moisseyev/iStock Editorial via Getty Images

If you’re waiting for Carnival Corporation & plc (NYSE:CCL) to reinstate its dividend, you could be waiting for a long time. Most investors are buying it as a turnaround stock that could potentially double or triple their money from price appreciation.

Like its peers, the cruise line company was whacked out of its course during the onset of the coronavirus pandemic. It’s still bleeding losses this year, though, on the bright side, the losses are shrinking in scale.

In fiscal 2020, it booked a net loss of $10.2 billion. In fiscal 2021, the net loss was $9.5 billion. Its trailing-12-month (“TTM”) net loss is $7.1 billion. For reference, Carnival reported net income of about $3 billion in fiscal 2018 and 2019.

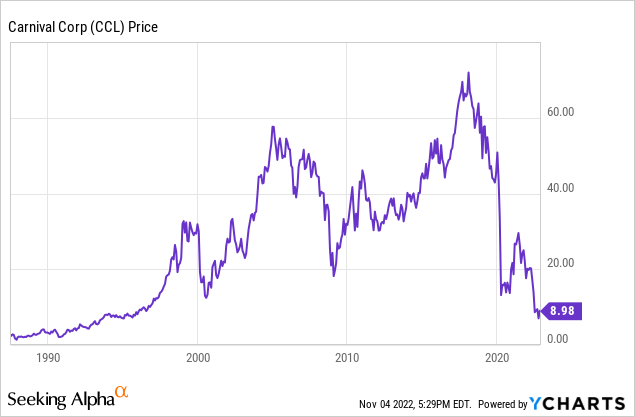

The consumer cyclical stock trades at some of its lowest levels in its history of trading. The stock rallied from a 2020 pandemic low trough of about $12 to over $30 in 2021. That roughly 2.5x investors’ money for folks who timed the stock trade well.

Alas, the rally dissipated and CCL stock trades at under $9 per share at writing. A sustainable rally requires durable earnings to return and we’re simply not there yet.

That said, the stock price often moves ahead of earnings changes. If the cruise line company is anticipated to experience a jump back to profitability, the stock will likely rebound in a vengeance.

Currently, analysts project the company will return to profitability by fiscal 2023, which is expected to sustain into even higher profits into fiscal 2024. If this were to materialize, investors could potentially 3x their money over the next few years as the stock returns to the $30 level.

What’s Stopping Carnival Stock from Restarting its Dividend?

Let’s use 2019 as a base year for comparison.

Reason 1: Net Losses

Healthy dividends are paid from earnings. As mentioned earlier, Carnival is operating at a loss and losing money.

Carnival ended fiscal 2019 with a current ratio (as defined by current assets ÷ current liabilities) of 23%, including $518 million in cash and cash equivalents.

In the last reported quarter at the end of August, its current ratio improved to 65%, including cash and cash equivalents of $8.9 billion. However, it needs greater liquidity because of its current poor financial position.

Reason 2: Poor Financial Position

After operating at losses for 3 years, Carnival’s financial position has deteriorated significantly. For instance, let’s look at its debt-to-equity ratio (“D/E”). In 2019, CCL’s D/E was 0.78%. In the last reported quarter at the end of August, its D/E skyrocketed to 5.2.

One reason is that its debt more than doubled by 2.2x. Another reason is its losses resulted in its retained earnings shrinking from over $26 billion to under $1.9 billion. Carnival now has a junk S&P credit rating of B.

In fact, investors would argue against even touching Carnival’s bonds, which are lower risk investments than its common stock. To get a sense of the riskiness of the junk bonds, they currently yield from 8.75% to 18.3%, while they were originally issued with coupon rates of 4.0% to 10.5%.

What Would It Take for Carnival Stock to Restart its Dividend?

First, it needs to turn a profit. To turn a profit, it requires the macro environment to improve. After that, assuming normalized annual net income of $3 billion, it would take a little more than 8 years for its retained earnings to return to the 2019 base year levels (when it last paid a healthy dividend).

If Carnival survives through this, you’ll see credit rating upgrades over time. The company’s S&P credit rating was downgraded from investment-grade BBB- to BB- in June 2020. So, it probably won’t restart its dividend until at least it returns to an S&P credit rating of BBB-.

Investor Takeaway

Carnival has a long way off before it can reinstate its dividend. First, it needs to survive through this tough operating environment that was triggered by the coronavirus pandemic. After it begins making profits again, it’ll steadily improve its financial position.

There’s light at the end of the tunnel. Currently, analysts expect it to swing back to profit by fiscal 2023. If so, investors will experience strong price appreciation (potentially a double or triple) way before its dividend comes back.

Right now, Carnival stock remains a highly speculative turnaround stock. If you’re looking for a safer investment in the space, you can look into Booking Holdings Inc. (BKNG), which has an S&P credit rating of A- with a strong rebound of earnings this year.

Even safer investments are available after a 20% bear market, including solid stocks that pay out nice yields. Risk-averse investors can consider defensive sectors like consumer staples and utilities that provide lower returns but also expose investors to much lower risk.

Be the first to comment