mphillips007

Investment Thesis

In our opinion, Lumen Technologies, Inc (NYSE:LUMN) remains a speculative play, due to the massive debts, lower FCF profitability, and continued asset sales, only countered by its attractive dividend yield of 9.48% thus far. While the company would probably get by decently for the next few years, we are highly concerned about the debt maturity of $10.97B by FY2027. In addition, with slowing revenue and profitability growth ahead, we expect further downwards pressure on its stock performance in the intermediate term, further worsened by the rising inflation and potential recession.

However, we are cautiously optimistic that LUMN is a viable investment if its dividend payouts are maintained at current yields. Nonetheless, investors should always size their portfolios accordingly, given the potential volatility ahead.

LUMN Continues To Trim Its Business While Paying Off Debts

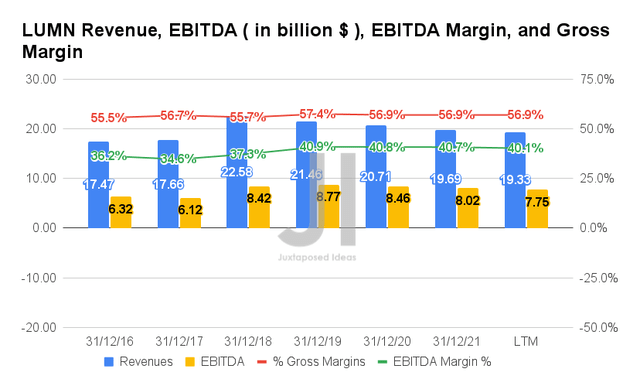

LUMN has had a notable deceleration in revenue growth thus far, due to the continued sale of its assets. By the last twelve months (LTM), the company reported revenues of $19.33B and gross margins of 56.9%, representing a decrease of 10% and 0.5 percentage points from FY2019 levels, respectively. This has directly impacted LUMN’s EBITDA as well, since it reported an EBITDA of $7.75B and an EBITDA margin of 40.1% in the LTM, representing a decrease of 11.6% and 0.8 percentage points from FY2019 levels, respectively.

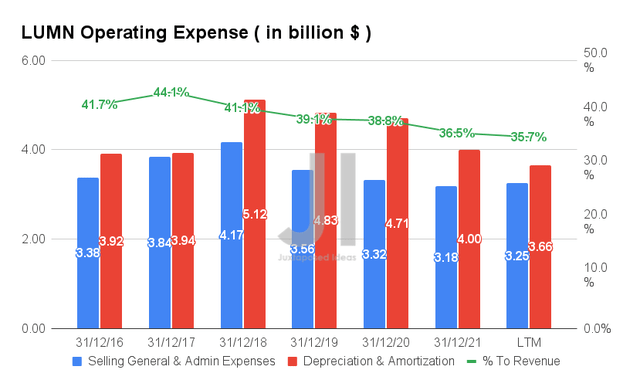

Nonetheless, LUMN has also been prudent in its capital management thus far, due to the moderation in its operating expenses to $6.91B in the LTM. It represented a decrease of -17.6% from FY2019 levels of $8.39B, which helped to reduce the ratio to its declining revenue to 35.7% at the same time, compared to 39.1% then.

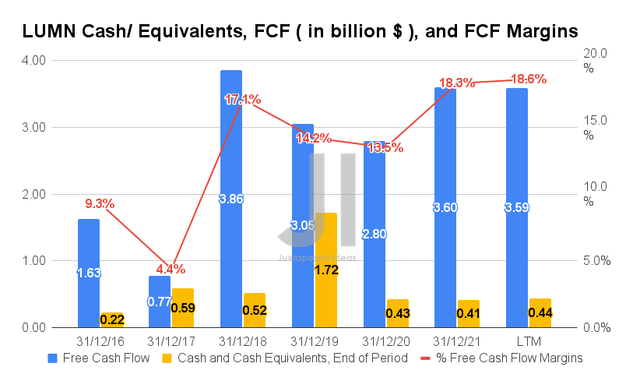

Therefore, due to the LUMN’s significantly lowered Operating Expenses and Interest expenses in the past two years, it reported a more robust Free Cash Flow (FCF) generation of $3.59B and an FCF margin of 18.6% by the LTM. It represented a massive improvement of 17.7% and 4.4 percentage points from FY2019 levels, respectively. In the meantime, LUMN’s cash and equivalents on its balance sheet remained relatively stable at $0.44B in the LTM.

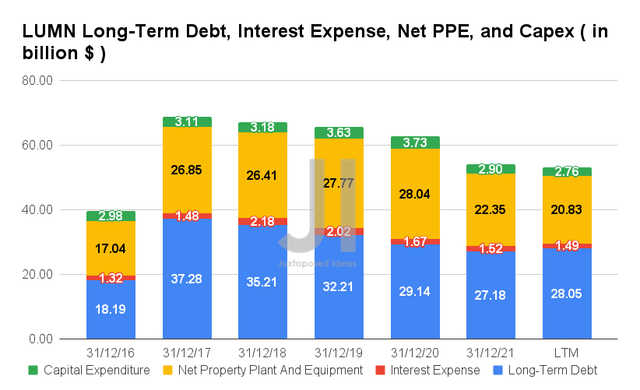

From the chart above, it is evident that LUMN has been regularly divesting its assets thus far, given the reduction in its net PPE assets to $20.83B in the LTM, representing a decrease of 25% from FY2019 levels. The combination of the offloading of its financial obligations and continuous deleveraging efforts had allowed the company to reduce its long-term debts to $28.05B in the LTM, indicating a favorable reduction of 12.9% from FY2019 levels.

Given the reduced debts, it made sense that LUMN reported lower interest expenses of $1.49B in the LTM, representing a moderation of 26.2% from FY2019 levels. Nonetheless, we expect the company to continue investing in its capacity moving forward, given its guidance of capital expenditure of up to $3.4B in FY2022 – thereby potentially being top and bottom lines accretive eventually. We shall see.

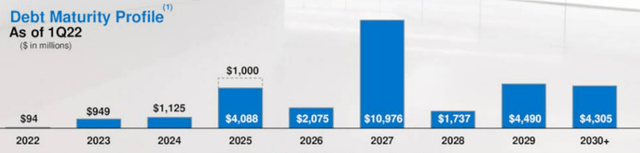

LUMN Debt Maturities

Based on the chart above, LUMN has a few notable major debt maturities on the horizon, namely $0.94B in FY2023. We expect to see FY2022’s projected FCF of up to $2.2B to fully fund its debt payment and annual dividends in FY2023 with no issue. However, the critical question will be from FY2024 onwards, since we are looking at $1.12B of debt maturity then and $4.08B in FY2025. We expect the recent Apollo sale to aid momentarily, given the sizeable $7.5B net cash deal.

Nonetheless, due to LUMN’s reduced scale from FY2023 onwards and the eye-watering debt maturity of $10.97B in FY2027, we expect the company to potentially raise more capital in the long term, similar to that in 2021 to repay debts. Thereby, unfortunately, continuing the debt cycle for this decade due to its lowered FCF profitability and continued $1.04B dividend expense.

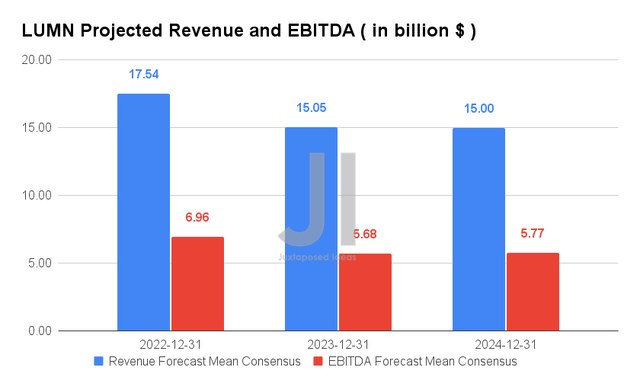

Over the next three years, LUMN is expected to report an apparent deceleration of revenue and EBITDA growth, given the potential sale of its assets in the US and EU. However, it is essential to note that the sale will negatively impact its EBITDA margins, from 40.9% in FY2019 to 38.4% in FY2024.

For FY2022, consensus also estimates that LUMN will report revenues of $17.54B and EBITDA of $6.96B, representing a YoY decrease of 10.8% and 13.1%, respectively. The decline was mainly attributed to the sale of its assets in 20 US states to Apollo, which still represented an excellent raised financial performance for the year, since the company guided adj. EBITDA of up to $7.1B and FCF of up to $2.2B, indicating favorable increases of 5.9% and 22.2% from previous estimates, respectively.

In the meantime, analysts will be closely watching its FQ2’22 performance, with consensus revenue estimates of $4.59B and EPS of $0.45, representing a YoY decline of -6.68% and -5.67%, respectively. Nonetheless, those looking for a quick stock rally should definitely look elsewhere, given the historically mixed performance thus far.

LUMN Is Still A Viable Dividend Stock For New Investors

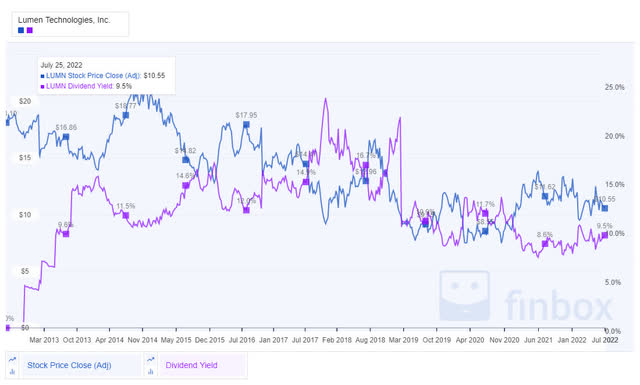

LUMN 10Y Share Price & Dividend Yield

Unfortunately, LUMN has had a discernible downtrend stock price performance over the last ten years. Long-term investors who had bought the stock for dividends may be disappointed as well, since the payouts have been decreasing drastically since hitting the peak of $2.90 annual payout in 2010 to $1 in 2022, despite the reasonably flat dividend yield of 9.48% thus far. However, new LUMN investors who had gotten in at lows from 2019 onwards would have definitely benefitted, since the stock offers a relatively high dividend yield compared to its peers, such as Verizon (VZ) at 5.8% and AT&T (T) at 6%.

In addition, LUMN completed a commendable $1B share buyback program in October 2021, returning much value to its long-term investors by reducing the share count by -7% then. Therefore, the stock remains a viable buy and hold for new investors looking for decent dividend returns during the turbulent stock market ahead.

So, Is LUMN Stock A Buy, Sell, or Hold?

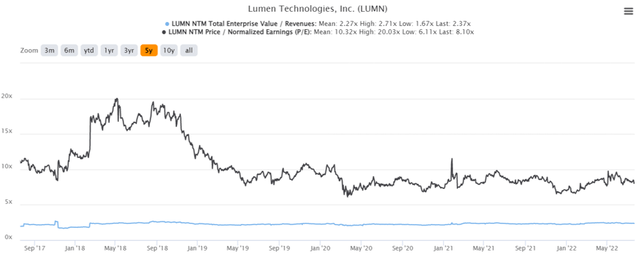

LUMN 5Y EV/Revenue and P/E Valuations

LUMN is currently trading at an EV/NTM Revenue of 2.37x and NTM P/E of 8.1x, in line with its 5Y EV/Revenue mean of 2.27x though lower than its 5Y P/E mean of 10.32x. The stock is also trading at $10.55, down 27.2% from its 52 weeks high of $14.50, nearing its 52 weeks low of $9.31.

LUMN 5Y Stock Price

Based on the chart above, it is evident that LUMN has been on unfavorable sideways price action for the past few years. Thereby, leading to consensus estimates’ sell stock rating, with a price target of $10.67 and minimal upside of 1.14% – barring an unlikely positive catalyst for recovery.

Nonetheless, we are not overly optimistic, given the poorer performance of the industry thus far – Communication Services Select Sector SPDR Fund (XLC) had fallen by -28.42% YTD, with Frontier Communications (NASDAQ:FYBR) and Consolidated Communications (NASDAQ:CNSL) also falling by -12.2% and -15.80% at the same time, respectively. AT&T and Verizon have not fared better with -4.17% and -15.24% declines YTD, respectively.

Given the mixed signals ahead, we do not recommend anyone to add LUMN at this level, since the company is also expected to report FQ2’22 earnings soon. It would provide us with more information about the company’s performance YTD. However, we expect a pleasant surprise in the intermediate term, given the strength of its long-term contracts.

Therefore, we rate LUMN stock as a Hold for now.

Be the first to comment