JHVEPhoto/iStock Editorial via Getty Images

Dear readers,

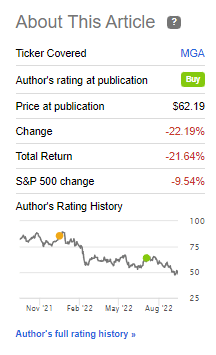

I’ve not made a secret of the fact that I don’t want to buy Magna International (NYSE:MGA) at an expensive valuation. Going from a “HOLD” to a “BUY” was a big step for me, but it’s clear based on the current results, that this stance change, in the context of the market, was done too early.

Why?

Because this happened.

Magna article (Seeking Alpha)

Yes, the company is down 40%+ since my first article, but I could have been even more conservative in my stance back then. I bought some shares of Magna, and these have obviously underperformed.

Am I worried?

No, I’m not worried – but it’s always annoying when I could have bought quality cheaper than I ended up buying.

Let’s review recent results and forecasts for Magna.

Revisiting Magna International

As I said, it’s not as though I’m worried about my Magna Investment. Not in the long term. Will I see my investment back? With spades, I believe. When? Now that’s a question that’s far more difficult to answer, and something I won’t be attempting to do here.

As before, the appearance that the company’s share price development gives us is that things are going very badly for the company. This is actually not true. One of the biggest arguments for the company has always been its positioning, size, and portfolio which will enable it, as I see, to capture a significant share of future sales and demand going forward.

None of this has changed.

We’re talking about a $38B business with over 160,000 employees serving the largest automotive manufacturers on earth – and that’s aside from developing its own vehicle platforms. Magna is still A-rated, and while I personally may not 100% believe in what many see as a fact – namely EV’s taking over and ICE going the way of the dinosaur, I have full respect for the company’s ambitions, and them being in a far more knowledgeable position than me to determine this.

Worldwide electrification of the automotive fleet is set to enhance the company’s appeal as a manufacturer and supplier. The same is true for connectivity, and mobility focus as well as a higher focus on autonomous driving. These trends come with positive implications, as MGA is doing all of these things already, so from that sense, the company is aligned to a future trend, while weighing up all drop-offs in legacy through these new sales.

2Q22 which came out only 2 days after my last article, was mostly in line with expectations – in that MGA’s challenge continues for the time being. LVP continues to be a headwind except well into the later part of 2H22. The company very slightly bumped its outlook.

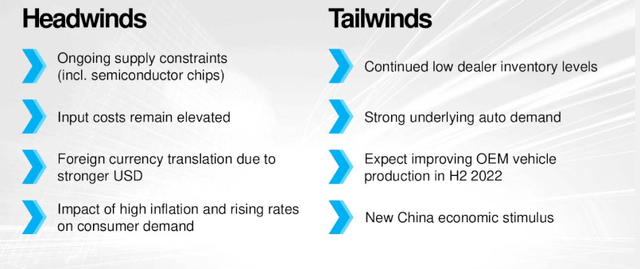

More important than hard fiscal data for 2022E becomes the company’s progress in long-term plans, because the head/tailwinds s things currently look are a serious mix.

MGA IR (MGA IR)

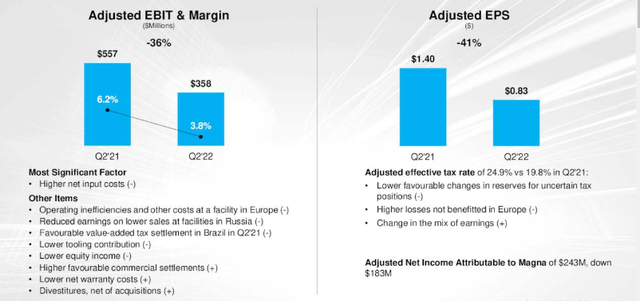

Sales were up 4% in 2Q22, but margins dropped by close to 2.5%, with free cash flow at a very meager $52M – no higher. EPS is down 41% on an adjusted diluted basis. The company isn’t in a position where it can dictate price as well as it might like to. We see this because unlike some other businesses, rather than increase pricing, MGA had to give pricing concessions for customers. They also had Russia risks, FX issues, and ongoing divestitures.

The overall positives of LVP reversal, new programs, and price increases for new contracts couldn’t completely weigh this down. The 4% consolidated sales increase is solely a function of NA – Europe and China were down by single digits. This also flowed to earnings and EBIT.

MGA IR (MGA IR)

Still, the company lacks fundamental, truly impactful issues. Financial flexibility continues well, with well-laddered maturities weighted towards 2024 and beyond. Adjusted debt on and adj. EBITDA basis is below 1.5x despite everything, and the 2022E outlook still calls for a significant sales increase compared to the 2021 number. Even EBIT is still expected to be flat, in terms of margin and income.

So, overall, there are a few fundamental issues that should cause Magna to trade down like this – more than 40% in less than 6-7 months. FCF expectations have also stayed the same.

Fundamental appeal remains. The company has an impressive, established track record having produced 3.7M vehicles, and doing the manufacturing for a wide range of appealing cars, including but not limited to the BMW 5, The G-wagon, the Jaguar I-Pace, The Toyota Supra, and other cars. The company is also moving beyond just manufacturing with services like lifecycle management, mobility infrastructure, and other things. I had this question from a reader in my last article, and note that Magna does not have any tire manufacture – there is a company called Magna Tyres, but this is a family-owned Netherlands business and not part of MGA.

Magna might have underperformed in 2Q22 – by not reaching consensus EPS, but this should not detract overly much from the company’s prospects at this valuation.

Risks do exist here – at least for the short term. The company saw a fairly weak 2Q22 considering what sort of targets we’re looking at for the full year. The supposed logic behind that expected acceleration is volume and mix going into 2H22. We’ll see if that materializes. The second key assumption is FX normalization, which seems doubtful. Another assumption is a recovery in LVP-related markets, which I will give the company, seems to be happening. Also, the company, while analysts were expecting better results, was in line with their own assumptions.

I also want to point to trends in the industry here. Ford is one of the manufacturers doing a full-on restructuring and resegmenting of its EV/ICE lineup, which changes the order flow for suppliers like Magna. Other manufacturers might do the same – and this obviously impacts Magna as well.

But what impacts things most is company valuation. So let’s look at how this has developed since my last article.

Magna International Valuation

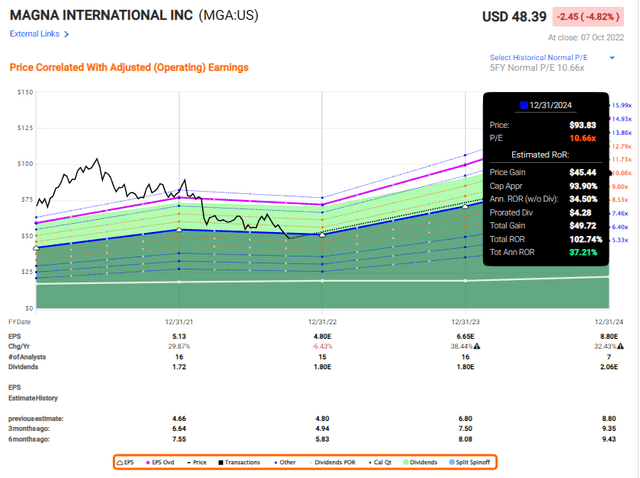

It’s not a complex update. From having been grotesquely overvalued as a product of EV trends, the company has finally reached an inflection point to where it actually trades below its 10-12 year average or 10-11x P/E. The company’s current valuation is around 9.9x. Thanks to this trend, the yield is up to over 3.7% for the US ticker MGA.

This valuation drop is despite the fact that after 2022, the company is currently forecasted to close to double the 2020A results in terms of EPS, and grow it by double digits yet again as we move into 2024.

Let me show you what this could mean for your returns.

MGA Upside (FAST Graphs)

Magna has crossed over into being an A-rated, higher-yielding, low-debt, triple-digit upside. There are more of these on the market today than we had a year ago, but this is still a good one.

The company doesn’t have the best track record of hitting analyst estimates, but neither is it a company that successively fails to hit targets. It has a 38% negative miss forecast ratio with a 10% margin of error, and less on a 2-year basis. There is some accuracy to these earnings forecasts, and I believe the trend to be solid enough to take as a realistic indicator for 2023-2024. I, therefore, call these forecasts “good enough” to go by.

Even if the company were to decline in valuation, it would take a lot more to generate negative RoR from this overall valuation. I consider it unlikely at this time, that we’ll see long-term negative returns from Magna given the current forecasts. What were expected to be 2022E tailwinds turned out not to exactly be tailwinds, but still very decent enough, all things considered. I always focus on the conservative upside or thesis. The conservative thesis calls for an automotive supplier to trade at no more than an 11-12x normalized P/E. As you can see, at this assumption with current forecasts, this now generates impressive amounts of alpha, if materialized.

I would now go by the 11x P/E – and it still gives you an upside at this time. This article marks the realistic return I expect, even from just a 10.66x P/E, to potentially be over 100% until 2024E.

Other analysts have followed suit with their overall targets. Remember that less than a year ago, analysts considered this company worth $102 on an average basis, with valuation highs of $127. That seems insane these days. I wouldn’t give Magna a triple-digit share – as I’ve always been very clear about. We’ve now moderated these expectations to around $75/share, which is more accurate, but still a touch high for my thinking.

17 analysts follow the company and 15 of them Give Magna a “BUY” or “outperform” rating here. I agree with the sentiment and the rating, but I would want to cut that to my previous price target – $65/share. At that price, I think we’re well within conservative bounds for the company, and can expect if not a triple-digit, at the very least double-digit upside at a 3.5%+ yield.

That’s good enough for me. I’m buying more Magna.

The thesis for Magna is the following:

- Superb company, with decent management (ex-Veoneer), with a good upside in the right situation. At below 10X P/E, this becomes a no-brainer “BUY” to me. But that’s not where we are here.

- I’m willing to consider Magna at a price of $60-65, but before I would buy even then, I’d want to see recovery indications.

- Quality is never enough. Never. You want valuation on top of quality. Magna gives us half of that equation at this time, not both.

- The company is now a “BUY”.

My cost basis is now close to $52/share.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment