GuyNichollsPhotography/E+ via Getty Images

Introduction

As legendary investor Warren Buffett says, “Be fearful when others are greedy and greedy when others are fearful.” That’s why I always try to maintain a certain balance within my portfolio between stocks that I think will perform above average in current market conditions and stocks that are currently underperforming but in which I see the potential for above-average performance in the future.

Malibu Boats (NASDAQ:MBUU) is one of the leaders in the manufacturing and sales of recreational powerboats and performance sport boats. Their product portfolio includes 8 brands (Malibu, Axis, Pursuit, Maverick, Cobia, Pathfinder, Hewes and Cobalt). These boats can be used for a wide range of activities e. g. recreational boating, several types of water sports and fishing.

To sell their boats, Malibu Boats uses a dealer sales strategy. According to 2022 10-K their distribution network consists of over 400 dealers globally (over 300 in the US and 100 across Europe, Asia, Australia and New Zealand).

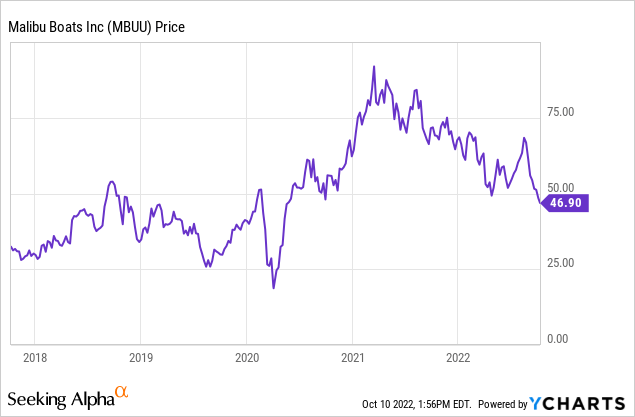

Malibu Boats belongs to the consumer cyclical sector. This sector tends to be avoided by investors at the moment. Negative market sentiment is also reflected in the share price. If we look at the share price of Malibu Boats we can see that since March 2021 the share price has been steadily declining to the current $47.20 per share.

This decline was first attributed to supply chain problems caused by the COVID-19 pandemic and is now driven primarily by concerns about macroeconomic effects and a possible coming recession. In this article, I would like to outline that these fears may not be entirely justified and that Malibu Boats stock is poised to deliver nice appreciation for investors in the coming years.

Total addressable market of Malibu Boats doubled in the last six years

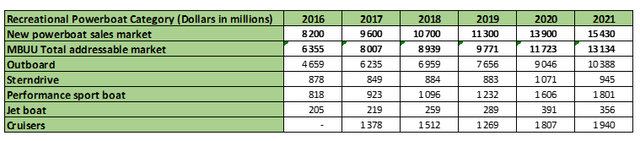

For those who have read any of my previous articles, it is already clear that I will not forgive myself for at least a brief insight into the industry and its prospects at the beginning. According to the data from the company’s various annual reports, we can see a long-term growth trend in the sales of new powerboats. This market has risen from an initial $8.2B in 2016 to $15.4B in 2021. It is estimated that the future CAGR of this industry should be ranging from 6 to 7%.

Powerboat sales market 2016 – 2021 (Annual reports)

The main reason for the growth in sales of powerboats has been the increasing popularity of boating and fishing as recreational activities. More than 100 million Americans go boating each year and more than 11.9 % own their own recreational boat. Boating was also one of the activities that people enjoyed during the COVID-19 period, as it provided an effortless way to distance themselves from other people.

This positive trend within the industry had a positive impact on the total addressable market of the company. TAM has more than doubled to $13.1B since 2016 and includes outboard, sterndrive and performance sport boat products. But the positive development in new boat sales was not the only driver of the company’s growth.

Long-term growth was supported by clever capital allocation through acquisitions

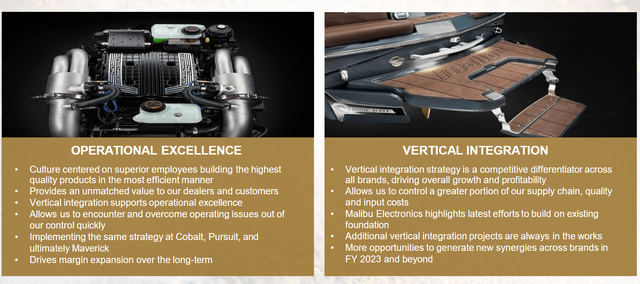

No less important were the acquisitions made. These acquisitions were both aimed at expanding the company’s own product portfolio, but also at vertically integrating the supply chain where the company focused on gaining greater control over the entire production process.

Long term strategy explanation (Q4 2022 Earnings presentation)

The three most important acquisitions in recent years include:

The strategic acquisition of Cobalt Boats was announced in June 2017, with a purchase price set at $130 million. Cobalt Boats was a direct competitor to Malibu Boats, particularly in premium sport boats and outboard boats. The business model for both was very identical and therefore allowed for quick integration of the two companies and therefore a quick benefit from the acquisition in question. The fact that the two companies were so similar in their products offered the opportunity to combine the strengths of each product to bring greater value to customers. On top of that along with the acquisition of Cobalt Boats, Malibu Boats also gained an established dealer network with more than 132 locations, which I consider to be a huge advantage to this acquisition.

In 2018 acquisition of Pursuit Boats valued at $100 million was announced. I think that the main purpose of this acquisition was quite different from the purpose of Cobalt Boats. With the Pursuit Boats acquisition, Malibu could expand its product portfolio to a more luxurious segment. If we compare the average prices of these brands, Malibu Boats and Cobalt boats have an average price of $89k and an average price of Pursuit Boat is $243k. After finishing this deal Malibu also acquired a huge manufacturing facility (more than 230k sq. ft.), which helped them to expand their production even more.

Maverick Boat Group’s latest acquisition follows a similar pattern to the two previous ones. Malibu Boats management especially appreciates that Maverick is a leader in the center console and bay boat categories, which should achieve good synergies with the Pursuit boat category. At the same time, the acquisition will bring further opportunities to expand sales and production capacity with an additional 70 dealer locations and 2 manufacturing facilities.

If I had to evaluate the acquisitions, I would have to say that from my point of view the management did a very good job. These acquisitions were not only driven by the need to allocate surplus funds, but they clearly show that management has also thought about their integration within the production process and the overall benefit they can provide to the company. These were always purchases with a clear purpose (e.g., to expand the current product portfolio, to expand the company’s production capacity, or to expand the sales network). At the same time, all acquired companies were leaders in a particular segment and were able to have an almost immediate positive impact on the financial results of Malibu Boats. It is this type of capital allocation that is most beneficial to companies and allows them to better position themselves in the market and increase their competitive advantage.

A quick look at the financial results and relative valuation of Malibu Boats

Now let’s take a look at how the aforementioned aspects are reflected in the company’s financial statements.

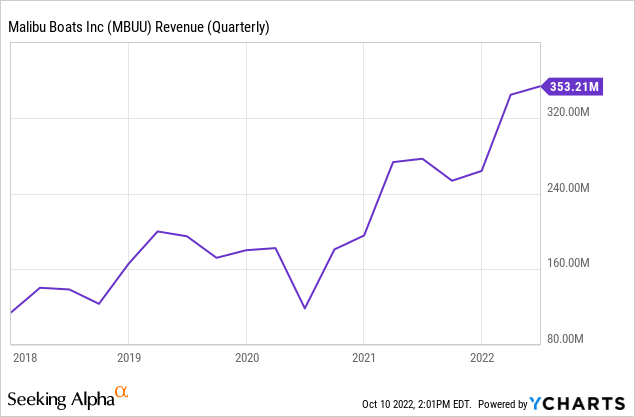

Revenue

First, let’s look at the company’s sales. There is a clear upward trend in the company’s sales. As mentioned, this growth has been supported by developments within the industry and by the various acquisitions that the company has made during this period.

The only exception was a significant drop in sales in mid-2020. This decline was due to the COVID-19 pandemic, which forced Malibu Boats to close some of its production facilities. Although it appears from the sales figures that the company was able to cope with this quickly, make no mistake. This closure, along with other disruptions in the supply chains, has had a significant impact on Malibu Boats to this day.

During the COVID-19 pandemic, there was a significant increase in demand for new ships. This also increased demand for Malibu Boats’ products and, as confirmed by management in the latest earnings call, this demand has virtually continued to this day. In this earnings call, Jack Springer CEO of Malibu Boats mentions that the company has already filled pre-orders for boats for the first half of 2023.

However, the real problem is that because of the closure of Malibu Boats’ production facilities, this demand could not be met by the production of new boats. Most of this demand had to be met from inventories that were already produced. Although production has already started at the Malibu Boats facilities, most of the boats currently produced have already been sold and so there’s no way to replenish the missing inventories.

Now you may be thinking that this is not negative news and that the high demand for Malibu Boats products is solely positive. I agree with that. On the other hand, we have to recognize that some customers are not willing to wait for a new ship and are looking for alternatives to get it faster. Malibu Boats’ dealers can offer such customers an extremely limited choice precisely because of the exceptionally low inventory, and this may lead these customers to seek acceptable alternatives from competitors.

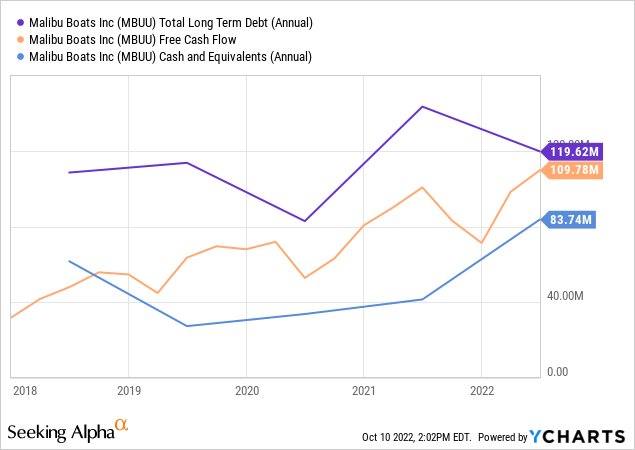

Long-term debt, cash and free cash flow

The other thing I would like to address in this section is the long-term debt of Malibu Boats and its evolution. Stocks that base much of their growth on acquisitions often have a problem with the debt that arises because of financing those acquisitions. However, this is not the case with Malibu Boats.

Although long-term debt has gradually increased over time, there is certainly no over-indebtedness. We can see that the company currently has approximately $83 million in cash and cash equivalents, which would be sufficient to repay a substantial portion of its long-term debt. At the same time, it generated a total of $109 million of free cash flow in its most recent fiscal year. This means that if the company chose to, then it could pay off its long-term debt almost immediately.

Relative valuation and operating margin

Next, I would like to focus on the relative valuation of Malibu Boats compared to other competitors in the same industry. For this comparison, I have selected three competitors:

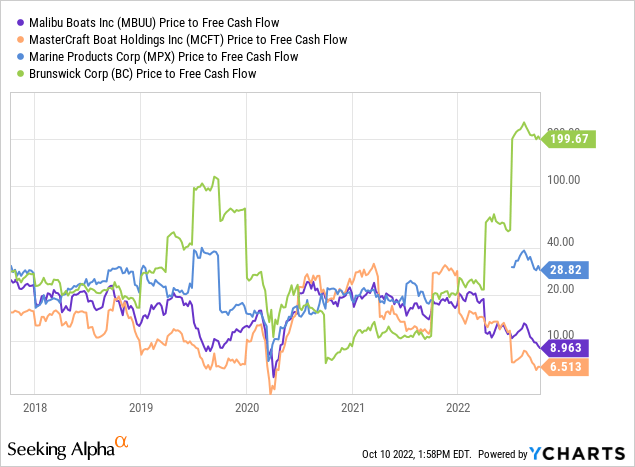

I will compare these companies in terms of P/FCF ratio.

We can see that of the selected companies, Mastercraft Boat Holdings has the lowest P/FCF ratio with a value of 6.36. Malibu Boats trades at a slightly higher multiple of 8.97 and well above both values are Marine Products Corp. with a P/FCF ratio of 29.22 and Brunswick Corp. with a value of 199.23. The long-term industry median is 15.68. Thus, this means that according to the P/FCF ratio, both Mastercraft Boat Holdings and Malibu Boats appear to be highly undervalued.

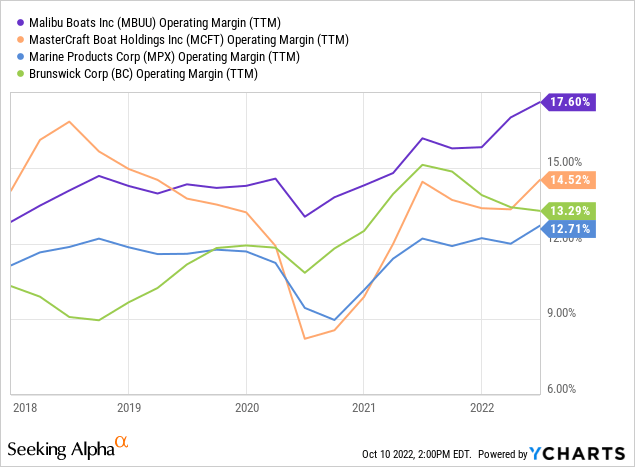

Although the P/FCF ratio showed that Mastercraft Boat Holdings is cheaper it does not automatically mean that such stock will be better in terms of potential returns. The quality of these stocks is also important. For this reason, I proceed to supplement the results obtained using this ratio with the operating margin of the individual companies. A stock that has a certain competitive advantage over others will usually have a higher margin than its competitors.

In terms of operating margin, we can say that Malibu Boats really stands out above its competitors. Not only because it has the highest operating margin of the four, but mainly because of its stability and how it is able to maintain its operating margin even in times of crisis. This was most evident in the last COVID-19 crisis. Although boating as a sector did not perform badly at all, we see a significant decline in the operating margins of Malibu Boats’ competitors during this period. For Malibu Boats, this decline was only about one or two percentage points at most. Therefore, if I had to choose which of these companies to invest in, it would be Malibu Boats. From my perspective, it is always better to own a company that is valued at slightly higher valuation multiples and that achieves higher and more stable margins.

Key takeaways from latest earnings call.

Last quarter was also the quarter that Malibu Boats reported results for fiscal year 2022. It was another record year for the company. For the fourth quarter of 2022, Malibu Boats reported total revenues of $353 million (27.64% Y/Y growth), beating analysts’ estimates by $24 million. Likewise, EPS of $2.43 beat analysts’ estimates by 14 cents per share.

Strong demographic and no signs of slowing demand right now

The financial results that Malibu Boats presented for this year were absolutely stunning, but what is even more important is the following statement regarding the demand for large boats by Malibu Boats CEO Jack Springer:

Speaking to our brands and what we have, we are not seeing any type of a shift change. We continue to see people come out and buy the larger boats.

This confirmed that Malibu Boats has not yet experienced any significant changes in its customers’ behavior as a result of the current economic conditions. At the same time, there is also no reduction in current demand. However, this is completely contrary to what we would expect in a sector as cyclical as boat sales and contrary to what the market expects.

Jack Springer, however, also offered an explanation for this phenomenon. According to him, it is due to the demographic distribution of their customers. Most of them are people with high annual incomes and therefore the current high inflation and high-interest rates have not yet had as big impact on them as on customers from lower income brackets.

If this is true, and indeed most Malibu Boats customers are people from high-income group, then it completely changes the view of the entire company. If we want to talk about any change in the buying behavior of these customers, it will be at most in the late stages of a recession, when economic conditions are so miserable that it will force even these people to change their habits. However, we are nowhere near that stage at the moment.

Vertical integration strategy brings benefits

In the section where we discussed the individual acquisitions, we said that some of the companies being bought have a business model close to that of Malibu Boats and that one of the reasons for buying them may be to achieve certain synergies that will provide both higher production capacity and increase the company’s profitability. On how the vertical integration strategy is helping the company to cope with the current period of increased demand, Jack Springer commented this way:

During the fiscal year, we have met unwavering demand by ramping up our production capabilities through our vertically integrated model. As a result, we supported strong order volumes that ultimately exceeded our full year guide.

It is great to have this confirmation that the vertical integration strategy is delivering the expected benefits to the company. The anticipated benefits in the form of increased production capacity at the individual production plants are already beginning to take effect.

Not great, not terrible FY23 outlook

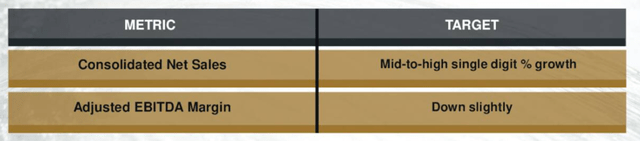

As this was the last quarter of fiscal year 2022, management also provided its estimates of future developments. They expect mid-to-high single digit % growth in sales and EBITDA margin to go down a little bit.

FY2023 Outlook (Q4 2022 Earnings presentation)

They still expect relatively strong growth in the first half of 2023, given the number of pre-orders they currently have, and in contrast cooling and lower growth in the second half of fiscal 2023. Although no significant changes in customer behavior can be seen at present, management’s outlook assumes a scenario that customer demand will be down high-single-digit percentage in 2023.

In my view, this is a conservative assumption. If this assumption proves to be correct, it is already included in the outlook for next year and thus priced into the stock price. On the other hand, given the circumstances presented throughout the article, I can also imagine a situation where demand for Malibu Boats’ products does not decline significantly, and this could be a positive catalyst for immediate price growth.

Risks

There are inherent risks associated with any investment, and Malibu Boats is no exception. Therefore, in this part of the article, I would like to highlight the main ones. These risks will primarily be associated with the current elevated level of demand and also with possible negative developments within the overall market.

One of the risks, which had already been mentioned in the article, can be seen in the context of supply chains and low stock levels. As people do not want to wait six months or in some cases even a year for their ships to be delivered, they may decide to approach a competitor who will have the model of ship they want. In doing so, Malibu will not only lose revenue from the sale of the boat itself but also from the sale of accessories and extras that are inherently associated with the purchase. At the same time, this is one of the risks that the company cannot significantly influence. The problems with supply chains that arose because of the COVID-19 pandemic in the market persist and it is not possible to say with certainty when they will subside, and production can be fully resumed.

Another potential risk also relates to the current increased demand for powerboats. As a result of this high demand, first-time buyers have entered the market. Going forward, it will be important whether Malibu Boats will be able to retain these customers and ensure that they remain loyal to their brand the next time they buy.

Risks that are not related to demand but to the current economic conditions include the risk of rising interest rates. The average purchase price of Malibu Boats brands is in the lower hundreds of thousands of dollars and customers are using several types of financing for these purchases. If interest rates rise significantly and customers lose the ability to finance these more expensive boats with their income. This will undoubtedly lead to a reduction in demand. However, as we have outlined throughout this article this risk is slightly reduced by the demographics of Malibu Boats’ customers as they are mainly high-income customers.

A fourth potential risk that could affect Malibu Boats’ profitability is the current rising inflation. This is not only affecting households but also firms and making their production inputs more expensive. Malibu Boats is trying to combat this in part by sourcing a large part of its production in-house. However, it is still dependent on the supply of some components from other suppliers.

Summary

Overall, I have to say that I was positively surprised by Malibu Boats stock. At the current valuation, they strike me as a great fit to add to an investment portfolio. The company operates in an industry that is growing over the long term, management has defined a long-term strategy to follow and is making decisions that are clearly positive for the company’s shareholders. Financially, it is a healthy company with almost zero debt. And although the market conditions are now not very favorable for similar companies, Malibu Boats shows that it is well positioned for future growth. I’m definitely putting Malibu Boats stock on my watchlist, and I’ll be thinking about whether or not to gradually start building my stock position in this company.

Be the first to comment