YorVen

Introduction

LyondellBasell (NYSE:LYB) is a company specializing in the production of olefins and polyolefins, oxyfuels, refining and the like. The share price, like that of other chemical companies, has fallen sharply this year. The high dividend yield of 5.9% makes it interesting to take a look at the stock. Free cash flow to market cap is a strong 22%. LyondellBasell is not only paying a high dividend, but management is also initiating a share buyback program. Management is a strong capital allocator.

LyondellBasell is a value stock that offers a high dividend and whose management uses free cash flows efficiently. Investors can enjoy a high and safe dividend yield, which is why the stock is a buy.

Great Capital Allocators

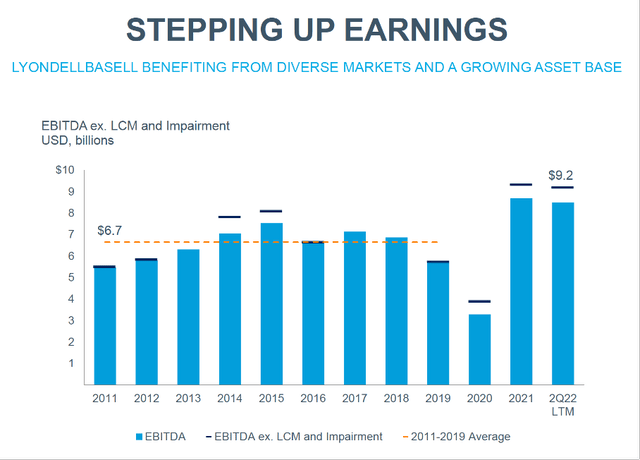

LyondellBasell’s profit came in strong in the second quarter. Better refining margins mainly contributed to a strongly increased EBITDA. The free operating cash flow yield of 26% and the cash conversion rate of 91% are high, and LyondellBasell returns a large portion to shareholders and uses it to reduce debt.

Stepping up earnings (2Q22 Investor Presentation)

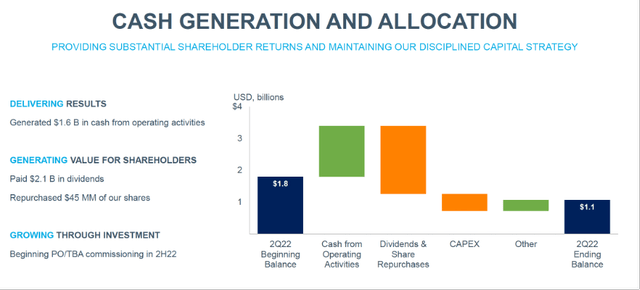

Cash flow from operating activities was $1.8 billion in the second quarter. LyondellBasell returned $2.1 billion to shareholders, including $45 million in share repurchases. This quarter’s high dividend payment is unique, LyondellBasell paid a special dividend of $5.20 per share in the second quarter.

Cash Generation And Allocation (2Q22 Investor Presentation)

PO/TBA Project Update

A plant under development is the PO/TBA project. LyondellBasell’s patented technology provides the most cost-effective production method for the growing demand for polyurethane and clean-burning oxyfuels. This supports the energy transition by improving ICE’s fuel efficiency and reducing harmful emissions. The plant is expected to start up in early 2023 and is expected to generate a solid $450 million in EBITDA per year.

PO/TBA Project Update (2Q22 Investor Presentation)

LyondellBasell Stock Valuation Metrics

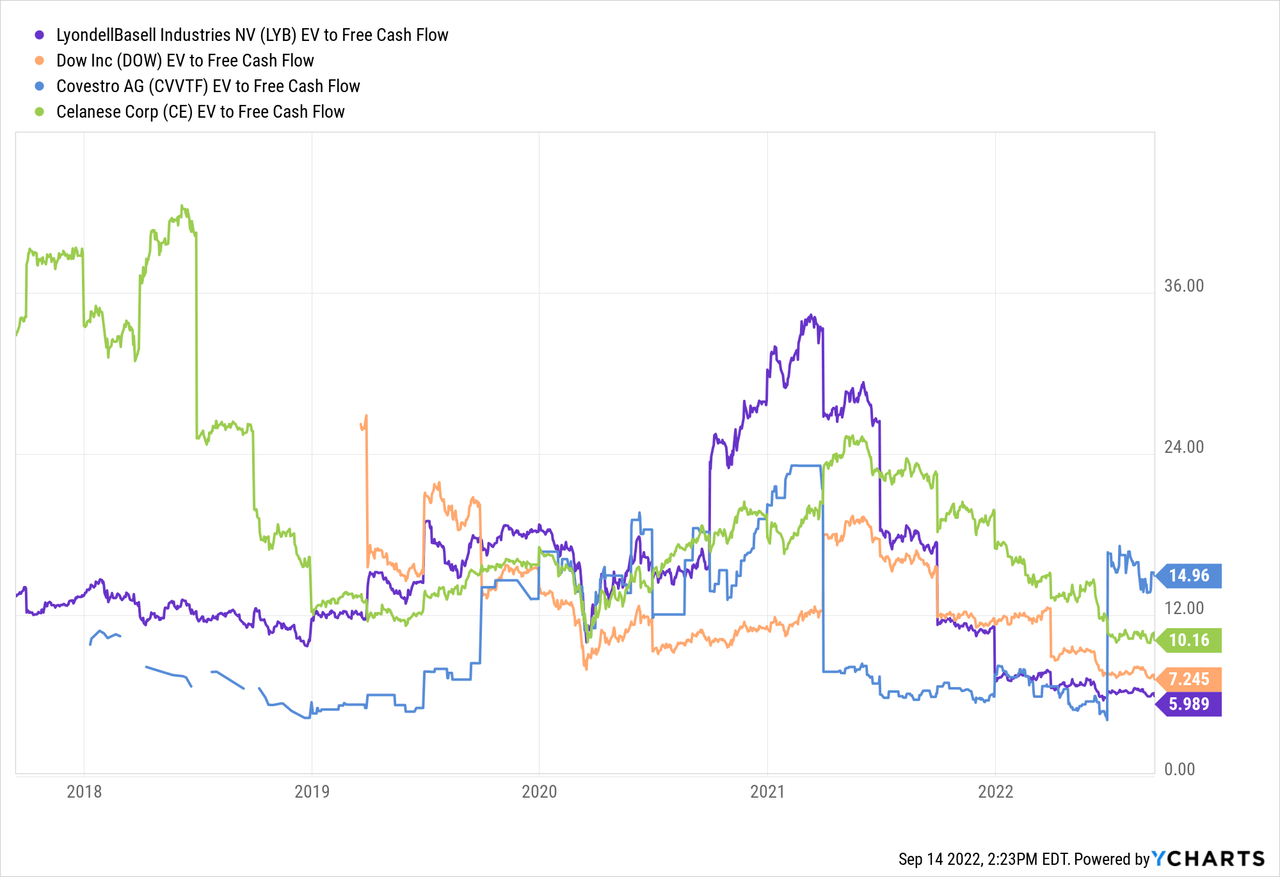

To map the valuation of LyondellBasell, I compare the EV/Free cash flow with that of competitors. This takes the market value plus debt minus cash and compares it to the company’s free cash flow. Some other players in the chemical industry are Dow (DOW), Covestro (OTCPK:CVVTF) and Celanese (CE).

LyondellBasell is valued cheaply by the EV/FCF valuation metric compared to other players in the chemical industry. The low stock valuation allows for a high dividend yield and the opportunity to buy stocks cheaply.

LYB’s Dividend Is Well Covered

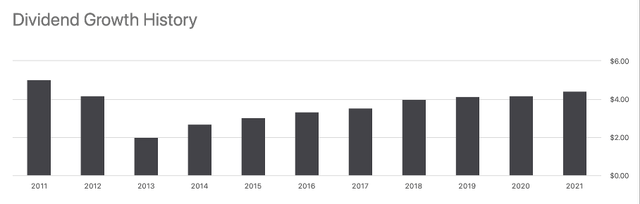

LyondellBasell has been paying dividends for years and has been increasing its dividend per share annually since 2014. Despite the fluctuations in sales in recent years, earnings and free cash flow have remained roughly stable. This indicates that they have the overhead costs well under control. The dividend has increased by an average of 6% year-on-year over the past 5 years. The share price has remained fairly stable over the past 5 years and the dividend yield is now around 5.9%.

Dividend Growth History (LYB Ticker Page On Seeking Alpha)

The current dividend is well covered by both earnings and free cash flow. The high EPS of 2021 is due to strong demand and the tight market in which LyondellBasell has benefited well. The 2022 estimate is based on 19 analysts’ expectations on Seeking Alpha’s LYB ticker page. Dividend per share (DPS) is well covered by the expected Non-GAAP EPS of $16.56.

|

Jaar |

DPS |

FCF per aandeel |

Non-GAAP EPS |

|

2017 |

$3.55 |

$9.17 |

$10.23 |

|

2018 |

$4.00 |

$8.65 |

$11.27 |

|

2019 |

$4.15 |

$6.42 |

$9.60 |

|

2020 |

$4.20 |

$4.36 |

$5.61 |

|

2021 |

$4.44 |

$17.17 |

$16.84 |

|

2022 estimate |

$4.76 |

N/A |

$16.56 |

Share Repurchase Program

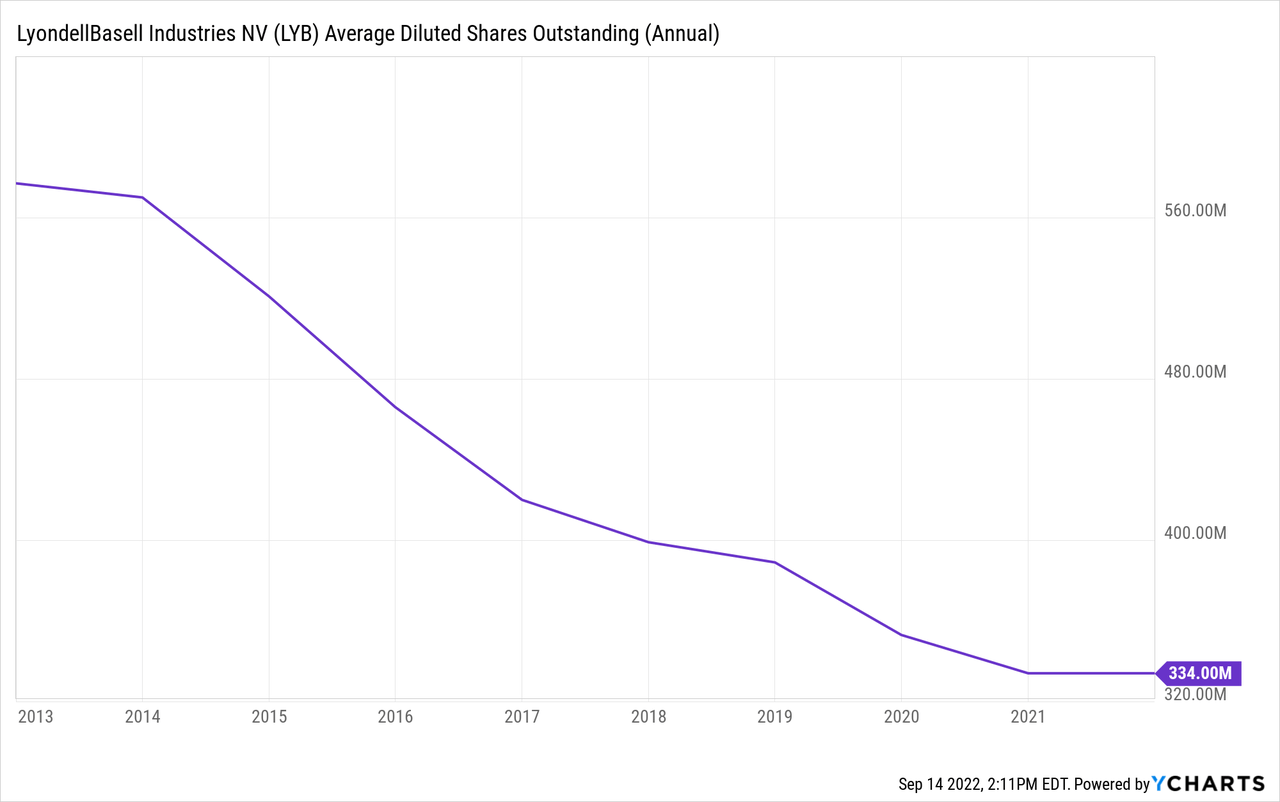

In addition to paying a high dividend, LyondellBasell is repurchasing treasury shares. In 2021 it bought back $0.5B worth of shares, which at the time amounted to a buyback yield of 2%. Since 2013, the shares outstanding have been reduced by about 45%.

In June 2022, LyondellBasell paid a special dividend of $5.20 per share. LyondellBasell management supports the continuation of the disciplined capital allocation by both paying dividends and buying back shares.

Conclusion

LyondellBasell’s principal activities include the production of olefins and polyolefins, oxyfuels, refining and the like. This generates a high free operating cash flow yield of 26% and a cash conversion rate of 91%. The management is shareholder friendly as a large part of this is paid out as dividend and the company buys back shares. The dividend yield is currently a solid 5.9% and the buyback yield for 2021 was 2%. LyondellBasell is developing a plant that has technology to produce polyurethanes and clean-burning oxyfuels in the most cost-effective way. This plant is expected to be operational in early 2023 and is expected to generate an EBITDA of $450 million per year. Based on the EV/FCF valuation metric, LyondellBasell is the cheapest valued compared to other players in the chemical industry. Shareholder-friendly management, high and safe dividend, share buyback program and cheap valuation make LyondellBasell a buy.

Be the first to comment