FreezeFrames

Marathon Oil Corporation (NYSE:MRO) produces oil, natural gas liquids and natural gas in the US and the African country of Equatorial Guinea. It bought private south Texas Eagle Ford company Ensign Natural Resources for $3 billion in an acquisition expected to close by year end.

In the US, Marathon Oil is primarily active in the Bakken (North Dakota) and Eagle Ford with smaller operations in the New Mexico side of the Permian and Oklahoma.

As before, I do not recommend Marathon Oil to dividend hunters due to a slender (1.3%) dividend.

However, I do recommend Marathon to energy investors looking for capital appreciation at a medium-sized oil and gas producer due to strong supply-demand fundamentals for oil presently and natural gas in the future, particularly as US LNG export expands.

Through share repurchases, the company is meeting its commitment to return at least 40% of annual operating cash flow to investors when WTI oil prices are $60/bbl or above, which looks likely in 2023.

Macro

The Russian invasion of Ukraine and subsequent redirection of Russian energy exports away from the European Union continues, leaving the EU energy short. OPEC is not increasing its production targets, but Saudi Arabia reinforced ties with China in lavish meetings between leaders of the two countries. China’s exit from extreme COVID lockdowns is estimated to boost global oil demand about 1 million BPD, or 1%. While 1% sounds small, it’s significant for marginal pricing.

A 14,000-barrel oil leak from the 622,000 BPD Keystone Pipeline was discovered in Kansas, so the entire pipeline has been shut down until the leak can be found and repaired. Pipeline owner TC Energy (TRP) has not announced a reopening time. Keystone ships heavier, sourer Western Canadian Select (WCS) crude oil to US Gulf Coast refineries (and to Cushing storage for later sale to other refineries). Its closure has deepened the WCS discount to WTI from about -$25/bbl to -$33.50/bbl.

For perspective, US refineries use about 17.9 million BPD of oil as feedstock and the US produces 12.2 million BPD domestically. Canada supplies the largest percentage of US oil imports, including via now-shut Keystone Pipeline. Adding to the complexity, the Biden administration has drawn the Strategic Petroleum Reserve down to its lowest level (387 million barrels or 54% of capacity) in years and due to sanctions, Russian oil supplies have been redirected from the EU and US to India and China.

Lack of WCS imports has thus boosted the price of domestically produced US crude oil.

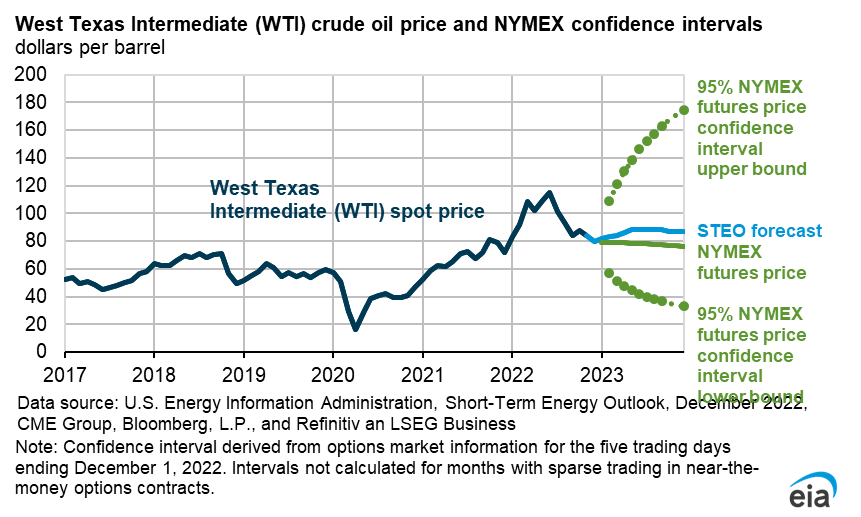

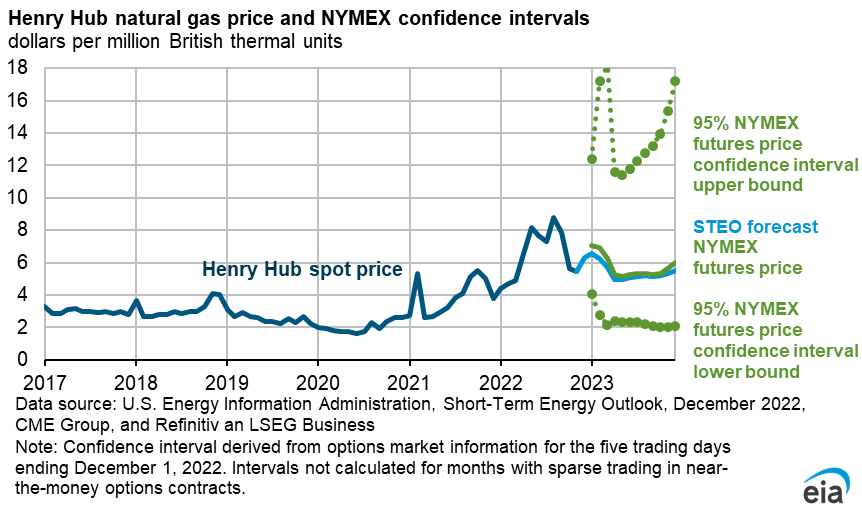

In its December 6, 2022, Short Term Energy Outlook (before the Keystone leak and shutdown) the Energy Information Administration (EIA) provided 5-95 confidence intervals for US oil and gas futures prices through the end of 2024, shown below.

Energy Information Administration

Energy Information Administration

Third Quarter 2022 Results and Guidance

In the third quarter of 2022, Marathon Oil reported net income of $817 million ($1.22/diluted share). Net operating cash flow was $1.6 billion and free cash flow was $1.1 billion. The company returned $1.2 billion to shareholders in 3Q22, most ($1.1 billion) in the form of share repurchases, reducing its share count 20%. The board increased the outstanding buyback authorization to $2.5 billion in November 2022.

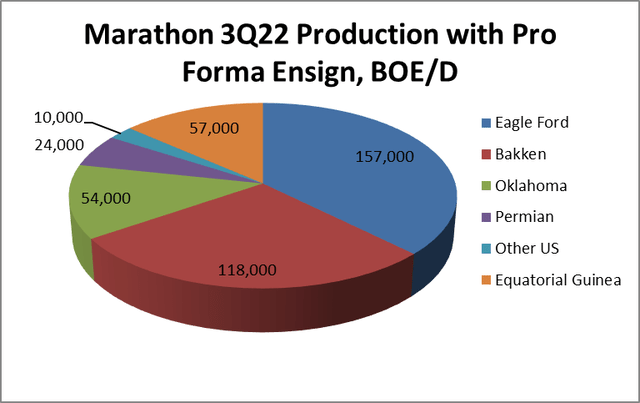

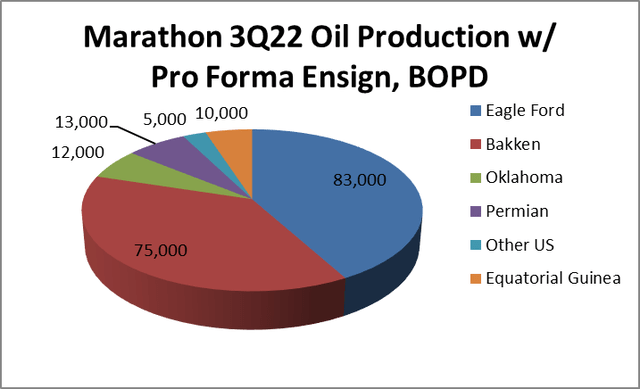

Marathon produced 352,000 net barrels of oil equivalent per day (BOE/D); of that, oil was 176,000 net barrels per day (BPD), or 50%.

Ensign’s production is 67,000 BOE/D total and oil at 22,000 BPD.

The graphs show operational regions. Note Ensign’s production is added in for the Eagle Ford region.

marathonoil.com and Starks Energy Economics, LLC

marathonoil.com and Starks Energy Economics, LLC

US Oil and Gas Prices, and Differentials

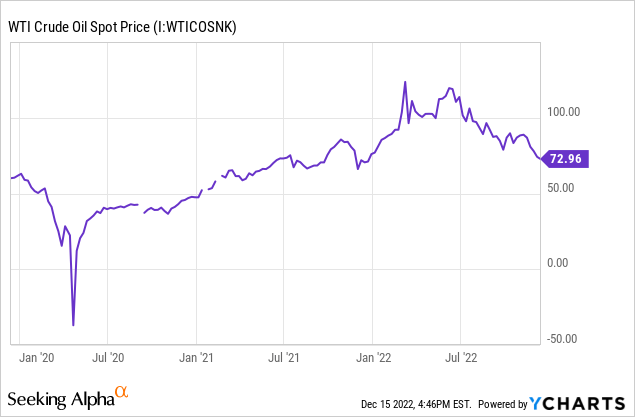

The December 15, 2022, oil futures price was $76.29/barrel for West Texas Intermediate (WTI) crude oil delivered in January 2023.

Forward prices for WTI are relatively flat through December 2023.

On December 14, 2022, when WTI was $73.82/barrel, the price for Louisiana Light Sweet (link to Oil Monster) was $77.28/barrel and the price for Bakken crude oil (North Dakota Light Sweet) was $71.87 per barrel.

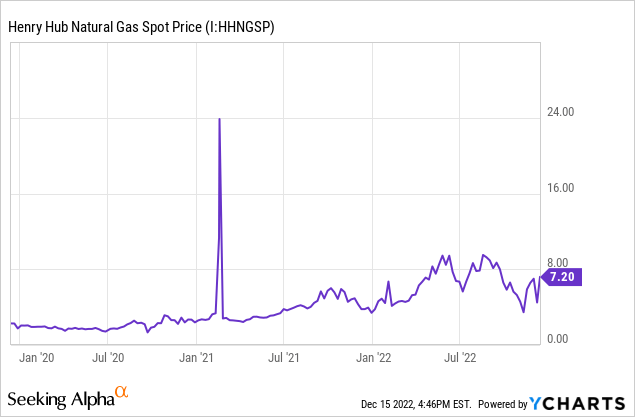

The December 15, 2022, Henry Hub, Louisiana, natural gas futures price for January 2023 delivery was $6.90/MMBTU.

The Dutch spot LNG price for January 2023 is $41.19/MMBTU, or 6x the US price at Henry Hub.

In 2023, US natural gas production at over 100 BCF/D is expected to exceed US demand + LNG export demand + Mexican export demand until late 2024, when more LNG export capacity comes online on the US Gulf Coast, according to East Daley Analytics. The prices could lift this spring when the 2 BCF/D Freeport LNG export facility returns to service. And, as traders know, natural gas spot prices are also subject to winter spikes due to higher cold-weather demand.

Ensign Natural Resources Acquisition

On November 2, 2022, Marathon announced it was acquiring private Eagle Ford company Ensign Natural Resources for $3.0 billion, to close by the end of 2022 with an effective date of October 1, 2022.

According to Marathon, “The 130,000 net acres (99% operated, 97% working interest) Marathon Oil is acquiring from Ensign Natural Resources span… the condensate, wet gas, and dry gas phase windows of the Eagle Ford. Estimated fourth quarter 2022 oil equivalent production is 67,000 net boed (22,000 net bopd of oil).”

Ensign’s acreage is adjacent to Marathon’s and increases Marathon’s Eagle Ford basin scale to 290,000 acres. The acquisition includes 700 wells and about 600 undrilled locations.

Reserves Pre-Ensign

Reserve totals do not include the company’s $3 billion acquisition of Ensign. Investors may want to check year-end 2022 SEC PV-10 reserve calculations, once available in 2023, for the inclusion of Ensign Natural Resources’ reserves.

At December 31, 2021, Marathon’s total proved reserves were 1.1 billion BOE. This divided as 89% US and 11% Equatorial Guinea. Of the total, 52% was crude oil and condensate.

The SEC PV-10 value of the reserves was $12.4 billion.

Only 3.5% of this reserve value ($429 million) is attributable to the company’s Equatorial Guinea holdings.

Competitors

Marathon Oil Corporation is headquartered in Houston, Texas.

In the Eagle Ford, some of Marathon Oil’s competitors include BP (BP), Chesapeake (CHK), ConocoPhillips (COP), EOG Resources (EOG), SilverBow Resources (SBOW), and Exxon Mobil (XOM).

In the Williston/Bakken region, Marathon Oil’s competitors include Chord Energy (CHRD), private Continental Resources, ConocoPhillips, Devon (DVN), EOG Resources, Hess (HES), and Exxon Mobil.

The company also has many competitors in Oklahoma’s SCOOP/STACK formations and the Permian.

The company’s largest competitor in Equatorial Guinea is Exxon Mobil.

Governance

At December 1, 2022, Institutional Shareholder Services ranked Marathon Oil’s overall governance as a 3, with sub-scores of audit (6), board (4), shareholder rights (5), and compensation (2). In this ranking a 1 indicates lower governance risk and a 10 indicates higher governance risk.

Short shares are 4.75% of floated shares at November 30, 2022. Insiders own a tiny 0.16% of outstanding stock.

Marathon Oil’s beta of 2.44 represents considerably more volatility than the overall market but is in line with cyclic oil and gas prices.

On September 29, 2022, much of Marathon Oil’s stock was held by institutions, some of which represents index fund investments that match the overall market. The three largest institutional holders of Marathon’s stock were Vanguard (12.4%), BlackRock (8.1%), and State Street (7.4%).

BlackRock and State Street are signatories to the Net Zero Asset Managers Initiative, a group that, as of November 9, 2022, manages $66 trillion in assets worldwide and which (despite less energy supply due to reduced Russian exports to Europe) limits hydrocarbon investment via its commitment to achieve net zero alignment by 2050 or sooner. Note Vanguard was also originally a signatory but has recently withdrawn.

BlackRock is experiencing fund withdrawals by state treasurers in Arkansas, Arizona, Florida, Louisiana, South Carolina, Texas, and Utah who contend its anti-hydrocarbon activism hurts primary businesses in their states and/or leads to unacceptably low investment returns.

Financial and Stock Highlights

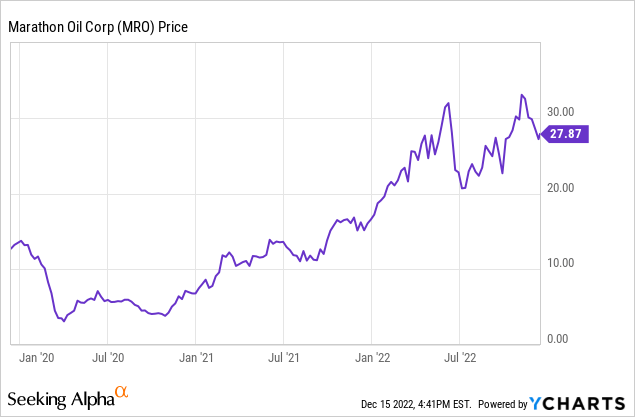

The company’s 52-week price range is $14.29-$33.42 per share, so its December 15, 2022, closing price of $27.86 is 83% of its 52-week high and 80% of its one-year target of $34.76. Market capitalization is $17.7 billion.

Marathon Oil’s trailing twelve months’ earnings per share (EPS) is $5.21 for a bargain price/earnings ratio of 5.3. The average of analysts’ 2022 and 2023 EPS estimates is $4.65 and $4.30, respectively, for a forward price-earnings ratio range of 6.0-6.5.

Twelve-month return on assets and equity are both excellent at 12.6% and 34.0%, respectively.

Trailing twelve-months operating cash flow is a hefty $5.45 billion and levered free cash flow is $2.6 billion.

Marathon Oil’s annual dividend is $0.36/share for a yield of 1.3% and expects to increase this to an annual $0.40/share (1.4%) after closing the Ensign acquisition.

Marathon has a large share repurchase authorization that helps meet its commitment to return at least 40% of cash flow from operations to investors when WTI oil prices are $60/bbl or more.

At September 30, 2022, the company had $6.7 billion in liabilities, including $3.6 billion of long-term debt. Marathon Oil had $17.9 billion in assets giving it a liability-to-asset ratio of 37%. The debt-to-EBITDA ratio was a comfortable 0.8.

The company’s mean analyst rating is a 2.5, between “buy” and “hold” from twenty-seven analysts.

Notes on Valuation

With an enterprise value (EV) of $20.3 billion, the EV/EBITDA ratio is small 3.8, well below the maximum preferred ratio of 10 or less, suggesting the stock is a bargain.

The company’s book value per share of $17.40 is below the current market price, indicating positive investor sentiment.

Market capitalization per flowing BOE, including Ensign, is $42,200 while the market cap per flowing barrel of oil is $89,300. This more-than-doubling reflects the inclusion of lower-valued natural gas and natural gas liquids in the BOE calculation.

Summarizing, the company has a current market capitalization of $17.7 billion and enterprise value of $20.3 billion.

Pre-Ensign acquisition, on September 30, 2022, it had $17.9 billion in assets, $6.7 billion in liabilities including $3.6 billion of long-term debt, and 2021 SEC PV-10 value of $12.4 billion.

Positive and Negative Risks

Potential investors should consider their oil and natural gas price expectations as the factors most likely to affect Marathon Oil. While the Eagle Ford is prolific and sizable, its reserves are also smaller (and more gas-prone) than those in the Permian. It is possible Marathon will not realize synergies from its Ensign acquisition.

The Bakken Tier 1 core is smaller than the Permian.

There is US political risk as the Biden administration continues its anti-US-hydrocarbons policies.

Equatorial Guinea depends on oil and gas production for its GDP and fiscal revenues: both it and Marathon Oil are incentivized to keep volumes flowing.

Recommendations for Marathon Oil

Despite similar names, Marathon Oil is an upstream oil and gas company distinct from Marathon Petroleum Corporation (MPC), a downstream refiner.

I do not recommend Marathon Oil to dividend-hunters.

The Ensign acquisition is gas-heavy. Gas demand is expected to strengthen further when more US LNG capacity export comes online in 2023-2024 (and when 2 BCF/D Freeport comes back online in the spring of 2023. Marathon is well-prepared to integrate Ensign with existing operations.

On price/earnings ratios, enterprise value/EBITDA ratio, and upside to the one-year target price Marathon Oil is a bargain. I recommend it to energy investors looking for capital appreciation. The company’s policy is to repurchase shares opportunistically when the WTI oil price exceeds $60/bbl, as it does now.

Marathon Oil may further appeal to bargain-hunters given a likely positive reserve valuation surprise due to higher (than 2021) year-end 2022 prices and volumes.

marathonoil.com

Be the first to comment