MagioreStock

Thesis

Successful investing is a relative discipline — meaning that an investor must allocate capital in accordance with the best relative pick. True, one could invest equally in all stocks. But this would cost an investor the opportunity to overweigh a specific outperformer.

With that in mind, Amazon (NASDAQ:AMZN) and Google (NASDAQ:GOOG)(NASDAQ:GOOGL) are amongst widely followed stocks not only in the U.S., but also worldwide. But which one is the better buy? Both GOOG and AMZN stock are considerably cheaper than a few months ago, being down YTD about 33% and 31% respectively.

In this article, I reflect on and discuss the relative comparison of the most important decision metrics: (1) technology, products and business model, (2) growth, (3) profitability, and (4) valuation.

In my opinion, Google stock is clearly the much better investment opportunity, as the leading internet search giant points with strong profitability and attractive valuation.

1. Technology, Products & Business Model

I understand that many readers have an excellent understanding of what Amazon and Google do, given that we all use the companies’ services on a daily basis. So, I keep this section as short as possible.

Arguably, Google operates three key segments: Google Services, Google Cloud and Other Bets.

Google Services is Google’s most important business unit and includes products and services such as Google Search (ads), Google Maps, Google Play, and YouTube, as well as Android and hardware IT products such as Google Pixel. The segment is estimated to account for about $97 billion of operating cash flow in 2022.

Google Cloud is expected to generate about $26.9 billion of revenues in 2022 and the unit offers clients cloud computing, data storage and workflow solutions.

Other Bets can be best understood as Google’s new business venture arm, that ‘bets’ on emerging technologies. The most ‘notable’ bet is arguably connected to autonomous driving and organized under the Waymo venture. The segment does not contribute any meaningful share of revenues, or profits.

To simplify, Google is a high-tech company with notable strength in everything that is related to information and artificial intelligence products, as well as entertainment (with YouTube).

Amazon

Also Amazon operates three key business units, as I see it: The Retail Business, Amazon Web Services, and the Subscription Businesses and Advertising.

The Retail Business: Amazon owns and operates, in my opinion, the world’s most competitive retail company. As of March 2022, the business serves more than 300 million unique customers/shoppers and more than 6 million unique sellers. In addition to size and scale, Amazon’s retail business is highly competitive in terms of customer satisfaction — personally, I see no reason to shop somewhere else.

AWS: Amazon Web Services is defined as Amazon’s cloud business segment. The segment builds and offers access to various cloud computing platforms that provide access to data storage, computing processing and software tools. In Q2 2022, Amazon generated $19.7 billion from this segment, which equals $77.8 billion annualized.

Subscription Businesses are sold under Amazon Prime, and include shipping benefits, as well as video and music streaming services.

Advertising accounted for about $8.8 billion of revenues in Q2 2022, $35.2 billion annualized. The segment sells advertising space on Amazon’s e-commerce platform.

A Tough Comparison

As compared to Google, Amazon is less a technology company, but at least equally competitive: Amazon has managed to build infrastructure and global consumer trust of such scale, that growth optionality for new business ventures seems almost infinite. Also, there should be no doubt that Amazon is an exceptionally well managed business.

Both Google and Amazon offer highly competitive products, and their respective moat, although different is almost impenetrable: Google enjoys leading tech capabilities, a monopoly in online information discovery, and network effects provided by YouTube. Amazon enjoys the most competitive commerce and logistics infrastructure, as well as a level of trust that is close-to-impossible to replicate. In my opinion, these companies are so different, that it is impossible to pick a winner in the ‘Technology, Products & Business Model’ segment.

Google Vs. Amazon: 1:1

2. Growth

As a function of the product portfolio, it is arguably enormously difficult to derive a conclusion which company has a stronger growth outlook. But I believe Amazon might enjoy a better position for a near-term growth acceleration, given that Amazon’s platform of trust and infrastructure provides so much business optionality. At the same time, Google’s major growth driver, which is still advertising, might experience some short-term headwinds.

With reference to the past 5 years of revenue expansion, Amazon has slightly grown at a faster rate than Google. In fact, Amazon has grown revenues at an annual compounded growth rate of 25%, while Google has expanded revenues at about 23% CAGR. The picture doesn’t change if the relevant metric is not revenue growth, but operating income growth — which is much more relevant in my opinion. Google has managed to grow operating income from $28.9 billion in 2017 to $82.5 billion in 2022 (TTM reference), which is a 29.5% CAGR. Over the same period, Amazon’s respective metric has expanded at a 34% CAGR, from $4.1 billion in 2017 to $15.3 billion in 2022 (TTM reference).

Thus, although the comparison for business growth is highly competitive, Amazon takes the lead vs Google with 2:1.

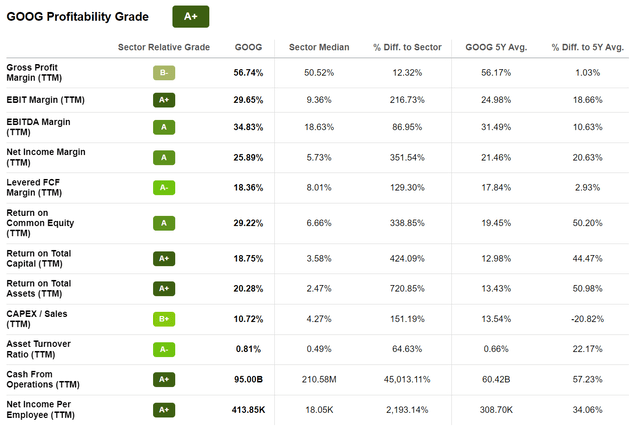

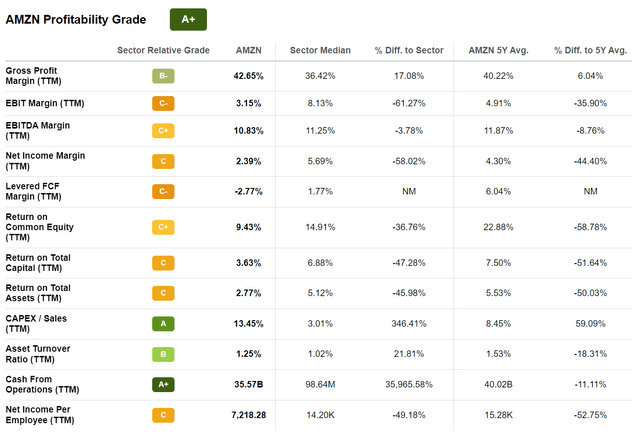

3. Profitability

This section provides an easy win to Google.

For the trailing twelve months, Google has managed to claim a gross profit margin of 56%, versus 42.6% for Amazon. Respectively, with regards to EBIT margin Google wins with 29.7%, versus 3.15% and with regards to net-income Google wins 25.9% versus 2.4%.

There is also a clear takeaway which company operates more capital efficient. Google enjoys a return on total assets (TTM reference) of about 20.3%, as compared to only 2.77% for Amazon. At the same time, Google generates $413,850 of net income per employee versus $7,218 for Amazon.

Amazon

Google Vs. Amazon: 2:2

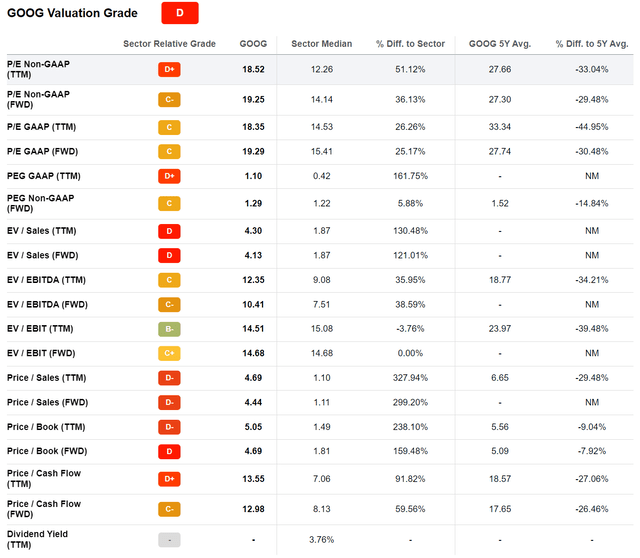

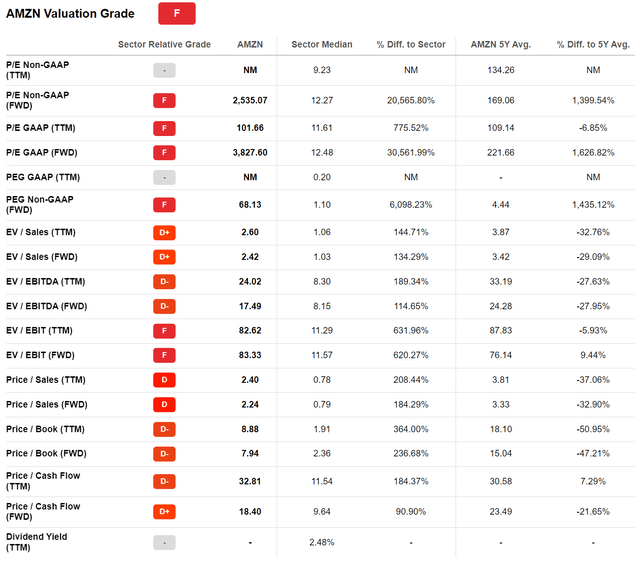

4. Valuation

Google is simply much cheaper than Amazon.

According to data compiled by Seeking Alpha, Google is valued at a one-year forward EV/EBIT of about x15, while Amazon’s one-year forward EV/EBIT is x83. The argument of a valuation dispersion can be made for all relevant multiples, including P/S and P/B. Enclosed is some more data.

Amazon

I understand that multiples might not provide an accurate valuation comparison. Thus, I would like to highlight that I have previously written about a valuation deep dive for both Amazon and Google, where I have valued the companies based on a multiple analysis, a sum-of-the-parts-valuation and a residual earnings framework.

The takeaway is clear. Google is trading cheap, with considerable valuation upside, while Amazon is trading expensive, with notable downside.

For the relative multiple comparison, I calculate a $173 target price, for the sum-of-the-parts valuation I view $187 as fair, and for the residual earnings model an investor could assume a $156.24 anchor.

According to the relative multiple comparison, Amazon’s fair valuation should be approximately $90/share. My residual earnings framework returns a base-case target price of $84.55/share. The sum-of-the-parts valuation boils down to a key question, namely, if Amazon’s retail business is worth more than Walmart’s?

Google Vs. Amazon: 3:2

Conclusion

The takeway for investors is clear, in my opinion. Amazon’s growth outpaces that of Google only by a slight margin, but Amazon clearly lacks Google’s profitability and attractive valuation. That said, I feel very comfortable buying GOOG stock at a one-year forward EV/EBIT of below x15. I am less comfortable doing the same with AMZN stock, which is valued at a EV/EBIT multiple of x83 respectively.

Be the first to comment