JasonDoiy/iStock via Getty Images

Manhattan Bridge Capital (NASDAQ:LOAN) is a New York based hard money lender.

This is a recurring coverage article. For more detailed information on the company’s operations and history, please visit the initiation coverage article from January 2022 and the latest article, from June 2022.

In previous articles, I commented positively on LOAN’s operational history, conservative management and financing, and lean cost structure. My main thesis in both articles (both rated buy) was that LOAN would benefit in a context of higher rates and tighter credit conditions. The reason was that I expected LOAN would be able to use its low leverage balance sheet to provide credit while competitors had to cut their balance sheets. The fall in credit supply would more than offset the fall in demand for credit, allowing LOAN to keep growing.

Reviewing LOAN’s reports up to 3Q22, I find that the fundamental thesis has not changed. LOAN has continued expanding its balance sheet and has not shown problems with loan repayments. Although LOAN is now suffering from higher rates on the liability side that have not been compensated on the asset side, I believe that its net interest margin should improve in following quarters.

A key factor in following quarters is a renovation of the company’s credit facility (maturing in February 2023) that allows it to keep expanding its balance sheet until share issuance becomes attractive again.

Company overview

As commented, please visit the initiation coverage article from January 2022 for a more detailed review of LOAN’s operations and history.

LOAN is a New York based hard money lender. HMLs provide fast-processing, short-term credit to real estate developers. They differ from other types of lenders because they concentrate on collateral, not credit scoring, and have fast processing pipelines. A developer goes to an HML to secure a deal and then either sell the property on a fix-and-flip deal or refinance at more attractive rates with another kind of lender. For this kind of special lending, HMLs usually charge higher rates.

LOAN is special among HMLs for several reasons.

First, the company has its niche in residential properties in New York. As of December 2021, the company had 95% of its loan portfolio concentrated in New York and 90% of it concentrated in residential. Lately this characteristic has changed a little. First, the company has expanded to Florida, although with a limit to its Florida book of $5 million. Second, the company has expanded into commercial real estate, which makes 20% of its loan book as of 3Q22.

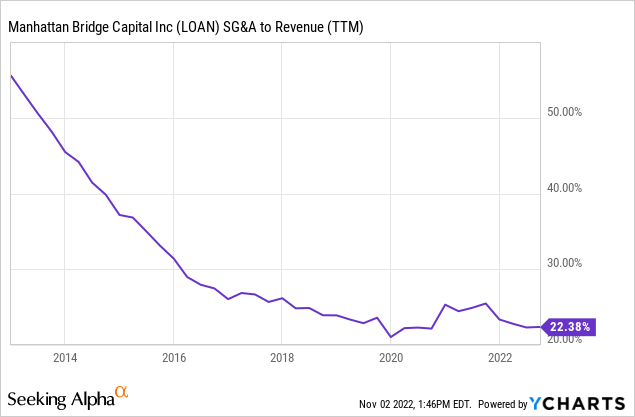

This concentration provides LOAN with a competitive advantage when sourcing and judging loans among residential developers in New York. This advantage has generated two results. First, LOAN has never had a foreclosure or default, although it has refinanced many loans (as of 3Q22, $5 million or 7% of its loan book has a longer maturity than it should have had originally). Second, LOAN’s credit operation is super lean. The company only has six employees, and has very low and relatively fixed SG&A costs.

LOAN’s lean operations have allowed it to multiply its yearly net income 10 times in the past 10 years, but they also represent a risk and a limitation. The company depends heavily on its CEO and CFO, the only two people in charge of sourcing and approving loans. With about 125 loans that have to be renewed each year, managers have less than 3 days on average to work on a deal, including weekends. It seems obvious that at some point LOAN will have to outgrow its managers.

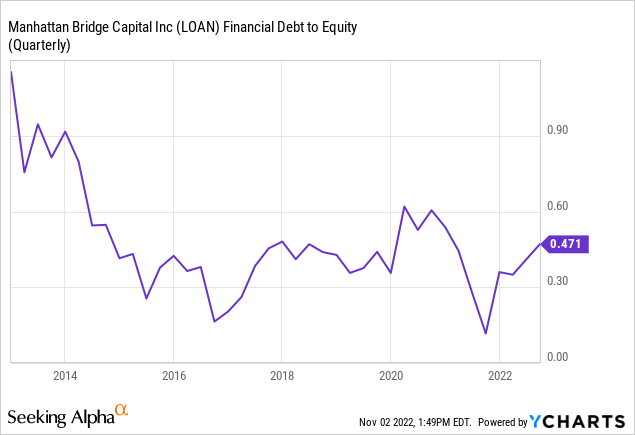

Finally, LOAN has a super conservative financing structure. The company has been mostly financed by equity. Being a REIT that decides to distribute 100% of earnings, the only way it has to grow equity is to issue shares. In recent quarters, LOAN has made use of a credit facility for $32.5 million ($23 million drawn as of 3Q22) to grow its balance sheet without issuing shares.

Moving into thesis territory, I consider that LOAN provides sufficient protection in a catastrophic scenario, an interesting dividend return in a stagnant scenario and growth possibilities in a positive scenario.

Starting with catastrophe, if the loan market collapses, LOAN only has to recover 31% of its loan book to repay its credit facility and remain mostly equity financed (it has $6 million in notes maturing in 2026). This means LOAN is not exposed to solvency or liquidity risks in the most catastrophic scenarios. It is definitely exposed to a fall in earnings capacity, if it had to reduce its balance sheet or write down some loans, but that is a relatively low risk for a lending operation in this context.

Next, in a tight credit scenario, LOAN could actually benefit. If its leveraged competitors have to quickly reduce their balance sheets because their liquidity dries up, or if they decide to cut risks, LOAN can step in and continue lending, thanks to its equity financed balance sheet. Under such a context, LOAN could ask for higher spreads, or make more income expanding its balance sheet. This means, in essence, that I believe a fall in either credit supply or demand in the overall market will be offset by competitors leaving the market and opening more room for LOAN.

Finally, in the business as usual scenario, LOAN is offering dividends of $0.5 per year on a stock price of $5.5, or a 9% yield. If the company can hold this, it will be providing investors with an interesting return. Of course, given that LOAN has to distribute at least 90% and usually 100% of its earnings each quarter, the effective return on the investment depends on how dividends are taxed for each investor.

Latest developments

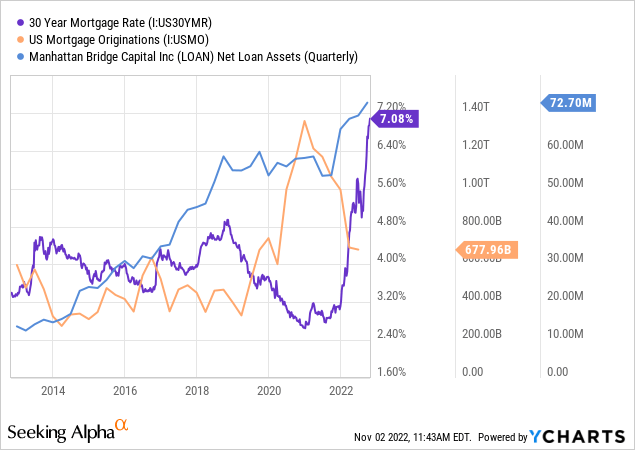

As I expected in January’s article, LOAN has continued expanding its loan book despite mortgages and therefore residential demand falling off a cliff.

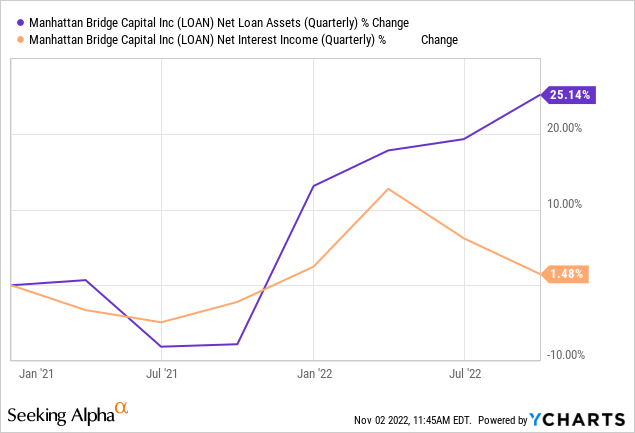

Because the company has a policy of not issuing shares below a previous issuance price, it has used its credit facility to finance its loan book’s expansion. LOAN’s credit facility is tied to LIBOR, meaning that the company was paying 7% rates on that debt as of 3Q22. With more liability financed loans, and higher rates, the company’s margins are falling, as can be seen below.

This has not been felt at the bottom line because the company is still lending more than during 2021, and has generated more fee income. However, bottom line growth, averaging 35% on a YoY basis for 1H22, stood at “only” 11.5% for 3Q22.

Although this scenario is not good, I believe the situation should improve in the following quarters, albeit slowly. LOAN discloses the range charged for its loans on its management’s commentary. For much of 2021, the range had been moving down, both the upper portion and the lower portion, until reaching 8% on the lower end in 1Q22 and then 12% on the upper end in 2Q22. What this means is that older loans (higher rates) were being repaid, and newer ones were being originated at lower rates. For 3Q22, the bottom limit raised to 9%, and the upper one remained at 12%. This means loans are starting to pick up.

How much can be passed to borrowers?

Of course, raising loan rates by 100 basis points for the whole year is nothing against risk free rates or LIBOR rising 400 basis points. LOAN’s cost of funds is rising faster than the company can raise its own rates. This is natural given that there has to be a limit to how much borrowers are willing to pay for a loan in any circumstance. It seems that LOAN has prioritized volume over pricing.

In case LOAN’s liability costs continued rising while it is unable to pass those costs to its borrowers, the company can always choose to cut its balance sheet and repay its credit facility. Again, the credit facility only represents 30% of the company’s book. In that case, LOAN would be generating less business but financing it mostly with equity, at a lower cost.

However, in my opinion LOAN has space for raising rates without disrupting demand. For much of its operating history, LOAN’s rates were above 12%. The extraordinary case has been the 2020, 2021 period, with HML rates below 10% and as low as 8%. If LOAN could reach a 12% level, it should be able to accommodate much of this year’s liability cost increases.

In any case, the balance between credit demand, loan volumes and interest margins is at the core of my investment thesis on LOAN.

Costs are rising for all lenders, and they want to pass some of those costs to borrowers. But home sales are falling, meaning borrowers are less willing to borrow than before, therefore setting a demand limit for rising interest rates. The macroeconomic context calls for a reduction in loan volumes and a compression of spreads.

However, the more leveraged players will quickly find themselves either entering negative spreads territory, or not being able to refinance their own books. These leveraged players may need to wind up a big portion of their operations, and leave the market. In that case, credit supply will drop faster than credit demand, and LOAN would actually find itself in a better position than before.

This is the competitive advantage gained with a strong balance sheet when credit runs dry. In the short-term, it allows LOAN to charges higher rates despite falling demand. In the long-term, it cements LOAN’s business relationships and a reputation for sturdiness. Remember that one of HMLs’ characteristics is that they are ready and quick to lend.

The credit facility

An interesting development to follow in the next two quarters is the renegotiation of LOAN’s credit facility. The facility, with a maximum of $32 million, $23 million of which have been drawn already, matures in February 2023.

Without the facility, LOAN will not be able to grow its balance sheet, and in fact would need to shrink it by 30% in order to repay the facility. On the contrary, if the facility is either maintained or increased, and its maturity extended a few years, it will represent a great vote of confidence on LOAN, cementing its capacity to provide liquidity when others are leaving the market. If creditors lend to LOAN while they cut credit to other lenders, then LOAN will have more leeway to choose business and set rates.

LOAN commented on 3Q22 that it is ‘currently working on extending the Webster Credit Line for an additional three years’, a comment that was absent in both 2Q22 and 1Q22 reports. Because the facility matures in February 2023, it should be renegotiated during 4Q22.

Conclusions

When I recommended LOAN in January and June, I knew it would not be a soft trip. The company was positioned to suffer from rising rates, much like any other business, and particularly those involved in lending.

But the investment thesis was based on LOAN’s competitors being punished more than LOAN because of their excessive leverage. The competitive advantage gained with a strong balance sheet when credit runs dry can be great, both in the short and long term.

In general, the situation has not changed much for LOAN compared to previous quarters. It is suffering as expected, albeit still providing record earnings. The main question has not been answered yet, can LOAN use its strong balance sheet as a competitive advantage? I tend to believe that as conditions worsen, LOAN’s strength will become more evident.

Be the first to comment