Nils Jacobi

After the bell on Wednesday, we received second quarter results from communication services company Lumen Technologies (NYSE:LUMN). The name was my top income pick for this year based on its very nice dividend, and shares have held up better than the overall market so far. While headlines suggested the company’s Q2 results were not very good and shares sold off in the after-hours session, I was actually pretty encouraged by the results.

For the quarter, revenues came in above $4.61 billion. While this was down more than 6.3% over the prior year period, analysts were expecting a total sales decline of about 6.9%. The company had actually missed street estimates five quarters in a row, so this beat was a welcome surprise. With the previous three sequential quarters showing narrower misses each time, the trend is certainly heading in the right direction currently.

The stock sold off after the report because adjusted earnings per share came in at $0.35, which missed street estimates by 11 cents. This garnered a lot of headlines, but a deeper dive suggests the number wasn’t that bad. It turns out that the company lost $137 million in the quarter due to a re-valuation of an investment in a limited partnership. Below, you can see key details I’ve taken from the company’s 10-Q filing on this matter:

We hold an investment in a limited partnership that functions as a holding company for a portion of the colocation and data center business that we divested in 2017. The limited partnership holds investments in those entities and a related security business, and has sole discretion as to the amount and timing of distributions of the underlying assets. As of June 30, 2022, the underlying investments held by the limited partnership are traded in active markets and as such, we account for our investment in the limited partnership using net asset value (“NAV”).

Other (expense) income, net for the three and six months ended June 30, 2022 also included a loss on investment in a limited partnership as a result of changes in the value of underlying investments held by the limited partnership, which commenced active trading in late 2021, resulting in an decrease to the net asset value of our investment at June 30, 2022.

I think the bottom line result that showed adjusted net income of $357 million (which doesn’t take out the above mentioned loss) would be viewed a bit differently if you took out this non-core item. Perhaps the most important part of the company’s results was that management maintained guidance for the year, including Adjusted EBITDA of $6.9 billion to $7.1 billion and free cash flow of $2 billion to $2.2 billion. This cash generation will allow the company to pay its shareholders a very nice dividend of $0.25 per quarter, which is close to yielding 10% on an annual basis again with the stock under $10.50 in Wednesday’s after-hours session.

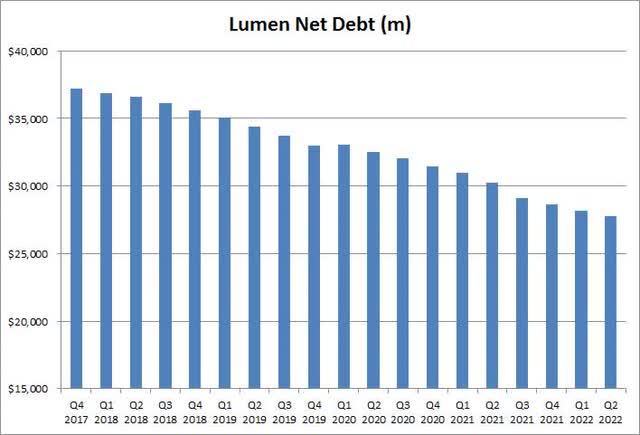

I mentioned in my previous Lumen article that the company was facing a major headwind at a bad time. With a net debt pile of almost $28 billion currently, rising rates are obviously not good for the company’s interest expenses over time. The continued surge in LIBOR rates will cost the company even more in the short term than I had projected recently, but the recent divestiture of the Latin America business is allowing for the repayment of some higher rate borrowings which can hopefully offset these increased debt costs.

As a reminder, the company has one other major divestiture remaining for 2022. The proceeds from the two combined transactions are expected to be about $7 billion, of which I am currently assuming $5 billion will be spent on debt repayments and $2 billion on share repurchases. The company has already made tremendous progress on improving its balance sheet in recent years, but these divestitures will help quite a bit more. As the chart below shows, net debt has already been reduced by more than a quarter, or about $9.4 billion, and this key financial figure could be down to around $20 billion in the next couple of years.

Lumen Net Debt (Company Filings)

As a reminder, investors are not investing in Lumen for potential revenue growth in the near term. Between declines in the current business and these two major asset sales, top line numbers are expected to continue dropping for the indefinite future. Shareholders like this name because it produces a lot of free cash flow, which is allowing for the highest annual dividend yield in the S&P 500 currently. With shares continuing to trade towards the lower end of their recent multi-year range, investors may also see a good deal of shares repurchased in the coming quarters.

Another stock buyback like the one we saw last year will save on quarterly dividend payments moving forward, which is actually a nice benefit at current levels. That’s because what’s saved on dividend payments is a higher amount than what would be saved on interest payments from debt repayments, given the stock’s annual dividend yield is much higher right now than the company’s cost of debt. Thus, free cash flow remaining after dividend payments does better with share repurchases than debt repayments, holding all else equal. I don’t think we’ll see any dividend raises in the near term, but there’s a nice balance currently between cash payments to shareholders and cash being used to repay debts.

In the end, Lumen announced a decent set of Q2 results, but the stock sold off as headlines detailed a large earnings miss. I think investors are looking at this a bit wrong, given revenues finally beat and the miss was primarily due to a non-core write down of an investment. Management reiterated its full year forecast, and this year’s divestitures are allowing for debts to be repaid, helping offset the added expenses from rising LIBOR rates. While analysts don’t see a ton of upside in the stock currently, this is a name to own for its tremendous S&P 500 leading dividend yield, which again is approaching 10%. That’s a lot better than you’ll do with any fixed income investments currently.

Be the first to comment