jetcityimage

The following segment was excerpted from this fund letter.

Tesla (NASDAQ:TSLA)

Our highest conviction idea, Tesla, continues to execute on its core objectives. Right now, we believe fair value for the business is far higher than the stock quote, but we do not believe this discrepancy can exist for much longer.

To be clear, this quarter presented significant—but temporary—challenges for Tesla. In particular, Covid-related shutdowns caused a multi-week idling of Tesla’s factory in Shanghai, which halted all vehicle production. Supply chain issues have also persisted globally, limiting Tesla’s true production capacity.

These challenges—combined with macroeconomic factors—have certainly weighed on Tesla’s stock price year-to-date. Looking forward, however, we remain increasingly bullish on both the business and its stock price. Tesla achieved record production in June 2022. Barring no future factory shutdowns, we believe Tesla is poised to accelerate production in the coming years—far beyond consensus expectations.

This quarter, we also released a 90+ page research report detailing our view on Tesla’s near- term and long-term structural advantages, its opportunities, and its likely growth trajectory. The report covers many substantive themes—from Tesla’s lead in artificial intelligence to its extreme vertical integration. At a very high level, we believe Tesla is on a path to dominate the S&P 500. And we believe this could happen sooner than many people might believe.

For this letter, we want to emphasize one theme from the report that we think many on Wall Street miss: Tesla is in a class of one when it comes to manufacturing. In fact, we believe Tesla is ushering in an advanced manufacturing renaissance that will drive production speed, capacity, and margins at an accelerated pace. We also believe Tesla will soon be generating extreme levels of cash flow, which we elaborate on below, along with an update on how we view its fair value.

Speed is cash

As you’ll note above, the theme of this quarter’s letter is “Continuous motion, experimentation, and innovation.”

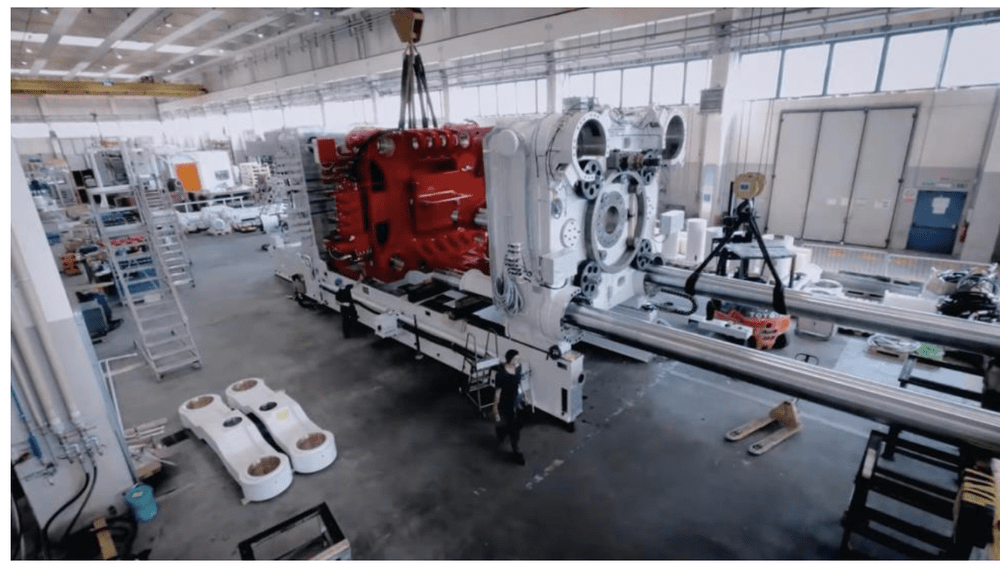

Tesla’s manufacturing process is a prime example of experimentation and a First Principles approach: Based on our on-the-ground research, they have made significant strides in the reinvention of the production of a large manufactured good by using extreme automation, unique die-casting molds, and novel stamping processes (using Tesla’s giant “Giga press”) that speed production of a Tesla vehicle by a factor of at least 10x.

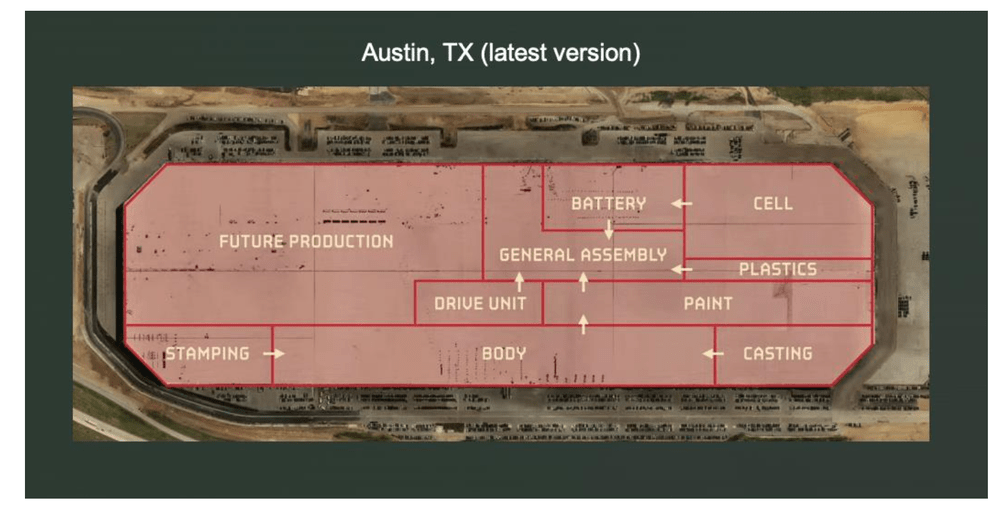

At Tesla’s new facilities in Austin and Berlin, for instance, lines will stamp out car bodies every 45 seconds—an order of magnitude faster than any existing production line in the world.

One of the major themes we see very often in the media and financial press is that incumbent OEMs or startup EV manufacturers could tweak existing factories to produce electric vehicles at scale. This, the theory goes, will create significant competition for Tesla — and thus Tesla’s demand will slow. We believe this is a fundamentally incorrect view.

While OEMs and well-capitalized startups have come to market with new EV variants in recent months, no other manufacturer has come close to Tesla’s ability to generate millions of units of EVs at a 30%+ gross margin profile.

There is a good reason for this: Tesla’s factories—not its cars—are becoming the true drivers of its technical innovations.

Back in 2020, Elon Musk noted that Tesla needed to redesign its factories from scratch to allow for maximum speed and efficiency, and to meet the company’s ambitions of 50 percent annualized growth.

Speed is cash, and the results of this continuous experimentation and innovation is bearing fruit.

In Q1 2022, Tesla generated $2.2 billion in free cash flow—a 660% YoY increase. Despite challenges encountered in Q2 2022—from Covid lockdowns to supply chain issues—Q3 and Q4 are poised for explosive growth. For a product that has excessive demand, the speed at which a factory can build and deliver goods to customers enables free cash flow to grow dramatically.

By designing its new factories with the goal of maximizing volumetric efficiency, Tesla also increases the speed and density of movement within the facility.

The goal, of course, is increasing margins, faster cash flows, and more output. “A factory that’s moving at twice the speed of another factory is equivalent to two factories,” Musk noted. “And the company that will be successful is the company that with one factory can accomplish what other companies take two or three or four factories to do.”

Later, he added: “Tesla is aiming to be the best at manufacturing of any company on Earth.”

We agree. In our report, we noted the comparison of Tesla’s factories to semiconductor chips. The similarities are striking. Tesla’s initial factories were arguably more bloated, larger, and certainly slower—just like early semiconductor chips. Tesla’s newer factories in Shanghai, Berlin and Austin are increasingly more compact, faster, and utilize more volumetric space, enabling far more efficiencies to scale. The use of the third dimension of space generates faster output with a smaller footprint.

We believe the financial implications of increasing velocity in the manufacturing process will show up in the P&L, far beyond current sell-side estimates over the next several years.

Looking out towards 2024, we believe Tesla could deliver 5 million units (if existing factories ramp as we expect them to ramp). As of this writing in mid-2022, the average sell-side estimate is 2.4 million units produced by 2024. This discrepancy in expectations of volume growth is, in our view, creating a significant discount to Tesla’s share price today—but it will not last forever.

To use some basic math: By 2024, if Tesla produces 5 million vehicles at an ASP of $50,000, that is $250 billion in revenue. On those topline figures, we believe they’d achieve roughly $50 billion in net income (assuming ~20% net income margins) in 2024. This would translate to roughly $50 in earnings per share by year-end 2024, assuming no further dilution to the stock (which we do not expect). Based on these projected earnings, our anticipated stock price for year-end 2024 would be around $3,750. This implies roughly 400% upside from where it trades today—and a market capitalization of nearly $4 trillion.

Again, this is our conservative view, and does not factor in additional earnings growth from the company’s energy operations division, FSD operations, or other future ambitions, such as the humanoid bot.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment