Christopher Jue

You Ain’t Seen Nothing Yet!

Bachman Turner Overdrive.

Last Wednesday, the Federal Reserve raised interest rates by 75bps. This was expected. In most of the financial world, the demolition of any dovish pause or pivot being imminent in Chairman Powell’s speech with Q&A was not expected, though.

We have been talking about a “mean Fed” since the September meeting and have been preparing for the volatility that the Fed would unleash if it maintained a particularly hawkish stance.

We have further been keeping open the possibility that, if the Federal Reserve oversteps, then there is a significant chance that a liquidity crisis develops. International economic threats also loom, likely with even worse implications than a Fed overstep.

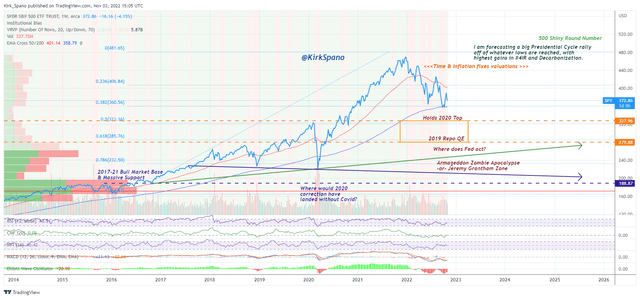

What I have been calling the “Armageddon Zombie Apocalypse” scenario for stocks is clearly in play.

Divining The Fed

Since late last year, I have broken down that the Federal Reserve was going to be a major drag on stocks in 2022 as they reloaded their bazooka.

Macro Dashes: The Fed Is Reloading Its Bazooka For Next Time.

This idea has gotten pooh-poohed by the inexperienced and those with magic trading formulas who talk a good game. Nonetheless, here we are in a bear market that threatens to get worse – even if there is a short-term technical rebound

Last spring, I said that the Federal Reserve needed to start backing off by the end of the year or risk a stagflationary recession.

Kirk Spano’s Q2 2022 Outlook And Game Plan For A Tighter Fed.

I originally thought that September made sense for the Fed to shift to lower interest rate increases. On that point, Jeff Gundlach and I agreed.

From September: Macro Dashes – The Fed Could Cause Stagflation Next.

After Jackson Hole, though, it became apparent that December was the month that the Federal Reserve might, but not necessarily would, start backing off a little. I am not sure that is the case anymore, as Powell talked about “a plateau of quite some time” for higher interest rates.

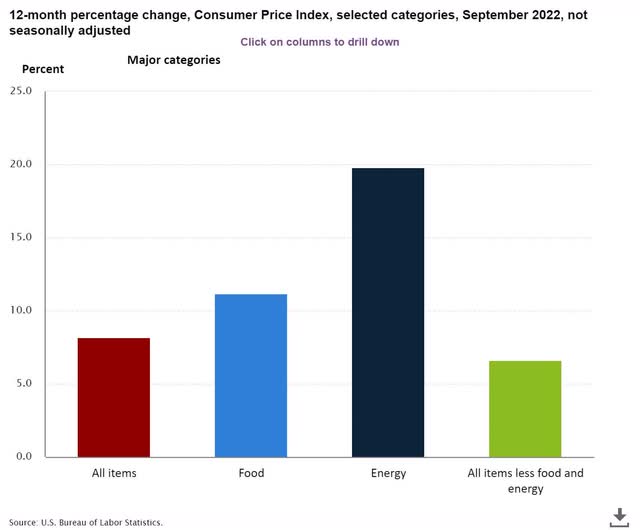

While a few members of the Federal Reserve have echoed what I have said all year, that inflation is mainly from energy and supply chains, it might not be enough to change what has become a higher for longer scenario.

So, while a few Fed voices hint they would like to turn more dovish just as soon as inflation gives them an opening, Chairman Volker, I mean Powell, might have different ideas.

Powell made it clear that there would be no pause in December and that rates would likely continue up in early 2023. He very forcefully made the point that fighting inflation, not a soft landing, is his number one priority.

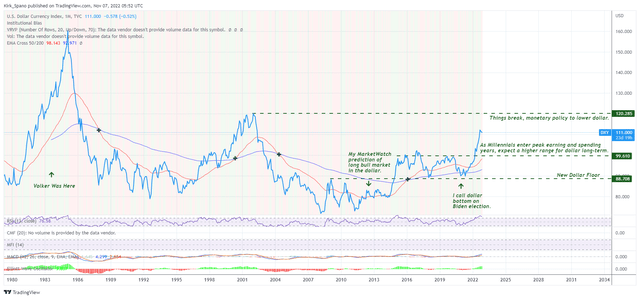

In addition, as we have discussed in our webinars, it could also be that the dollar is being weaponized for geopolitical reasons. Think about how the dollar can be used to put pressure on China’s and Russia’s economies as we duel with them for global hegemony.

If the dollar is being used as a geopolitical tool, then not much else matters, and the idea of an independent Federal Reserve goes out the window more than a bit.

Readers of mine since MarketWatch from 2012-16, know my thesis on the Fed: the dual mandate is really there to camouflage their real mandate – which is protect the dollar.

So, all things considered, the only scenario I see for a 25bp hike in December, instead of the projected 50bp, would be:

- inflation coming down noticeably, with unemployment ticking up a little, but not much.

- and, the dollar no longer needed as a geopolitical countermeasure.

In other words, a Goldilocks script that could allow Chairman Powell to start to claim he was winning the war on inflation and not tell us the rest of the story if there is one.

What is more likely, though, in my opinion, is that the Fed raises 50bps in December and reaffirms that it is not going to pause until it is forced to by a surging unemployment rate.

Unemployment might not surge for a long time, though, unless the Federal Reserve or international factors induces a major recession.

As I’ve described repeatedly, and as embedded in my “slow growth forever global economy” thesis, high employment rates are now largely structural, not cyclical. That is due to aging demographics and xenophobia that prevents us from allowing more immigrants.

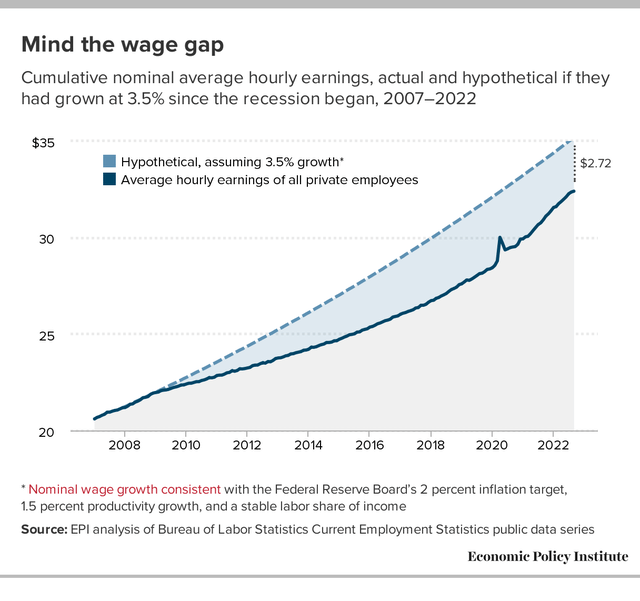

There is also a thesis out there that wage inflation is somehow a big deal and needs to be squashed. However, the numbers do not back that up. Americans are still not even recovered on wages from the Great Recession.

Here is where inflation is really coming from:

So, strongly consider that higher rates are here until we really need them to come down. This has huge implications for the dollar, real estate, stocks, bonds, and commodities.

Higher rates mean a stronger dollar and lower asset prices.

International Risk

Perhaps the biggest risk to the economy and asset prices lies not with the Federal Reserve, but internationally. There are several risks lining up that we know of:

- Russia in Ukraine.

- European bank collapses.

- Iranian conflicts simmering again.

- OPEC staying tight on oil and gas supplies.

- China continuing to squeeze supply chains.

And then, there are all of the unknowns. The true “black swans.”

Again, I point to the geopolitics of dealing with Russia and China, while OPEC nations continue to be wildcards trying to play all sides as they maximize their energy profits.

If indeed the dollar is being pushed higher for geopolitical reasons, then a valuation normalization in stocks is not likely complete. And, I think it is still a bit too early to buy most bonds.

And, let’s think about just how strong the dollar really is, with interest rates just barely approaching normal having spiked it so high.

The Fed Funds rate is now 3.75-4%. What if interest rates rise to historical norms of around 5.4%? We could see the U.S. dollar Currency Index (DXY) make a run even higher. What if rates went higher yet?

Here’s the problem with an even stronger dollar. It can break things. There is already massive stress on Europe and emerging markets. The yuan and yen are both falling, making commodities expensive for China and Japan. Foe and friend alike.

Now, bring back international events. What does a flight to safety look like if there is a dirty bomb, war with Iran, or a China move on Taiwan? What if there is a cascade of financial dominos in Europe around energy and debt into a slowing global economy where debt financing is difficult?

Most expect the Fed to rescue the world with QE. What if they don’t?

I don’t subscribe to the simplistic FRED charts some toss out there suggesting the Federal Reserve can’t do a lot more QE. But, I do think that there is a predatory nature of those with dollars, to use them to buy assets all over the world, when the price is right.

Well, the price is right when the dollar surges. That is one reason we have started to scale into emerging markets investments recently.

There are certainly a lot of moving parts, but if you are following my thinking, then you are seeing two avenues for higher rates for longer and a stronger dollar. The reasons they give us and the reasons they don’t give us.

Either way, it seems the dollar is going to be strong for a while.

What’s Politics Got To Do With It

Not much. There won’t be a red wave. The Democrats might hold the Senate, but lose the House by a few seats.

Even if the Republicans take both chambers, it won’t be by much and it won’t mean much with President Biden carrying the veto pen.

Reality is that the recent Democratic bills have been pretty good for the future, but don’t change much now.

- The CHIPS for America Act will help move semiconductor supply chains back to America and that might be the most important supply chain in the world.

- The Inflation Reduction Act did what it needed to do to get us back to energy independence in a few years, so that OPEC and Russia can’t manipulate energy prices anymore.

- Limiting corporate tax breaks, so that some of the most profitable companies in the world actually pay some taxes, allowed the Democrats to pass a budget-neutral bill that also limits healthcare expenses.

In addition, the hard line that President Biden has taken with Russia and China has put both on their heels.

Ukraine is beating back Russia with western munitions, and rumors persist the President lil Vladdy Putin is at risk of being overthrown.

China lost thousands of American tech minds when President Biden placed huge restrictions on working with China on technology. Frankly, that’s one of the ballsier moves I’ve ever seen.

In the end, though, that’s not usually what Americans vote on, so, we’ll see what happens Tuesday.

For the next two years, unless the Democrats hold both houses, I would expect gridlock and gamesmanship into the next Presidential election. If the Democrats somehow hold both houses, then I think we see another pretty decent reconciliation bill.

Parsing Out SPY Scenarios

Here were my thoughts about the SPDR S&P 500 ETF (SPY) coming into the year:

“…I think the S&P 500 will hit both low 5000s and middle 3000s in 2022. I think that 2022 will end up looking a lot like 2018, the way I thought that 2020 would if not for Covid and massive bailouts.”

My 2022 Futile Forecast: The Dollar, Stocks, REITs, Crypto, Inflation.

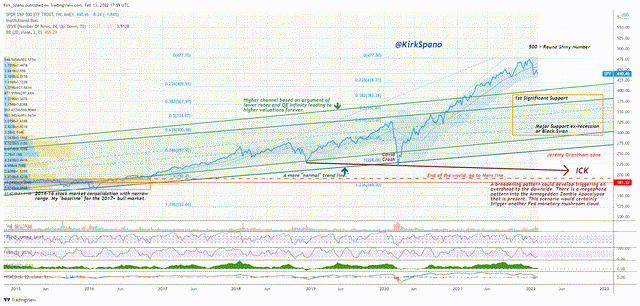

This is how I charted that a few weeks later in SPY: Large Caps Are On Thinning Ice:

The S&P 500 (SP500), of course, just missed 5000 and is now heading to the middle 3000s by all indications.

In the chart above, you’ll see that I identified a “broadening wedge” or “megaphone pattern” at the bottom of the chart. That’s a result of a lower low in 2020 vs 2018.

Megaphone patterns usually manifest over several years. Many traders saw one in 2018 when the early year “short vol” correction lows were eclipsed by the year-end lows. For a trader, that might have meant something; to me, it was the set-up for a rally.

The rally that followed in 2019 ended up having two parts. The first was a rebound from the correction. The second part was instigated, by many accounts, from the QE directed at the Repo market beginning in September 2019. Roughly a trillion dollars of QE entered the market from September to February. It wasn’t enough to overcome Covid though.

Covid threw a lot of things out of whack (supply side-driven inflation anyone), so it’s difficult to know if that megaphone pattern is entirely valid. If it is, then the floor for this stock market is much lower than most people think.

I update my SPY chart once or twice per quarter. Below, you can see I lowered my base case again on SPY.

I can very easily see a SPY reaching into the $280s without a Fed pause in December – which, again, Chairman Powell said wasn’t coming that fast.

The $280s on SPY is where the Fed started that Repo market QE program in September 2019. There’s no reason that has to hold, other than, I don’t think the Federal Reserve wants more correction than that, even though they want more correction than we have had so far.

SPY Landing Zones (Kirk Spano)

What if inflation continues to be sticky and the Federal Reserve continues to be hawkish into 2023 past January? In that case, there are far lower levels on the S&P 500 that we could see.

If the Federal Reserve is ushering in a liquidity crisis, then we had better start thinking like Sam Zell, Nouriel Roubini, and Jeremy Grantham. All of them, and more, including me, have warned that if the Fed is too aggressive in its inflation fighting, we could see a liquidity crisis that acts like an elevator shaft for the stock market.

From June: Peering Down Elevator Shaft: SPY Can Easily Drop Another 20-30%.

And of course, there are the international items I talked about above.

There is a trend line (in green) from the 2016 retest of a breakout to the 2020 bottom. To me, that should act as massive support if my thesis these past few years – which is that the 2014 to 2016 choppy “stealth bear market” is the base of the 2017-21 bull market – is correct.

But, what if the megaphone pattern is valid? In that case, a liquidity crisis that the Fed does not intervene on fast enough or forcefully enough, could cause the S&P 500 to make a run at 2000.

So, my base case remains that the S&P 500 will stabilize somewhere around 3000, a little above or a little below. However, the circumstances in the economy today, in my view, mean that we are at an abnormally high risk of a deeper dive than a run of the mill bear market of around 30% decline.

Closing Investment Thoughts

I am maintaining my base case of a bear market bottom near 3000 on the S&P 500. However, we have to be aware of the possibility that either the Fed really screws up, or that there are international factors that cause an even grizzlier bear market.

I do still think there is a chance for a soft landing, but it will require cooperation from nations friend and foe. That includes China at least coming to the table on trade, technology, Taiwan, and Russia’s invasion of Ukraine. What are the odds?

If there is a technical rally in U.S. stocks and it is not accompanied by some very good news internationally, especially cheaper energy, improving supply chains and a bit more peace, I will start to trim some positions to lock in profits and/or to raise cash.

My outlook since September has become more cautious. That is, still a short-term outlook, think sometime into next year. I still see a large, even if it’s a bit later than normal, Presidential cycle rally. And, remember, as the U.S. becomes energy independent in a few years as renewables come online, I believe that will be a trigger for a very long-term bull market in the U.S. and many emerging markets.

I think stock market gains will be concentrated in 4th Industrial Revolution, cleaner energy (think solar and other renewable energy, batteries, certain utilities, carbon neutral biofuels, carbon capture and certain clean energy linked commodities), biotech, and certain consumer discretionary stocks. Continuing coverage coming.

Housekeeping

I will be releasing more pieces of research in coming months to help people come out of this bear market.

I also offer weekly webinars. Keep an eye on my Seeking Alpha blog for details. I look forward to discussing today’s ideas with you in the comments below.

Be the first to comment