FatCamera/E+ via Getty Images

Investment Thesis

Spectrum Brands Holdings (NYSE:SPB) is a consumer conglomerate that operates under 4 distinct business segments: Hardware & Home Improvement (HHI), Global Pet Care (GPC), Home & Garden ((H&G)), and Home & Personal Care (HPC). Spectrum is currently in the process of selling its HHI segment for $4.3B in an all-cash sale to ASSA ABLOY. While this sale is currently facing pressure from the DOJ, the market is acting as if there is a 0% chance of the deal going through. Additionally, Spectrum recently finished internally carving out its HPC segment and is readying it for a sale. In the midst of this restructuring, Spectrum is currently being overlooked due to its high debt level, and pressure from the DOJ on its HHI sale. However, the net proceeds from these sales will be used to aggressively deleverage, and bring Spectrum to a much safer debt level. In order to mitigate the DOJ risk, ASSA ABLOY is pursuing a sale of its EMTEK segment, which should remove any further antitrust concerns from the DOJ. Through a SOTP and probability analysis, we found an implied 4-year share price of $83.64, representing an IRR of 18.7%.

Company Overview

As stated in the investment thesis section, Spectrum operates under 4 distinct business segments. Under each segment, Spectrum operates a collection of consumer brands which include Kwikset, Black + Decker, Healthy Hide, Hot Shot, Cutter, Repel, IAMS (Europe), and other brands that you may recognize. Spectrum operates through a B2B business model and sells these products to retailers and online merchants.

2021 Data (Author) Author

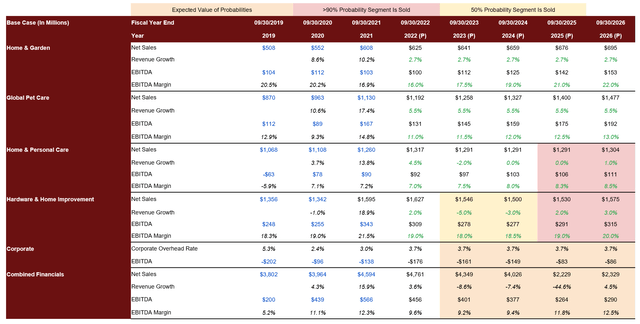

In terms of EBITDA, HHI is by far the highest EBITDA-generating segment for Spectrum, followed by GPC. HHI was listed as a discontinued operation halfway through FY 2021, so we only have the first 2 quarters of data available. However, using an H1 run rate, we came up with projected 2021 data for the segment.

Home & Garden

The Home & Garden segment operates the following brands:

Spectrum Brands Investor Relations

The H&G segment experience strong tailwinds from Covid-19, as people had more time on their hands to pursue home gardening. It is estimated that the Covid-19 pandemic created 18.3 million gardeners, most of whom are Millenials and Gen Zers. Over the past 5 years, H&G has produced average EBITDA margins of 22%, the highest of any Spectrum segment. Spectrum Brands will be keeping the H&G segment throughout the restructuring process, and will become a major part of their business.

Global Pet Care

The Global Pet Care segment operates the following brands:

Spectrum Brands Investor Relations

The GPC segment is arguably the hidden gem within Spectrum. The pet market has exploded over the past decade, as covid-19 created further tailwinds for the market. Since 2017, global pet care expenditures have grown at a 15.4% CAGR! Additionally, pet ownership is being rapidly adopted by younger generations. This will allow for continued growth in the coming decades, as younger generations find themselves in a stronger financial position. With these tailwinds, the GPC segment has been the fastest growing segment in Spectrum, with a 5-year revenue CAGR of ~6.5% (Spectrum has a 5-year revenue CAGR of 3.6%)

Hardware & Home Improvement

The Hardware & Home Improvement segment operates the following brands:

Spectrum Brands Investor Relations

The HHI segment produces the most EBITDA for Spectrum, accounting for nearly 50% of all EBITDA. HHI is currently listed as a discontinued operation, as they’ve entered a definitive agreement to sell the segment to ASSA ABLOY. HHI is a very strong segment, with 5 Year EBITDA margins of 18%, and a 5-year revenue CAGR of ~5%. It is worth noting that the HHI segment is correlated to the housing market, and will likely experience some hardships in the coming year.

Home & Personal Care

The Home & Personal Care segment operates the following brands:

Spectrum Brands Investor Relations

The HPC segment is the weakest segment for Spectrum Brands. HPC has a 5-year revenue CAGR of -.04%, and 5-year EBITDA margins of ~6.5%. This is both the lowest growth rate and the lowest margins of all segments. Additionally, HPC products are more dependent on discretionary spending, which is not great news for the segment given the current economic environment. Spectrum Brands has internally carved out the segment and is pursuing a spin or sale of the business.

Restructuring Overview

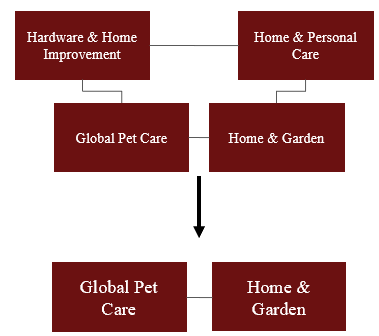

Spectrum has perfectly timed the sale of the HHI segment at the peak of the housing market. A valuation of $4.3 billion represents 12.5x our assumed EBITDA for the segment of $343 million. Spectrum is currently trading at an enterprise value of $4.85 billion, nearly what ASSA ABLOY is valuing just the HHI segment at. In addition to the HHI deal, Spectrum has also internally carved out the HPC segment and is looking to sell that segment as well. In doing so, Spectrum will create a more lean and focused business with just the H&G and GPC segments.

Author

Base Case Valuation

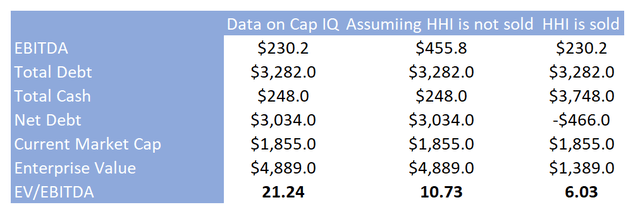

One thing to keep in mind as we look at financials and valuation metrics. The HHI segment has not yet been sold, but it is not reported on the income statement right now. This is because it is listed as a discontinued operation. If you go look at financials on Yahoo Finance or Cap IQ, you will see that HHI financials have been removed. So the EBITDA has been removed, no cash has been received, and no debt has been paid off. This makes the numbers extremely misleading and will make valuations look much higher than they really are. Here’s a good way to look at it:

In the first column, this is likely what you’ll see on financial data sites. Due to HHI being listed as a discontinued operation, the EBITDA from HHI is not taken into account… neither is the potential cash from the deal. So the entire value of the HHI segment is wiped away. We then see the EBITDA multiple plunges in the other two columns, which accurately reflect Spectrum’s current valuation. With this in mind, let’s take a look at the assumptions for the base case:

- 50% chance of HHI segment being sold to ASSA ABLOY at 12.5x 2021 (P) EBITDA by 06/30/2023, with $3.5 billion in net proceeds

- 40% chance of HHI sale being blocked by DOJ, but selling at a lower valuation by 12/31/2024, with $2 billion in net proceeds

- 10% chance of HHI being blocked by the DOJ, and not being sold at a later date

- 100% chance of HPC being sold by 09/30/2024, with net proceeds of ~$600 million

- Net proceeds are used to deleverage to a 2.75x gross leverage ratio, per management guidance.

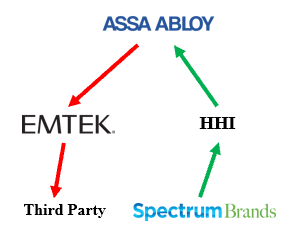

With ASSA ABLOY recently announcing that they are pursuing a sale of EMTEK, the DOJ will likely not have any grounds for antitrust, increasing the probability of the deal going through.

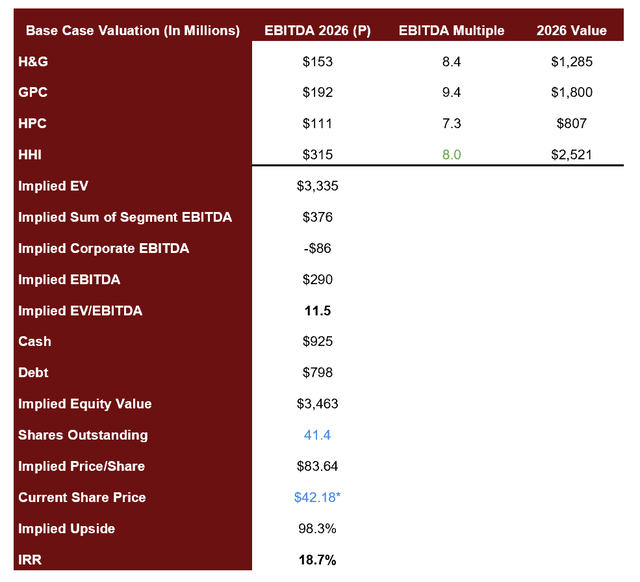

Through a SOTP, using a comp analysis for each segment, we found the implied value of each segment by 2026. We then multiplied the 2026 value by the probability of the segment not being sold and added them together to find the implied EV. From there, we took the expected value of net proceeds and used them to deleverage. This led us to an implied 2026 share price of $83.64, with an IRR of 18.7%.

Asymmetric Risk/Reward

We also completed a bull and bear case analysis with the following assumptions:

Bull Case

- 100% chance that HHI deal closes by 06/31/2023 with net proceeds of ~$3.5 billion

- 100% chance that HPC segment is sold by 09/30/2024 with net proceeds of $700 million

- Net proceeds are used to deleverage to a 2.75x gross leverage ratio, per management guidance

- Macroeconomic environment makes little impact on financials

In this scenario, where everything goes as planned, we see a 4-year price target of $138.53, representing an IRR of 34.6%.

Bear Case

- 0% chance that HHI deal closes

- 0% chance that HPC segment is sold

- 0 net proceeds to deleverage with

- Macroeconomic environment makes a sizable impact on financials

In this scenario, where everything goes poorly, we see a 4-year price target of $39.84, representing an IRR of -1.4%.

______________________________________________________________

These two scenarios highlight the current mispricing of Spectrum. In an absolute best-case scenario, we could see an impressive IRR of 34.6%! This sort of return should thrill any type of investor. On the downside, markets appear to have already priced in the worse case scenarios, with an IIR of only -1.4%! This is an example of an investment with a highly attractive asymmetric risk/reward ratio.

Catalysts

- The sale of the HHI segment is a clear catalyst for SPB shares. With pressure from the DOJ, the market is currently pricing the stock as if there is a 0% chance of the deal going through. However, with ASSA ABLOY divesting its EMTEK segment, the DOJ antitrust concerns should be largely mitigated. Additionally, the sale of the HHI segment will help reduce Spectrum’s exposure to adverse market conditions.

- The sale of the HPC segment is another clear catalyst for SPB shares. Selling the HPC segment will complete Spectrum’s vision for a “pure play Home & Garden and Pet Care business” (Assuming HHI is sold). This will allow management to more efficiently allocate capital to the remaining segments.

- Deleveraging is another potential catalyst that the market is overlooking. Using net proceeds from restructuring, Spectrum will be able to go from a ~6x gross leverage ratio to a 2.5x – 3.0x and have cash to spare. The reduction of debt is very likely to lead to multiple expansion as the investment will appear less risky.

- Lastly, excess cash after deleveraging can be used to fuel organic growth or return value to shareholders. The announcement of a new share buyback program or an increased dividend could serve as another catalyst.

Risks

- The antitrust lawsuit from the DOJ is a large risk for the HHI sale. The inability to sell the HHI segment would largely reduce its capability of Spectrum to reduce its current debt load. However, ASSA ABLOY has announced they have started the selling process of its EMTEK segment in the U.S and Canada. This should eliminate antitrust concerns from the DOJ, and greatly increases the chances that the deal goes through.

Author

2. Spectrum has a somewhat concentrated customer profile. Across all segments, ~39% of sales come from 4 different customers: Home Depot, Lowe’s, Walmart, and Amazon. Unfortunately, there is no real way to mitigate this risk. However, 39% for 4 customers is not concentrated to the point of being uninvestable, but rather something to keep in mind.

3. Lastly, the current macroeconomic environment poses a threat to Spectrum’s business. By selling the HHI and HPC segments, Spectrum will be able to reduce some of the macro risks involved. The HHI segment is correlated to the housing market, while HPC is dependent on discretionary spending. By selling these two segments, Spectrum will be left with a more resilient core business. However, the inability to sell these segments could lead to increased earnings volatility.

Final Recommendation

Spectrum Brands appears to be an attractive investment opportunity as the market is currently pricing in the worst-case scenario. An investment in Spectrum provides a large upside potential with relatively limited downside. I recommend initiating a long position, and holding it for 6 months – 4 years. I wouldn’t necessarily plan to hold Spectrum for 10+ years, as I don’t really see them as a potential long-term compounder. However, with a medium-term time horizon, the current restructuring offers substantial potential for outsized returns.

Be the first to comment