ablokhin/iStock Editorial via Getty Images

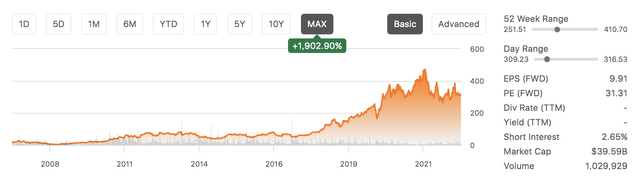

Lululemon Athletica Inc. (NASDAQ:LULU) stock has surged by nearly 2000% since its initial public offering in 2007. Moreover, recent history shows the asset has skyrocketed by more than 300% in the past five years. However, 2022 threw a few curveballs at retail stocks, and Lululemon in particular. The apparel company has struggled with unexpected rising input costs, leading to a flight to safety from several of its investors.

Despite various claims about a slowdown, we believe the firm’s most recent headwinds are misunderstood and should be considered temporary. Moreover, today’s stock market environment is probably aligned to support growth stocks such as Lululemon. As such, we assign a strong buy rating to LULU stock with a twelve-month horizon; here’s why.

Operating Analysis

I’d like to take you from the bottom-up with this analysis, as the firm’s margins seem to be the main talking point on the Street.

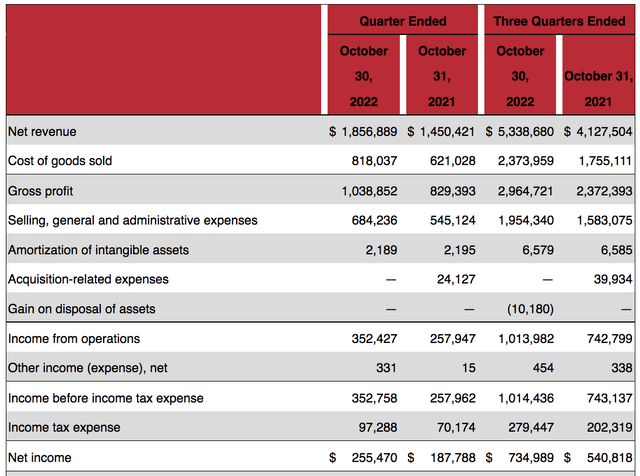

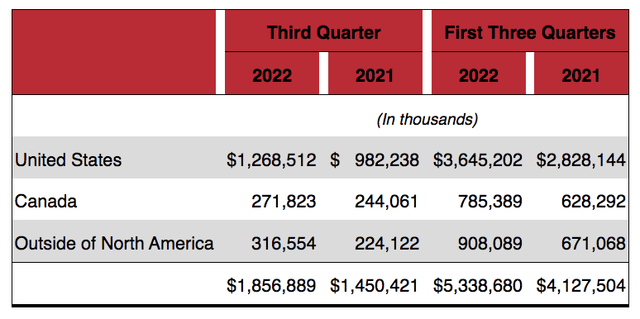

As displayed by the company’s income statement, revenues grew by approximately 28% year-over-year, expanding the company’s market share to 6.12%. The firm typically prices its products higher for branding purposes. This tactic partially worked as year-over-year quarterly margins expanded; however, calendar full-year gross margins between 2022 and 2021 shrunk from 57.5% to 55.5%.

- Note: The P&L illustrates a date in October, but rest assured that it reflects the company’s Q3 results, revealed on December 08, 2022.

Income Statement (Lululemon 10-Q; Seeking Alpha)

Analysts such as Wall Street firm Bernstein and fellow Seeking Alpha contributor Cavenagh Research believe Lululemon’s earnings will soon compress. Sure, lower short-term guidance by the company and business cycle maturity should be considered; nevertheless, we think it will take a few years before Lululemon’s normalized performance trends downward.

The company still yields a tremendous stronghold over its customers, with features like concentrated consumer base, product differentiation, and low barriers to exit all playing a role. Furthermore, various analysts base their cost estimates on the company’s short-term trajectory without considering 2022 as an outlying supply-side inflationary event. On top of that, Lululemon incurred a few abnormal costs over the last few quarters that could soon be phased out.

Let’s run through a few critical line items pertaining to Lululemon’s costs.

- A year-over-year quarterly gross margin increase was overshadowed by lower calendar year gross margins, which were realized due to elevated freight and fuel costs. Additionally, slight markdowns occurred as the company adjusted its product prices downward for income elasticity reasons. Yet, we expect all of these variables to turn around as global supply chains have eased. Moreover, fuel costs are tapering, and consumer demand could reignite with China’s reopening, an abated EU recession, and a higher-than-anticipated GDP growth in the USA.

- Gross margins were also impacted by unfavorable currency translations. The company’s reporting currency is the U.S. dollar, and we can easily see a slower USD in 2023 relative to foreign currencies, which could increase gross margins after conversion. However, higher relative costs for materials should be considered as a juxtaposition.

- SG&A costs increased due to employee headcount and higher wage demands. We do not see the latter persisting as we’re currently in an “overfiring” market, whereas 2022 was an “over-hiring market” that provided employees with bargaining power. The prior isn’t necessarily a bad thing as it relates to company expansion.

- A $97.8 million increase in depreciation and amortization dampened the firm’s income statement. This is a non-cash cost, and it was exacerbated due to the firm’s acquisition of MIRROR, which enlarged its asset base. Sure, some are concerned about MIRROR’s organic growth; however, the additional D&A expenses are monetized expenses.

- Lululemon’s omnichannel incurred significant costs during the past quarter, amounting to $2.6 million. However, the methodology could add to sales growth. As such, these are also ‘monetized expenses’.

Finally, let’s consolidate the argument by analyzing Lululemon’s growth trajectory.

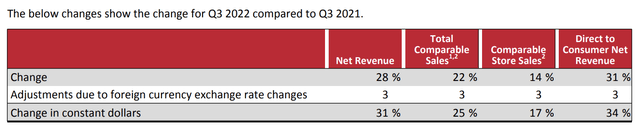

Lululemon achieved a 22% surge in same-store sales between Q3 2021 and Q3 2022. The company’s top-line growth is robust as it has managed to tap into the women’s fitness market, which we think is lucrative.

The company still primarily sells its products in North America. However, the plus side is that it can expand into foreign markets, such as Asia, which could inject tremendous growth into the firm’s top line.

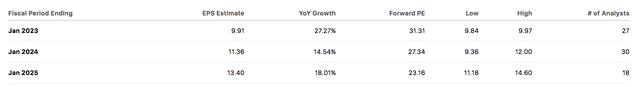

To add a cherry on top of the cake, a sample of Wall Street analysts’ EPS estimates implies that Lululemon’s bottom line could surge in the coming years, subsequently passing down residual value to its shareholders, which the markets might see as a positive sign.

Sampled EPS Growth Estimates (Seeking Alpha)

Total Return Prospects

As a growth stock, it should be expected that Lululemon’s price multiples will be elevated (which is the case). However, most of the stock’s price multiples are at significant discounts to their cyclical averages. A combined ex-ante and retrospective analysis tells us that Lululemon’s growth rates remain intact, prompting the case that the stock is undervalued.

Nonetheless, a risk remains that the market will see its elevated ratios as unattractive, deeming the stock overvalued. In essence, it depends on the market’s risk appetite.

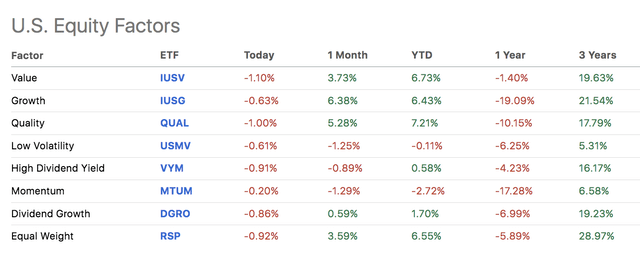

Lululemon’s stock possesses a beta coefficient of 1.33, suggesting that it yields excess risk over the broader market. This could be an advantage in 2023 as we’ve already seen high-beta growth stocks outperform lower volatility assets amid a shift in investor sentiment, which an improved inflationary outlook has triggered.

Although Lululemon doesn’t pay dividends, the stock possesses relative value and could benefit from an unfolding risk-on market appetite. As such, we think the stock has lucrative total return prospects.

Additional Risks

Risks were highlighted throughout the article. However, I want to re-highlight them in a discreet section to balance the argument.

Firstly, the high-beta outlook on the stock market remains subjective as it’s based on recent performance and excludes the possibility of a recession. A risk-off environment might lead to a slump in market value for Lululemon. Furthermore, the company operates in a competitive market with low customer switching costs. As such, the firm’s sales will be volatile until it reaches maturity.

Another factor to consider is the sustained volatility in the FX market. Interest rate risk remains high for multinationals, which attaches risk to Lululemon’s consolidated earnings and procurement strategy.

Final Word

At face value, business cycle maturity and calendar year margin compression indicates that Lululemon Athletica Inc.’s business and stock could slump in 2023 and beyond. However, a closer look implies that variable costs might recede and that a large chunk of the firm’s incremental costs was due to features such as acquisition integration, expansionary projects, and abnormal systemic events.

Furthermore, the company’s brand is growing steadily, allowing it to price its goods at a premium. Additionally, expansion into growth markets awaits, which could sustain the business’ current growth trajectory into the next few years.

Lastly, the stock market’s segmental performance and macroeconomic variables indicate that investors currently favor high beta growth stocks such as Lululemon. Not to mention that Lululemon’s stock is trading at a cyclical discount.

- We assign a strong buy rating to Lululemon Athletica Inc. with a 12-month horizon.

Be the first to comment