Andrii Yalanskyi

Investment Thesis

ManpowerGroup (NYSE:MAN) Inc offers workforce solutions and services in the Americas, Southern Europe, Northern Europe, and the Asia Pacific Middle East (APME). The company is recovering from the adverse effects of Covid-19 and might attain the pre-pandemic levels of revenue of earnings with the strong demand from the clients. The company has a solid and stable dividend yield of 3.91%.

About ManpowerGroup

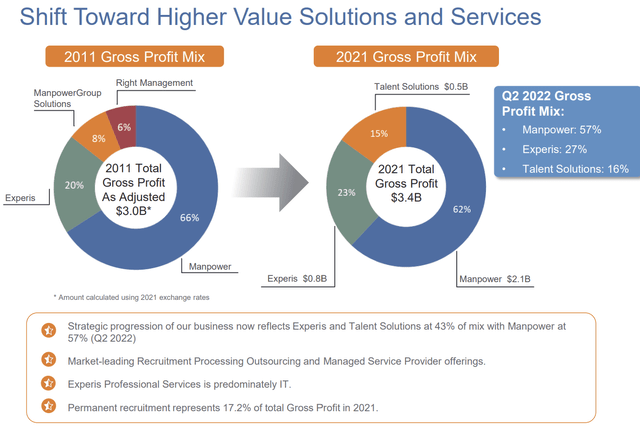

ManpowerGroup provides workforce solutions and services such as recruitment & assessment, training & development, career management, outsourcing, and workforce consulting. The company operates its business primarily on a geographic basis. Therefore, the company has classified its revenue under four geographical segments: Americas, Southern Europe, Northern Europe, and APME. The company generates 18% of the total revenue from the American segment, while Southern Europe contributes 41% of the total sales. Northern Europe generates 20% of the total revenue, and the APME segment earns 21% of the total sales. The company is currently focusing on accelerating its growth by developing higher margin business in all brands. The company also focuses on increasing efficiency and productivity across all businesses. The company has three primary brands: Manpower, Experis, and Talent Solutions. The Manpower brand concentrates on permanent hiring and contingent staffing, while Experis provides expert resourcing and project-based solutions, particularly in finance, engineering, and information technology. The third brand, Talent Solutions, strive to satisfy customer need for knowledgeable services, integrated workforce solutions, and data-driven workforce solutions. Experis and Talent Solutions are two brands where MAN seeks to improve to become a more successful business.

Gross Profit Mix Comparison (Investor Presentation)

The current HR solution market is fragmented, but the industry does not have a strong entry barrier, which exposes the company to the threat of new entrants.

Financial Trends

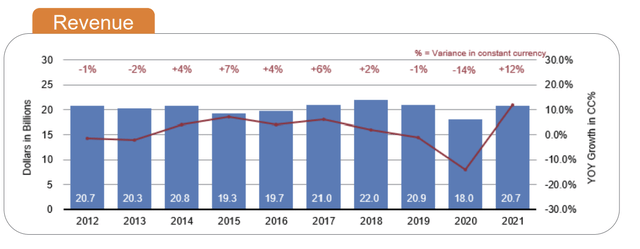

Revenue Trends (Investor Presentation)

As we can see in the above chart, the revenue growth has been stagnant for the previous ten years. Only during FY2020 the company experienced a slight decrease in sales due to the low demand for the workforce. The reason behind low demand was the slowdown and economic uncertainty caused by Covid-19. The revenue has grown from $21 billion in FY2020 to $20.7 billion in FY2022, resulting in a 5-year CAGR of -0.29%. The above chart shows that the company is now recovering from the adverse effects of Covid-19. However, the revenue is still slightly below pre-pandemic levels. I think we can expect a full revenue recovery in the coming years as the company is experiencing strong demand across all major markets. However, I believe the investors cannot expect the revenue to significantly exceed the pre-pandemic levels as we know the overall economy is facing headwinds such as adverse impacts of the Russia-Ukraine war, rising inflation, and fluctuating interest rates, which might offset the strong labor demand. That’s why, in the best-case scenario, we can expect the revenue to sustain at the pre-pandemic levels, and in the bear-case scenario, the revenue might decrease to the levels of FY2019.

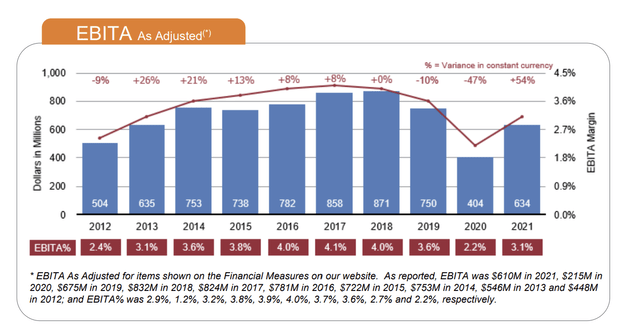

EBITDA Trend (Investor Presentation)

Despite the history of sluggish revenue growth, the company has experienced strong EBITDA growth until FY2018. The company has managed to expand its EBITDA margin from 2.4% to 4.1% from FY2012 to FY2018. But due to the economic slowdown and uncertainty, in FY2019, the EBITDA margin started contracting and reached 2.2% in FY2020. The EBITDA growth has significantly surpassed the revenue growth, which I think indicates the company’s substantial operational leverage. In FY2021, we can observe a significant rise in EBITDA and EBITDA margins which resulted from the accelerated demand recovery. Even the EPS of the company has increased significantly in FY2021. The company has reported an EPS of $7.24 in FY2021, which is a 69.14% YoY growth compared to the EPS of FY2020. In the best-case scenario, the company can achieve pre-pandemic level revenue and EBITDA margin with strong demand and operational leverage. Hence, I estimate the EPS of FY2023 in the best-case scenario to be somewhere near FY2018’s EPS. After considering these factors, I believe the EPS of FY2023 in the best-case scenario to be $8.60. In the bear-case scenario, the company can experience low labor demand and revenue due to economic headwinds. Hence, I estimate the EPS of FY2023 in the bear-case scenario to be somewhere near FY2019’s EPS. After considering these factors, I believe the EPS of FY2023 in the bear-case scenario to be $7.20.

Solid Dividend Yield

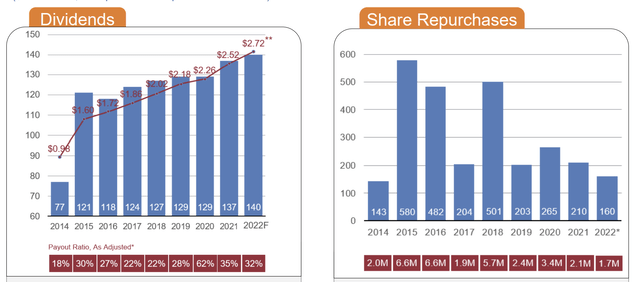

Dividend & Share Repurchase Trend (Investor Presentation)

Currently, the company has a forward payout ratio of 32.03%. Recently, the company announced its semi-annual dividend payment of $1.36, which is equivalent to a $2.72 annual dividend payment, representing a 3.91% forward dividend yield compared to the current share price. The company has a long history of dividend payments. According to seeking alpha, the company has an A grade in safety and consistency of payment. It also has a B- grade in the growth of dividend payment and an A- grade in dividend yield. I think all these grades give the investors assurance and safety about the strong dividend payment in the coming years. Due to the economic headwinds, the share is facing selling pressure. The share has lost 38.15% of its value since the last year’s same period. I believe this has created a perfect opportunity for risk-averse investors. I know there is a possibility of a dividend cut if the company faces a significant earning decrease in the coming years due to economic headwinds. But according to Q2 FY2022 results, the company has $886 million in cash, which is equivalent to 25.3% of the current market capitalization. Therefore, I think the company can keep paying dividends even in the low earnings scenario.

What is the Main Risk Faced by MAN?

Economic Headwinds

The company’s operations are subject to changes in the macroeconomic climate worldwide. The company has occasionally encountered unpredictability and volatility in the state of the global economy, including variations in the growth or decrease rates in the markets it serves. The operating nations and areas of the corporation have gone through erratic growth or collapse, and MAN anticipates that the current state of the world economy will continue to be unstable and unpredictable. These circumstances have caused clients to cut down on or postpone spending on new projects that call for the company’s services or solutions, and they may continue to do so. This could lower the demand for the company’s various staffing services. A sluggish or prolonged period of economic contraction could have a materially adverse impact on the business and operating results of the company. Currently, the company is facing economic headwinds such as rising inflation, the negative impact of the Russia-Ukraine war, and volatile interest rates. Suppose the company’s clients experience a slow down or margin contraction due to rising inflation or interest rate. In that case, they might decrease their spending on workforce services which can negatively affect the company’s financials.

Valuation

The company is recovering from the adverse effects of Covid-19 with the help of solid demand from its clients. I believe the strong demand can accelerate the recovery of the revenue and earnings of the company in the coming years. In the best-case scenario, the company can again attain the pre-pandemic level of revenue and earnings. Hence, I estimate the EPS of FY2023 in the best-case scenario to be somewhere near FY2018’s EPS. After considering all these factors, I believe, in the best-case scenario, the company can achieve a full-year EPS of $8.60 in FY2023, which gives the forward P/E ratio of 8.08x. According to my analysis, the company is undervalued as its forward P/E ratio is significantly lower compared to the sector median of 15.34x. I believe the share might gain strong momentum in the coming years and trade at its 5-year average P/E ratio with the strong growth of the earnings. Hence, I believe the company might trade at a P/E ratio of 14.94x, which gives a target price of $128.4, representing an 84.6% upside from the current share price. In the bear-case scenario, I think the company might face a significant decrease in earnings and trade below its 5-year average P/E ratio due to economic headwinds. Hence, I estimate the EPS of FY2023 in the bear-case scenario to be somewhere near FY2019’s EPS. After considering all these factors, I believe the full-year EPS and P/E ratio of FY2023 in the bear-case scenario to be $7.20 and 11x, respectively, which gives the target price of $79.2, representing a 13.9% upside from the current share price.

Conclusion

The company is recovering from the negative effects of Covid-19. The clients’ strong demand is accelerating revenue and earnings recovery. It is experiencing economic headwinds, such as rising inflation and interest rates. MAN has a solid dividend yield of the 3.91%, which can give fixed returns to the investors in a bear case scenario. According to my analysis, the company has 84.6% and 13.9% upside from the current share price in the best-case and bear-case scenarios, respectively. With dividend yield, the investors can expect a total return of 88.51% and 17.81% in best-case and bear-case scenarios. After considering all these factors, I assign a buy rating for MAN.

Be the first to comment