marchmeena29

Within the Walls

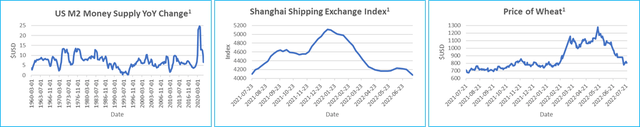

The combination of extraordinary events such as the pandemic, enormous policy stimulus, and the war in Ukraine has driven the recent surge in inflation, which is the culprit behind the stock market decline. All of these events are typically “one-time” in nature and we’re already seeing many of the negative occurrences associated with each starting to subside. The price of wheat spiked over 80% on the news of the invasion of Ukraine. The price of wheat is now below where it was before the invasion.

The yearly change in the Money Supply (M2), which saw an unprecedented spike due to stimulus payments, is now back to pre-covid levels. Finally, the supply chain issues brought about due to lockdowns are subsiding. The most representative example of this decline is the cost of freight. The Shanghai Shipping Exchange Index, a benchmark rate for container freight, is now down over 30% from its highs.

Fed Funds Futures, which in essence is the odds of future interest rate moves by the Fed, is now pricing in an interest rate CUT near the beginning of next year. This is all to say that things aren’t perfect and we have a lot of work to do. However, we strongly believe the worst is behind us.

As market declines intensify, the typical investor response is to focus more and more on the short-term. Developments in Ukraine, the price of gas, or daily changes in treasury yields. They become glued to their screens, not only just watching the day-to-day stock price movements but genuinely having their emotions bound to the direction of the market. Their time horizon shortens which leads to making mistakes. Decisions are made based on emotions like fear instead of fundamental analysis.

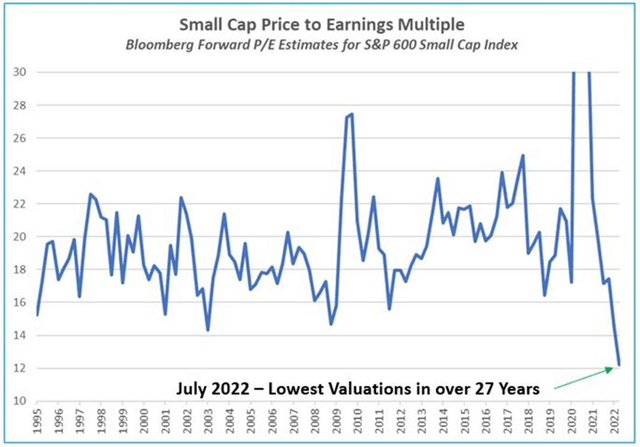

People see weak price action and assume something is wrong with the business. When the market starts selling first and asking questions later, many stocks, especially small-cap stocks, can see significant selloffs that are divorced from the fundamentals of the business.

The mistake on our part was believing that owning a concentrated collection of profitable, growing, fairly priced quality companies would outperform in this environment. The war in Ukraine and its impact on inflation caused more widespread multiple contraction than we anticipated. Small to mid cap growth stocks were hit especially hard. This is our area of focus and even though we forecast our investments significantly growing revenues and earnings this year, we had a difficult first half of 2022 in such a macro-driven market.

As long-term investors, looking for ‘compounders’ that we can hold for years, what really matters is what is going on at the company, not with the stock. We refer to this as what is going on “within the walls of the company”. The CEO can’t control the price of their stock, however they are in control of their company’s strategy, the associated capital allocation, and the execution. As the stock market sell-off intensified over the last few months, it became ever more important to test our assumptions and make sure we are only investing in our highest conviction stocks.

During this downturn we sold any position where we didn’t have complete confidence. We focused on selling businesses that aren’t self-financing, meaning that they would have to rely on the stock market or issue debt in order to raise cash in the future. In addition, we sold many of our most illiquid names. Now more than ever, we are positioned in our highest conviction, highest quality, compounders. We have been focusing on what is happening within the walls of the businesses.

Speaking with these management teams has led to one major takeaway, and that is although their stocks may be down, and in some cases down a lot, their businesses are doing well. Our highest conviction investments are not seeing a growth slowdown of any significance and are not seeing pricing pressures of any significance.

During selloffs like this one, where all stocks get hit irrespective of their fundamentals, the rebound off the bottom can be just as powerful if not more than the sell-off. During the selloff, the multiple on the stock declines, but if its is a real compounder, the earnings and cash-flow continue to grow. This leads to a whippy snap back in price because the companies are more valuable now versus before the correction started.

This portfolio reconfiguration left us with roughly 14 main portfolio investments, representing ~90% of the fund’s investments. These companies in aggregate are trading on 7.2x 2023 cash earnings, growing 2023 revenue at 29% with 0.5x Debt/Cash earnings2. The combination of growth rates, balance sheets and multiples are by far the most attractive we have seen. Only the stock market bottom in 2009 would be comparable4.

Excessive Pessimism

There isn’t a time in history when stocks didn’t rebound and hit new highs. Yes, there are certain companies (stocks) that didn’t rebound, and yes, sometimes it takes longer than others, but high quality (profitable & growing) businesses are now trading with excessive pessimism. The pendulum has swung too far. High quality businesses are now trading at such low cash earnings multiples (so cheap) that when sentiment turns (the pendulum swings back) we should see multiple 200%-300% moves to the upside. The fact that many of you will read that with disbelief only reinforces our point of excessive pessimism in the market.

This downturn has similar feelings in many ways to the 2008/2009 recession. At that bottom people got too negative and some of the best investment returns in recent history were made from investments that were made during the market lows of that recession. For example, Constellation Software (OTCPK:CNSWF) sold for $22/share at the time and now trades for $2,110/share5. Carfinco traded down to$0.30/share and then went on to get bought out at $11.25/share a few years later.

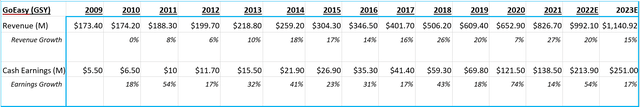

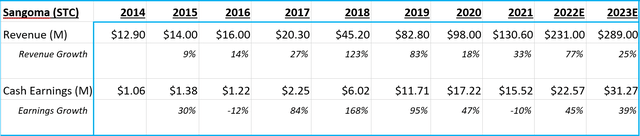

Looking ahead, to get a 125% return out of GoEasy (GSY) the stock only needs to trade on 15x cash earnings which is less than where the stock normally trades2. For Converge Technology (OTCQX:CTSDF) to return close to 300%, the stock only needs to trade on 16x earnings, which is where the stock was trading in 20212. For Sangoma (OTCPK:SAMOF) to return more than 300% it only has to trade on a modest 15x projected cash earnings2. This is the type of upside we are now seeing in this environment.

We continually sit down with company management teams and go over assumptions and growth estimates in order to update our views. We want to be close enough to our investment companies, so that we can see their future. Gaining this comprehension allows an investor to look past short-term factors and focus on the long-term. True compounders are making more money this year than last, will invest in their businesses to make even more money next year and so on. Even in this environment, management teams are still compounding their value of their businesses.

At this point, most of the disagreements we have based on the future are if a company is on 5x earnings versus 6x earnings. Deciding not to invest would be missing the larger picture of buying companies at historically low valuations that will continue to grow in this economic environment. We expect to look back at current prices and opportunities as easy pitches. Low valuations, consistent growth and profitability are how homeruns are hit.

Cyclical vs. Secular Businesses

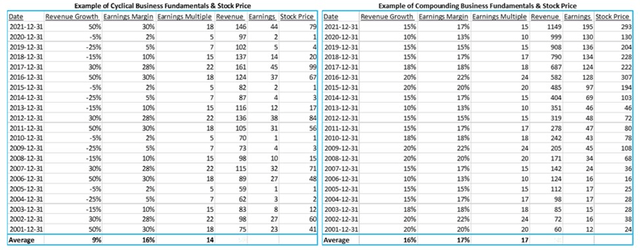

The economy has ups and downs due to the natural business cycle. The economy expands, peaks, contracts, troughs, and then repeats itself. For some businesses their success relies on the business cycle. They do well during expansion and peak phases. Their revenue increases, they expand and try to ride the cycle higher. However, expansions lead to contractions. Shortages lead to gluts. Leveraging leads to deleveraging.

We want to avoid companies that are reliant on the businesses cycle to succeed and specifically commodity prices they do not control. For example, steel companies, lumber companies, and miners. The value of their business is controlled by a commodity price in which they have no control. Extending the metaphor, cyclical businesses are much more controlled by “outside their walls” forces. The value of their business is controlled by ‘uncontrollables’.

The revenue and earnings of cyclical businesses decrease as the cycle turns over. That’s why they are a trade and not an investment. This is different than compounders who will continue to increase the underlying value of their business year over year independent of the cycle. The pace of growth may change but they continue to compound.

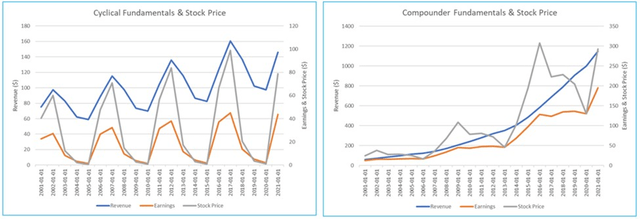

Below is a theoretical comparison of a cyclical business versus a compounding business. Notice, the cyclical business on the left has some very high levels of growth followed by contraction. The compounder on the right, might not have as much growth in peak years but it is much more consistent. Growth and margins vary within a range and it continues to increase earnings year to year.

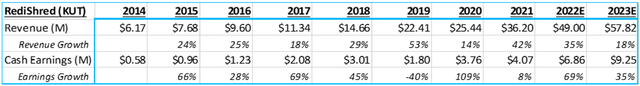

Below are real world examples of compounders. The growth may vary from year to year but management does a great job at continually growing the value of the business. On average, these 4 compounders are down ~40% from their 52 week highs, even though we project them to grow their earnings this year, and next year2.

These growth companies went out of favour starting in 2021 but that’s a market sentiment force at play. If the businesses continue to perform the market will recognize this progress. The timing isn’t precise so an investor should have a long-term view and realize short term declines, even as bad as this one, are temporary if you’re in the right businesses. Our investments for the most part continue to grow and produce cash. That’s why we’re confident in a strong bounce back similar to 2009 after the great financial crisis.

A lot of the cyclical stocks like Teck Resources (OTCPK:TCKRF) are now coming back down. Commodity prices like copper, steel, aluminum, and lumber are down 30-50% from their highs6. The time to sell these stocks was at the top of the cycle and the expected growth and profitability of these companies is now expected to decline. We’re in that part of the cycle where economic growth slows down, commodity prices drop and cyclical stocks decline.

This whole time however, the compounders continue to grow and increase earnings. Their stocks have been sold off, but with history as a guide, sentiment shifts back to quality growth and these businesses and stocks will continue to increase in value. These are the businesses we own in the DKCI Fund.

Final thoughts

We have been through many resets before; The Asian Financial Crisis, The Great Recession, The Taper Tantrum & The Covid Correction. There is a common saying that “they don’t ring the bell at the bottom.” Meaning no one is going to give you the all-clear and let you know when the market is going to turn. However, there are sign posts and when people are this negative and stocks are this cheap, it has historically been a very opportune time.

To our investors, thank you for your continued confidence in DKAM’s strategy and our team. So far this year we have seen relatively good inflows into our fund and it is great to know that past and new investors see the opportunity in front of us. We remain committed to our investors and focused on getting the fund’s performance to new highs.

We welcome questions from partners about our portfolio and strategy. Please do not hesitate to reach out. We are now releasing monthly podcasts for our investors. At the beginning of the month, we will address investors questions and give our thoughts on the market and company specific topics.

Feel free to reach out questions or comments,

Jason Donville, President & CEO | J.P. Donville & Jesse Gamble | info@donvillekent.com

Footnotes

All estimates, projections, and calculations have been generated by DKAM. This does not constitute advice for personal investments but rather a breakdown of how Donville Kent approaches stock analysis.

- Source: Bloomberg

- DKAM estimates based on projected earnings

- The S&P 600 Smallcap Index is a capitalization-weighted index that measures the performance of selected U.S. stocks with a small market capitalization. The forward earnings estimates are provided by Bloomberg.

- Measuring market bottoms using quarterly data and history of the index back to 1987

- As at July 29, 2022

- Copper traded at $494.40 as at March 4, 2022, and now trades at $330 as at July 29, 2022. Steel traded at $1945 as at August 31, 2022, and now trades at $855 as at July 29, 2022. Aluminum traded at $3875.50 as at March 4, 2022, and now trades at $2400 as at July 29, 2022. Lumber traded at $1686 as at May 7, 2021, and now trades at $536.70 as at July 29, 2022.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment