ArtistGNDphotography

Lumen Technologies, Inc. (NYSE:LUMN) announced its third quarter earnings presentation on Wednesday, shocking investors by canceling its dividend payment.

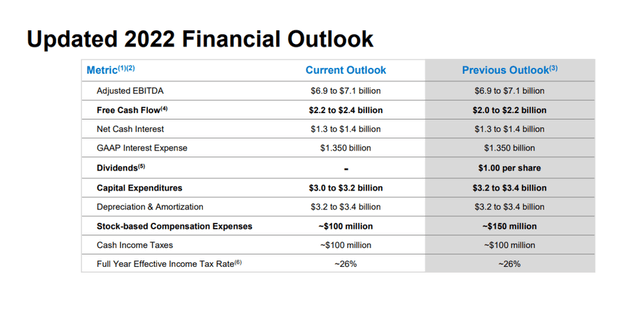

The company also increased its free cash flow forecast from $2.0-2.2 billion to $2.2-2.4 billion, but decided to replace its dividend with stock repurchases in the future. The news caused significant turbulence for Lumen’s stock price, which fell 17% on Wednesday in response to the dividend cut.

I believe the stock will remain appealing in the long run, but with the dividend cut, LUMN is little more than a Hold right now.

Ongoing Decline In Sales, But Fiber Is Giving Hope

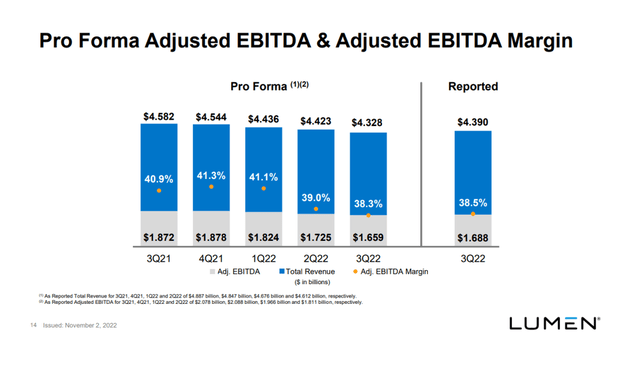

Lumen operates in a mature and saturated market, which means that market expansion is slow or non-existent. Lumen generated $4.32 billion in adjusted sales in 3Q-22, 5% less than the previous year.

Lumen’s sales have been declining for some time, particularly in the mass market segment, as market penetration is high and incremental buyers are becoming increasingly difficult to find.

Lumen generated robust profits in the third quarter on an adjusted EBITDA basis, with total EBITDA totaling $1.66 billion, an 11% decrease YoY. To be honest, the only place I see Lumen making money in the future is in the fiber broadband business.

Adjusted EBITDA (Lumen Technologies)

Lumen also recently completed some significant business transactions, totaling approximately $10 billion in gross proceeds.

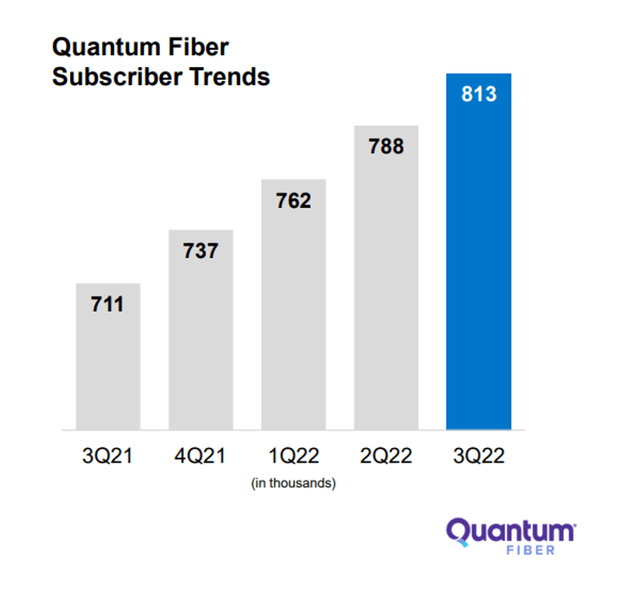

While the overall telecommunications industry is struggling to grow, Lumen’s ability to steadily grow its subscriber base gives reason for optimism. Lumen increased its fiber broadband sales by 18% YoY in the third quarter, and its subscribers increased by 14% YoY to 813K.

Quantum Fiber Subscriber Trends (Lumen Technologies)

3Q-22 Free Cash Flow, Updated Forecast And Dividend Cut

Lumen’s operations generated $620 million in free cash flow in the September quarter, more than enough to cover the $260 million it costs the company to pay its dividend each quarter. In 3Q-22, the implied free cash flow pay-out ratio was 42%.

To focus more on growth, Lumen announced the elimination of its dividend, which will also not be paid in the fourth quarter. Lumen has instead authorized a two-year share repurchase program that could result in the repurchase of up to $1.5 billion in Lumen stock.

In comparison, the dividend payout would have cost Lumen approximately $2.0-2.1 billion over the next two years, so the policy change is expected to save the company $500-600 million.

Lumen increased its forecast for 2022 free cash flow from $2.0-2.2 billion to $2.2-2.4 billion, a 9.5% increase at the midpoint. Nonetheless, the telecommunications company canceled its annual dividend of $1.00 per share as management shifted its focus to growth and debt reduction.

Furthermore, Lumen intends to gain financial flexibility by foregoing its obligations to shareholders. The dividend suspension is a major disappointment for me because Lumen would have easily covered its dividend based on free cash flow.

Updated 2022 Financial Outlook (Lumen Technologies)

Lumen’s Valuation Has Dropped To 2.6x Free Cash Flow After Yesterday’s Meltdown After Earnings

Lumen retains an appealing valuation based on its revised free cash flow forecast. With free cash flow expected to be $2.2-2.4 billion in 2022, the stock is valued at a 2.6x free cash flow multiple, reflecting a very high margin of safety. However, because the company recently canceled its dividend, I believe the stock price could fall in the short term.

Why Lumen Could See A Lower/Higher Valuation

The worst thing that could have happened to Lumen has already happened: the company suspended its $0.25 per share quarterly dividend pay-out due to a shift in priorities and a desire to generate more financial flexibility for itself, and investors who calculated Lumen’s dividend income (including myself) are outraged.

Moving forward, the fiber business expansion could be a growth catalyst for the telecommunications company, but dividend shock is likely to linger for some time.

My Conclusion

Lumen’s stock plummeted on Wednesday after the company cut its dividend while increasing its free cash flow forecast for 2022. This surprised me, and the corporate actions regarding Lumen’s dividend policy are a major disappointment.

With the dividend gone, there is no longer a compelling reason to buy Lumen’s stock. Because the valuation is still appealing based on the new free cash flow forecast, I believe the stock is a Hold for the time being, but not much longer.

Be the first to comment