SunnyVMD/iStock via Getty Images

With MPLX’s (NYSE:MPLX) heavy presence in crude oil and hydrocarbon product transportation, in particular for its former parent Marathon Petroleum (MPC), the company’s unit price, which attaches itself, at least in a loose fashion, to crude prices, might be expected to follow suit in a crude oil bull market. Picking up a magnifying glass, we took a closer look at this and other growth potentials.

A Company Summary

MPLX consists of two businesses, Logistics & Storage plus Gathering & Processing. Logistics & Storage manages a multitude of pipelines across the Mid-West, Southwest and Rocky Mountains. Gathering & Processing resides heavily on northeast properties. During 2021, the company generated $4.6 billion in distributive cash flow (DCF).

From the Last Quarterly Results

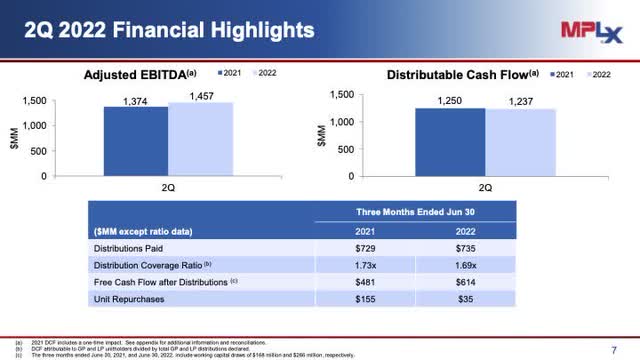

Beginning with last quarter, the company stated:

“Our operating results this quarter represented 6% increase from the second quarter of last year. This performance highlights the continued resiliency of our base business, tailwinds from higher NGL prices, as well as the growth coming from recent capital investments.”

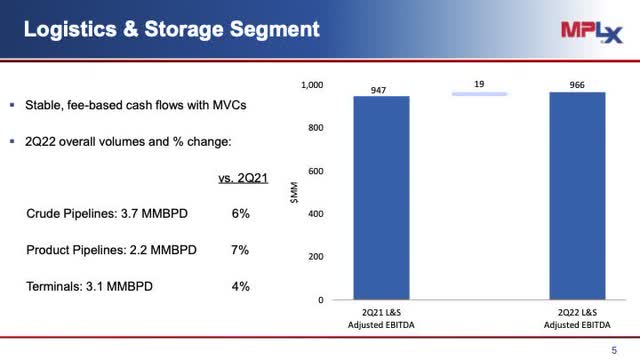

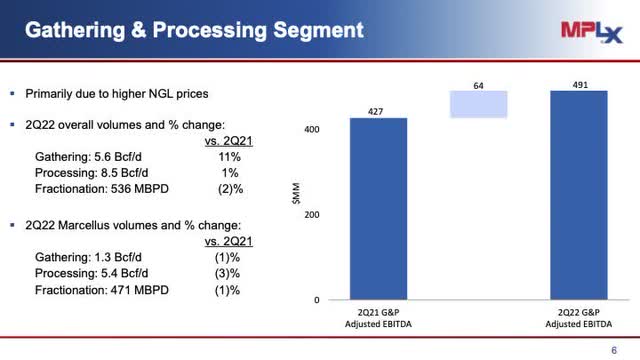

The next two slides from their latest presentation summarize the 2nd quarter results year over year. First, a summary of Logistics & Storage followed by a summary of Gathering & Processing.

The L&S segment shows little growth with the G&P segment growing nicely primarily from higher NGL prices.

MPLX’s Future Existence & Growth

Next we consider some important issues on growth and others. In the past investors have quipped over whether Marathon would back rollup MPLX. We begin with this statement from Marathon’s last quarterly report when Michael Blum of Wells Fargo asked about a possible future MPLX rollup.

“Our quick answer is our situation is a lot different than many of the others that you’ve seen, roll it up. So we’re pretty comfortable in the structure that we have today. We still think it’s good for the marathon family. It works for both, as we just talked about in our prepared remarks, we just, re-upped another 10 years of asset use between the two entities. So we’re pretty comfortable with where we stand and we think it’s a good structure for us.”

The short answer: while others chose to rejoin its once spun-off transportation element, Marathon has zero plans thus maintaining its two business approach. Continuing, straight from the boss, Michael Hennigan, at Marathon, said, “We’re pretty pleased with our MLP’s performance, continues to kick cash back to MPC.” It must be noted that at this point, MPLX pays two-thirds of the Marathon’s dividend.

Continuing, MPLX announced renewal of its Marathon contracts. Management stated, “Contracts now have extended terms to 2032 and have two automatic renewal provisions, which will allow for an additional 10 years of extensions, which could take them out to 2042.” This is excellent news for investors.

Growth, especially in boom markets for related commodities such as natural gas (NG) or crude oil, is a paramount parameter for investors to consider. MPLX transports crude and products with some refining in NGL. A few years back, the company had grandiose plans for capital expenses. In the 2nd quarter 2020 presentation, MPLX’s management announced a $700 million reduction in capital dropping it to under $1 billion. At that point, the company focused this capital on L&S. The proposed change drove the company toward complete cash flow independence for capital and distribution payments, a goal achieved in 2021. Management continued this lean capital practice into 2022 with total expenditures of $600 million budgeted. Our focus here on capital comes with an understanding of the important role it plays in predicting future growth.

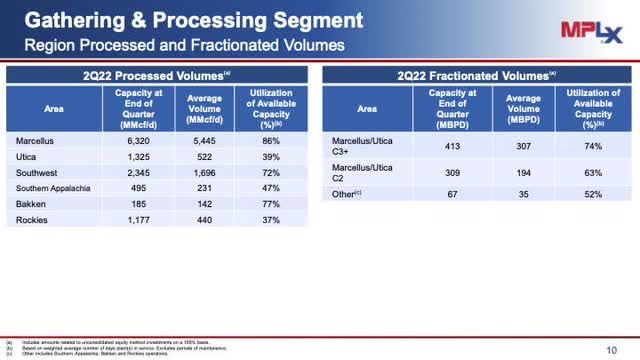

Let’s hone in with our glass on capital expense targets. Our close up begins with a slide summary of the Gathering & Processing Segment.

Available capacity ranging from 10%-50% jumps out or should jump out to investors. Marcellus is the lowest at 10%. From the prepared remarks at MPLX’s last conference, “This performance highlights the continued resiliency of our base business, tailwinds from higher NGL prices, as well as the growth coming from recent capital investments.” This above statement and others during the call confirm its plans to expand the Marcellus region capacity with a new plant at Harmon Creek scheduled for start-up in 12-18 months.

Continuing with the L&S growth where more growth is expected, management noted,

“In the L&S segment, expand[ion of] long haul natural gas and crude gathering pipeline support[s] the growing Permian and Bakken regions. Specifically in the Permian, . . . with the expansion of the Whistler pipeline from 2 bcf per day to 2.5 bcf per day, along with laterals into the Midland basin and Corpus Christi markets.”

Focusing the lenses deeper at the $600 million in 2022, a significantly larger sum than in 2021, we can ascertain probable cash returns. Companies invest in either low hanging fruit (50%-100% returns) or investment grade (15%-20% returns). Investors might expect $100-$300 million per year in return coming within 12-18 months. Again, this represents growth, but modest.

Future Growth: From Where & Where Not

At least two other future NG pipelines in the Permian are in the planning stage, one being Matterhorn. These assets are needed to allow for further expansion within the fracking business with NG transportation capacity being in short supply. Remember, flaring is basically outlawed by Federal law and fracking generates extraordinary levels of NG. These out in the future opportunities will add to the “future” growth.

With capacity utilization at the parent company of 91% in the 1st quarter, 100% in the 2nd quarter and guided at 94%, 3rd quarter lower due to fall maintenance schedules, investors shouldn’t expect significant growth at MPLX from the parent, Marathon.

The Charts & Unit Growth

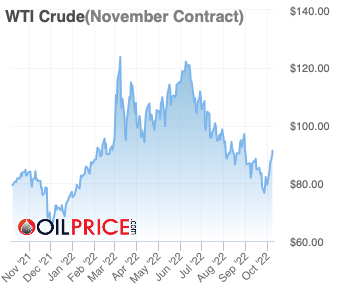

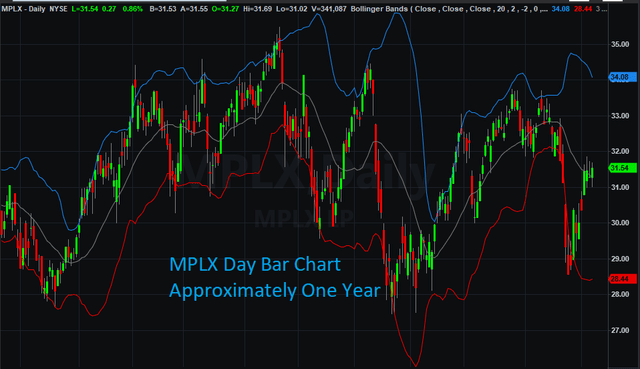

Another factor, discussed in our opening, that affects MPLX unit pricing is the price of crude oil, which in recent periods has been extremely volatile. Beginning, with a one year price chart for crude oil pricing from OilPrice and adding a chart for MPLX made using TradeStation, investors should notice a loose positive relationship between crude oil prices and MPLX.

Oil Price

A day bar chart of MPLX follows.

A careful comparison of the two suggests that the price follows in loose fashion to the price of crude oil. Yes, other elements also affect pricing including higher prices trending into ex-dividend dates and afterward falling. Another the stock market direction also comes into play. Understanding at least some of the outside effects can help investors chose better entry points. We mention crude oil pricing especially with a bullish stance still in place. An unnamed oil executive stated,

“I struggle to understand why spot oil prices are as low as they are today and why there is still backwardation in the forward curve. It appears to me that the world is very short on supply, with big draws in Organization for Economic Cooperation and Development inventories still taking place . . .”

With an overall bullish crude oil stance as stated above, investors might expect positive price movements going forward. But, always remember, MPLX units prices won’t be straight up and to right.

Risk & Investment

In the past three years, MPLX has modestly grown its business, Adjusted EBITDA attributable to MPLX LP beginning with 2021 and looking backward equals in millions 5,556, 5211, and 5104. MPLX DCF attributable to MPLX LP equaled in millions beginning in 2021 equals 4,644, 3,489, 2,781. The increases in 2021 came mostly with the economy restart after the virus issues subsided. Since 2019, MPLX cash generation increased $400 million or at a rate of approximately 4% per year. Thus far, for the first two quarters in 2022, the DCF increased by $60 million or 2-3% on a yearly basis.

Our investment posture rides completely on a qualitative analysis. Looking out several years forces this type most generally. The reality for MPLX is that it has minor exposures to higher growth business including the Permian and Bakken Basins. Outside of this exposure, investors should expect slow growth going forward with a safe distribution even in times of economic stress.

With slow growth predicted, investors might be tempted to look elsewhere. We offer a couple of reasons against that temptation. First of all, MPLX generates a lot more cash than it pays in distributions shown the next slide.

Next, over the past few years, it has spent $1.6 billion to repurchase units. At some point, the repurchase will end leaving significant amounts of cash for distribution increases. Second with regard to distribution increases, management stated this, “And with the strength and stability of the business, we will evaluate an increase to our base distribution later in the year.” Last year, the company paid a special of approximately $0.60 after the 3rd quarter. We expect something smaller but of significant size this November. And with a continued growth, the total fixed distribution is likely to improve to $0.80-$0.90 a quarter over the next few years.

With this analysis in mind, we rate MPLX a buy. Our reasoning includes the following. We believe that crude in time is destined for much higher prices. Even though our magnifying glass picked up slow growth, the distribution, the main reason we own this company, likely increases measurably. Lastly, we advise investors to hold off at prices near $36 unless a major change happened.

Be the first to comment