peshkov/iStock via Getty Images

|

Investment Results |

Full Year 2019 |

Full Year 2020 |

Full Year 2021 |

Year-To-Date 2022 |

Since Inception1 |

|

LVS Defensive Portfolio (net of fees) |

7.0% |

13.2% |

9.1% |

3.3% |

36.4% |

|

Benchmark: Barclays High-Yield Bond Index |

13.4% |

5.0% |

4.0% |

(18.5%) |

0.9% |

|

LVS Growth Portfolio (net of fees) |

– |

61.8% |

16.1% |

(34.1%) |

23.9% |

|

Benchmark: S&P 500 Total Return Index |

– |

18.4% |

28.7% |

(17.7%) |

25.4% |

|

Note: investment performance is presented net of all fees and expenses. Investment results are as of October 31, 2022. 1 LVS Defensive was incepted on January 1, 2019. LVS Growth was incepted on January 1, 2020. |

Dear Investors,

In the third quarter, the Defensive Portfolio gained 2.9%. The portfolio gained an additional 1.3% in October bringing the year-to-date gain to 3.3% (net of all fees and expenses). This compares favorably with our benchmark, the Barclays High-Yield Bond Index which is down 18.5% year-to-date.

The Growth Portfolio was down 5.5% in the third quarter. The portfolio gained 9.4% in October bringing the year-to-date performance to down 36.4% year-to-date (net of all fees and expenses). The Growth Portfolio has underperformed the S&P 500 in 2022.

In the first part of this letter, I will discuss why merger arbitrage has proven to be a resilient strategy during this market downturn. The second part of this letter will discuss new investments we have made in the Growth Portfolio and how we are positioned to recover from our current drawdown.

The Resilience of Merger Arbitrage Investing

As pointed out in our Q2 2022 letter, the LVS Defensive Portfolio has outperformed nearly every other asset class in 2022. The secret to our success is our focus on merger arbitrage investing.

As merger arb investors, we purchase shares of public companies that have agreed to sell themselves in a pending deal. Therefore, we will generate a positive return so long as the deals we are betting on are completed. The good news for arb investors is that mergers are almost always completed as expected.

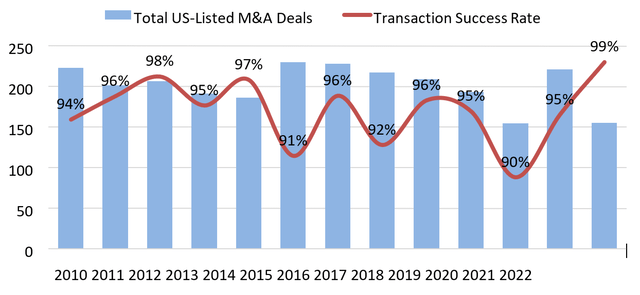

According to research from Insider Arbitrage, 95% of US-listed M&A deals close as expected. This data point captures over 2,600 announced public company deals going back to 2010, a robust sample size and measurement period.

Data Source: Inside Arbitrage.

M&A deals have a high success rate for a few reasons. First, there are legal protections in place for the seller in the form of an ironclad merger contract with a buyer. This contract creates a binding commitment, and the buyer must use their reasonable best efforts to consummate the deal. Second, acquisition financing is generally secured in advance, and debt/equity commitment letters are rock-solid, as this year’s credit cycle taught us. Finally, most transactions receive approval from regulators.

Why 5% of Public M&A Deals Fail to Close

The downside to merger arbitrage investing is that getting stuck in deals that fail to close can lead to losses. I have worked hard to study the conditions that cause deals to fail and have developed risk management processes to avoid situations where there is an elevated risk of a deal failing to close.

The table below captures the 137 deals that failed to close since 2010. I would like to share some analysis as to why deals fail and draw lessons that can be used to protect our capital from losses.

|

Reason for Failure |

# |

% |

|

Regulatory Issue |

36 |

26% |

|

Deal Re-cut |

34 |

25% |

|

Shareholder Rejection |

23 |

17% |

|

Business Impairment |

11 |

8% |

|

Financing Issue |

10 |

7% |

|

Other |

23 |

17% |

|

Total Failed/Recut Deals Since 2010 |

137 |

100% |

|

Data Source: Inside Arbitrage. |

Re-cuts Deals

25% of deals that did not close on the original terms were renegotiated; this usually translates into a slight price cut for a buyer that overpaid but can sometimes result in a price increase for the selling shareholders. We recently benefited from such a price increase when the Hill International (NYSE:HIL) buyout price was adjusted from $2.85 per share to $3.40, a 19% price increase.

Sometimes deals are re-priced so that the buyer can save face and the seller retains the resolve to go forward with the deal. In 2020, LVMH cut the acquisition price for Tiffany’s from $135 per share to $131.50, a 2.6% price reduction, after threatening to walk away from the deal during the pandemic.

Shareholder Rejection

17% of unsuccessful deals were rejected by shareholders. This usually occurs when a buyout price is deemed too low.

Qiagen (NYSE:QGEN) experienced a rapid acceleration in revenue growth between the time it agreed to sell itself to Thermo Fisher Scientific (NYSE:TMO) in March 2020 and the shareholder vote in August 2020. Thermo refused to increase its acquisition bid and Qiagen’s stock price rallied after shareholders rejected the deal.

Regulatory Issues

The most common reason a deal fails is due to regulatory issues, representing 26% of unsuccessful transactions. Luckily, these situations are usually obvious and easy to avoid.

Acquisitions that do not have regulatory issues tend to get fast-tracked for approval. The deals that are rejected by regulators tend to drag on for months past the expected close dates and are subjected to additional rounds of scrutiny.

For example, Rogers Corp (NYSE:ROG) agreed to sell itself to DuPont (NYSE:DD) in November 2021 in a deal that was expected to close in Q2 2022. However, the deal close was delayed twice after regulatory approvals were not received on time. These delays provided a warning that the deal could be in trouble and nimble investors had an opportunity to trade around the situation and avoid losses. The deal was officially terminated on November 2, 2022.

Other Miscellaneous Issues

There are other reasons a deal may fail. A buyer may fail to line up financing or the selling company may fail to satisfy an obscure closing condition. These miscellaneous reasons generally stem from poorly structured deals or a target company that sold itself out of desperation. These situations can be identified by studying the publicly disclosed merger contracts and acquisition process.

Lessons to Draw from Failed Deals

Having spent years studying deals, I have developed some simple rules to help us avoid unsuccessful deals and protect our capital from losses.

- Avoid deals that are too one-sided. If a deal overwhelmingly benefits the seller, the buyer may threaten to re-cut a deal or walk. If a deal isn’t attractive for the seller, shareholders may reject it.

- Pay attention to deal timelines and processes. If a deal misses key deadlines or is delayed due to extended regulatory scrutiny, it is at higher risk of an adverse regulatory decision.

- Avoid deals with nonstandard terms. If a deal is contingent on sketchy financing or unusually onerous conditions, something is likely amiss.

Growth Portfolio Update: Taking Advantage of the Market Dislocation

The Growth Portfolio has underperformed the S&P 500 so far in 2022. I detailed the factors that have led to our underperformance in our Q2 letter.

The Growth Portfolio’s goal is to maximize long-term capital appreciation and we willingly accept higher levels of volatility to achieve this goal. We often invest in small caps, foreign stocks, and businesses with aggressive reinvestment plans. We are also willing to establish a large position size if an investment presents a particularly compelling risk/reward outcome. This is a long-winded way of saying that the volatility in our portfolio is a feature, not a bug.

I am extremely dissatisfied with our underperformance so far this year. The totality of my family’s investable capital is split roughly evenly between the two strategies I manage, and I am highly motivated to climb out of our current drawdown and generate strong investment results in the periods ahead. I am quite bullish on the forward return prospects for the Growth Portfolio and have been allocating more of my family’s capital to the strategy.

Going forward, I will provide more transparency in the quarterly letter into what we own and why we own it. The table below discloses our top 5 positions in the Growth Portfolio and their relative weights. The top 5 positions account for 36% of the portfolio. The top 10 positions account for 59% of the portfolio.

|

Growth Portfolio Top Holdings |

% |

|

Interactive Brokers (IBKR) |

11.4% |

|

Charles Schwab (SCHW) |

7.5% |

|

Avid Technology (AVID) |

6.4% |

|

SS&C (SSNC) |

5.7% |

|

Xpel (XPEL) |

5.2% |

|

Total Top 5 Positions |

36.1% |

|

Total Top 10 Positions |

59.4% |

2022 has also been one of the most exciting years to be a public markets investor. Unlike 2020, the market’s decline has been protracted giving us ample time to find and diligence great businesses available at bargain prices. We have taken full advantage and have made several new investments throughout the course of the year.

Interactive Brokers (IBKR)

The most notable new position this year has been our investment in Interactive Brokers (IBKR). I published a detailed write-up (link here) and also appeared on the ‘Yet Another Value Podcast’ (link here) to discuss our IBKR thesis. To boil it down, IBKR benefits from higher interest rates, and the stock was available at an exceptionally cheap price. I believe IBKR represents a particularly good risk/reward bet and have made it our largest position.

Charles Schwab (SCHW)

We purchased shares of Charles Schwab (SCHW) around the same time as Interactive Brokers. The investment thesis is similar. Schwab benefits from higher interest rates as it collects income earned from client cash. While IBKR mostly serves retail investors, Schwab has a greater emphasis on wealth advisors and corporate retirement plans. B2B channels are sticker than retail traders and give Schwab pricing power to collect a greater portion of the interest earned than IBKR.

Schwab is a more mature business and has fewer reinvestment opportunities than IBKR (which is why I prefer IBKR on the margin); however, Schwab has authorized a massive $15 billion share buyback program (!) representing over 10% of the company’s market cap at the time of announcement. Given that Schwab trades for a mid-teens price-to-earnings multiple and has a low cost of capital, the share buyback should be highly accretive. The combined tailwind from higher interest rates and the buyback program will lead to attractive earnings per share growth over the coming years.

Xpel primarily sells paint protection film which is a coating that protects the paint job on cars. This is a highmargin specialty chemical product that is rapidly growing in adoption globally. The company has successfully expanded its product line from paint protection film to window tint with an opportunity to sell additional auto accessories down the road.

The business is run by an incredible entrepreneur who navigated the business from the brink of bankruptcy 10 years ago and generated incredible returns for investors in the public markets. We purchased the stock during Q2 when the stock price was depressed due to the shortage of new car production. I see an attractive long-term opportunity for the company to continue growing its distribution of paint protection film and expand into more product adjacencies.

Netflix (NFLX)

I have long admired Netflix but have never owned the stock before 2022. The company saw its market valuation soar during the pandemic as the world stayed at home and the company gained subscribers. Netflix’s growth rate stalled during the first half of 2022 as many subscribers churned at the end of the pandemic. The stock price fell 75% from a high of $692 in November 2021 to a low of $170 in July 2022. The stock which once traded for a price-to-earnings multiple of 60x became available at a below-market multiple of 17x.

Furthermore, the company laid out plans to restrict account sharing and launch an advertising-supported tier to attract customers unwilling to pay up for more expensive plans. Based on my research, I believe Netflix’s new ad-supported tier will be even more profitable than its traditional plans and lead to significant subscriber growth. Finally, the company has struck a new tone in 2022 around its intent to manage expenses more carefully to defend margins and drive cash flow per share growth for shareholders. I liked Netflix’s 2022 pivot and we invested in the stock over the summer at an attractive entry point.

SS&C is a publicly traded acquisition platform led by its founder Bill Stone who is also the largest shareholder. SS&C’s platform focuses on investment fund services (accounting, administration, back-office tools) and enterprise software. The company routinely makes large acquisitions in its target markets financed by debt and then quickly rationalizes the acquired companies and pays down debt. SS&C and its operators are very good at what they do.

Since becoming public in 2010, SSNC has compounded its earnings per share at 25% per year (over 11 years). Despite this impeccable track record, the stock is down more than 40% this year. Investors are generally skeptical that an acquisition platform can generate strong investment returns given the current level of interest rates. Investors are also worried that SS&C’s customer base will be negatively impacted by the decline in asset prices. I am happy to take the other side of that bet!

While SS&C will face some near-term headwinds from the market’s volatility, its client base is largely composed of private equity funds and hedge funds which have fared relatively well during 2022. SS&C’s valuation multiple is the cheapest it has ever been since its IPO and the company is aggressively buying back stock. A well-timed transaction could also be in the cards. SS&C made a number of outstanding, opportunistic acquisitions during the great recession from 2008 to 2010 and the company is primed to run that playbook again.

Until Next Time

While this has been a difficult environment to allocate capital and manage investments, I am incredibly excited about the opportunity set in both of our strategies. The Defensive Portfolio has proven itself as an all-weather strategy during bull and bear markets. The Growth Portfolio is down with the market, but we have seized the opportunity to purchase several quality businesses at bargain prices. I expect a strong resurgence in our Growth Portfolio over the coming years.

Best regards,

Luis V. Sanchez CFA

LEGAL DISCLAIMERThe information and statistical data contained herein have been obtained from sources, which we believe to be reliable, but in no way are warranted by us to accuracy or completeness. We do not undertake to advise you as to any change in figures or our views. This is not a solicitation of any order to buy or sell. We, any officer, or any member of their families, may have a position in and may from time to time purchase or sell any of the above mentioned or related securities. Past results are no guarantee of future results. This report includes candid statements and observations regarding investment strategies, individual securities, and economic and market conditions; however, there is no guarantee that these statements, opinions or forecasts will prove to be correct. These comments may also include the expression of opinions that are speculative in nature and should not be relied upon as statements of fact. LVS Advisory LLC is committed to communicating with our investment partners as candidly as possible because we believe our investors benefit from understanding our investment philosophy, investment process, stock selection methodology and investor temperament. Our views and opinions include “forward-looking statements” which may or may not be accurate over the long term. You should not place undue reliance on forward-looking statements, which are current as of the date of this report. We disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events or otherwise. While we believe we have a reasonable basis for our appraisals and we have confidence in our opinions, actual results may differ materially from those we anticipate. The information provided in this material should not be considered a recommendation to buy, sell or hold any particular security. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment