Yarygin/iStock via Getty Images

Aurora Cannabis Inc. (NASDAQ:ACB) has lost more than 40% of its market value since my previous article on the company in May. Yesterday’s earnings report did little to convince investors that Aurora is on the path to profitability. With its first mover advantages, one would have thought Aurora would become a profitable cannabis giant, but industry dynamics and the company’s questionable business strategy have made it difficult for Aurora to leverage the first mover advantages. Things do not seem to be changing either, and I will avoid Aurora Cannabis stock for the time being.

Aurora Q4 earnings – Saving costs to achieve positive EBITDA won’t move the needle

Aurora’s fiscal fourth quarter performance was truly disappointing, but shareholders of the company are getting used to disappointing numbers from the company.

- Revenue declined 8.4% YoY to C$50.22 million.

- EBITDA loss narrowed to C$12.9 million from C$21.8 million in FQ4 2021.

- Adjusted gross margin shrank to 52% from 57% in FQ4 2021.

- Net loss shot up to C$618.8 million from C$134 million (non-cash impairment charges of C$505.1 million).

- Consumer cannabis segment revenue declined 8% YoY to C$12.6 million.

- Medical cannabis segment revenue increased 4% YoY to C$36.6 million.

As I have now gotten used to, the earnings call started with management discussing the progress Aurora has made in its cost savings goal along with the measures the company has taken to strengthen its balance sheet which include repurchasing $155 million in convertible debt. Aurora, according to management, had $370 million in cash as of September 19.

The company seems to be laser-focused on cutting costs to achieve its EBITDA goals, which is not a bad thing, but I doubt whether achieving this goal will move the needle and trigger a positive response from investors. In my opinion, Aurora has a growth problem as the company seems to be struggling to unlock meaningful growth opportunities despite the promising outlook for the cannabis industry.

The market loves growth and disruption, and today, Aurora is finding it difficult to grow. There are inherent problems that limit the company’s growth.

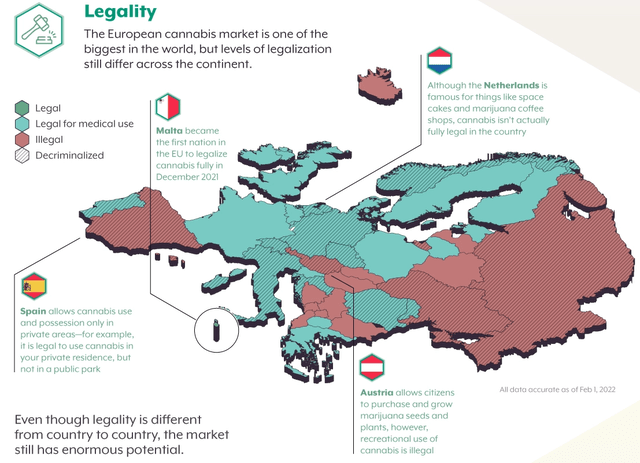

- The Canadian medical cannabis market is growing slowly and the company is looking for growth in international markets, primarily in Europe. Although international revenue clocked in more than 35% YoY growth in FQ4, these markets are considerably smaller than the U.S. and Canada, which is why Aurora is failing to grow its topline despite strong international sales.

- As illustrated in Exhibit 1, cannabis legalization still has a long way to go in Europe, and current regulations are complicated and difficult to navigate. Aurora and its shareholders, therefore, have to curb the enthusiasm about international medical sales moving the needle in the next few years.

- The recreational cannabis market is growing faster than the medical market as legalization for adult use in key regions is bringing consumers to more legal channels. Aurora has been late to act on the opportunities available in this market. The current challenges stem from the low margins associated with recreational cannabis, which is a problem that I believe will persist in the foreseeable future for reasons discussed in the next segment of this analysis.

- Aurora will have to invest substantial amounts of money in the next decade to retain its market leadership position in the medical cannabis sector, and because Aurora is not backed by a large food and beverage company, most of the funding is likely to take the form of debt and equity issuance. Issuing equity is a double-edged sword.

Exhibit 1: Legalization of cannabis in Europe as of February 1

Visual Capitalist

Source: Visual Capitalist

The findings presented in the next segment will reveal why Aurora will continue to remain challenged to achieve growth.

The illegal cannabis market poses a massive threat to legal cannabis sales

When I read some of the articles published on the prospects for the cannabis market, I always get the feeling that certain analysts believe the legalization of cannabis will trigger a shift in consumer purchasing habits and go on to kill the illegal cannabis market once and for all. This, in my opinion, is a very risky assumption.

According to a new study conducted by the School of Public Health Sciences, the University of Waterloo, the price and inconvenience associated with purchasing cannabis from legal channels are pushing many consumers to use illicit cannabis in both the United States and Canada. In the U.S., slow delivery and requiring a credit card were also reported as barriers to the growth of the legal cannabis industry. The price difference between illegal and legal cannabis is a primary reason for consumers to prefer illegal sources, and this is a barrier Aurora and its competitors are finding difficult to overcome. If we look at California, one of the first few states to legalize cannabis for recreational use (2016), legal cannabis is losing to illegal cannabis because of the substantial costs associated with selling cannabis legally. Below are some of these costs.

- Approved companies must apply for a state license to sell cannabis and obtaining a license could cost 6-figure amounts because of consulting fees.

- Businesses are expected to register every gram of weed that is sold or grown, and this rule forces companies to spend large amounts on purchasing and maintaining software solutions.

- Legal cannabis should be tested for more than 100 different contaminants.

- Several taxes are levied by the state government such as cultivation tax, excise tax, and sales tax.

These costs eventually add up and make legal cannabis significantly more expensive than illegal cannabis. There are other limitations too. For example, in California, retailers can sell legal cannabis between 6 am and 10 pm, meaning legal cannabis cannot be sold after 10 pm. This is a major limitation faced by legal sellers in attracting and retaining customers.

Although the consumer cannabis market is expected to boom in the coming years with favorable regulatory decisions, I believe the black market for cannabis poses a major threat to the success of legal cannabis in every corner of the world. Consumers are used to purchasing cannabis products in the black market and those products are considerably cheaper as well. Legalization, therefore, is unlikely to tilt the odds in favor of legal cannabis until there is cost parity between the two markets.

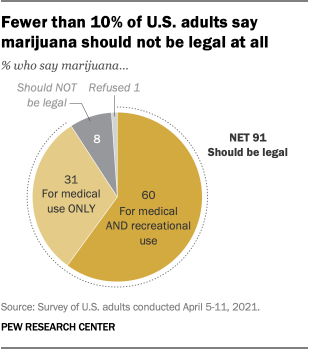

Many people, however, support legalization, which is evident from the survey results published by Pew Research Center in 2021.

Exhibit 3: U.S. adults support cannabis legalization

Pew Research Center

Source: Pew Research Center

Despite this support for legalization, cannabis consumers, in my opinion, will stick to illicit cannabis when given a choice, which makes it difficult for Aurora and its peers to make the most of legalization.

Consolidation is on the cards

The medical cannabis market is growing slowly. The consumer cannabis market is growing fast, but it’s difficult to overcome the threat of illicit cannabis for many reasons. Aurora, therefore, has found itself in a tough spot. There’s no room to cut down on investments too as the entire future of the business hangs on the company’s ability to improve its product offering and science to attract customers and gain the approval of regulators. What works for Aurora is that the company is the leading player in the medical cannabis market in Canada and has already started exporting products to Europe and Australia. In the coming years, I believe the cannabis industry in Canada will see consolidation as it does not seem viable for hundreds of companies to operate in a fragmented market with no guarantee of earning positive ROIC.

Takeaway

Aurora Cannabis stock is not appealing despite losing more than 94% of its value in the last five years. Cost cutting, in my opinion, will not bring back the glory days, and on the other hand, there are many barriers to growth. I will avoid ACB stock until there is concrete evidence to suggest the company is moving in the right direction to convert its first mover advantages into stellar financial results.

Be the first to comment