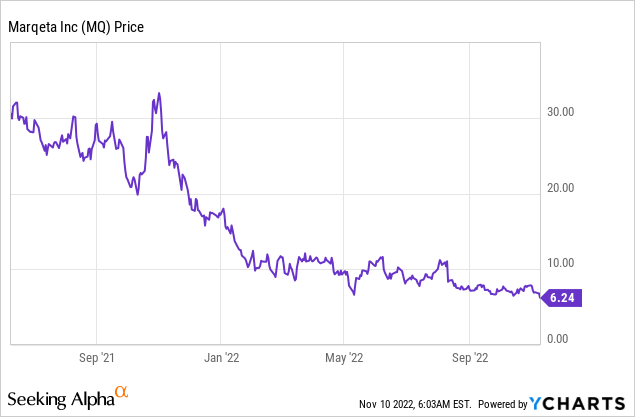

Marqeta, Inc. (NASDAQ:MQ) is a disruptive fintech company that specializes in modern card issuing. The company has an elite list of customers which include Block (SQ) (formerly Square), Doordash (DASH) (Red Card program), Uber (UBER), Western Union (WU), JP Morgan (JPM), and more. In the third quarter of 2022, the company generated solid financial results, beating top-line growth estimates, but it did miss on earnings. Despite this, the company is in a solid position to benefit from the growth in Fintech, card issuing, and embedded finance. Its stock price is down 80% from its highs in June 2021. Thus, in this post, I’m going to break down the company’s third-quarter earnings report and valuation, let’s dive in.

Business Model and Updates

In my previous posts on Marqeta, I discussed its business model in more detail. Here is a quick recap with updates. Marqeta is a modern card-issuing and processing platform. Legacy card programs can be time-consuming to develop and have limited flexibility. Marqeta solves these problems with its Open API (Application Programming Interface) platform that allows fintechs to customize and granularly control how their card-issuing program works.

The business offers two main services. We have “Powered by Marqeta,” in which the company has a processing relationship with its customer. We also have “Managed by Marqeta,” which is a service offered to a card program manager. The net revenue “take rate” is lower for the pure processing service, while its full-service offering has higher margins.

Marqeta (Investor Presentation)

The embedded finance industry is a major secular trend Marqeta is aiming to help its customers develop solutions for. Embedded finance is basically the integration of financial services such as payment processing, lending, and insurance into nonfinancial businesses. The idea is for these financial services to be seamless and offer a greater customer experience. The industry is forecast to be worth $1.3 billion by 2026, growing by fivefold since 2021.

Marqeta has recently scored a partnership with ONE, an independent fintech startup backed by Walmart. Marqeta is powering the ONE Card program and a range of financial features. Marqeta is also working with the investment app “Stash” as it powers the “Stock-Back” debit card in partnership with Mastercard.

In late October 2022, Marqeta announced its “Marqeta for Banking,” which will provide a modular technology platform for its customers to build out banking services easily. These include direct deposits, Cash loading, ACH, bill pay, and instant funding. Marqeta has plans to continue its international expansion and has recently secured its data residency status for Europe. Many European customers have data residency requirements in that any data must be stored within that country’s borders, as opposed to heading to the U.S. Without the ability to do this, Marqeta was leaving a lot of business on the table in Europe.

Third Quarter Financials

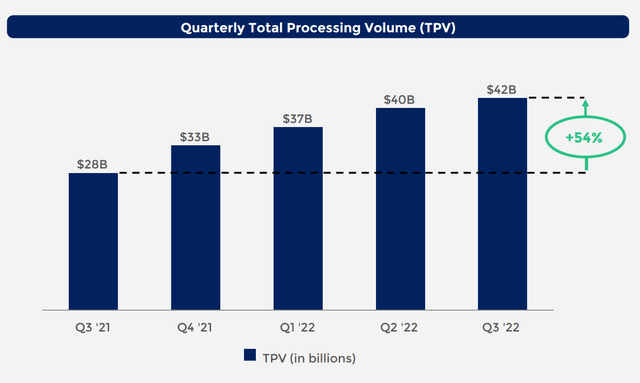

Marqeta generated solid financial results for the third quarter of 2022. Total Processing Volume [TPV] was $42 billion, which increased by a rapid 54% year-over-year. This growth rate is very similar to the first half of 2022, which is a positive sign given the uncertain macroeconomic headwinds. If I break down the TPV by industry vertical, we can get a better idea of the winners and losers. The Financial Services vertical continued to grow strong and increased by 10 percentage points quarter-over-quarter. In the third quarter, Marqeta scored a partnership with Raiffeisen Centrobank, a leading retail bank in eastern Europe. Marqeta is powering the card program for the Raiffeisen Digital Bank program.

Nondiscretionary spending such as food, fuel, and utilities makes up ~1/3 of total payment volume. Thus, this segment should be consistent even during a recessionary environment.

Lending, which includes Buy Now Pay Later (“BNPL”), demonstrated solid growth, but it was slightly slower than the second quarter, as consumers are making fewer discretionary purchases. Marqeta provides technology solutions for a range of BNPL providers. This includes Affirm Holdings (AFRM), which is partnered with Amazon (AMZN), European provider Klarna, Zip, and even Afterpay (acquired by Block).

With Affirm, Marqeta helps to power the “last mile” of the transaction between the consumer and merchant. The technical term is a “Server to Server Virtual Card” which is created. Recently, Marqeta has signed a Canadian expansion deal, with Affirm one of its long-standing customers. The company also has also recently signed a deal with Scalapay, a leading BNPL provider in Italy and Southern Europe. I have stated in previous posts that the Buy Now Pay Later market is very competitive, and it’s hard to choose a winner. Therefore, as Marqeta helps to power a range of technology solutions across all the main leaders, it is in a prime position to benefit from industry growth.

Total Processing Volume (Q3 Earnings)

Marqeta net makes its revenue based upon a “usage-based” model, which takes a small fee from the payment processing volume. In addition, the business charges platform access fees, Tokenization, and Fraud detection service fees.

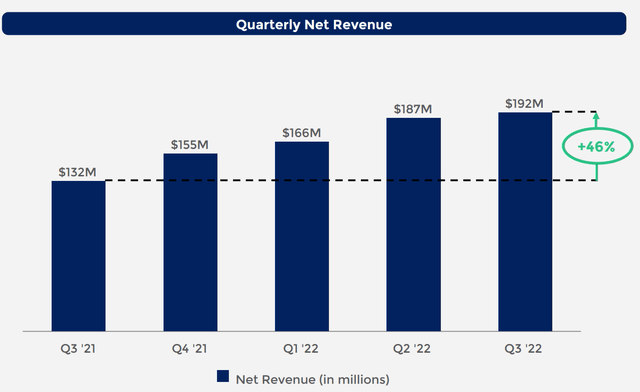

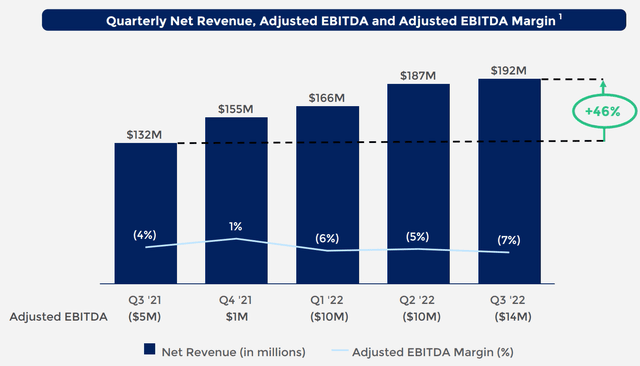

Its Net revenue was $192 million in the third quarter of 2022, which increased by a rapid 46% year-over-year and beat analyst expectations by $10 million. This was driven by strong growth across both its full-service “Managed by” and “Powered by” Matqeta offerings.

Fintech giant Block, formerly known as Square, makes up 72.5% of its net revenue. In 2020/2021, this concentration was positive, as Block generated strong results from the financially loose and stimulus check-fueled users of the pandemic. The Cash App Card (which is powered by Marqeta) enables business users to access and use their funds immediately, through the interface. Cash App users, which use a Cash App Card have grown from 31% in Q4,2021 to 35% by the third quarter of 2022. I discussed more details on Block and its Cash App in my third-quarter earnings report on the company. Although Block is performing well, revenue concentration to a single customer is a risk.

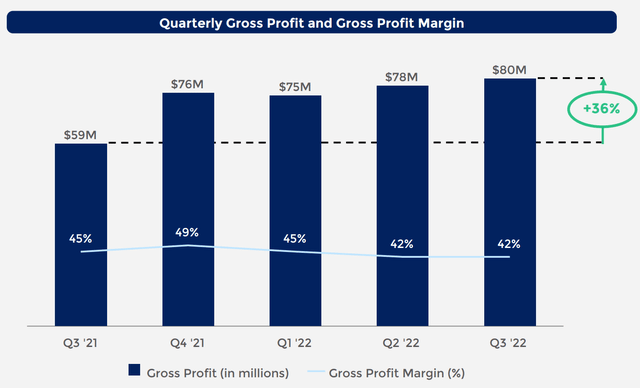

The company generated Gross profit of $80 million, which increased by 36% year-over-year. Marqeta has recently signed a key network contract, that has resulted in a “catch-up” incentive payment. If we exclude that payment, Gross profit would have grown by 4% more, which is a positive.

Although Block makes up over 70% of Marqeta’s revenue, its gross profit is 15 points lower, which is a positive. Its gross margin was 42%, which is 3% lower than the 45% reported in the prior year. This was primarily due to the timing of the aforementioned incentive payments and the “business mix.”

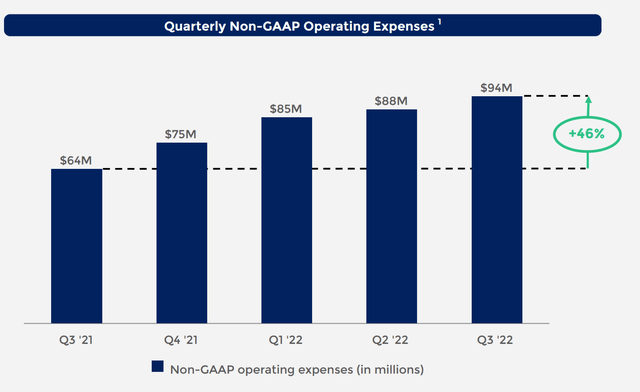

Third-quarter adjusted operating expenses increased by 46% year-over-year to $94 million. This increase was driven by an expense related to international processing “indemnification” costs. During the Q3 earnings call, Management called this an “unusually large expense,” and it contributed to 9% of the growth in the operating expenses. The rest of the expense growth was driven mainly by technology and product investments, which I don’t deem to be a bad sign overall. Studies show companies that invest more in R&D tend to produce greater shareholder value long term.

Operating expenses (Q3 earnings report)

Adjusted EBITDA was $192 million in the third quarter of 2022. This increased by 46% year-over-year and was $2 million better than expectations. This was mainly driven by gross profit growth. The business saw its Net Loss increase by $7 million to $53 million, which was mainly driven by increased compensation and technology expenses.

Marqeta has a solid balance sheet with $1.2 billion in cash and cash equivalents. In addition, it has $441 million worth of marketable securities. Its debt levels look to be very minimal with ~$14 million in total debt, which is a positive sign.

The company bought back 1.96 million shares in the quarter at a value of $13.9 million, or ~$7.05 per share. The Board has authorized up to $100 million in share repurchases, so I expect more stock repurchases in the future.

Advanced Valuation

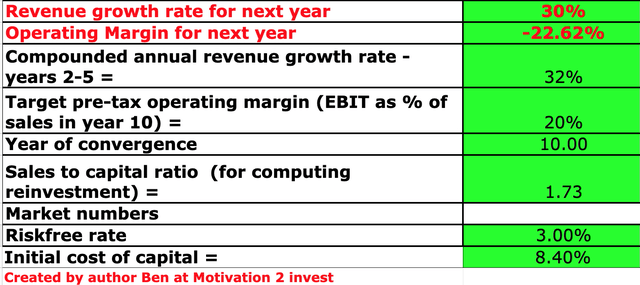

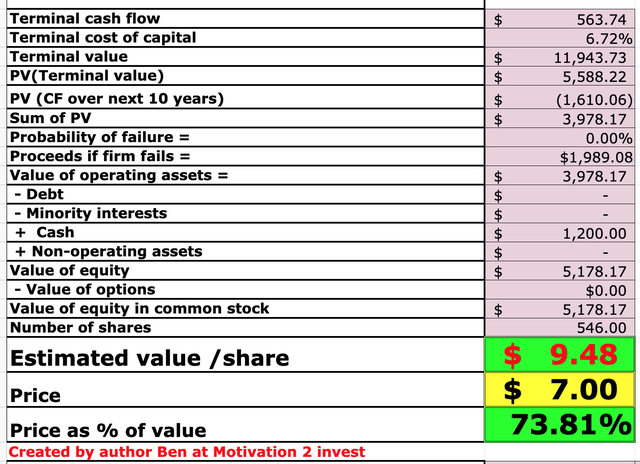

In order to value Marqeta, I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted 30% revenue growth for next year, which is aligned with management’s expectations of between 29% and 31% growth for Q4. After which, I have forecast revenue growth to increase to 32% per year over the next 2 to 5, as I forecast that the economy will rebound and consumer spending will bounce back.

Marqeta stock valuation 1 (created by author Ben at Motivation 2 invest)

Over the next 10 years, I forecast Marqeta to increase its operating margin to 20%. I forecast this to be driven by increased efficiencies as scale increases and due to lower expenses which management has forecasted.

Marqeta stock valuation (created by author Ben at Motivation 2 invest)

Given these factors, I get a fair value of $9.48 per share. Marqeta stock is trading at $7 per share at the time of writing. Thus, it is ~27% undervalued.

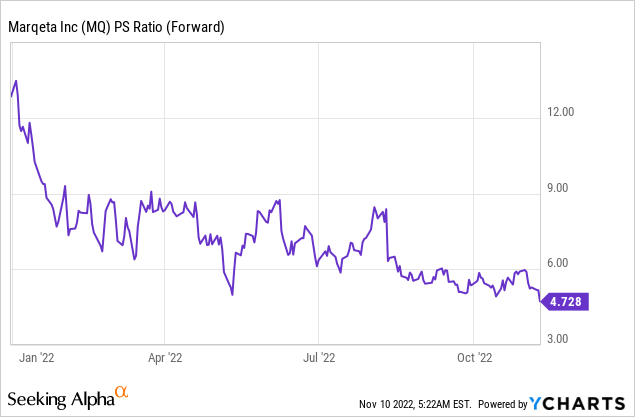

As an extra data point, Marqeta is trading at a Price to Sales ratio = 4.7, which is significantly cheaper than its previous P/S ratio between 6 and 14, in early 2022.

Risks

Competition

Marqeta is not the only provider of virtual card programs. Payments giant Stripe also offers virtual card issuing, as does Adyen (ADYEY, ADYYF), the Netherlands-based fintech company. Marqeta is not the cheapest provider in general, but I believe the company’s track record with rapidly scaling fintech is a strong positive.

Recession

The high inflation and rising interest rate environment have caused analysts to forecast a recession. Higher input costs for consumers and business generally results in lower consumer spending, lower payment volume, and thus lower profits for Fintech companies.

Final Thoughts

Marqeta is a thriving fintech company that has scored major partnerships with an elite list of scaling clients. The company continued to generate solid results in the third quarter, while its stock price has continued to fall. Marqeta stock is undervalued intrinsically at the time of writing and the company’s share buybacks are a positive signal. I do expect some volatility in the short term, as the company absorbs its increased expenses, and deals with the tough macroeconomic environment. However, for investors with a longer-term time horizon, Marqeta stock could be a solid investment.

Be the first to comment