Drew Angerer

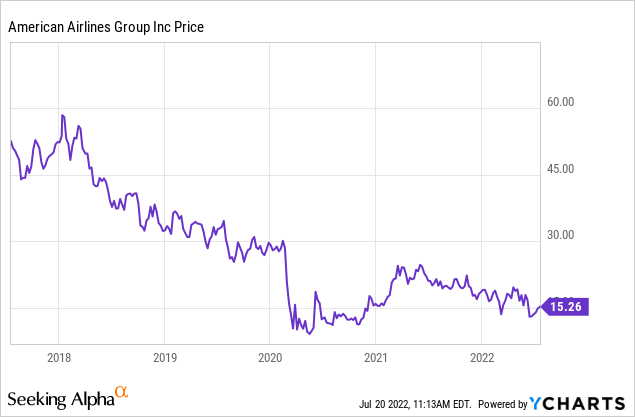

I’ll start by saying I like American Airlines (NASDAQ:AAL). Sure, the seat rows seem to have magically gotten closer together over the years, and post-COVID flying has not been the same experience. But I’ve also received unexpected kindness from gate agents, ticket counter agents, and flight attendants across America. As much as people complain about airline customer service, as a frequent AAL customer, I can say that I’ve been pleasantly surprised on several occasions, especially when something initially goes wrong. Since April, alcohol service is back and masks are optional! The world is getting back to normal. But during the pandemic, major airlines lost billions of dollars. Thanks to the quantitative easing policies of the Federal Reserve, American Airlines was able to borrow tens of billions of dollars that it needed to continue operating. But now, as the Fed pulls its blanket support from the bond market, there are questions about whether American Airlines will be able to continue refinancing its debt at viable interest rates. The stock has held its own as consumers continue to spend on summer travel. But winter is coming.

American Airlines’ Debt Load

One basic test for whether a stock is a viable investment is to compare the total assets of a company with the total liabilities. If a company has liabilities exceeding its assets, then the company is considered insolvent. As of their last quarterly report, American Airlines has roughly $76.3 billion in liabilities and $67.4 billion in assets.

This isn’t always a deal-breaker as sometimes companies will have unusual amounts of depreciation that cause them to hold assets on their books for less than their economic value. But when I checked peers Delta (DAL), United (UAL), and Southwest, (LUV), American is the only airline with a negative net worth. I checked smaller peers Spirit Airlines (SAVE) and JetBlue (JBLU) as well and they’re considered solvent. It’s pretty clear from comparing American to competitors that they’re in the weakest financial position of the major airlines. The credit rating agencies agree, rating AAL’s debt at B-.

This doesn’t mean in itself that American is done for, but what it means is that the company needs to earn its way out of the hole that they’re in. This quarter, they’ll be OK with COVID revenge travel in full swing. But after the summer is over, it’s not clear if business demand and off-season demand will continue to be strong in the absence of continued government stimulus. Additionally, American needs to be able to refinance the debt that they do have.

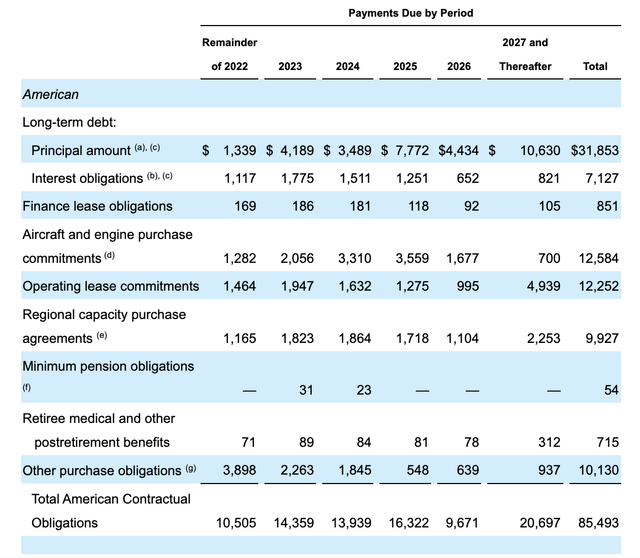

This is from their most recent 10-Q, showing their principal and interest obligations, lease obligations, aircraft purchase obligations, and other stuff that isn’t as talked about like pension and medical obligations.

American Airlines Debt Obligations (AAL 10-Q Report)

The idea here is that credit spreads on junk bonds are widening, and rates are rising as well. So when AAL goes to refinance all of this debt, they’re going to be paying more interest because they’re in a weak financial position and the Fed/Treasury is no longer backstopping debt the way it was.

There’s a path for American to turn this around, but they need everything to go right. The path to success for American Airlines is pretty simple. They need demand to stay strong while supply pressures like fuel ease. Additionally, they need the capital markets to stay easy enough for them to refinance their debt. It feels like betting on a parlay with the risks they face. Analysts expect AAL to lose $1.15 for 2022, but make $1.94 in 2023.

Operational Risks

There are many risks to AAL’s return to full-year 2023 profitability.

Fuel Costs

On page 44 of their 10-Q, American notes that they don’t have any fuel hedging in place. Delta actually owns an oil refinery in Pennsylvania (this makes DAL look really smart). I don’t think airlines should generally hedge fuel, as they don’t have a great track record of making money at it, but what this means is that American likely needs oil prices to go down to see their margins expand. If fuel keeps going higher, then it’s much less likely that AAL can make what they need to dig out of their debt load.

Labor Costs

The general position of the pilots union is that the airlines’ debt isn’t their problem, and if they want to continue to use the union, then they need to pay in line with cost of living increases. American offered a 17% pay raise to pilots, and as far as I know, they have yet to reach a deal. AAL’s margins are already thin, so a 17% pay raise for pilots over the next two years is not going to help the stock.

Pandemic Risk

AAL is among the stocks most exposed to a new variant or resurgence in the pandemic. COVID deaths are chugging along in the US at roughly the same pace that they were in the summer of 2021, so if this winter ends up being like last winter with more mask mandates and regulations, then pleasure travel is not likely to hold up.

Recession Risk

So far, the story with airlines is that business travel still hasn’t recovered, but pleasure travel has. Delta’s CEO expressed confidence in business travel returning, but this is by no means a sure thing. If we continue sliding into a recession, my guess is that pleasure travel will drop, while business travel stays somewhat low. Healthy airlines normally can survive recessions because input costs like fuel drop. The worst-case scenario for airlines is if a recession happens, but oil prices stay high (i.e., stagflation).

Will American Airlines Survive A Recession?

It’s not clear at this point whether American Airlines would be able to survive a recession. AAL’s ability to survive a recession would depend on how deep the recession is, how wide credit spreads go, and how it affects air travel. These would affect AAL’s ability to refinance its debt. The debt load doesn’t leave much margin for error, as the company is at the mercy of credit markets. A ray of hope: The news on the bonds has been good lately, as both the secured and unsecured bonds have been trading higher for AAL. My educated guess based on the credit rating, balance sheet, and junk bond yields is that if we enter a recession, American Airlines likely will be forced to massively dilute shareholders, and has a 50% chance or higher of bankruptcy. Of course, selling a ton of stock into a weak market could save the company from its debt, but it likely drives the share price to well under $5 per share.

To be clear, AAL is in a lot of distress. If I owned any stock in AAL, I would swap it for the bonds, as I think that the equity in the company probably isn’t worth much with the book value so deeply negative. $0 is a distinct possibility. It’s possible for AAL to earn their way out, but the risk-reward on the common equity is quite weak in my opinion. I actually believe buying LEAP puts on stocks like American is a useful hedge for investors, not because I have a personal grudge against airlines, but because they’re heavily indebted and very sensitive to the state of the economy. A well-known asset pricing anomaly is that the junk-rated debt of companies has a far better risk-adjusted return than the corresponding equity. The bond market is much more rational than the stock market when it comes to companies like airlines, which is why I would consider investing in airline bonds rather than airline stocks. In many cases, unsecured bonds pay 10% or more in interest.

We’ll find out more about the company’s prospects when the company reports earnings this week. AAL earnings will provide a window into consumer spending on travel and on the direction of the broader economy. For the quarter, analysts expect AAL to earn $0.75, before returning to losses this winter.

Bottom Line

American Airlines is set to report earnings this week, but the real test is how they do over the next few years. With a brutal debt load, the company needs everything to go right to get out of the danger zone. I believe AAL has a roughly 50% chance of going bankrupt if the US economy slides into recession and an 80%-90% chance of having to heavily dilute shareholders. While there is a path to turn the company around, it’s narrow and fraught with risks. For these reasons, I’d sell AAL stock and consider moving your investment into the bonds if you believe in the company. What do you think? Share your take in the comment section.

Be the first to comment