hamzaturkkol/iStock via Getty Images

Introduction

Upon the completion of the second quarter of 2022, it seemed that LyondellBasell Industries (NYSE:LYB) was entering a new era for dividends after paying their first-ever special dividend, as my previous article highlighted. Whilst the worsening natural gas crisis in Europe is creating issues for their operations as costs surge and erode earnings, thankfully their shares are still offering desirable value even with Europe suffering in the medium to long-term, as discussed within this follow-up analysis.

Coverage Summary & Ratings

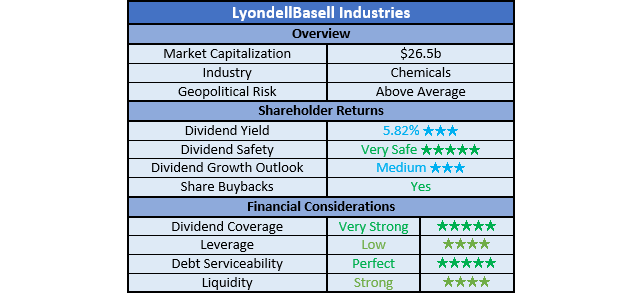

Since many readers are likely short on time, the table below provides a brief summary and ratings for the primary criteria assessed. If interested, this Google Document provides information regarding my rating system and importantly, links to my library of equivalent analyses that share a comparable approach to enhance cross-investment comparability.

Author

Detailed Analysis

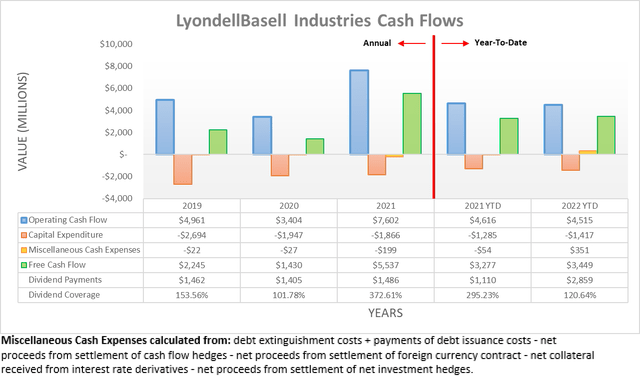

After seeing their cash flow performance soften during the second quarter of 2022 versus their previous results during 2021, economic pressure weighed down their results even further during the third quarter of 2022. This fully counteracts their otherwise very strong start to the year in the first quarter with their operating cash flow of $4.515b across the first nine months now slightly lower year-on-year versus their previous result of $4.616b during the first nine months of 2021, after having previously been ahead year-on-year following the first half of 2022.

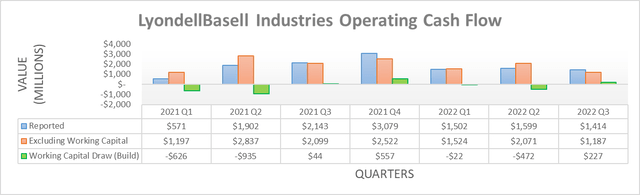

When viewed on a quarterly basis, their softening operating cash flow during the third quarter of 2022 is easily visible. Regardless of whether looking at their reported results of $1.414b or their underlying result of $1.187b that excludes working capital movements, they are both down sequentially versus the first and second quarters. Plus, they are also down year-on-year versus the third quarter of 2021 that saw a reported result of $1.902b, along with an underlying result of $2.837b. One soft quarter is not normally any cause for concern by itself, although this time may be different because they face weakness across both the demand and cost sides of the equation, as per the commentary from management included below.

“LyondellBasell’s business portfolio faced headwinds from rising costs and weaker demand at the same time.”

“In North America, the combination of customer destocking and expectations of additional supply from new assets resulted in lower product prices.”

“European markets were severely pressured by tight gas supplies and higher energy costs that reduced demand from both plastic converters and downstream consumers.”

“Across our European assets, September year-to-date energy costs are $1.8 billion higher than the same period in 2020.”

-LyondellBasell Industries Q3 2022 Conference Call.

The weakness they suffered on the demand side of the equation is merely par for the course when it comes to an economically sensitive and inherently volatile industry, such as observed in North America. More so, the bigger medium to long-term issue stems from Europe whereby they also endured far higher costs on the back of the natural gas crisis following the Russia-Ukraine war, which now sees the continent undergoing a massive structural transition. As a result, it is threatening energy-intensive industries on the continent with many already shutting down or at least, scaling back their operations, something LyondellBasell Industries find themselves doing, as per the commentary from management included below.

“Also, in response to lower demand and margins, we plan to operate our European assets at approximately 60% of capacity during the fourth quarter.”

-LyondellBasell Industries Q3 2022 Conference Call (previously linked).

Unlike demand weakness, this is not necessarily a short-term issue because there is no concrete timeline for when Europe will recover from their natural gas crisis because replacing the vast sums supplied by Russia is far from an easy nor quick task. At best, the timeline is likely measured in multiple years but even thereafter, no one necessarily knows what the new normal will look like on the other side because until the events of 2022, Russia was previously a reliable low-cost supplier.

Considering this difficult situation, it seems warranted to assess the outlook without any financial contributions from their European operations. When looking back at 2021, which is the most recent year not impacted too significantly by either the Covid-19 pandemic or the Russia-Ukraine war, they saw $1.228b of their total $6.773b of operating income stem from their international olefins and polyolefins business segment, thereby amount to circa 18%. Whilst this also includes their olefins and polyolefins operations throughout Asia Pacific, Middle East and South America, these are relatively smaller in scope than Europe and thus their inclusion should provide a reasonable margin of safety to account for other relatively small contributions Europe provides to their other smaller business segments that are not broken down by geographical region.

In theory, there should be a positive correlation between their operating income and their free cash flow, especially because a severe downturn in Europe would likely see management pull back on growth investments, thereby maximizing free cash flow generation via lower capital expenditure. If they were to lose around 20% of their free cash flow from 2021, their result of $5.537b would drop to circa $4.4b. When compared against their current market capitalization of approximately $26.5b, this still leaves a very high near 17% free cash flow yield.

Obviously, in the short-term the demand issues elsewhere in North America would see their free cash flow suffer to a greater extent than this estimation, assuming economic conditions continue deteriorating. Although, it should be remembered this is only temporary as chemical markets fluctuate in response to weakening economic conditions that will eventually recover and as such, the medium to long-term is far more important. To this point, even without any financial contributions from their Europe operations, their estimated double-digit free cash flow yield means they still retain ample capacity to fund large shareholder returns in the medium to long-term, despite fluctuating in the short-term with economic conditions.

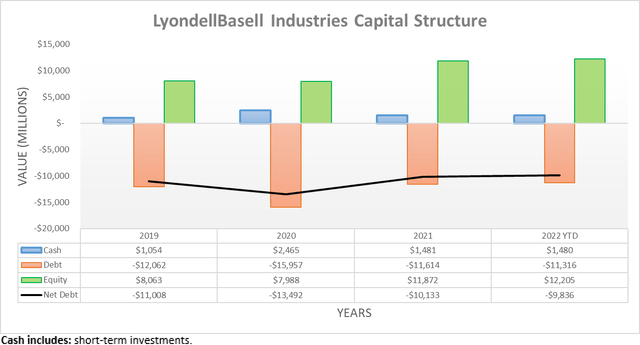

Despite their cash flow performance softening, the third quarter of 2022 still saw ample free cash flow to push their net debt lower to $9.836b versus where it ended the second quarter at $10.418b. Going forwards, their net debt will continue to fluctuate quarter-to-quarter but as discussed within my previous analysis, management stated an intention not to deleverage any further. There was no mention of “debt” nor “deleverage” throughout their previously linked third quarter conference call and thus no reason to expect their capital allocation strategy to change. As a result, their net debt should remain broadly unchanged on a per-year basis as they continue matching their shareholder returns to their free cash flow.

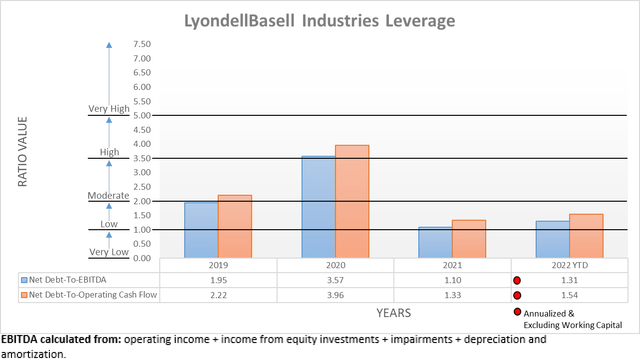

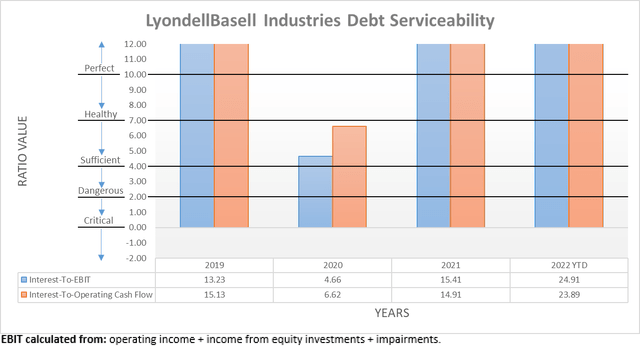

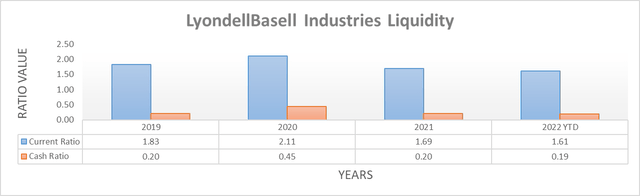

Since there was only a minor change during the third quarter of 2022, it seems redundant to reassess their leverage or by extension, their debt serviceability in detail. Plus, as their cash balance increased to $1.48b versus $1.057b across these same two points in time, it would also be redundant to reassess their already strong liquidity in detail because this could have only improved.

The three relevant graphs are still included below to provide context for any new readers, which shows their leverage is once again sitting within the low territory with net debt-to-EBITDA at 1.31 and their net debt-to-operating cash flow at 1.54. Elsewhere, their debt serviceability is perfect with interest coverage of 24.91 and 23.89 when compared to their accrual-based EBIT and cash-based operating cash flow, respectively. As expected, their already strong liquidity continued with their current ratio at 1.61 and their cash ratio at 0.19. If interested in further details regarding these topics, please refer to my previously linked article.

Conclusion

The outlook for softening financial performance on demand weakness in North America and cost issues in Europe are certainly not ideal, although thankfully, the former should only prove to be a short-term issue. Whilst the latter issues in Europe are likely to extend for multiple years, even if investors ignore any contribution to their financial performance, their shares still carry an estimated double-digit free cash flow yield in the medium to long-term. This sees their shares offering desirable value, especially given their ample capacity to fund large shareholder returns on the back of their rock-solid financial position. When combined, I still believe that maintaining my buy rating is appropriate but at the same time, shareholders should brace for volatility in the short-term given the gloomy economic outlook for 2023.

Notes: Unless specified otherwise, all figures in this article were taken from LyondellBasell’s SEC filings, all calculated figures were performed by the author.

Be the first to comment