Massimo Giachetti/iStock Editorial via Getty Images

Thesis

On July 26th LVMH (OTCPK:LVMUY) reported 1H 2022 results and surprised the market with truly excellent performance. Arguably, few investors and analysts have expected that the European luxury conglomerate can post double-digit year-over-year revenue growth amidst such a challenging macro-environment — pressured by falling asset prices, rising interest rates, inflation, a slowing economy in China and most notably decade-low consumer confidence. Or in other words, as Jean-Jacques Guiony, LVMH’s CFO, has described the company’s results:

The first half of 2022 has seen an excellent performance despite the difficult environment and clearly reflects the strength of LVMH strategy of having a diverse and balanced portfolio of brands, sold all around the world.

I am impressed by LVMH’s business resilience and I am confident to reiterate my Buy recommendation. In my opinion, any consumer-centric business that can post such strong performance amidst a global economic slowdown – and also trading at reasonable valuation – deserves to be in investors’ portfolio.

LVMH’s Strong 1H 2022

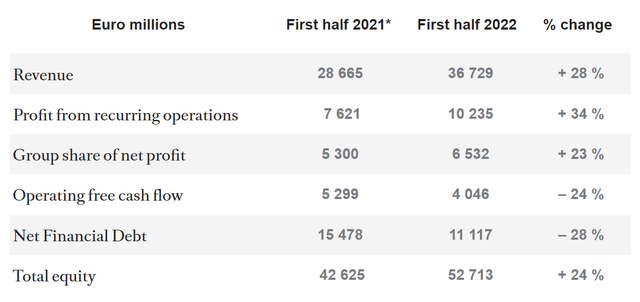

During the period from January to end of June, LVMH Moët Hennessy Louis Vuitton, has recorded total revenues of €36.7 billion, which represents an increase of about 21% as compared to the same period one year prior. Specifically for the second quarter, revenue increased by 27% year-over-year, of which 19% is attributable to organic growth (non-inflation driven).

Notably, during the first half of 2022, LVMH’s profit from recurring operations increased by more 34% and was recorded at €10.2 billion, indicating that the company was effectively defying inflationary pressures. Net profit increased by about 23% year-over-year to €6.5 billion.

Thanks to the strong revenue and profitability performance, LVMH managed to reduce net financial debt by more than one fourth, down to €11.1 billion. Respectively, total equity increased by almost one fourth, up to €52.7 billion

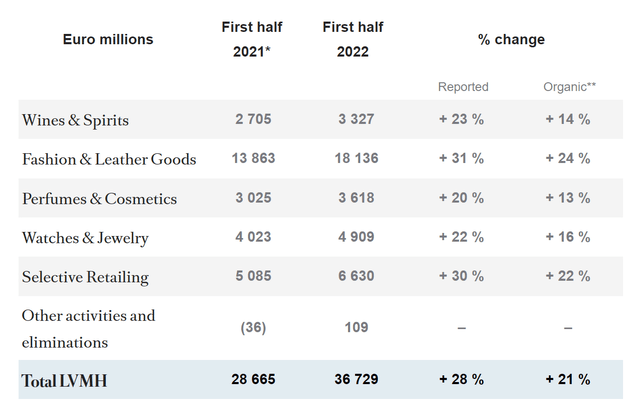

All Business Segments Are Up Double-Digit

Most notably, the strong performance was driven by the company’s entire portfolio, as all business segments have grown by double-digit rates. LVMH’s biggest segment Fashion & Leather Goods, accounting for more than 50% of the group’s total sales increased by 24% year over year. Bernard Arnault, Chairman and CEO of LVMH said:

LVMH has enjoyed an excellent start to the year, to which all of our business groups contributed. It is the creativity and quality of our products, the excellence of their distribution and the rich cultural heritage of our Maisons, fueled by their history and know-how, that enable the Group to excel around the world.

LVMH’s strong performance was driven by strong sales in the United States and a surprisingly strong demand in Europe. Japan was also quite strong, while China – unsurprisingly – showed a subdued performance. But overall, LVMH clearly outperformed buy-side expectations and since the company’s earnings release, the company’s stock has appreciated by about 8%.

Risks

LVMH stock is trading at a one-year forward P/E of about x23 and I thus believe an investment offers attractive risk/reward opportunities. But specifically with regards to the risk-side of the equation, I advise to keep in mind that despite the strong 1H results, it is too aggressive to imply that the company is not vulnerable to a sharp recession. In fact, LVMH remains consumer-centric with almost 100% of revenues being exposed to discretionary non-recurring spending. Bernard Arnault summarized the potential headwinds that the company might face in the second half of 2022 as follows:

We approach the second half of the year with confidence, but given the current geopolitical and health situation, we will remain vigilant and count on the agility and talent of our teams to further strengthen our global leadership position in luxury goods in 2022.

Reiterate Buy Recommendation

There are not many consumer-centric companies that can post such excellent results amidst one of the worst loss of consumer confidence in decades. Amongst inflationary pressures, rising interest rates, falling asset prices and a weak economy in China, LVMH’s results truly stand out.

I am impressed by LVMH’s business resilience and I am confident to reiterate my Buy recommendation and $700/share target price, which I have assigned to the company’s stock at $593/share. While my current (short-term) target price of $700/share only indicates about 5% upside, I continue to believe that LVMH will remain a secular growth story and a winning business.

My coverage initiation article: LVMH: I See A Buying Opportunity

Be the first to comment