metamorworks

Main Street Capital (NYSE:MAIN) is one of the most consistent dividend payers in the business development industry, in my opinion.

The company pays a $0.22 per share monthly dividend and supplements it with special dividends to distribute excess income. Having said that, I don’t believe Main Street’s valuation is fully justified.

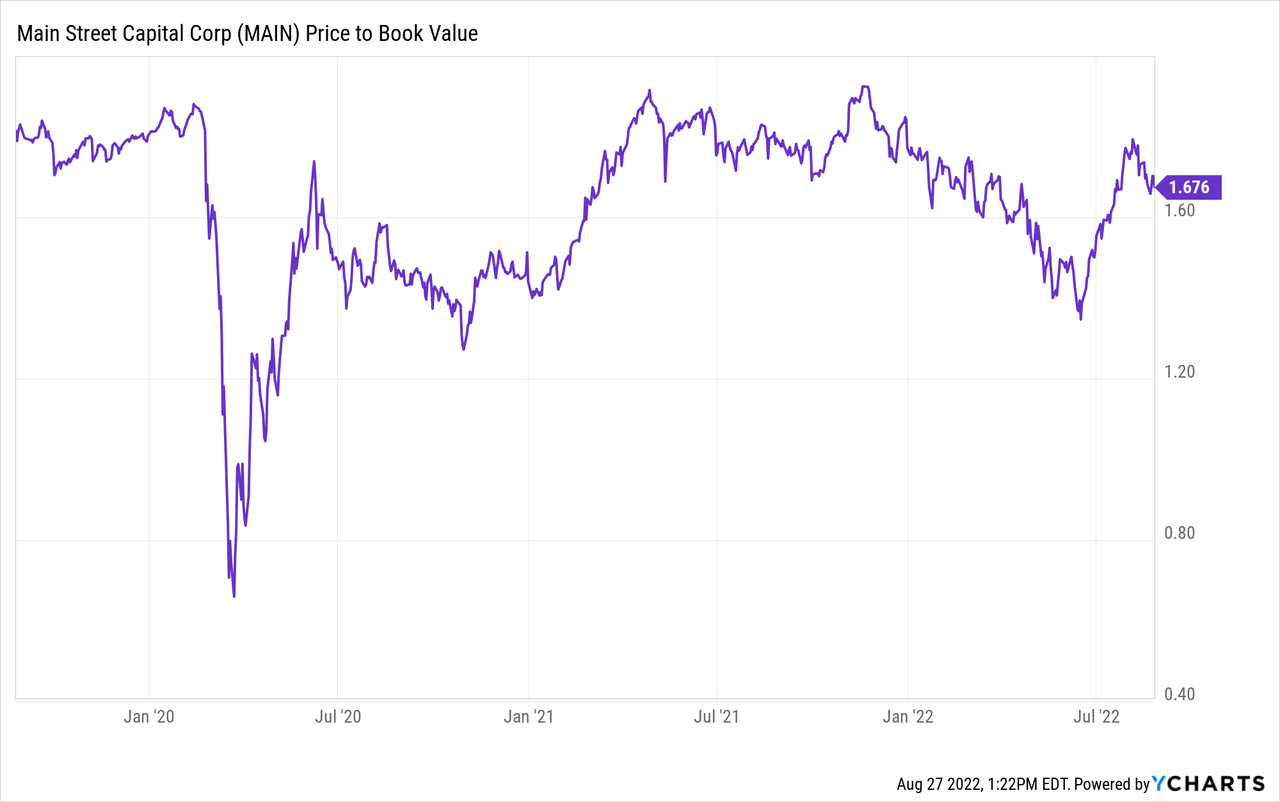

The stock of the BDC trades at a 69% premium to net asset value, which is the highest premium in the BDC industry.

Despite the fact that the dividend is attractive and is covered by net investment income, investors are likely overpaying for the BDC’s income stream.

Decent NAV Growth, Safe Portfolio And Low Pay-Out Ratio

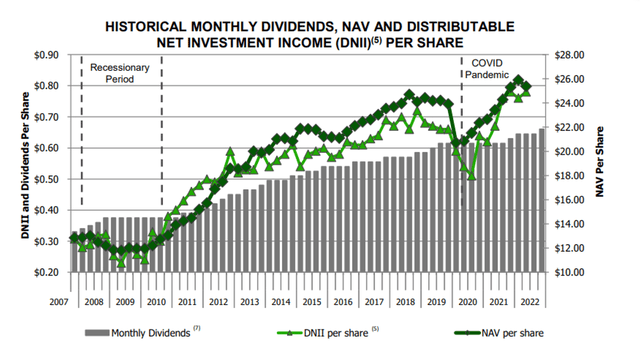

Over the last fifteen years, Main Street has made a name for itself by delivering consistent portfolio results, particularly in terms of net asset value growth.

Main Street’s net asset value fell during the Covid-19 pandemic as asset values fell and some borrowers experienced increased financial stress, but the BDC has recovered well from the pandemic shock.

Since its inception in 2007, Main Street has consistently increased its net asset value. The BDC’s net asset value was $25.37 as of June 30, 2022, representing a 97% increase since the end of 2007, when Main Street’s net asset value was $12.85.

Historical Monthly Dividends (Main Street Capital Corp)

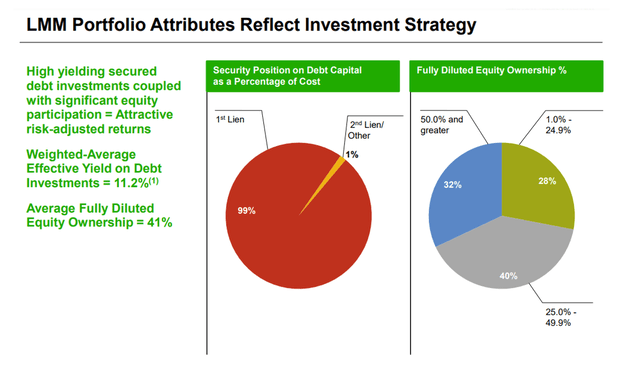

The lower middle market debt portfolio, which consists primarily of First Liens, is at the heart of Main Street’s investment portfolio.

First Liens are the most secure type of debt because they are highly secured and have low loss ratios. As of June 30, 2022, First Liens represented 99% of Main Street’s lower middle market portfolio, which was valued at approximately $1.8 billion and included 75 portfolio companies.

The average loan in the LMM portfolio had a fair value of $24.2 million and a cost of $20.1 million. As of June 30, 2022, the weighted average effective debt yield for the LMM portion was 11.2%.

Lower Middle Market Portfolio (Main Street Capital Corp)

Aside from the LLM portfolio, Main Street Capital has $1.3 billion invested in a private loan investment portfolio of 82 investments (99% secured debt) and a $364 million middle market portfolio (also 99% secured debt).

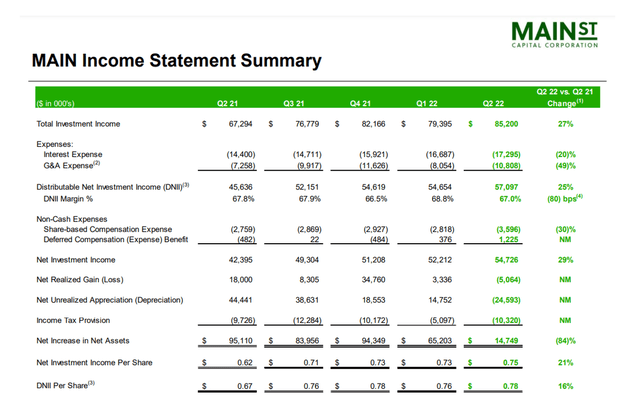

Main Street’s investment portfolio continued to perform well in the second quarter, with distributable net investment income increasing 25% YoY to $57.1 million in the midst of a broad economic recovery. Main Street’s distributable net investment income of $0.78 per share, up 16% YoY, more than covered the BDC’s regular monthly dividend, which cost the company $0.645 per share in 2Q-22.

The pay-out ratio was 83% in the second quarter and 82% over the last twelve months, giving Main Street’s dividend a very high margin of safety.

Income Statement Summary (Main Street Capital Corp)

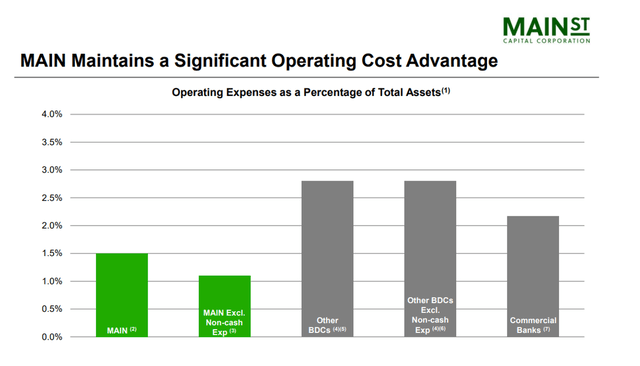

Internal Management Translates Into Lower Operating Costs

Main Street is an internally managed business development company, which distinguishes the BDC from others in the industry. Internally managed businesses save money on incentive fees that must be paid to the external manager, resulting in a more competitive cost structure and lower operating expenses.

Main Street can distribute a larger portion of its profits to shareholders as monthly dividends or special dividends due to lower operating expenses.

According to Main Street, the business development company’s operating expenses are 1.5% of total assets, which is slightly less than half of the national average for publicly traded BDCs.

Operating Expenses (Main Street Capital Corp)

A Very Generous Valuation

Despite the fact that Main Street is outperforming in terms of net investment income growth, the BDC’s stock is trading at such a high net asset value multiple that I believe investors are limiting their ability to earn attractive long-term returns.

Main Street’s net asset value in 2Q-22 was $25.37, representing a 69% premium to net asset value. I don’t believe that such a high premium is justified given that the stock only yields 6.1%, leading me to conclude that MAIN is significantly overpriced at its current valuation.

Why Main Street Could See A Higher Valuation

Main Street is a ‘flight-to-safety’ stock, which means that when emotions run high in the market and investors are concerned about the economy, for example, they tend to buy quality companies.

Main Street trading at such a high net asset value multiple is also due to its reputation as a dependable dividend payer with a rock-solid monthly dividend.

The perception that Main Street is a safe place to park capital may result in an even higher net asset value multiple.

My Conclusion

Despite Main Street’s strong portfolio and growing net investment income, I believe the business development company’s stock is likely significantly overvalued.

Main Street’s LMM portfolio yields 11.2%, while investors only receive a 6.1% dividend return based on monthly dividends.

Because Main Street’s stock is trading at a 69% premium to net asset value, I believe income investors’ opportunities to earn attractive total returns are limited.

Be the first to comment