stockcam

Online language learning app Duolingo, Inc. (NASDAQ:DUOL) is firing on all cylinders and there is ample runway for further growth.

Strong performance, all segments seeing double-digit growth rates so far

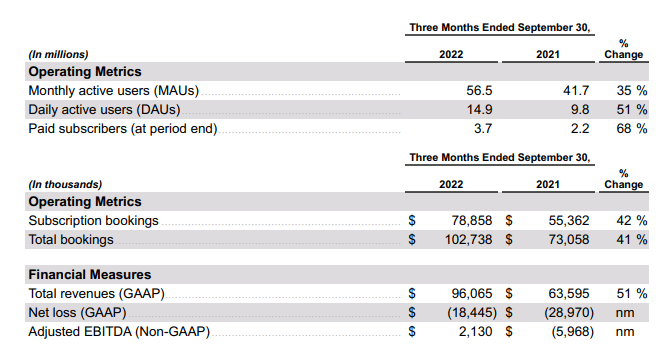

Online language learning platform Duolingo continues to notch stellar growth; MAUs (monthly active users) and DAUs (daily active users) continue to grow, reaching all-time highs in Q3 2022 (MAUs rose 35% YoY to 56.5 million and DAUs jumped 51% YoY to 14.9 million). Paid subscribers jumped 68% YoY to 3.7 million, helping subscription bookings jump 42% YoY to USD 78.8 million, contributing to total bookings growth of 41% YoY to USD 102 million. Total revenues soared 51% YoY to USD 96.1 million, while their net loss narrowed to USD 18.4 million.

Duolingo Q3 2022 earnings release

The momentum is a continuation of strong performance in all quarters this year, with all major metrics seeing double-digit growth rates.

|

Revenue growth YoY % |

47% |

50% |

51% |

|

Total bookings growth YoY % |

55% |

51% |

41% |

|

MAUs growth YoY % |

23% |

31% |

35% |

|

DAUs growth YoY % |

31% |

44% |

51% |

|

Subscriber growth YoY % |

60% |

71% |

68% |

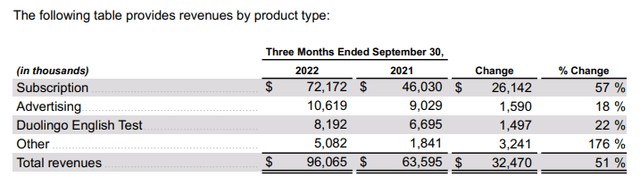

Near term, advertising revenue growth has been decelerating and is expected to be impacted as a result of weakening ad spend due to sluggish economic conditions. However with advertising accounting for a relatively small proportion of revenues (15% as of 2021), the impact to overall financials is likely to be limited and likely to be outweighed by growth in subscription revenues, Duolingo’s biggest segment, which is also one of its fastest-growing.

|

Subscription revenue growth YoY % |

45% |

50% |

57% |

|

Advertising revenue growth YoY % |

27% |

24% |

18% |

|

Duolingo English Test revenue growth YoY % |

60% |

66% |

22% |

|

Other revenue growth YoY % |

240% |

179% |

176% |

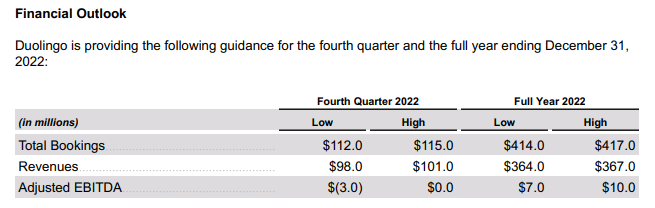

Helped by very strong performance so far, the company raised their full year guidance again, with full-year revenues expected to reach USD $364 million to USD $367 million in revenues.

Duolingo Q3 2022 earnings release

Looking ahead, Duolingo has tremendous opportunities for long term growth.

Subscriber numbers have room for growth

Subscriptions is Duolingo’s biggest revenue stream.

Duolingo Q3 2022 earnings release

There are more than 1.2 billion people learning languages and with just about 60 million learners using Duolingo, there is a tremendous runway for growth in user numbers. Learning online may not appeal to all students, and Duolingo may not suit serious learners, but the platform is nevertheless likely to find favor as a supplement for language learners, and their gamification elements in particular could make it particularly appealing for younger learners such as children (and parents too are likely to prefer their kids spending time learning a language rather than playing video games). Duolingo has historically been and still remains, a product-led rather than sales-led business (Duolingo’s R&D spend is about double that of its sales and market spend, and R&D spend accounted for about 41% of total revenues versus 24% for sales and market in 2021), and it is likely that Duolingo has yet to reach a significant number of language learners.

Expanding their userbase could increase subscriber numbers, as some users convert to paying members. Currently just about 6.5% of Duolingo’s users are paying subscribers and the company working to increase that figure; Duolingo introduced a Family Plan last year, and launched localized pricing last quarter to increase conversion rates, particularly in Asia, its fastest growing market where purchasing power is relatively lower compared to the West, notably the U.S. which accounts for about 45% of paying users. Although localized pricing might have the effect of reducing ARPU, the company thoroughly tests their prices over a period of time to ensure any price reductions are offset by higher bookings and ultimately higher subscriber lifetime value. Meanwhile the company’s continuous efforts to enhance their product with new features and functionality, should increase customer satisfaction and thereby incentivize conversions.

Duolingo’s re-entry into China this year (a market where it already enjoys considerable popularity), could potentially boost its user numbers as well. English is the undisputed most popular foreign language in China, and young Chinese are fully aware of the importance of learning English. Yet, according to some estimates, fewer than 10 million Chinese or less than 1% of the country’s population speak English, suggesting an enormous opportunity that could potentially add millions more users to Duolingo’s platform. Education and literacy is highly valued in China, and it is likely that a significant number of them would convert to paying subscribers as well.

Advertising revenues have room to grow

With USD $38.5 million in advertising revenues from 40 million free users as of FY 2021, each free user generates an ARPU of around USD $1, which is extremely low. YouTube (GOOG, GOOGL), for instance, generates an ARPU of around 14, and even Chinese video streaming giant iQIYI, Inc. (IQ) generates a higher ARPU of around $4. Although advertising is not a focus for Duolingo, there is clearly room for further increases in this revenue stream not just driven by ad monetization opportunities from user expansion, but also through higher ad monetization from their existing user base.

Duolingo English Test has room to grow

Launched in 2016, Duolingo’s English Test is Duolingo’s answer to relatively costly English language tests such as IELTS and TOEFL. Although arguably not as rigorous as IELTS and TOEFL, the Duolingo English test has numerous advantages, including being the cheapest by a wide margin, growing acceptance (accepted by more than 4,000 institutions worldwide and counting, closing the gap with IELTS’s 11,000), and unrivaled flexibility due to students being able to take the test online (IELTS rolled out their online test only in 2022), and at any time (TOEFL’s at-home tests have to be scheduled). Not surprisingly, Duolingo’s English test saw surging demand during the pandemic (becoming the top choice for students in countries such as China) and continues to gain traction at a rapid pace. Revenues jumped 63% YoY in FY 2021 (the second-fastest growing revenue segment), and although the momentum has begun to decelerate in Q3 2022, long-term prospects are optimistic. About 500,000 students took Duolingo’s English test in 2021, far fewer than IELTS (about 3 million) and TOEFL (2.3 million). Given Duolingo’s numerous advantages and growing acceptance, there is potential for further growth.

In-app purchases have room to grow

In-app purchases (categorized as “other”) is Duolingo’s smallest but fastest-growing revenue stream, notching triple-digit growth rates over the past several quarters. In-app purchases provide a way to monetize users on an ad-hoc basis in a relatively less intrusive manner compared to advertising, for instance, and, therefore, Duolingo’s focus on growing this revenue stream is positive; with the company adding new product features, and enhancing their “gem” economy (gems are Duolingo’s virtual currency), this revenue stream could see further growth going forward. Just about 5% of Duolingo’s revenues are generated from in-app purchases (up from 3% last year), considerably lower than Tinder, for instance, which generates about 30% of revenues from in-app purchases.

Highly differentiated product, solid financials

Duolingo stands out among the sea of language learning apps for its highly differentiated product which enhances user engagement and user stickiness through gamification and social elements based on a freemium model. Although there are numerous language learning products, Duolingo is without a doubt the most popular, and their strong differentiation as well as their focus on continuous product development and user experience improvement are factors that should help them maintain a leading market position going forward.

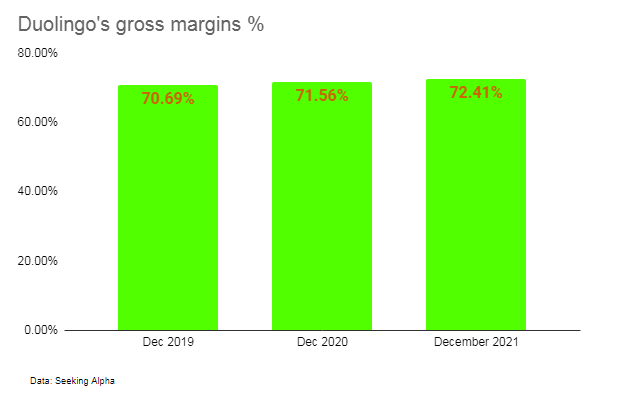

The company is financially strong and well-positioned to fund its development efforts. The company is operating cash flow positive, has a current ratio of 4.29, a quick ratio of 4.05, a debt to equity of just 5%, and their margins have been improving over the past few years and could improve further as the business scales.

Author

Duolingo’s platform is very scalable with all their products sharing a singular technology architecture which offers operational advantages (such as lower product development costs) and marketing advantages (such as lower customer acquisition costs thanks to cross selling opportunities) when expanding the platform by broadening their product offering. Replicating their successful language app business model, this month the company launched their new math app (Duolingo Math), and this could be just the beginning of an expansion into subjects longer term.

Risks

Apart from execution risks, geopolitical risks may hamper their Chinese business. While Duolingo’s re-entry into China is an enormous growth opportunity, the country is generally a tough market to crack, particularly for foreign players and Duolingo’s efforts may fail to bear fruit.

Despite the stock dropping 33% over the past year, Duolingo still has a high short interest (8%) suggesting quite a fair bit of pessimism over the stock’s near term prospects. This is likely due to Duolingo being loss-making (and likely to remain so in the foreseeable future), which makes the stock less appealing in a climate of rising interest rates.

Summary

Duolingo is enjoying strong growth and there is plenty of room for further growth in the foreseeable future. As the business scales, profitability may improve in terms of margins, but overall Duolingo is likely to remain unprofitable in the foreseeable future barring any major strategic changes such as a pullback in R&D spend, for instance.

Execution has been solid so far, but the possibility of Duolingo, Inc. missteps cannot be ruled out, and the consequences can be costly for an unprofitable business at a relatively early stage of growth. Given a climate of rising interest rates, Duolingo, Inc. stock may be unappealing for risk-averse investors, although others may view the stock as a buy.

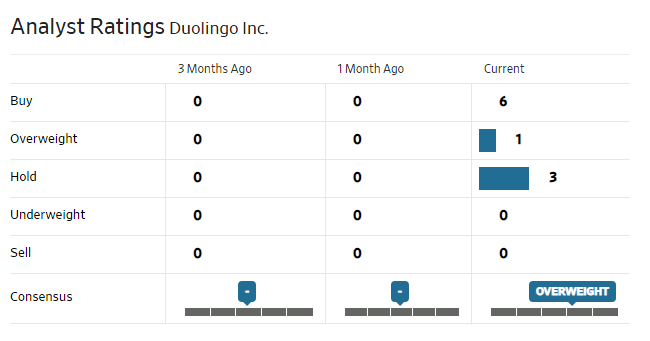

Analysts are generally split between buy and hold.

WSJ

Be the first to comment