Boogich/iStock via Getty Images

Overview

Luckin Coffee Inc. (OTCPK:LKNCY) is a coffee chain operating in mainland China. Conducting an initial public offering in Q2 2019, the company appeared to be scaling its revenues significantly – until it was alleged to be fraudulent in Q2 2020.

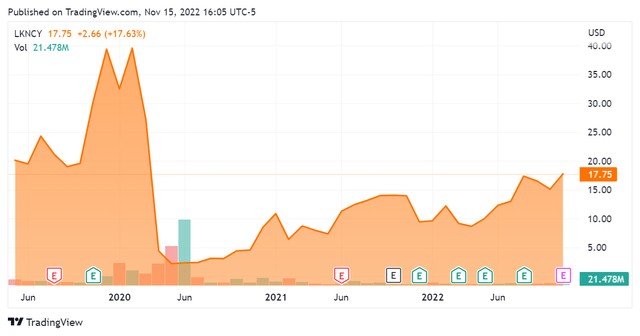

SeekingAlpha.com LKNCY 11.15.22

Subsequently losing most of its value as well as being forcibly delisted from NASDAQ, Luckin Coffee has since seen appreciation back to its IPO price while trading over-the-counter.

This article will look further into its story to see if things have really turned around for the better.

Financials

Ostensibly going from $10M revenue to $618M revenue in the span of 3 years, Luckin Coffee was alleged to have misrepresented its financial picture significantly.

SeekingAlpha.com LKNCY 11.15.22

Looking into the SEC’s lawsuit against the entity, we see that the company allegedly falsely created over $300M revenue from Q2 2019 through January 2020. Comparing this to its reported revenue numbers for this period, this implies that the majority of the revenue reported was not actual revenue whatsoever. While we can quantify this, it is immediately clear that this alleged fraud was so significant that it represented over 80% of revenues over that period. As such I don’t see much value in nickel-and-diming the figures, as we don’t really know what was real and not at that point.

Worth noting is the “at least” in the SEC’s press release on the matter. This is to say that they had reason to believe, although perhaps without hard proof, that the alleged fraud could have actually been more broad-ranging than what was discovered.

Additionally, the company allegedly had a “fake operations database” and even altered bank records. This apparently brings it to a completely different and elevated level of fraud. I do not hesitate to say that this company was provably a criminal enterprise during that time, though that was never adjudicated.

The company still appeared to come out ahead during this period, raising $864M via debt and equity instruments during that period.

Since then, Luckin has been trading over-the-counter, informally known as the “pink sheets.” Investors should be aware that trading OTC implies that the company no longer has to face audits for their financial reporting. Since their operations are in China, we don’t really have much of a view into what’s going on at present.

Although revenue growth since then has been ostensibly significant, we don’t really know that to be the case. There is unfortunately no way to find out, and the fact that the company has no operations in the U.S. makes us unable to even check this on a proxy basis.

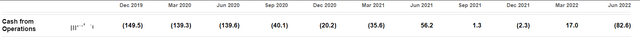

Furthermore, the cash picture appears to be volatile – and increasingly so. Somehow, the company managed to lose $82.6M from operations in Q2 2022 after posting a gain of $17M the quarter before. Coffee may be a discretionary consumer good, but it is generally not anywhere close to this volatile of a business.

SeekingAlpha.com LKNCY 11.15.22

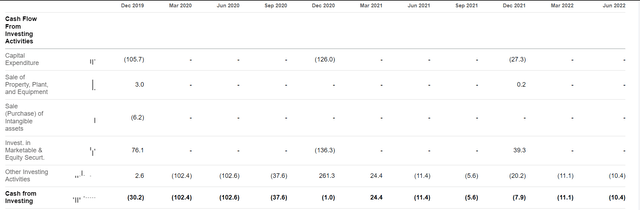

It would be one thing if this cash was going into investing – but even these unaudited financial statements indicate that to not be the case. The company had zero capital expenditures in the last 2 reporting periods, instead placing $10.4M in “Other Investing Activities.” This also fails to explain the significant cash loss of over $80M in the last quarter.

SeekingAlpha.com LKNCY 11.15.22

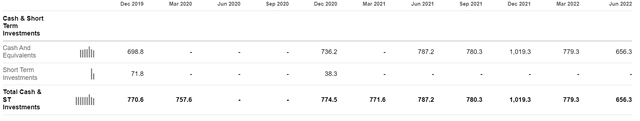

Additionally, the company is reporting a negative net debt – which would imply that it has more cash than liabilities.

SeekingAlpha.com LKNCY 11.15.22

Yet, its cash position has continued to weaken quarter-over-quarter while its total debt has actually increased. This doesn’t add up.

It is also notable the last two reporting periods do not report the company’s total buildings, full-time employees, or machinery – the very guts of its operations and the only visible things that an investor may yet glean.

SeekingAlpha.com LKNCY 11.15.22

While visibility into China is notoriously challenging, some alternative data can perhaps shed some light on this. A search on Baidu.com (China’s preeminent search engine) yields a very large number of locations, but the comparable search on Google Maps only gives us 2 results.

This is quite a stark disparity; I would be inclined to at least consider these figures if they were remotely close to each other. Since Google Maps leverages satellite imagery, on-the-ground automated photography, and various other algorithmic methods for generating listings, one would expect it to come up with more than 2 locations for such a popular coffee chain.

This picture overall is ripe with red flags.

Conclusion

Given the company’s history of alleged large-scale fraud, we must be that much more reserved in our analysis. Taking a look into Luckin makes me skeptical that it is really performing as described at present. The company is omitting basic operational details in its latest reporting periods, bleeding cash at rapid rates ($100MM cash loss increase quarter-over-quarter), and posting balance sheet numbers that simply don’t add up; I think that they are back at it.

While Luckin Coffee Inc. stock has appreciated significantly, the OTC exchanges are frequently ripe with pump-and-dump schemes and other kinds of financial malfeasance. It is the opinion of the author that Luckin Coffee Inc. is exactly that: a pump and dump. As such, it should be avoided by any prudent investor.

Be the first to comment