Povozniuk

About a month ago, I detailed how Q2 results for Lumen Technologies (NYSE:LUMN) were a lot better than initial headlines suggested. The communication services company reported a large earnings per share miss, but it was mostly due to a write down of a non-core investment. Lately, shares have fallen thanks to overall market weakness, which is again providing investors an amazing chance to grab some tremendous income potential.

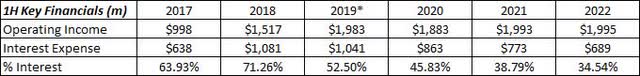

One of the reasons why this name has been on my radar in recent years is management’s effort to improve the balance sheet and reduce its interest expenses. A low interest rate environment certainly helped, but solid free cash flow also allowed for a number of debt repayments. In the graphic below, you can see how interest expenses as a percentage of operating income, for the first half of each year, have come down nicely in recent years.

Lumen 1st Half Interest Expenses (Company Filings)

*Operating income excludes $6.5 billion goodwill impairment charge.

Next year’s results will certainly look a bit different, because the company is in the process of two major divestitures. Lumen already finished the sale of its Latin America business during the current quarter, and a 20 state deal in the US to Brightspeed is expected to close in Q4 of this year. These two transactions are supposed to bring in $7 billion in cash for the company.

We don’t yet know how much operating income will be lost moving forward, but you can expect that management will likely use most of these deal proceeds to reduce debt even further. In the past four and a half years, the net debt amount on the balance sheet has gone from almost $37.2 billion down to less than $27.8 billion. As I’ve detailed in previous Lumen articles, my base assumption is that we’ll see another $5 billion in debt repaid off these asset sales.

When combined with free cash flow, these proceeds could get the net debt balance down close to $20 billion by the end of next year. That should allow for another few hundred million in interest expense savings, which should at least partially offset some operating income lost from the divestitures. Unfortunately some of these savings will be lost due to the rise in LIBOR rates costing the company more on its variable rate debts, but that’s what happens with interest rates finally starting to rise again.

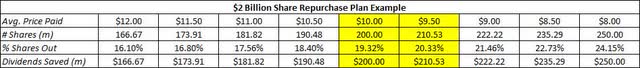

If you assume that $5 billion goes to debt repayments, that would leave $2 billion in proceeds left. With the stock falling towards the lower end of its yearly range again, my ongoing argument for a $2 billion buyback gets a little stronger. The graphic below shows what this could look like, with the yellow range being the two prices we are currently between.

Potential Share Repurchase Plan (Author’s Example)

With a market cap of just $10.2 billion as of last Friday’s close, a $2 billion buyback could potentially reduce the number of shares outstanding by about 20% at current levels. Perhaps more importantly here, it could save the company about $200 million in annual dividend payments. That could alleviate concerns about a potential dividend cut as free cash flow comes down a bit after the two divestitures. A buyback of this size would also be a good sign from the board and management that it believes shares are undervalued.

With Lumen shares closing last week below $10 again, it means the stock’s annual dividend yield is back up to 10.15%. This is the highest current continuous dividend yield of any S&P 500 firm, when excluding special dividends. Only about 20 names in this key market index have an annual payout over 5% currently, so this is a tremendous income opportunity for investors with the potential for a little price appreciation as well. Lumen was my top income pick for 2022, and with significant cash coming in from the two asset sales, it could very well be my top selection again in 2023.

Be the first to comment