JHVEPhoto

Dear readers,

In my last article on Magna International (NYSE:MGA), I made a case for why this company should be considered a “HOLD”, citing things like:

- COVID-19 closures/impacts

- Production schedule visibility

- Input cost increases/Inflation/FX

- Management forecast misses as little as 2-3 months before the fact

- Raw material/component shortages

Now we added to this the troubles in Russia and Ukraine, as well as a growing, negative global macro. This contributed to the negative case for Magna, and why the company’s share price deteriorated further – and relatively quickly.

Let’s look where things are today.

Updating on Magna International

Despite appearances of the contrary in terms of the company’s share price, Magna actually had a decent couple of 2022 quarters. One of the biggest arguments for the company is its positioning, size, and portfolio which will enable it, as I see, to capture a significant share of future sales and demand going forward.

Fundamentally, it’s the sort of business that you want to be looking at. It combines a market cap of $24B+ with an A-credit rating, sub-31% long-term debt/capital, and plenty of historical growth in what is usually considered a massively volatile market segment.

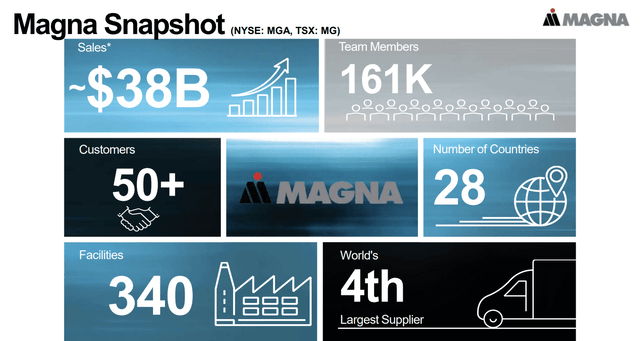

The company now has annual sales of $38B, and a wide customer base where 50+ major global customers account for 97% of overall sales. It’s not only NA’s largest automotive supplier – it’s in the 4th place in the entire world.

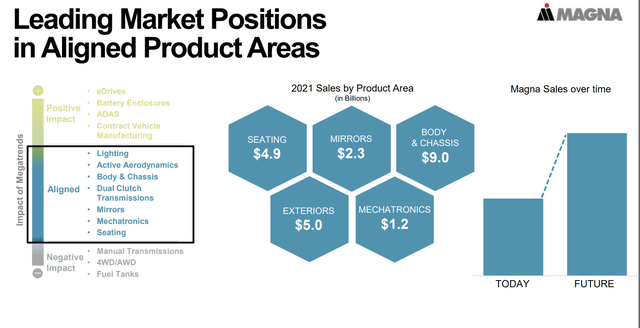

Future trends are directly aligned with Magna’s growth. Worldwide electrification of the automotive fleet is set to enhance the company’s appeal as a manufacturer and supplier. The same is true for connectivity, and mobility focus as well as a higher focus on autonomous driving. These megatrends come in a variety of impact severities and positives. The most positive of these include autonomous driving, battery enclosures and straight contract manufacturing. MGA is doing all of this already. We also have more general trends, such as a higher focus on lighting, active aerodynamics, dual-clutch transmissions, mechatronics and seating, which also aligns with Magna’s current operations.

The only negatives that we can see for the company are the drop-offs in legacy technologies, including things like Manual transmissions, 4WD and fuel tanks – which the company considers to be on the way out.

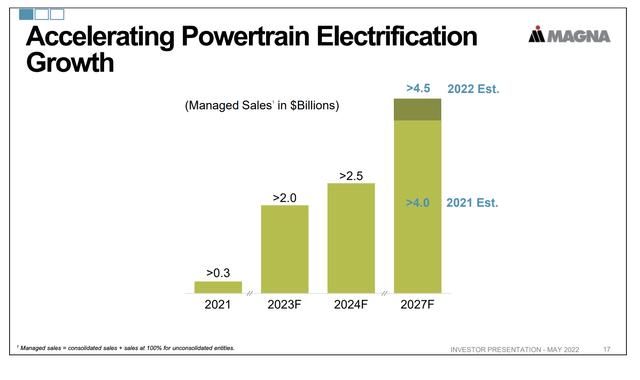

The company has recorded several significant wins in both Electric cars and electric truck, and is accelerating the growth of its electric powertrain products. MGA expects these sales to top $4.5B by 2027E.

Battery enclosures alone is a massive market, with a highly-engineered product, and the company is launching both the GMC Hummer EV as well as the new F-150 Lightning. The company expects this market alone to grow from nearly nothing in 2021, to $1.5B in 2027E.

The company also has a close-to market-leading position in most of the areas mentioned.

The company also has an impressive, established track record having produced 3.7M vehicles, and doing the manufacturing for a wide range of appealing cars, including but not limited to the BMW 5, The G-wagon, the Jaguar I-Pace, The Toyota Supra and other cars. The company is also moving beyond just manufacturing with services like lifecycle management, mobility infrastructure and other things.

The company’s fundamental targets continue to focus on preserving overall liquidity and investment-grade credit, with debt no higher than 1.5X on an adjusted debt/adj EBITDA, while focusing on inorganic and organic growth investments. Dividends are a tertiary priority, but Magna does pay one, and it’s not the lowest in the business. We can see that around 10-15% of the company’s cash flow is slated for the dividend, with the remaining split between internal investments and currently unallocated capital. The company continues to show increasing amounts of financial flexibility, and gives us 2022 outlooks that are, on a high level, relatively positive given the current macro.

Public Comps for Magna include businesses like Lear (LEA), Aptiv (APTV), Aisin (OTCPK:ASEKY), Autoliv (ALV), Denso (OTCPK:DNZOY), and others. You could also consider businesses such as Continental (OTCPK:CTTAF), but I don’t view them as such, because the business of selling tires and selling other automotive parts is vastly different.

Note that Magna does not have any tire manufacture – there is a company called Magna Tyres, but this is a family-owned Netherlands business, and not part of MGA.

Because of all of these facts, there is little doubt to my mind that Magna is very well-integrated and a business with impressive overall scale, a global reach and trust from major automotive brands. It has a moat, it has overall safety, and the volatility in the company’s share price and valuation reflect trends in macro rather than actual company results.

The overall returns of long-term investment are positive to the tune of around 11.5% annualized RoR for the past 20 years. From a fundamental point of view, Magna should be an appealing investment, albeit tied a bit to the cyclicality of the automotive trends.

That isn’t to say there aren’t issues to keep an eye on. Magna has, as I mentioned in my last article, some margin issues that have plagued the business going into the pandemic. We’ve seen some recovery since, but from that perspective, there are some reasons for the violent up and down.

Furthermore, the company’s capability to actually perform solid M&A’s is somewhat in question with the whole Veoneer debacle. The company would have massively overpaid for the business, and it’s a blessing that Qualcomm (QCOM) picked it up instead.

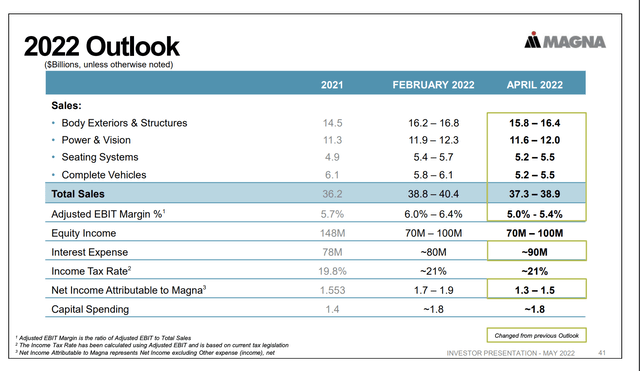

The company also viciously cut its sales forecast range by more than $3B on the high end. While this may seem small on an annual basis with a company holding the sales of Magna even during a bad year, doing it this late during the year indicates significant weakness in Automotive which caught the company a bit by surprise. Still, these trends are macro – they are not Magna-specific and its impossible for Magna to influence these to any major degree.

The expectation is for EV and automotive recovery to save the day. A few months back investors expected this to actually happen to where the shares wouldn’t decline. Obviously, this didn’t come to pass, with the company down over 20% since my last article.

However, we now have better visibility to 2022E and forward earnings – and these are positive.

Let’s look at the company valuation.

Magna Valuation

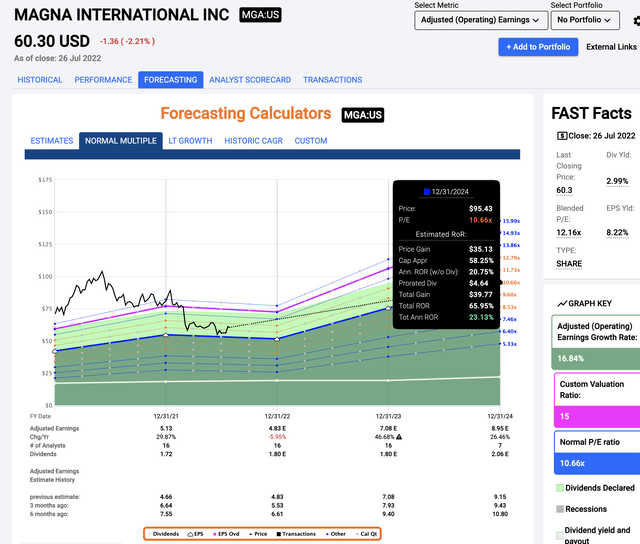

Since my last article on Magna, the company has declined significantly in overall valuation, with current multiples well below 15X, but still above the company’s 10-year average of around 10.6X.

However, this 10-year average fails to take into consideration the significant EPS growth expected in 2023-2024E once the company’s ambitions for EV’s, battery enclosures and other new segments come online. Because the visibility for these can be considered to be relatively good, I view the company as undervalued on this basis.

The simple fact is that we have a 23% annual upside to a 2024E where the likely adjusted EPS is around $9/share, compared to the $5/share that we saw in 2021. The company doesn’t have the best track record of hitting analyst estimates, but neither is it a company that successively fails to hit targets. It has a 38% negative miss forecast ratio with a 10% margin of error, and less on a 2-year basis. There is some accuracy to these earnings forecasts, and I believe the trend to be solid enough to take as a realistic indicator for 2023-2024.

There is, of course, also the question of what happens to the company’s averages when Magna averages 10-16% EPS growth for the next few years.

Magna International Upside (F.A.S.T graphs)

I called Magna’s valuation “extremely problematic” in my last article. I stand by that description – at the time.

I don’t see it that way any longer – and the fact that we’re down close to 30% should at least give understanding to my stance back at the time. I believe the decline is more than just Russia/Ukraine, but that there were perhaps a bit high expectations for the business.

Now on the other hand, we’re at a much more moderated level, and the upside is quite a bit better than it was previously. Even if the company were to decline in valuation, it would take a lot more to generate negative RoR from this overall valuation. I consider it unlikely at this time, that we’ll see long-term negative returns from Magna given the current forecasts.

Recent comments have said that the 2021 headwinds could turn into 2022 tailwinds. Entirely possible. MGA is one of the best automotive suppliers – again, not in contention. But we’ve already seen that in terms of valuation and actual 2022E, we’re likely to see a decline before we see an upside for the company.

I always focus on the conservative upside or thesis. The conservative thesis calls for an automotive supplier to trade at no more than an 11-12x normalized P/E. As you can see, at this assumption with current forecasts, this now generates impressive amounts of alpha, if materialized.

The S&P Global upside is far more muted today than it was little more than a year ago. Recall that the price targets called for Magna to trade at over $100/share, and we’re now talking at a price at times below $60/share. That’s quite a discrepancy. Not even the most conservative analysts called for a sub-$70/share price in 2021.

Now, the picture is very different.

Magna is being forecasted at an average of $78.5, with a high of $125 and a low of $53. Out of 18 analysts following the company, 15 are either at a “BUY” or “Outperform”.

At this valuation, I agree with them.

Recall my thesis for Magna.

Thesis

The thesis for Magna is the following:

- Superb company, decent management (ex-Veoneer), with a good upside in the right situation. At below 8X P/E, this becomes a no-brainer “BUY” to me. But that’s not where we are here.

- I’m willing to consider Magna at a price of $60-65, but before I would buy even then, I’d want to see recovery indications. This pushes my price target to the level of the lowest analyst PTs, but that’s where I am. As long as you realize that this target is based on extremely conservative metrics and want more clarity, then you can form your own stance.

- Quality is never enough. Never. You want valuation on top of quality. Magna gives us half of that equation at this time, not both.

- The company is now a “BUY”.

This was my thesis several months ago. I stick to my theses. Why? Because they’re based on conservative valuation.

That’s why I recently bought my first shares of Magna International below $60/share for the company’s NYSE ticker.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (bolded).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment