shylendrahoode/iStock via Getty Images

Investment Thesis: I take the view that a rebound to positive earnings in the next couple of quarters is plausible. Should this happen, then it could serve as a bullish signal for the stock.

In a previous article back in October, I made the argument that MakeMyTrip Limited (NASDAQ:MMYT) could potentially see upside if earnings growth returns to positive territory on the back of higher booking demand.

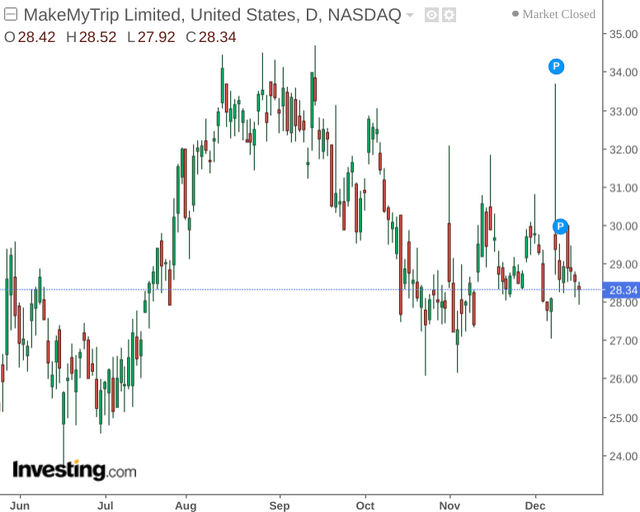

With that being said, the stock is down by just over 5% since my last article:

The purpose of this article is to determine if such downside is justified given recent performance, and whether MakeMyTrip could have scope to rebound from here.

Performance

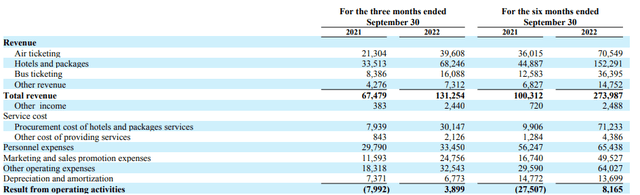

When looking at revenue performance, we can see that growth was strong across all segments on both a three-month and six-month basis.

MakeMyTrip Q2 FY23 Earnings Release

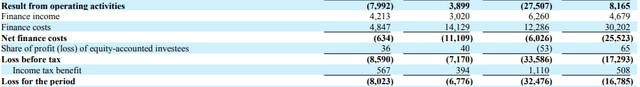

Additionally, we can see that result from operating activities has also rebounded to positive territory on a three and six-month ended basis.

However, we can also see that net finance costs substantially reduced profitability and the company saw a net loss – albeit lower than for the same period last year.

MakeMyTrip Q2 FY23 Earnings Release

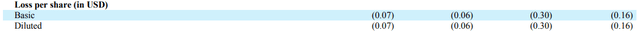

As a result, the company continued to see a net loss on a three and six-month ended basis:

MakeMyTrip Q2 FY23 Earnings Release

With that being said, MakeMyTrip reports that the sharp increase in net finance costs resulted from a net foreign exchange loss of $9.6 million for the quarter ended September 2022 as compared to June resulting from the depreciation of the Indian Rupee against the U.S. dollar.

In this regard, while a weaker rupee may have attracted booking interest from U.S. travellers thus resulting in higher revenue – the corresponding increase in net finance costs has still resulted in an overall loss.

From a balance sheet standpoint, we can see that while the quick ratio has decreased since March – the ratio still remains well above 1 – indicating that MakeMyTrip is still in a strong position to meet its current liabilities using existing liquid assets.

| Mar 2022 | Sep 2022 | |

| Total current assets | 591,365 | 636,721 |

| Inventories | 11 | 38 |

| Total current liabilities | 191,216 | 233,945 |

| Quick ratio | 3.09 | 2.72 |

Source: Figures sourced from MakeMyTrip Q2 FY23 Earnings. Figures provided in USD thousands, except the quick ratio. Quick ratio calculated by author as total current assets less inventories all over total current liabilities.

Additionally, we can also see that the ratio of long-term debt to total assets remains minimal.

| Mar 2022 | Sep 2022 | |

| Non-current loans and borrowings | 2,776 | 3,088 |

| Total assets | 1,322,744 | 1,329,155 |

| Long-term debt to total assets ratio | 0.21% | 0.23% |

Source: Figures sourced from MakeMyTrip Q2 FY23 Earnings. Figures provided in USD thousands, except the long-term debt to total assets ratio. Long-term debt to total assets ratio calculated by author.

From this standpoint, MakeMyTrip’s balance sheet is strong and the company looks to be in a strong position from both a short and long-term financial standpoint.

Looking Forward

Going forward, I expect that MakeMyTrip should be in a position to continue growing revenues – the company has shown that booking demand remains strong in spite of global inflationary pressures.

In addition, MakeMyTrip has seen an overall profit from operating activities – with net finance costs ultimately having resulted in an earnings loss. However, it is encouraging that even with a sharp rise in net finance costs – the company’s loss remains significantly lower on a six-month ended basis.

In this regard, should we see strong revenue growth continue – then it is conceivable that MakeMyTrip could see positive earnings in spite of a weaker Indian Rupee.

Moreover, a weak currency could have the effect of further bolstering booking demand by international travellers over the coming months – as the high season of October to March is typically a popular time for travel across India.

Conclusion

To conclude, MakeMyTrip Limited has seen strong revenue growth in the most recent quarter. While a strong dollar lowered profitability – it is encouraging that MakeMyTrip still managed to reduce its losses from that of the same period last year.

Additionally, MakeMyTrip’s strong balance sheet metrics have also been encouraging, and the company seems to be in a good financial position to fund further revenue growth.

Given that revenue from operating activities has rebounded into positive territory, I take the view that a rebound to positive earnings in the next couple of quarters is plausible. Should this happen, then it could serve as a bullish signal for the stock.

Be the first to comment